Letter Authorized Form Withdrawal

Description

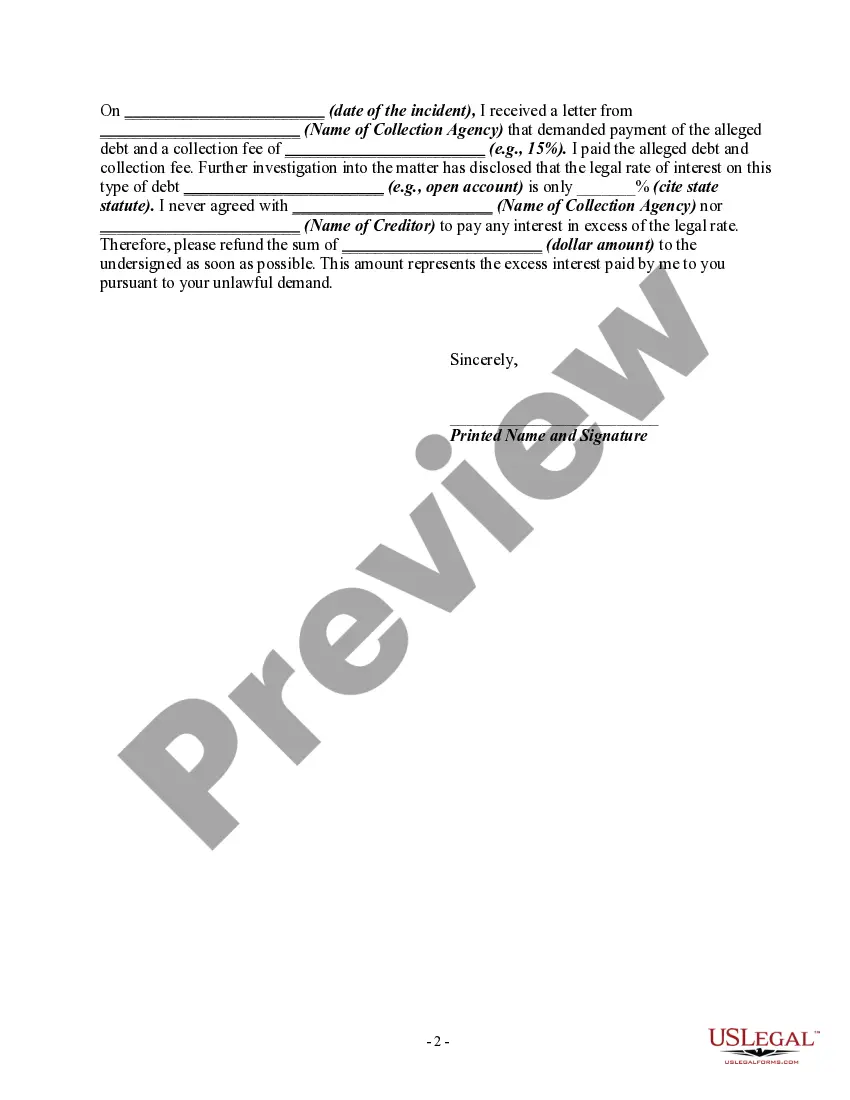

How to fill out Letter Informing Debt Collector Of Unfair Practices In Collection Activities - Collecting An Amount Not Authorized By The Agreement Creating The Debt Or By Law?

There's no longer a necessity to spend time searching for legal documents to fulfill your local state obligations. US Legal Forms has gathered all of them in a single location and streamlined their availability.

Our website provides over 85,000 templates for various business and individual legal circumstances organized by state and usage area. All forms are correctly drafted and verified for accuracy, so you can be confident in obtaining a current Letter Authorized Form Withdrawal.

If you're acquainted with our service and already possess an account, it's essential to confirm that your subscription is active before accessing any templates. Log In to your account, choose the document, and click Download. You also have the option to revisit all saved documents whenever needed by opening the My documents tab in your profile.

Print your form to complete it by hand or upload the sample if you wish to do it using an online editor. Creating official documents in accordance with federal and state laws and regulations is fast and easy with our library. Experience US Legal Forms today to keep your paperwork organized!

- If you have not previously used our service, the process will involve a few additional steps to complete.

- Review the page content carefully to confirm it has the sample you require.

- To accomplish this, utilize the form description and preview options if available.

- Employ the Search field above to find another template if the prior one didn't fit your needs.

- Click Buy Now next to the template title after you've located the correct one.

- Choose your preferred subscription plan and either register for an account or Log In.

- Process your subscription payment by credit card or via PayPal to continue.

- Select the file format for your Letter Authorized Form Withdrawal and download it to your device.

Form popularity

FAQ

The fax number for sending Form 2848, your Power of Attorney, varies depending on the taxpayer's location. You can find the specific fax number listed in the IRS instructions for Form 2848. This fax serves as your letter authorized form withdrawal, allowing the IRS to process your request efficiently. Make sure to double-check the correct number to avoid any delays.

The best way to submit your Power of Attorney to the IRS is to send Form 2848 by fax or mail to the appropriate IRS office. This form should be filled out accurately, as it acts as your letter authorized form withdrawal of authority. For quicker processing, e-filing your tax documents along with the POA is recommended. Always verify that you are using the correct address for your submission.

To remove yourself from being a Power of Attorney with the IRS, you must submit a written request or complete Form 2848 to revoke your designation. This serves as your letter authorized form withdrawal of authority. It is advisable to notify the taxpayer involved and retain a copy for your files. Remember, timely communication can prevent any confusion.

Typically, the IRS processes Power of Attorney submissions within a few weeks, but it may take longer during peak tax seasons. To ensure there are no delays, make sure your Form 2848 or Form 8821 are filled out correctly. This will act as your letter authorized form withdrawal and ensures the IRS has all the necessary information. If concerned, you can contact the IRS for updates on the process.

To submit Form 8821, simply complete the form, indicating the tax matters and years for which you are authorizing someone to receive your tax information. This form serves as your letter authorized form withdrawal of consent for that individual. Then, send it to the IRS at the address specified for your local office. Always keep a copy for your records to track your authorization.

You will need to file Form 8453 at the address provided in the instructions for the form. If you are filing electronically, this form acts as a letter authorized form withdrawal for signature and must be submitted alongside your e-filing. If you are filing by mail, ensure that you send it to the correct IRS address based on the type of return you are submitting. This helps to streamline the processing of your tax return.

As a Power of Attorney, you can file taxes on behalf of another individual by using their Form 1040. You must submit your completed return along with your signed Form 2848, as this serves as your letter authorized form withdrawal. Ensure that you have all necessary documents, such as W-2s and 1099s, to file accurately. Double-check for any specific requirements based on the taxpayer’s situation.

To submit a Power of Attorney (POA) to the IRS, you need to complete Form 2848. This form serves as your letter authorized form withdrawal of authority for someone else to act on your behalf. After filling it out, send it to the appropriate IRS office, which you can find based on the state or region. Make sure to retain a copy for your records.

Writing a claim withdrawal letter involves clearly stating your full name, contact details, and the claim number at the beginning. In the body, inform the recipient of your decision to withdraw the claim, and provide a brief explanation if relevant. Be sure to sign and date the letter to formalize your request. Utilizing US Legal Forms can help you ensure that your letter authorized form withdrawal meets all legal criteria.

To politely withdraw, express your gratitude for the opportunity presented to you. Clearly state your decision to withdraw and briefly mention your reason, if appropriate. It’s courteous to wish the organization or individual well for future endeavors. You can achieve this with ease by following templates available on US Legal Forms for your letter authorized form withdrawal.