Collection Collecting Law For The Following

Description

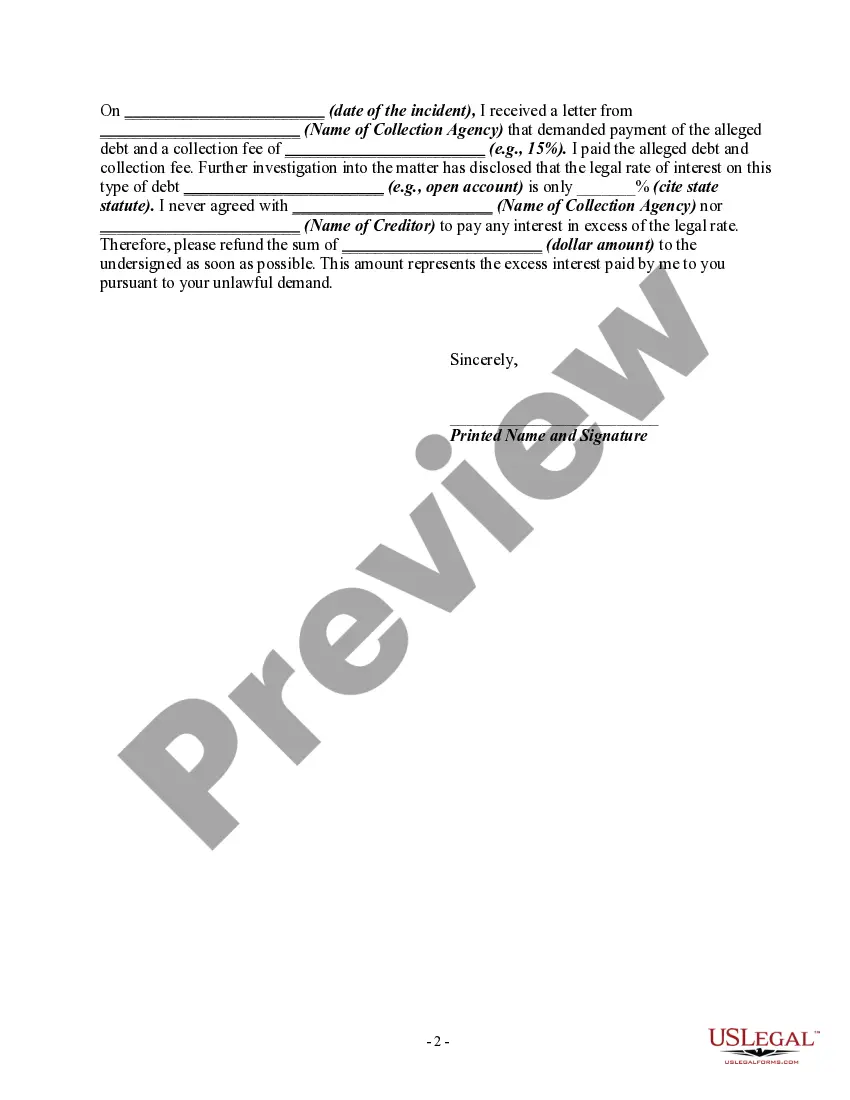

How to fill out Letter Informing Debt Collector Of Unfair Practices In Collection Activities - Collecting An Amount Not Authorized By The Agreement Creating The Debt Or By Law?

Dealing with legal paperwork and operations can be a time-consuming addition to your day. Collection Collecting Law For The Following and forms like it usually require that you look for them and understand the best way to complete them appropriately. Therefore, if you are taking care of financial, legal, or individual matters, having a thorough and convenient web catalogue of forms on hand will significantly help.

US Legal Forms is the best web platform of legal templates, featuring over 85,000 state-specific forms and a variety of resources that will help you complete your paperwork effortlessly. Check out the catalogue of appropriate documents accessible to you with just a single click.

US Legal Forms provides you with state- and county-specific forms offered by any moment for downloading. Protect your document managing processes having a high quality support that allows you to make any form within minutes without any additional or hidden cost. Simply log in to the account, find Collection Collecting Law For The Following and download it immediately from the My Forms tab. You may also access formerly downloaded forms.

Is it the first time using US Legal Forms? Register and set up an account in a few minutes and you’ll get access to the form catalogue and Collection Collecting Law For The Following. Then, stick to the steps below to complete your form:

- Ensure you have the right form by using the Preview option and reading the form description.

- Pick Buy Now when all set, and select the monthly subscription plan that is right for you.

- Select Download then complete, sign, and print the form.

US Legal Forms has twenty five years of expertise helping consumers manage their legal paperwork. Discover the form you want today and improve any process without having to break a sweat.

Form popularity

FAQ

The Fair Debt Collection Practices Act (FDCPA) is the main federal law that governs debt collection practices.

Debt collectors can only take money from your paycheck, bank account, or benefits?which is called garnishment?if they have already sued you and a court entered a judgment against you for the amount of money you owe. The law sets certain limits on how much debt collectors can garnish your wages and bank accounts.

You should dispute a debt if you believe you don't owe it or the information and amount is incorrect. While you can submit your dispute at any time, sending it in writing within 30 days of receiving a validation notice, which can be your initial communication with the debt collector.

Fair Debt Collection Practices Act.

The final rule also provides non-exhaustive lists of factors that may be used to rebut the presumption of compliance or of a violation." This is where we get our "7-in-7" concept. You can attempt to contact a consumer about 1 debt 7 times in 7 days. And it's the "1 debt" that's key here.