Schedule C Form Blank For 2020

Description

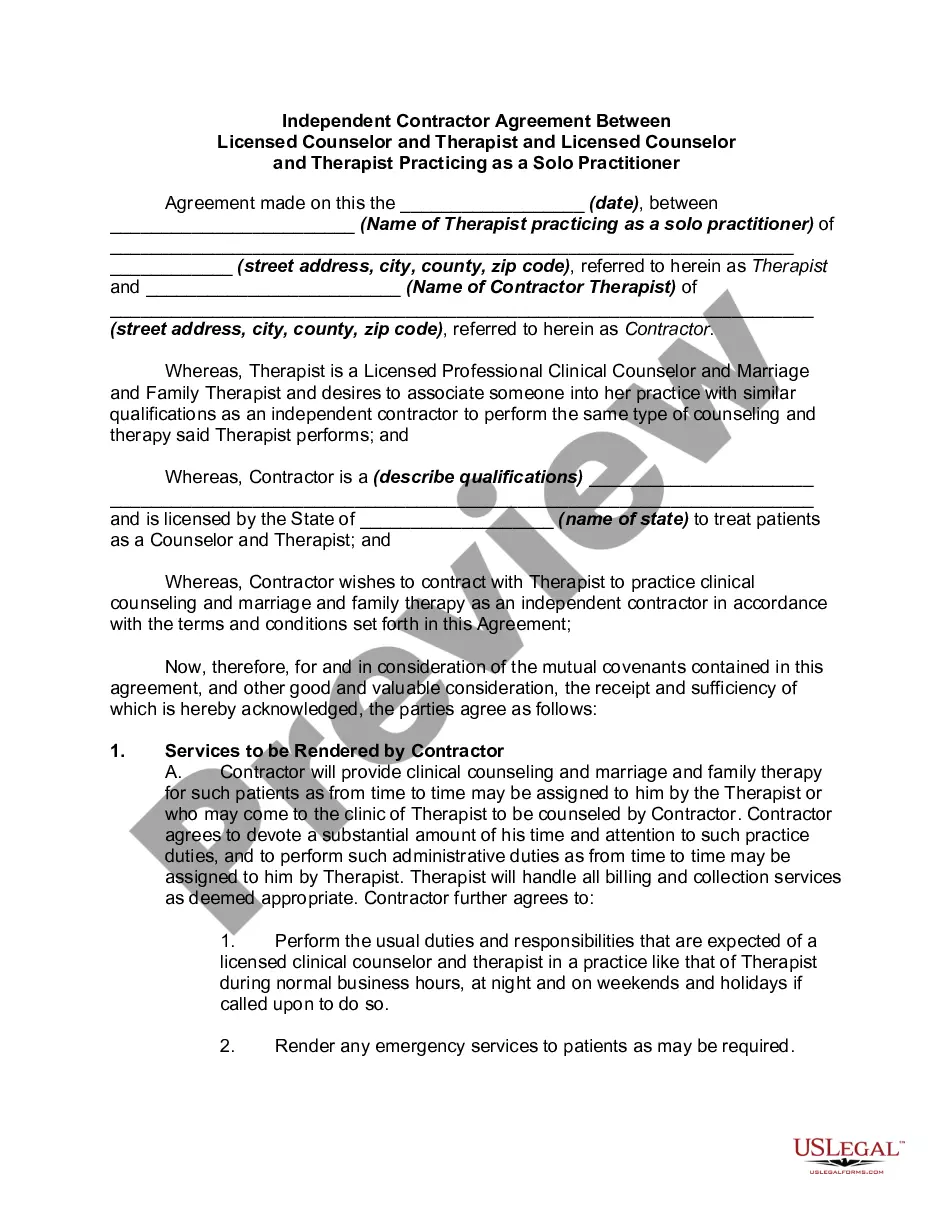

How to fill out Property Claimed As Exempt - Schedule C - Form 6C - Post 2005?

Creating legal documents from scratch can frequently feel overwhelming.

Certain cases may require extensive research and considerable expenditure.

If you are seeking a simpler and more cost-effective method of generating Schedule C Form Blank For 2020 or any other documents without unnecessary complications, US Legal Forms is always available to assist you.

Our online repository of over 85,000 current legal documents covers nearly every aspect of your financial, legal, and personal affairs. With just a few clicks, you can swiftly access state- and county-specific forms meticulously prepared for you by our legal experts.

Ensure the template you select meets the requirements of your state and county. Select the proper subscription option to purchase the Schedule C Form Blank For 2020. Download the file, then complete, sign, and print it. US Legal Forms has an excellent reputation and more than 25 years of experience. Join us today and turn form filling into a straightforward and efficient process!

- Utilize our platform whenever you require a dependable and trustworthy service to easily find and download the Schedule C Form Blank For 2020.

- If you are already familiar with our services and have previously established an account with us, simply Log In to your account, find the template, and download it immediately or re-download it anytime in the My documents section.

- Not have an account? No worries. It takes minimal time to register and browse through the library.

- Before jumping straight to downloading Schedule C Form Blank For 2020, consider these suggestions.

- Review the document preview and descriptions to confirm you are accessing the document you need.

Form popularity

FAQ

The Schedule C form for 2020 is used by self-employed individuals to report income and expenses from their business activities. This form helps you calculate your net profit or loss, which is essential for your annual tax return. If you're looking for a Schedule C form blank for 2020, you can easily find it through US Legal Forms, ensuring you have the correct document to fulfill your tax obligations.

Use Schedule C (Form 1040) to report income or loss from a business you operated or a profession you practiced as a sole proprietor. An activity qualifies as a business if: Your primary purpose for engaging in the activity is for income or profit. You are involved in the activity with continuity and regularity.

How to complete and file Schedule C for your small business Prepare your financial statements. ... File Forms 1099 for all contractors. ... Report cost of goods sold. ... Report income. ... Report business expenses. ... Report the business use of your vehicle. ... Add other expenses. ... Calculate net profit or loss and report on schedules 1 and SE.

Steps To Completing Schedule C Step 1: Gather Information. Step 2: Calculate Gross Profit and Income. Step 3: Include Your Business Expenses. Step 4: Include Other Expenses and Information. Step 5: Calculate Your Net Income. If You Have a Business Loss.

How To Complete Form 1040 Step 1: Fill In Your Basic Information. The first half of Form 1040 asks some basic questions about your filing status, identification, contact information and dependents. ... Step 2: Report Your Income. ... Step 3: Claim Your Deductions. ... Step 4: Calculate Your Tax. ... Step 5: Claim Tax Credits.

Use Schedule F (Form 1040) to report farm income and expenses. File it with Form 1040, 1040-SR, 1040-NR, 1041, or 1065. Your farming activity may subject you to state and local taxes and other require- ments such as business licenses and fees. Check with your state and local governments for more information.