This due diligence checklist lists industrial and operational information and issues within company departments regarding business transactions.

Operational Due Diligence Checklist For Startup

Description

How to fill out Prioritized Industrial Operational Due Diligence Checklist?

The Operational Due Diligence Checklist For Startup you see on this page is a reusable formal template drafted by professional lawyers in compliance with federal and local laws. For more than 25 years, US Legal Forms has provided people, businesses, and attorneys with more than 85,000 verified, state-specific forms for any business and personal scenario. It’s the fastest, most straightforward and most reliable way to obtain the documents you need, as the service guarantees the highest level of data security and anti-malware protection.

Acquiring this Operational Due Diligence Checklist For Startup will take you only a few simple steps:

- Browse for the document you need and review it. Look through the file you searched and preview it or check the form description to verify it satisfies your requirements. If it does not, utilize the search option to get the correct one. Click Buy Now when you have found the template you need.

- Subscribe and log in. Select the pricing plan that suits you and create an account. Use PayPal or a credit card to make a prompt payment. If you already have an account, log in and check your subscription to continue.

- Acquire the fillable template. Select the format you want for your Operational Due Diligence Checklist For Startup (PDF, DOCX, RTF) and save the sample on your device.

- Complete and sign the document. Print out the template to complete it manually. Alternatively, use an online multi-functional PDF editor to rapidly and accurately fill out and sign your form with a eSignature.

- Download your papers one more time. Utilize the same document once again whenever needed. Open the My Forms tab in your profile to redownload any earlier downloaded forms.

Subscribe to US Legal Forms to have verified legal templates for all of life’s situations at your disposal.

Form popularity

FAQ

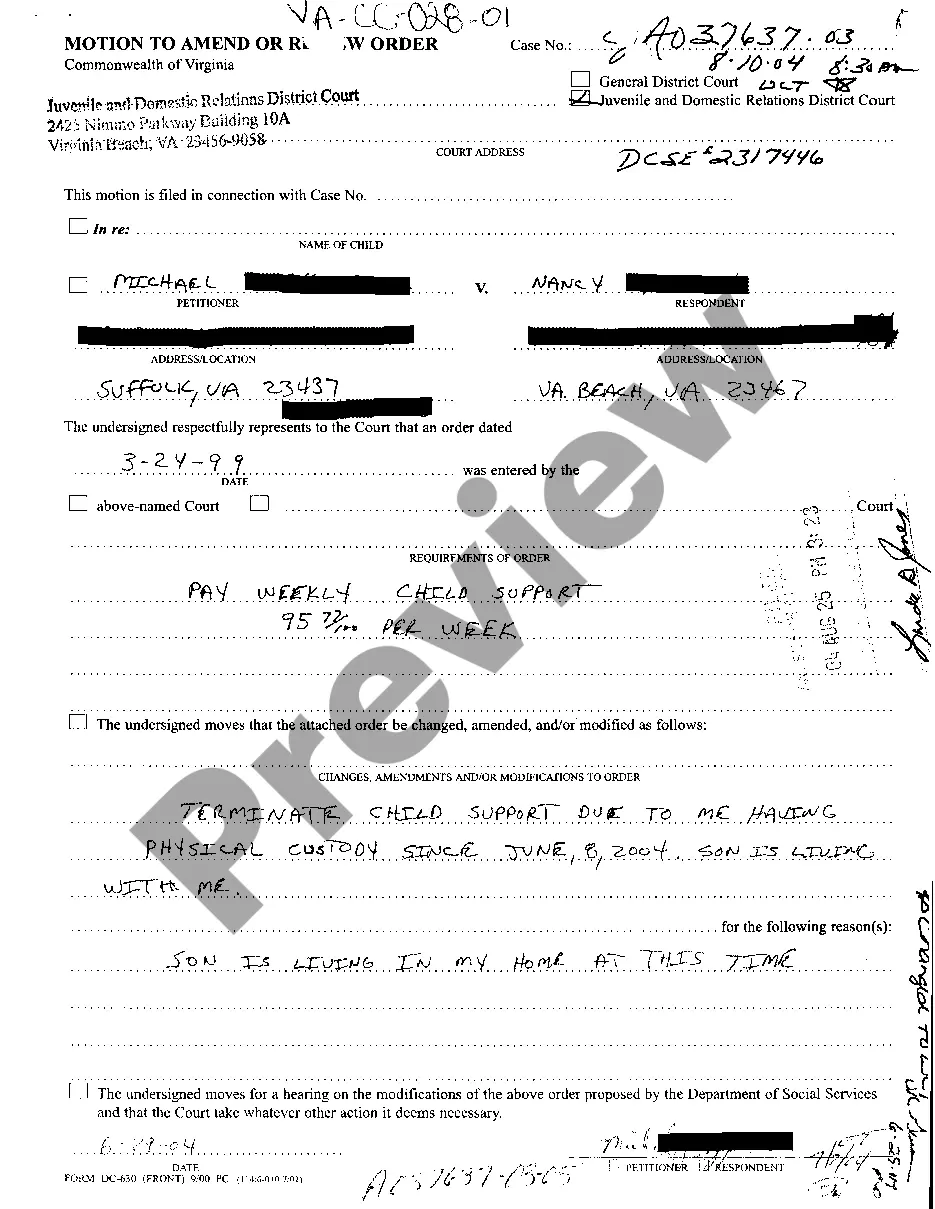

During due diligence, you may repeat a number of steps if new information comes to light: Analysis of the purpose of the project (i.e., if the deal still meets business goals) Analysis of the financial business case. Review of key documents. Risk analysis. Analysis of offer price (which may be tweaked based on discovery)

How to Conduct Due Diligence in a Private Company Review of MCA Documents. ... Review of Article of association. ... Assessment of statutory registers of the company. ... Review of books of accounts and financial statements. ... Review of Taxation Aspects. ... Review of legal aspects. ... Review of operational aspects.

Meanwhile, an operational due diligence checklist evaluates a company's internal operations. It reviews financial stability, risk factors, supply chain and logistics, technology infrastructure, human resources, operational efficiency, legal compliance, and risk management strategies.

Sample Due Diligence Questionnaire - What Questions Does it Include? Company Information. Financial Information. Employee Information. Legal Information. Product Information. Consumer Information. Intellectual Property Information. Physical Asset Information.

An Investor's Guide To Due Diligence In Early-Stage Startups Business & Management. Understanding a company's business and scope is critical for anyone considering investing in it. ... Risks. ... Product/Service & Marketing Strategy. ... IP & Technology. ... Financials. ... Funding. ... Exits & Pay Offs. ... Relevant & Appropriate Jurisdiction Selection.