Share Merger Stock For Cash

Description

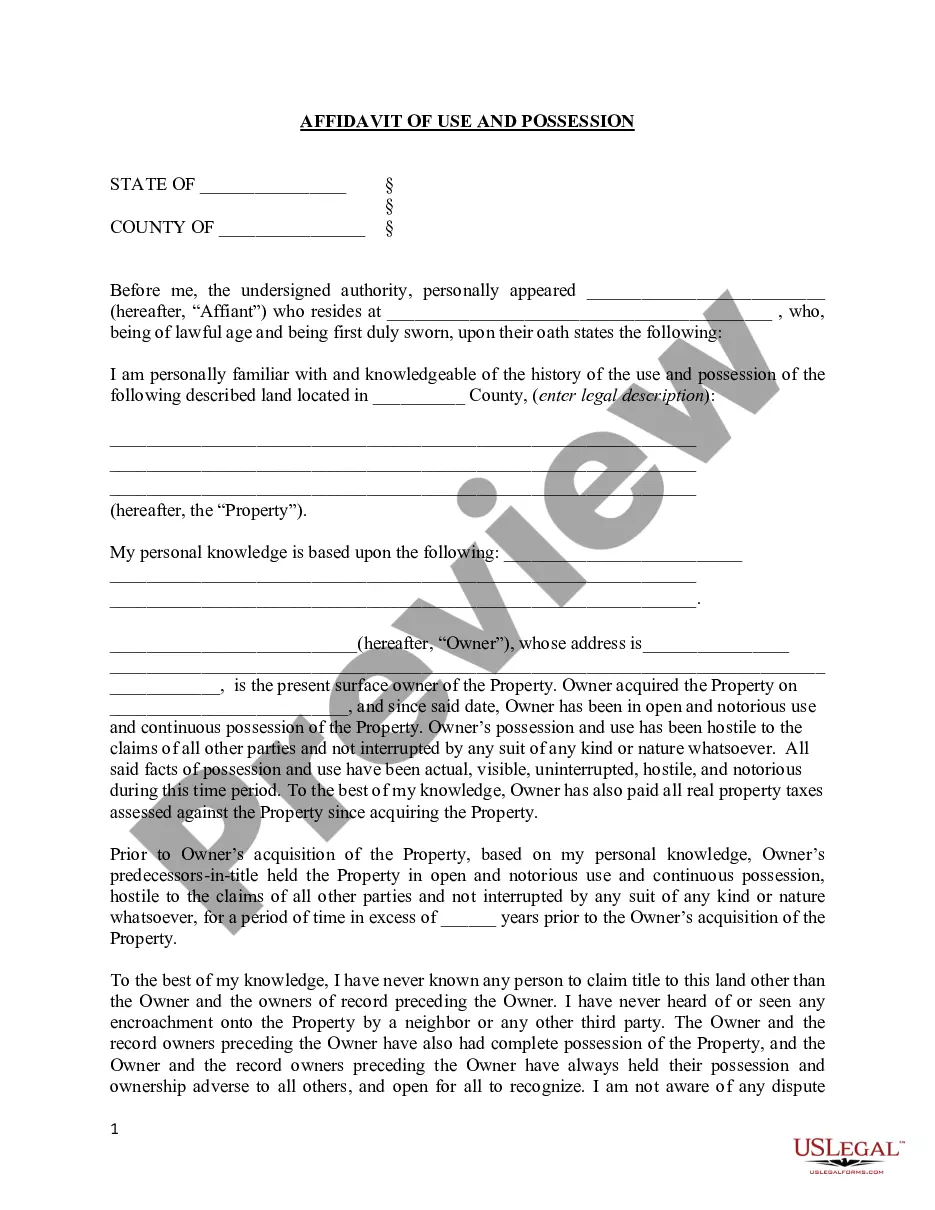

How to fill out Proposed Merger With The Grossman Corporation?

The Share Merger Stock For Cash you see on this page is a reusable formal template drafted by professional lawyers in line with federal and local laws and regulations. For more than 25 years, US Legal Forms has provided people, companies, and legal professionals with more than 85,000 verified, state-specific forms for any business and personal occasion. It’s the fastest, most straightforward and most reliable way to obtain the documents you need, as the service guarantees the highest level of data security and anti-malware protection.

Obtaining this Share Merger Stock For Cash will take you only a few simple steps:

- Search for the document you need and review it. Look through the sample you searched and preview it or check the form description to verify it satisfies your requirements. If it does not, make use of the search option to get the right one. Click Buy Now once you have located the template you need.

- Sign up and log in. Choose the pricing plan that suits you and register for an account. Use PayPal or a credit card to make a prompt payment. If you already have an account, log in and check your subscription to proceed.

- Get the fillable template. Select the format you want for your Share Merger Stock For Cash (PDF, DOCX, RTF) and save the sample on your device.

- Complete and sign the paperwork. Print out the template to complete it manually. Alternatively, utilize an online multi-functional PDF editor to rapidly and accurately fill out and sign your form with a legally-binding] {electronic signature.

- Download your paperwork one more time. Utilize the same document once again whenever needed. Open the My Forms tab in your profile to redownload any earlier downloaded forms.

Sign up for US Legal Forms to have verified legal templates for all of life’s circumstances at your disposal.

Form popularity

FAQ

If most or all of the merger consideration is cash, the acquisition will be classified as a taxable merger. Shareholders of the acquired company report a sale of their shares for an amount equal to the cash received plus the value of other consideration (typically stock of the acquiring company), if any.

How do stocks work with mergers? Depending on the specifics of the merger, investors may have their shares cashed-out, or exchanged for shares of the new company. Prices of stocks may increase or decrease, often depending on if they're shares of the target or acquiring company.

A really confident acquirer would be expected to pay for the acquisition with cash. Stock offers, then, send two powerful signals to the market: that the acquirer's shares are overvalued and that its management lacks confidence in the acquisition.

When reporting your cash in lieu payment, you will need Form 1099-B, as well as: Original cost basis (which is the original price or cost of the asset at purchase) Purchase date. Stock split date (or the date of the merger, acquisition or spin off) Reason why the cash in lieu of fractional shares was issued.

Hear this out loud PauseIf most or all of the merger consideration is cash, the acquisition will be classified as a taxable merger. Shareholders of the acquired company report a sale of their shares for an amount equal to the cash received plus the value of other consideration (typically stock of the acquiring company), if any.