Stockholders Corp Withdrawal

Description

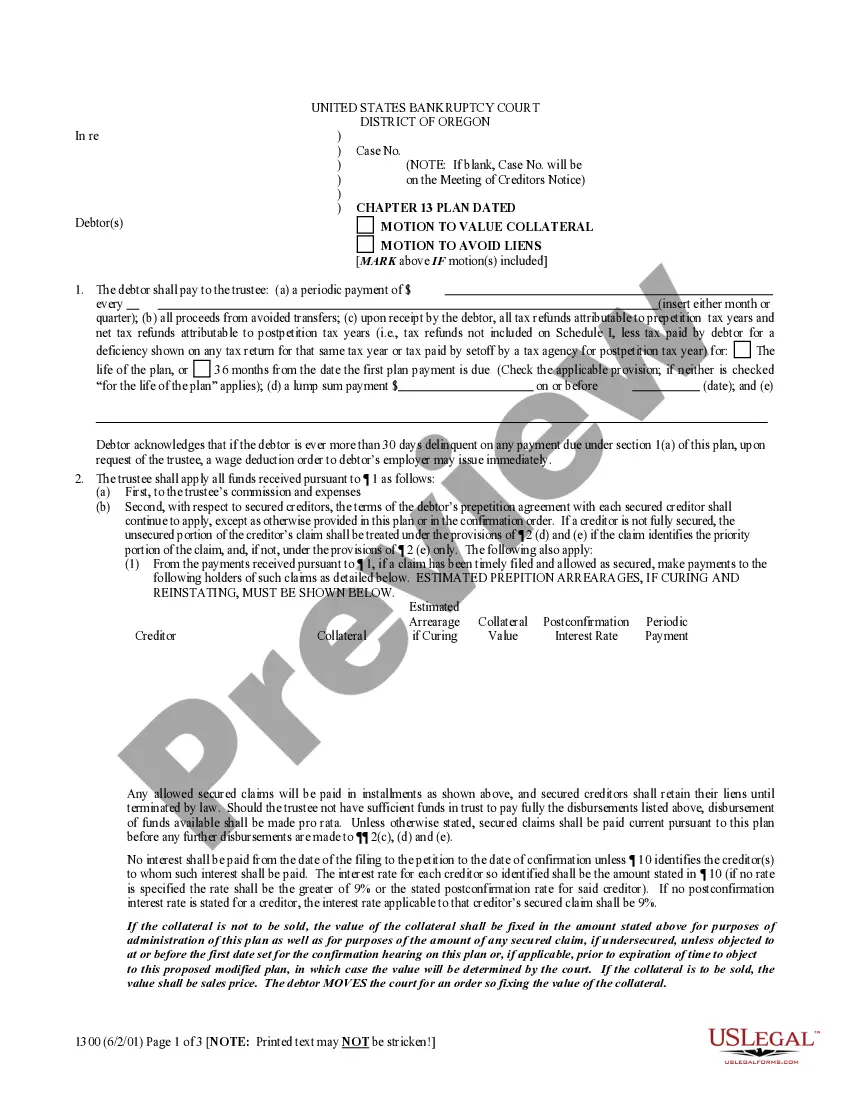

How to fill out Stockholders Agreement Between Schick Technologies, Inc., David Schick, Allen Schick, And Greystone Funding Corp?

Obtaining legal document samples that meet the federal and state laws is crucial, and the internet offers many options to pick from. But what’s the point in wasting time searching for the correctly drafted Stockholders Corp Withdrawal sample on the web if the US Legal Forms online library already has such templates gathered in one place?

US Legal Forms is the largest online legal library with over 85,000 fillable templates drafted by lawyers for any professional and life situation. They are easy to browse with all papers collected by state and purpose of use. Our specialists keep up with legislative updates, so you can always be sure your paperwork is up to date and compliant when obtaining a Stockholders Corp Withdrawal from our website.

Getting a Stockholders Corp Withdrawal is quick and easy for both current and new users. If you already have an account with a valid subscription, log in and save the document sample you need in the preferred format. If you are new to our website, follow the instructions below:

- Take a look at the template utilizing the Preview option or via the text description to ensure it meets your requirements.

- Locate a different sample utilizing the search function at the top of the page if necessary.

- Click Buy Now when you’ve found the correct form and opt for a subscription plan.

- Register for an account or log in and make a payment with PayPal or a credit card.

- Select the best format for your Stockholders Corp Withdrawal and download it.

All templates you find through US Legal Forms are multi-usable. To re-download and fill out earlier obtained forms, open the My Forms tab in your profile. Take advantage of the most extensive and simple-to-use legal paperwork service!

Form popularity

FAQ

Each shareholder's distribution amount for the corporation's fiscal year should be reported on Schedule K-1 (Form 1120-S) Shareholder's Share of Income, Deductions, Credits, etc., Line 16, with "D" as the reference code.

A distribution from an S corporation that does not have any earnings and profits generally is a nontaxable return of the shareholder's basis in the corporate stock. However, if the distribution is more than the shareholder's adjusted basis in the stock, the excess is taxable as a sale or exchange of property.

The corporation is responsible for telling the shareholder the amount of non-dividend and dividend distributions. Box 16D of Schedule K-1 reflects non-dividend distributions. Form 1099-DIV is used to report dividend distributions; dividends are not reported on the shareholder's Schedule K-1.

2. Three ways to take money out of the S Corporation Salary. The first way to take money out of an S Corporation is via payroll. ... Distributions. The second way to take money out of an S Corporation is a cash distribution to owners. ... Loans. The third way to take money out of an S Corporation is via a Shareholder loan.

?File Form 966 within 30 days after the resolution or plan is adopted to dissolve the corporation or liquidate any of its stock. If the resolution or plan is amended or supplemented after Form 966 is filed, file another Form 966 within 30 days after the amendment or supplement is adopted.