Forward Contract For Hedging

Description

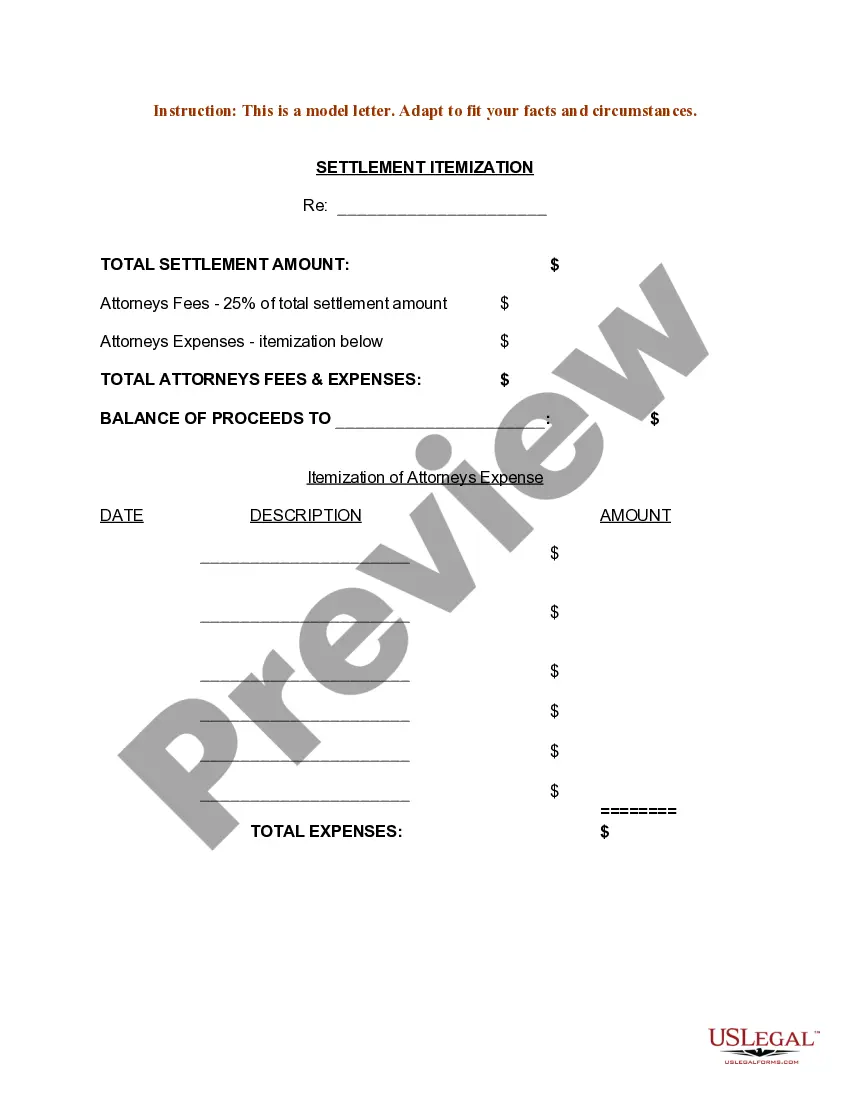

How to fill out Natural Gas Inventory Forward Sale Contract?

What is the most reliable service to obtain the Forward Contract For Hedging and other current versions of legal documents? US Legal Forms is the solution! It boasts the largest compilation of legal paperwork for any purpose.

Every template is thoroughly prepared and confirmed for adherence to federal and local laws. They are organized by region and state, making it simple to find what you require.

US Legal Forms is a fantastic resource for anyone needing to handle legal documents. Premium users can benefit even more as they can complete and authorize previously saved files electronically at any time with the built-in PDF editing feature. Give it a try today!

- Experienced users of the website only need to Log In to the system, verify their subscription status, and click the Download button next to the Forward Contract For Hedging to obtain it.

- After saving, the template stays accessible for future use within the My documents section of your profile.

- If you do not have an account with us yet, here are the steps you should follow to create one.

- Form compliance assessment. Prior to acquiring any template, ensure it meets your use case requirements and complies with your state or county's regulations. Review the form description and utilize the Preview option if available.

Form popularity

FAQ

Forward contract is used for hedging the foreign exchange risk for future settlement. For example, An importer or exporter having FX contract limit may lock in current exchange rate by entering into forward contract with the bank to avoid adverse rate movement.

Forward market hedging is a maneuver to protect against loss in the event of a drop in or weakening of assets, interest rates or currency, but hedging is not without risk as an entity in the forward market may find they have over-hedged (creating a liability, or debt) or under-hedged (thus accruing profit loss).

Money Market HedgeBorrow the foreign currency in an amount equivalent to the present value of the receivable.Convert the foreign currency into domestic currency at the spot exchange rate.Place the domestic currency on deposit at the prevailing interest rate.More items...

Hedging is accomplished by purchasing an offsetting currency exposure. For example, if a company has a liability to deliver 1 million euros in six months, it can hedge this risk by entering into a contract to purchase 1 million euros on the same date, so that it can buy and sell in the same currency on the same date.

Companies that have exposure to foreign markets can often hedge their risk with currency swap forward contracts. Many funds and ETFs also hedge currency risk using forward contracts. A currency forward contract, or currency forward, allows the purchaser to lock in the price they pay for a currency.