An inheritance waiver form in New Jersey is a legal document that allows a person to voluntarily give up their right to inherit any assets or property from an estate. This form is often used when someone does not wish to receive their share of an inheritance, typically due to personal reasons or financial considerations. By signing this document, the individual formally disclaims their interest in the estate and forfeits any rights they may have had to the assets. This waiver form serves an important purpose in estate planning, as it provides clarity and certainty regarding the distribution of assets. It ensures that the inheritance is passed on to the next eligible beneficiaries in a straightforward manner, without any complications or delays resulting from a potential heir's lack of interest. Additionally, it can help to avoid potential conflicts or disputes among family members who may have differing opinions on the distribution of assets. While the term "inheritance waiver form" typically refers to a general document disclaiming one's right to inherit, there are no specific types of waiver forms unique to New Jersey. However, it is worth mentioning that various estate planning documents, such as a disclaimer of interest form or a renunciation of inheritance form, may be used to achieve a similar result in relinquishing one's entitlement to an inheritance. In summary, an inheritance waiver form in New Jersey allows individuals to give up their right to inherit an estate's assets voluntarily. By doing so, they can provide a clear and uncomplicated pathway for the distribution of assets to the remaining beneficiaries. While there are no specific types of inheritance waiver forms in New Jersey, related documents such as disclaimer of interest forms or renunciation of inheritance forms can serve a similar purpose.

Inheritance Waiver Form Nj

Description

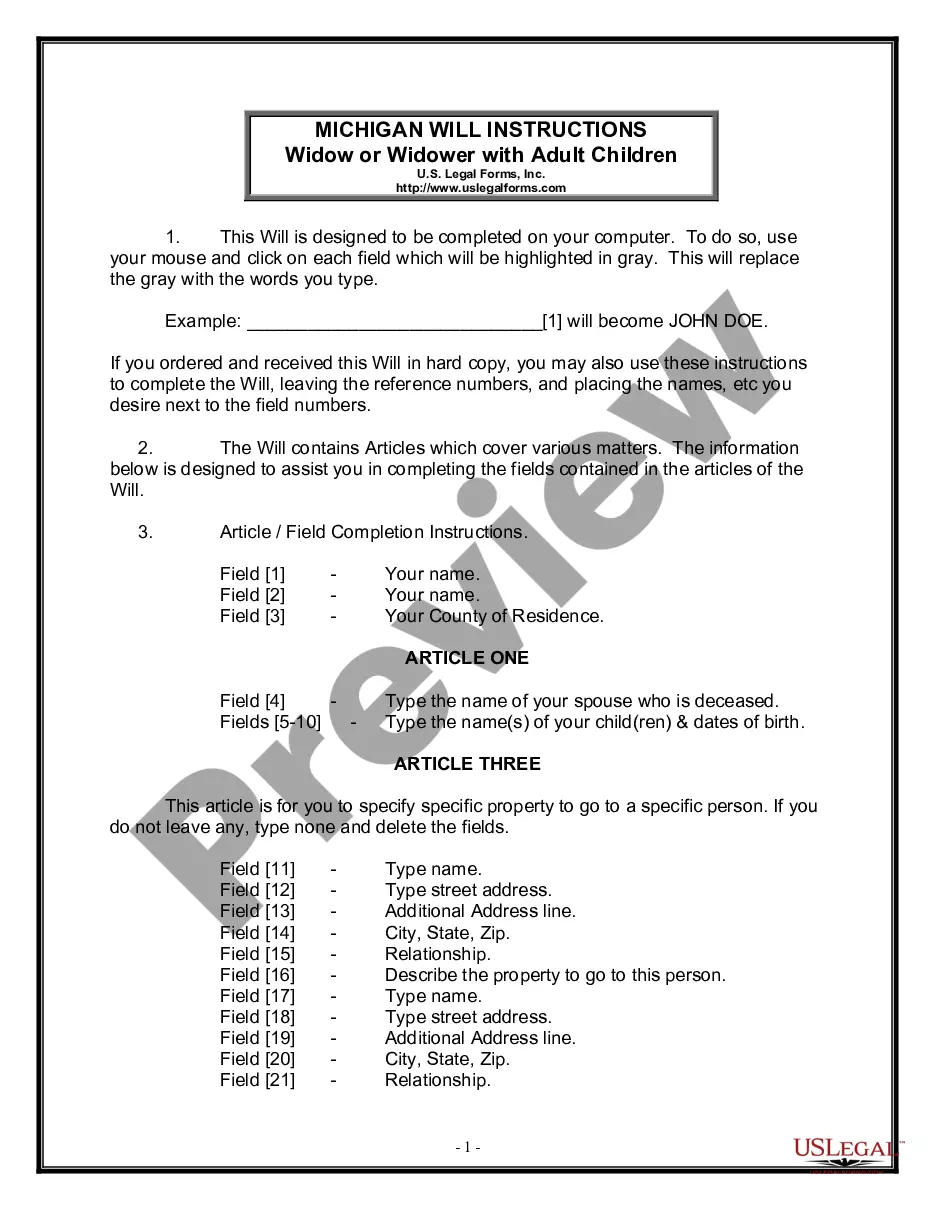

How to fill out Inheritance Waiver Form Nj?

The Inheritance Waiver Form Nj you see on this page is a multi-usable formal template drafted by professional lawyers in line with federal and state regulations. For more than 25 years, US Legal Forms has provided people, businesses, and legal professionals with more than 85,000 verified, state-specific forms for any business and personal scenario. It’s the fastest, simplest and most reliable way to obtain the paperwork you need, as the service guarantees the highest level of data security and anti-malware protection.

Acquiring this Inheritance Waiver Form Nj will take you just a few simple steps:

- Browse for the document you need and review it. Look through the sample you searched and preview it or check the form description to ensure it satisfies your requirements. If it does not, use the search bar to get the appropriate one. Click Buy Now when you have located the template you need.

- Sign up and log in. Opt for the pricing plan that suits you and create an account. Use PayPal or a credit card to make a prompt payment. If you already have an account, log in and check your subscription to proceed.

- Obtain the fillable template. Pick the format you want for your Inheritance Waiver Form Nj (PDF, DOCX, RTF) and download the sample on your device.

- Fill out and sign the paperwork. Print out the template to complete it by hand. Alternatively, utilize an online multi-functional PDF editor to quickly and precisely fill out and sign your form with a valid.

- Download your papers one more time. Make use of the same document again whenever needed. Open the My Forms tab in your profile to redownload any earlier saved forms.

Subscribe to US Legal Forms to have verified legal templates for all of life’s circumstances at your disposal.

Form popularity

FAQ

11% on any amount in excess of $25,000 up to $1,100,000 (there is no tax on an amount below $25,000); 13% on any amount in excess of $1,100,000 up to $1,400,000; 14% on any amount in excess of $1,400,000; and. 16% on any amount in excess of $1,700,000. New Jersey Inheritance Tax: Everything You Need To Know klenklaw.com ? estate-inheritance-taxes ? ne... klenklaw.com ? estate-inheritance-taxes ? ne...

There is a $25,000 exemption for amounts inherited by Class C beneficiaries. The tax rate is 11% on the first $1,075,000 inherited above the exemption amount, 13% on the next $300,000, 14% on the next $300,000, and 16% on the amount above $1,700,000. Class D beneficiaries can receive $500 tax free.

Class A Beneficiaries The good news is that close relatives of New Jersey decedents will not have to pay inheritance tax. This includes the following Class A beneficiaries: Spouses, domestic partners, and civil union partners. Does New Jersey Have an Inheritance Tax? - Simon Quick Advisors simonquickadvisors.com ? articles ? does-new-jers... simonquickadvisors.com ? articles ? does-new-jers...

Other Inheritance Tax Exemptions transfers of less than $500. life insurance proceeds paid to a named beneficiary. payments from the New Jersey Public Employees Retirement System, the New Jersey Teachers' Pension and Annuity Fund, or the New Jersey Police and Firemen's Retirement System. New Jersey Inheritance Tax | Nolo nolo.com ? legal-encyclopedia ? new-jersey... nolo.com ? legal-encyclopedia ? new-jersey...

Children in New Jersey Inheritance Law Intestate Succession: Spouses and ChildrenChildren, but no spouse? Children inherit everythingSpouse, but no children or parents? Spouse inherits everythingSpouse and children from you and that spouse; the spouse has no other children? Spouse inherits everything6 more rows ? New Jersey Inheritance Laws: What You Should Know - SmartAsset smartasset.com ? financial-advisor ? nj-inheritance... smartasset.com ? financial-advisor ? nj-inheritance...