Amendment To Certificate Of Incorporation New Jersey

Description

How to fill out Amendment And Restatement Of Certificate Of Incorporation With Exhibit?

Locating a primary venue to acquire the latest and suitable legal documents is half the battle of managing bureaucracy.

Selecting the correct legal forms demands precision and attention to detail, which is why it is crucial to procure samples of Amendment To Certificate Of Incorporation New Jersey only from reliable sources, such as US Legal Forms.

Eliminate the stress associated with your legal documentation. Browse the comprehensive US Legal Forms catalog where you can locate legal samples, verify their relevance to your circumstances, and download them immediately.

- Utilize the catalog navigation or search function to discover your template.

- Review the form’s details to ensure it meets the criteria of your state and locality.

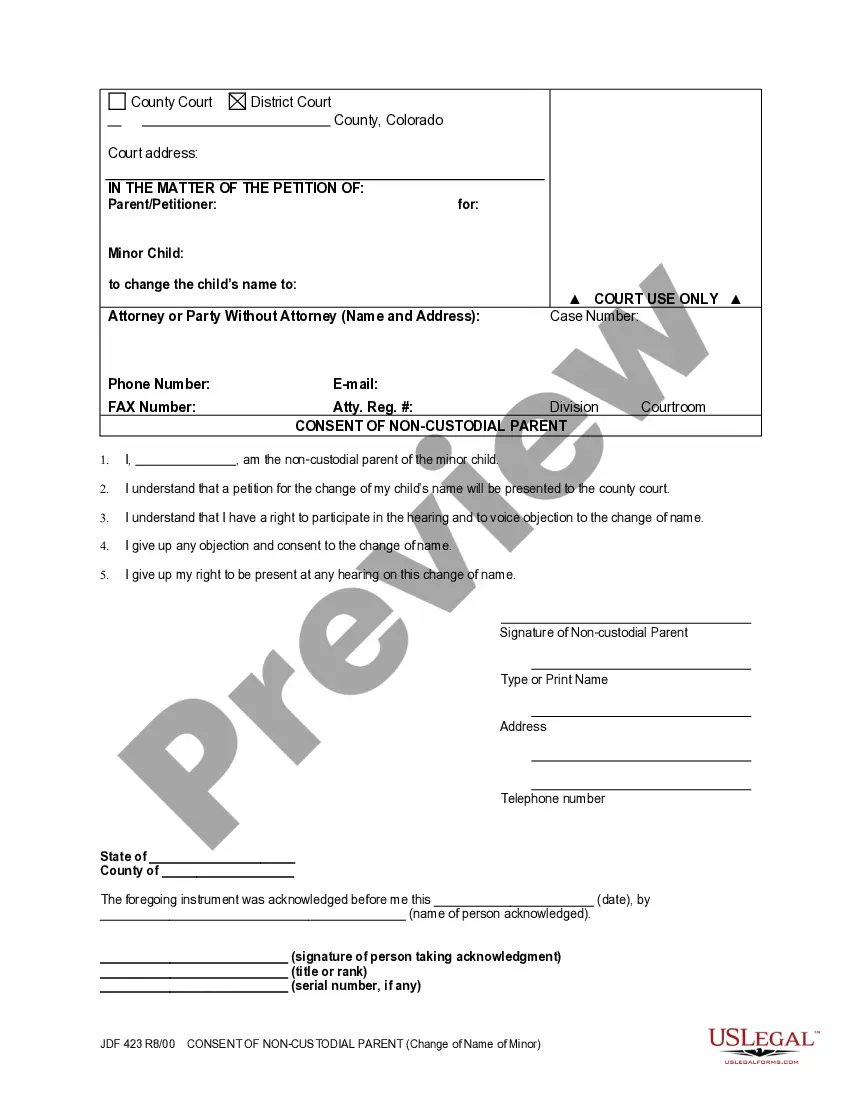

- Access the form preview, if available, to verify that the form is the one you require.

- Return to the search and find the appropriate template if the Amendment To Certificate Of Incorporation New Jersey does not meet your needs.

- If you are confident about the form’s applicability, download it.

- When you are a registered user, click Log in to verify and access your chosen forms in My documents.

- If you lack an account, click Buy now to acquire the form.

- Select the pricing package that best fits your needs.

- Proceed to the registration to complete your transaction.

- Finalize your transaction by choosing a payment method (credit card or PayPal).

- Choose the document format for downloading Amendment To Certificate Of Incorporation New Jersey.

- Once you have the form on your device, you can modify it with the editor or print it and complete it manually.

Form popularity

FAQ

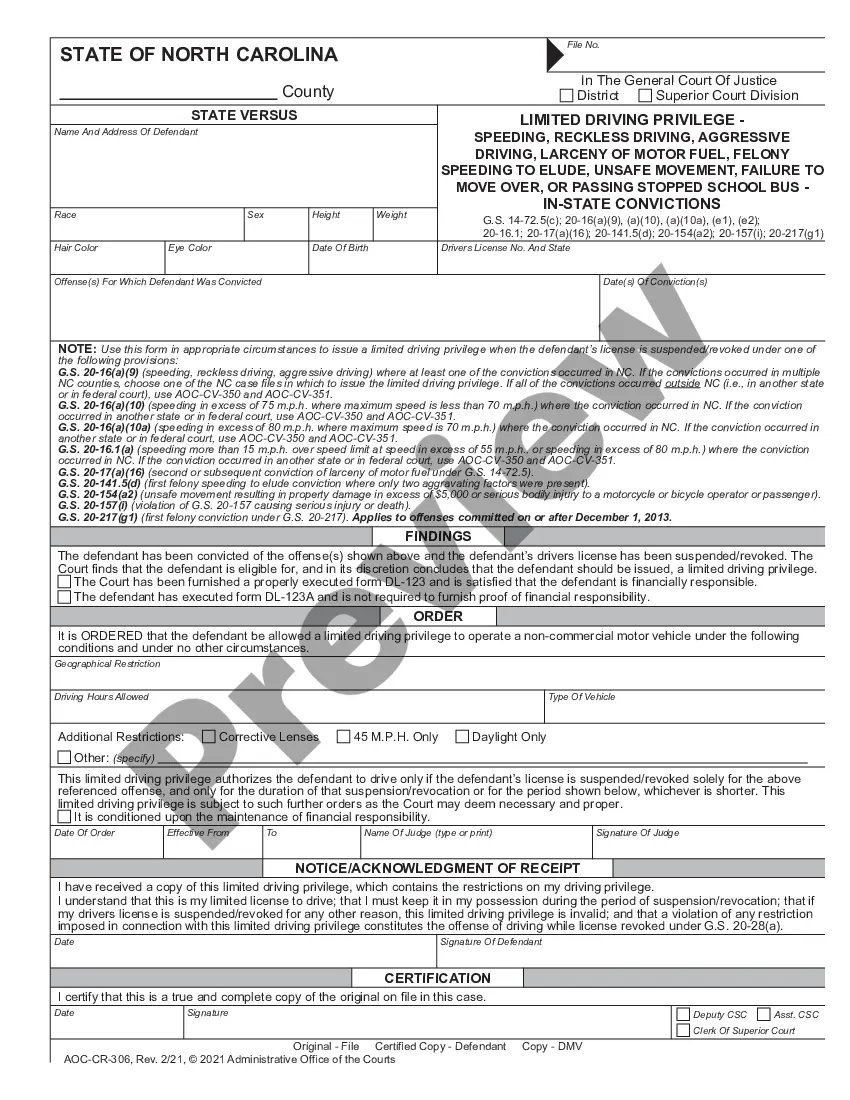

The Department of the Treasury recommends directly filing amendments online, but also accepts mailed, faxed or uploaded copies of a Certificate of Amendment (Form L-102) or the Business Entity Amendment Filing (Form Reg-C-EA) included on page 38 of the New Jersey Business Registration Packet (NJ-Reg), both of which can ...

Certificate of Amendment This form may be used to amend a Certificate of Formation of a Limited Liability Company on file with the Department of the Treasury. Applicants must insure strict compliance with NJSA 42, the New Jersey Limited Liability Act, and insure that all applicable filing requirements are met.

How to Amend Articles of Incorporation Review the bylaws of the corporation. ... A board of directors meeting must be scheduled. ... Write the proposed changes. ... Confirm that the board meeting has enough members attending to have a quorum so the amendment can be voted on. Propose the amendment during the board meeting.

You would file Restated Certificate form to restate or restate and amend the certificate of incorporation. For profit corporations would file form C-100A Restated Certificate of Incorporation. There are two pages required to restate the certificate. Make sure you submit both pages to the Division of Revenue.

If you are changing the name or ownership of your business: The letter must be signed by an owner, principal, officer or director of the company. If applicable, submit a copy of your dissolution papers. ?Certificate of Amendment.? No fee is required.