Sample Debt Forgiveness Letter

Description

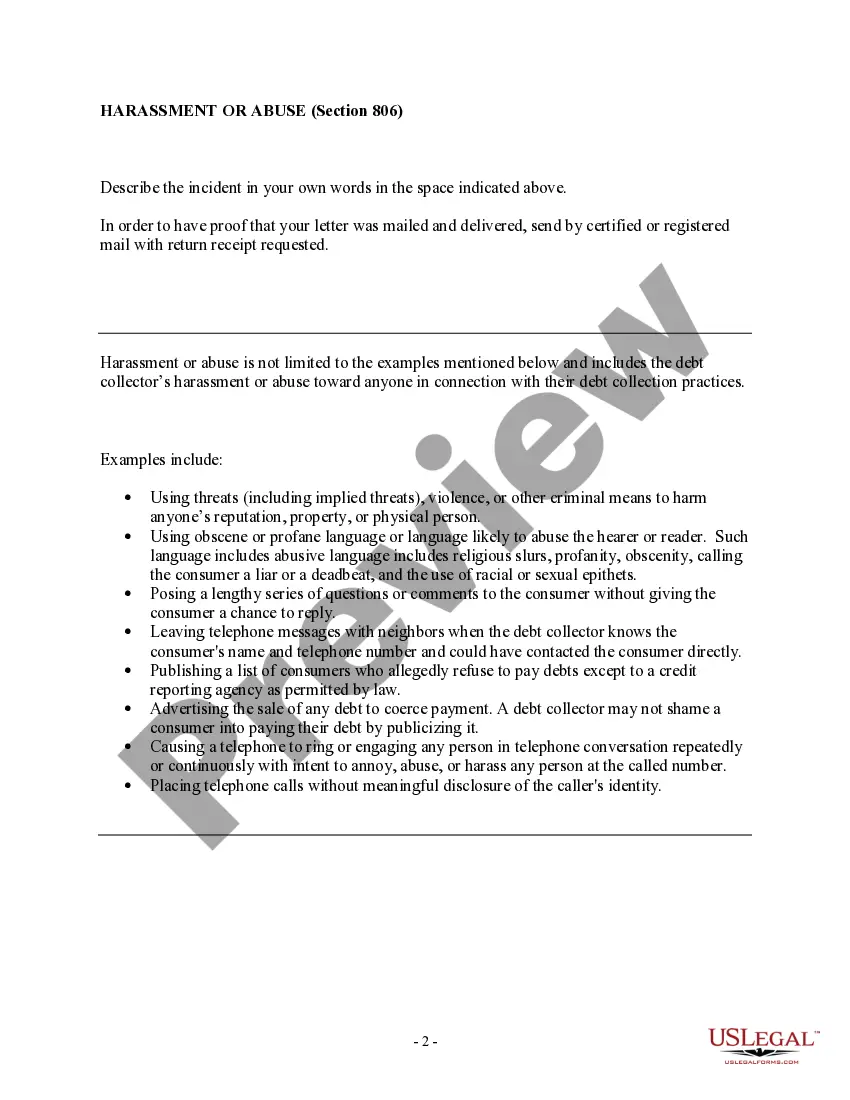

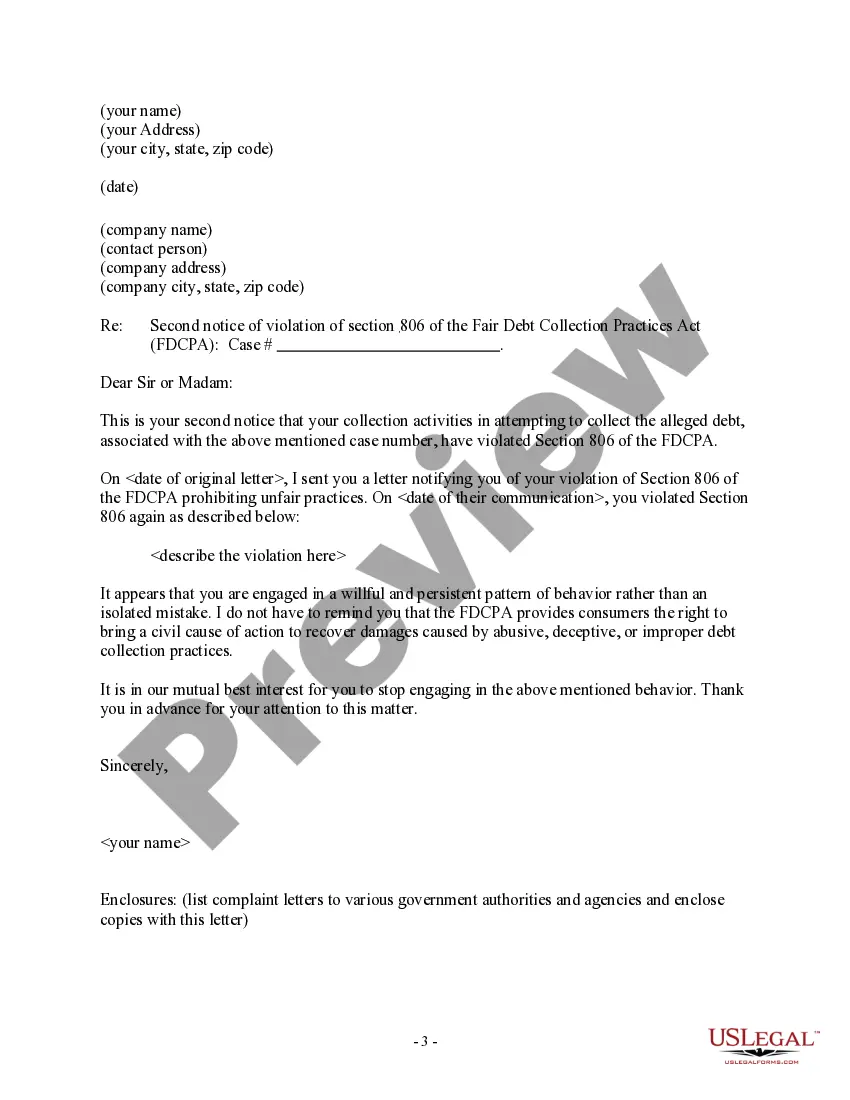

How to fill out Notice Letter To Debt Collector Of Section 806 Violation - Harassment?

There is no longer any need to spend countless hours searching for legal documents to adhere to your local state guidelines.

US Legal Forms has gathered all of them in one location and streamlined their availability.

Our website provides over 85k templates for every business and personal legal situation compiled by state and field of application. All forms are suitably drafted and authenticated for legitimacy, so you can feel confident in acquiring a current Sample Debt Forgiveness Letter.

Print your form to complete it manually or upload the sample if you prefer to fill it out in an online editor. Organizing legal documents under federal and state laws is quick and effortless with our platform. Experience US Legal Forms now to keep your records organized!

- If you are acquainted with our service and already possess an account, you must verify that your subscription is active before obtaining any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all downloaded documents at any time by accessing the My documents tab in your profile.

- If you have not interacted with our service before, the procedure will require a few additional steps to complete.

- Here’s how new users can find the Sample Debt Forgiveness Letter in our catalog.

- Carefully review the page content to confirm it includes the sample you require.

- To achieve this, utilize the form description and preview options if available.

- Use the Search field above to look for another template if the previous one was unsuitable.

- Click Buy Now next to the template title once you identify the correct one.

- Select the most appropriate pricing plan and create an account or Log In.

- Process payment for your subscription using a credit card or through PayPal to proceed.

- Choose the file format for your Sample Debt Forgiveness Letter and download it to your device.

Form popularity

FAQ

Writing a credit forgiveness letter involves a few key steps. Start by clearly stating your request for debt forgiveness, including details like the amount owed and your account number. Next, explain your financial situation, providing context that supports your request. For a strong reference, consider using a sample debt forgiveness letter to guide your format and phrasing, ensuring your letter is professional and persuasive.

To write a letter to settle a debt, outline your offer to settle for a reduced amount. State your financial difficulties and why you believe settling is the best solution for both parties. Use a clear and respectful tone to foster goodwill, and look at examples of sample debt forgiveness letters for inspiration on your wording.

To write a letter for forgiveness of debt, start by clearly stating your request for debt forgiveness. Include your account details, a brief explanation of your financial situation, and express your willingness to engage in negotiations. Consider adding a date when you would like to hear back from the creditor. A well-crafted sample debt forgiveness letter can guide you through this process.

For a debt relief order, you need to provide evidence of your financial situation. This typically includes your income statements, expenses, and a breakdown of your debts. Accurate documentation supports your claim and can greatly enhance the effectiveness of a sample debt forgiveness letter, making your case more persuasive to creditors.

To ask for a debt to be forgiven, start by gathering all necessary information about your debt. Write a concise letter explaining your situation and why forgiveness is necessary. A sample debt forgiveness letter can guide you in creating a compelling argument that captures your creditors' attention and encourages favorable consideration.

Asking for a debt to be written off involves communicating directly with your creditor. Be honest about your financial situation and illustrate why you cannot repay the debt. A well-crafted sample debt forgiveness letter can help you articulate your request in a clear and respectful manner.

To ask for debt forgiveness, you can create a sample letter that outlines your request clearly. Begin with your personal information, followed by the creditor’s details, and state your case succinctly. Mention any relevant circumstances and provide evidence that supports your need for forgiveness, ensuring you stay polite and professional throughout.

To qualify for debt relief, you generally must demonstrate financial hardship or an inability to manage your debts. This can include factors like income level, monthly expenses, and current debt load. Lenders typically look for evidence that supports your request, so using a sample debt forgiveness letter helps you present your case effectively.

When you ask for a debt in a polite way, approach the creditor respectfully. Start by expressing appreciation for their understanding. Clearly state your situation and why you are requesting assistance. A sample debt forgiveness letter can provide a structured way to frame your request professionally.

To report debt forgiveness, you should receive a Form 1099-C from the creditor that canceled your debt. This form will detail the forgiven amount, which you must include when filing your taxes. If you do not receive this form, contact the creditor directly to ensure accurate reporting.