Hardship H

Description

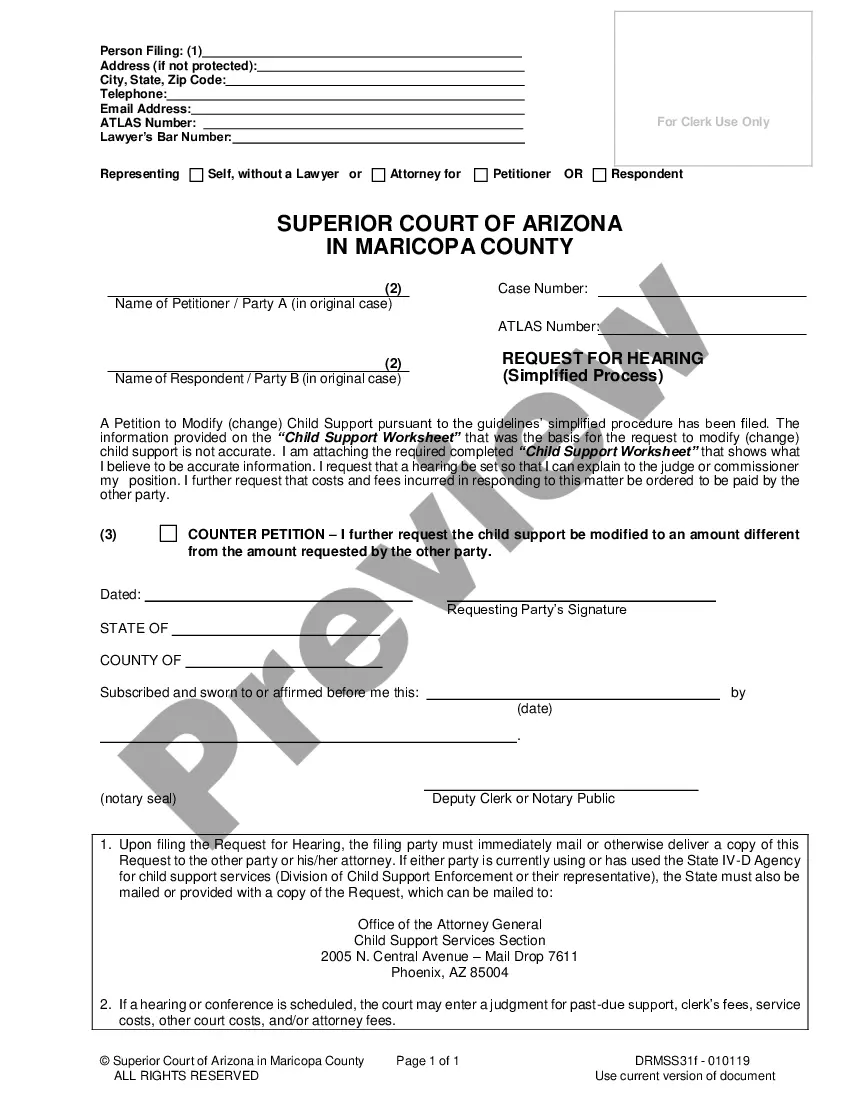

How to fill out Driving Hardship Licenses Handbook - Driver's Hardship?

- Log in to your US Legal Forms account if you're a returning user. Ensure your subscription is active; renew it if needed.

- For first-time users, start by reviewing the Preview mode and form descriptions to find the document that suits your legal needs and aligns with local jurisdiction.

- If adjustments are necessary, utilize the Search feature to find an alternative template that fits your requirements.

- Select the document you desire by clicking on the 'Buy Now' button and choose a suitable subscription plan. Registration is required to unlock full access.

- Complete your purchase by entering your payment information via credit card or PayPal.

- Download the form to your device, ensuring easy access for completion later. Find it anytime in the 'My Forms' section of your profile.

With US Legal Forms, obtaining legal documents is not only simplified but also assures accuracy and compliance with legal standards.

Ready to take control of your legal needs? Start your journey with US Legal Forms today and discover the ease of accessing comprehensive legal forms.

Form popularity

FAQ

A hardship withdrawal from a 401k typically qualifies based on immediate financial needs like purchasing a primary home, preventing eviction, or covering medical expenses. The IRS has clear guidelines, and you will need to demonstrate that your financial situation meets these criteria. Ensure you understand the requirements to avoid unnecessary setbacks. Resources from US Legal are available to assist you in navigating 401k hardship withdrawals efficiently.

A hardship is generally defined as a financial situation where you cannot meet your immediate and pressing expenses. This may include costs related to housing, medical care, or education. It's essential to review specific criteria set by the IRS or your plan administrator for a hardship to ensure your situation qualifies. Using resources from US Legal will help you better understand what qualifies as a hardship.

Filling out a hardship form requires careful attention to detail. Start by gathering all required documentation to clearly illustrate your financial need. When completing the form, provide accurate information and follow any specific instructions given. You can access easy-to-use forms from US Legal, which can simplify the process of submitting your hardship withdrawal request.

To increase the chances of getting your hardship withdrawal approved, you should submit complete and accurate documentation that supports your financial need. Make sure you comply with the company's specific guidelines for hardship applications. Being thorough and precise in your application will help to avoid delays. US Legal can provide guidance and templates helpful for ensuring your request meets the necessary criteria.

A hardship withdrawal might be denied if the documentation provided does not adequately prove your immediate financial need. Additionally, if your request does not align with the IRS guidelines for hardship withdrawals, it may also be rejected. Understanding the specific conditions for a hardship withdrawal is crucial to avoid denial. Consider consulting with US Legal forms to make sure your application meets all requirements.

To qualify for a hardship withdrawal, you will need to provide documentation that clearly outlines your financial need. This may include bills, eviction notices, or medical expenses. Certain types of proof are essential in demonstrating that your situation meets the criteria for a hardship withdrawal. Utilizing tools from US Legal can streamline this process, ensuring you have all necessary documents.

To qualify for the IRS hardship program, you must demonstrate that your financial situation prevents you from meeting basic living expenses and tax obligations. This often includes individuals facing job loss, reduced income, or unexpected medical expenses. The program aims to assist those in genuine financial distress, allowing them to settle their tax debts more manageable. If you find yourself needing help, consider resources like US Legal Forms to guide you through the process.

When applying for assistance related to hardship, you usually need to provide documentation that verifies your financial situation. This may include bank statements, income records, medical bills, or eviction notices. Accurate documentation plays a vital role in proving your claims and securing the necessary aid, so make sure to gather all relevant papers before submitting your application.

An emergency hardship generally refers to a sudden and unexpected financial challenge, such as a serious illness, significant home repairs, or natural disasters that disrupt your financial stability. These emergencies can create urgent need for assistance, making it essential to address them promptly. Understanding the specifics of your situation can help you identify the right resources for support.

Hardship payments are typically available to individuals who demonstrate financial need due to significant life challenges. This may include unemployment, severe medical conditions, or unexpected family responsibilities. If you find yourself struggling to maintain essential services or meet your basic needs, you should consider applying for hardship payments.