A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of a debt. This includes failing to disclose in the initial communication with the consumer that the debt collector is attempting to collect a debt and that any information obtained will be used for that purpose (Mini Miranda)

Mini Miranda Debt Collection Script For Business

Description

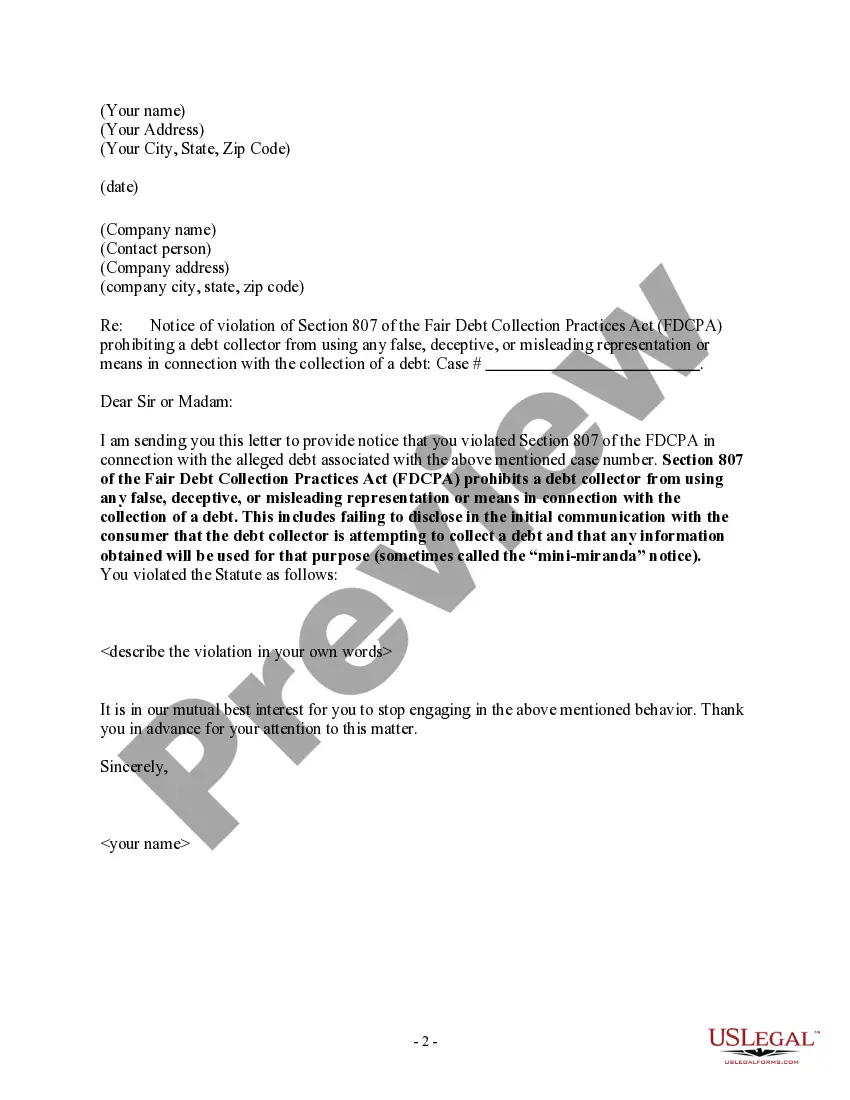

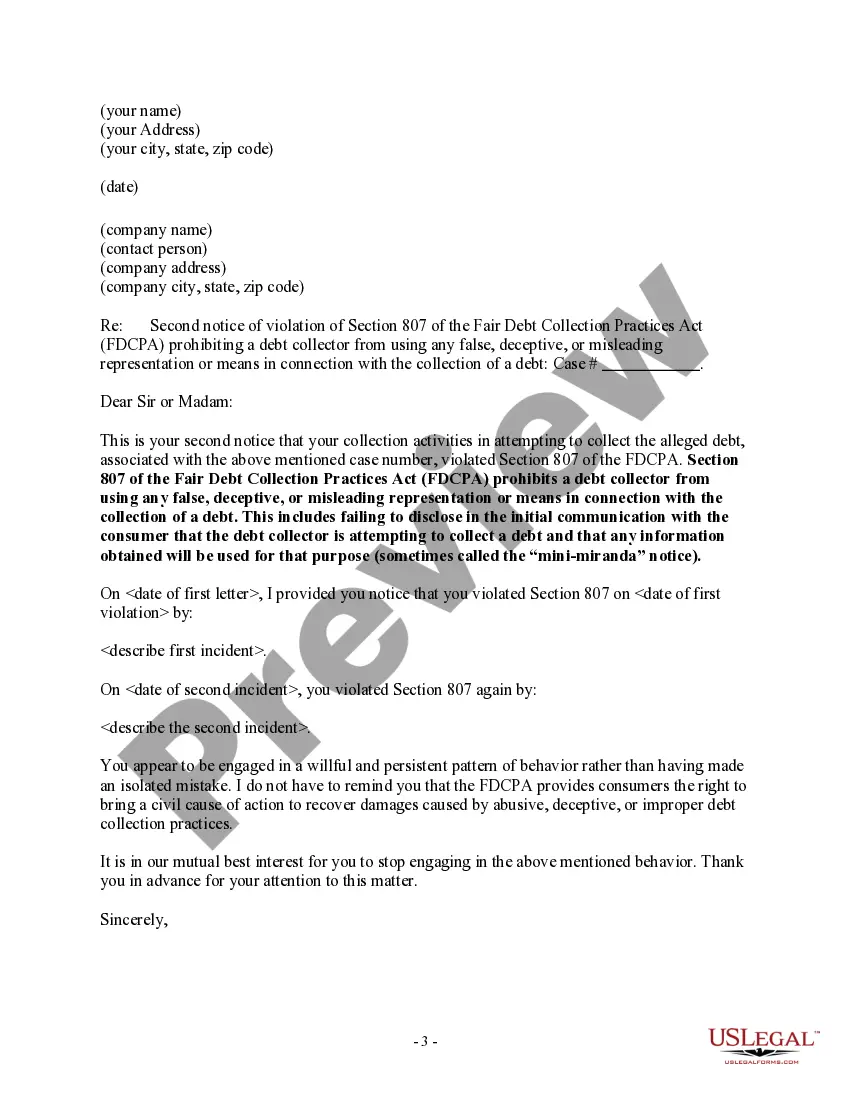

How to fill out Notice To Debt Collector - Failure To Provide Mini-Miranda?

The Mini Miranda Debt Collection Script For Business you see on this page is a reusable legal template drafted by professional lawyers in compliance with federal and state laws. For more than 25 years, US Legal Forms has provided people, organizations, and legal professionals with more than 85,000 verified, state-specific forms for any business and personal scenario. It’s the fastest, easiest and most trustworthy way to obtain the paperwork you need, as the service guarantees bank-level data security and anti-malware protection.

Acquiring this Mini Miranda Debt Collection Script For Business will take you only a few simple steps:

- Browse for the document you need and review it. Look through the file you searched and preview it or review the form description to verify it fits your requirements. If it does not, make use of the search option to find the appropriate one. Click Buy Now once you have located the template you need.

- Subscribe and log in. Opt for the pricing plan that suits you and create an account. Use PayPal or a credit card to make a prompt payment. If you already have an account, log in and check your subscription to proceed.

- Obtain the fillable template. Choose the format you want for your Mini Miranda Debt Collection Script For Business (PDF, Word, RTF) and save the sample on your device.

- Fill out and sign the document. Print out the template to complete it manually. Alternatively, use an online multi-functional PDF editor to rapidly and precisely fill out and sign your form with a legally-binding] {electronic signature.

- Download your papers one more time. Use the same document again whenever needed. Open the My Forms tab in your profile to redownload any previously downloaded forms.

Subscribe to US Legal Forms to have verified legal templates for all of life’s circumstances at your disposal.

Form popularity

FAQ

The Process of Debt Collection for Small Businesses Explained in 8 Simple Steps Sending the invoice. Contacting the debtor by yourself. Negotiate. Issuing dunning letters. Discontinuing the services. Going to small claims court. Hiring a debt collection agency. Filing a lawsuit.

Overdue payments on credit card balances, phone bills, auto loans, utility bills, and back taxes are examples of the delinquent debts that a collector may be tasked with retrieving. Some companies have their own debt collection departments.

My name is John, and I am a debt collector with XYZ Company. Your bill payment is past the due date. Based on our records, the total outstanding balance of $10,000 is overdue. We have tried contacting you seven times during the last two weeks.

What do you include in a debt collection letter? The amount the debtor owes you, including any interest (attach the original invoice as well); The initial date of payment and the new date of payment; Clear instructions on how to pay the outstanding debt (banking details, etc);

The first notice from the debt collector to the debtor must include a warning known as the "Mini-Miranda Warning," which must state that the communication is from a debt collector and that any information obtained may be used to collect the debt.