Bond Claim Letter Example With No Response

Description

How to fill out Bond Claim Notice?

Creating legal documents from the ground up can occasionally be overwhelming. Certain instances may require extensive research and significant financial investment.

If you’re seeking a simpler and more cost-effective method of drafting a Bond Claim Letter Example With No Response or any other paperwork without unnecessary complications, US Legal Forms is always available to assist you.

Our virtual repository of over 85,000 current legal documents covers nearly every aspect of your financial, legal, and personal affairs. With just a few clicks, you can promptly access state- and county-compliant templates carefully prepared for you by our legal experts.

Utilize our website whenever you require a dependable and trustworthy service through which you can effortlessly locate and download the Bond Claim Letter Example With No Response. If you're already familiar with our website and have previously registered an account, simply Log In to your account, find the form, and download it immediately or re-download it at any time later in the My documents section.

Ensure that the form you select meets the standards of your state and county. Choose the most appropriate subscription option to purchase the Bond Claim Letter Example With No Response. Download the document. Then complete, sign, and print it. US Legal Forms has an impeccable reputation and over 25 years of experience. Join us today and transform document completion into something easy and efficient!

- Do you not possess an account? No worries.

- It takes minimal time to register and explore the library.

- But prior to directly downloading the Bond Claim Letter Example With No Response, consider these suggestions.

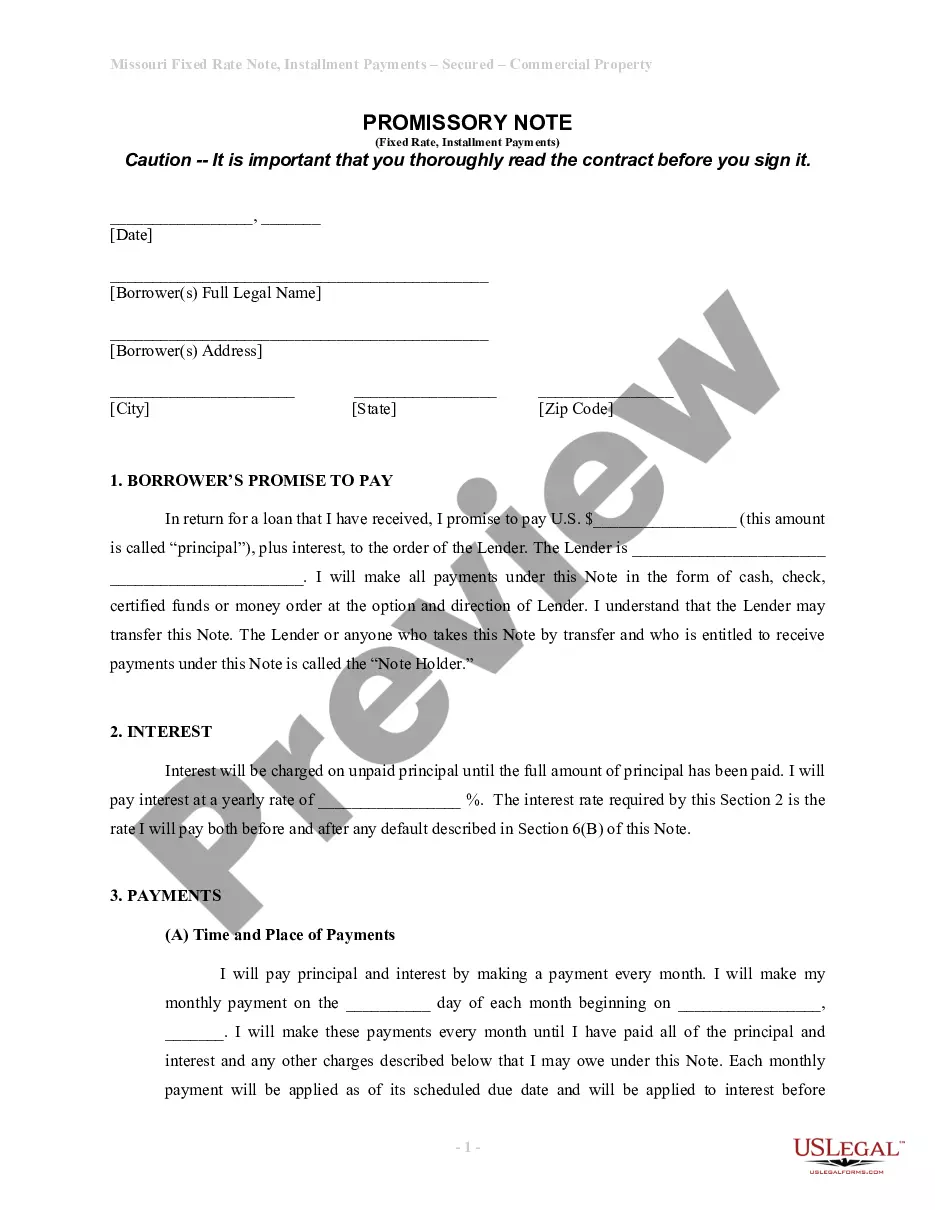

- Review the document preview and descriptions to make sure you have identified the document you need.

Form popularity

FAQ

Writing a bond claim letter involves being clear, concise, and organized. Start with your contact information and a formal greeting, followed by a detailed explanation of the claim. Include all relevant dates, amounts, and facts, and be sure to specify what compensation you seek. Referring to a bond claim letter example with no response can guide you in creating an effective letter.

To file a claim against a broker's bond, begin by gathering all necessary documentation, including the contract and agreements. Next, prepare a formal claim letter that outlines your damages and evidence supporting your claim. Make sure to send your claim to the appropriate bonding company and keep a copy for your records. For additional guidance, accessing a bond claim letter example with no response can be quite helpful.

To prepare a letter of claim, collect all relevant information, such as contracts or agreements tied to the claim. Draft your letter with a clear introduction that states your intention and provides a brief summary of the claim. Use sections to clearly outline the facts and the compensation you seek. You can look for a bond claim letter example with no response to see how to articulate your points effectively.

When writing a response to a claim letter, begin by acknowledging receipt of the claim. Address the specifics of the claim and provide a clear explanation of your stance. If you decide to reject the claim, outline the reasons while remaining professional and courteous. For your reference, searching for a bond claim letter example with no response may offer useful insights on how to structure your reply.

An example of a bond claim involves a situation where a contractor fails to fulfill their obligations, and the project owner seeks compensation. In this case, the project owner may file a claim against the contractor's bond to recover financial losses. It's important to follow proper procedures to ensure your claim is valid. For a clear illustration, consider reviewing a bond claim letter example with no response.

To write a good claim letter, start by clearly stating the purpose of your letter. Include relevant details like dates, amounts, and any supporting documents. Always maintain a professional tone and be concise; this helps to ensure that the recipient understands your request. For inspiration, you can refer to a bond claim letter example with no response.

Writing a claim intimation letter requires clarity and precision. Begin by stating your intent to file a claim, including specific details about the bond in question. Reference a 'Bond claim letter example with no response' to guide your structure and content. Providing clear information helps the recipient understand your claim and ensures an efficient process.

A good claim example is one that presents clear, specific details related to the situation. It includes factual information, such as dates and amounts, along with supporting documentation. When crafting your own claim, consider using a bond claim letter example with no response for guidance. Providing evidence strengthens the claim and increases the likelihood of a favorable outcome.

A strong claim statement requires clarity and detail. Begin by summarizing the facts and providing evidence to support your claim, referencing the bond when necessary. For inspiration, look for a bond claim letter example with no response to understand how to structure your statement effectively. Remember, the more straightforward and factual your statement, the better your chances of a quick resolution.

To write a simple claim letter, start by clearly stating your purpose. Include essential details such as dates, parties involved, and the nature of the claim. Referencing a bond claim letter example with no response can guide you in structuring your letter effectively. Ensure you remain polite and concise while providing all necessary information for a prompt resolution.