Self Evaluation Examples For Medical Assistant

Description

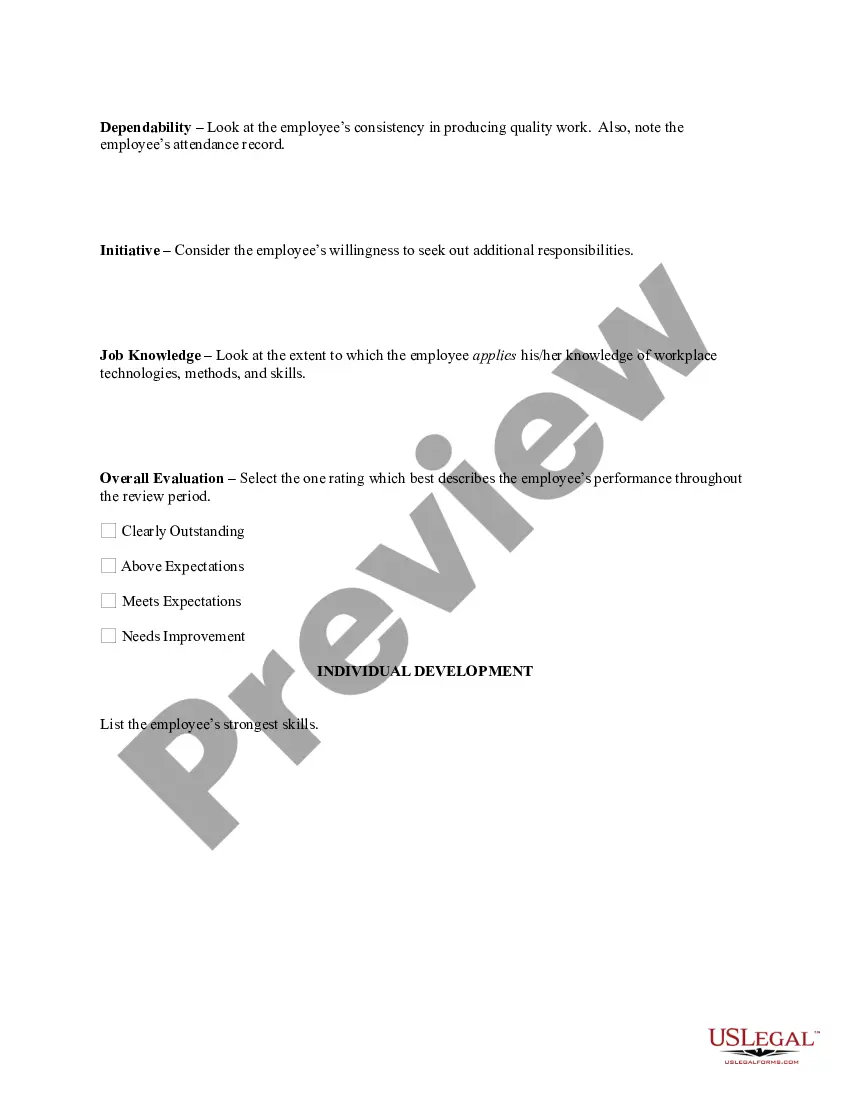

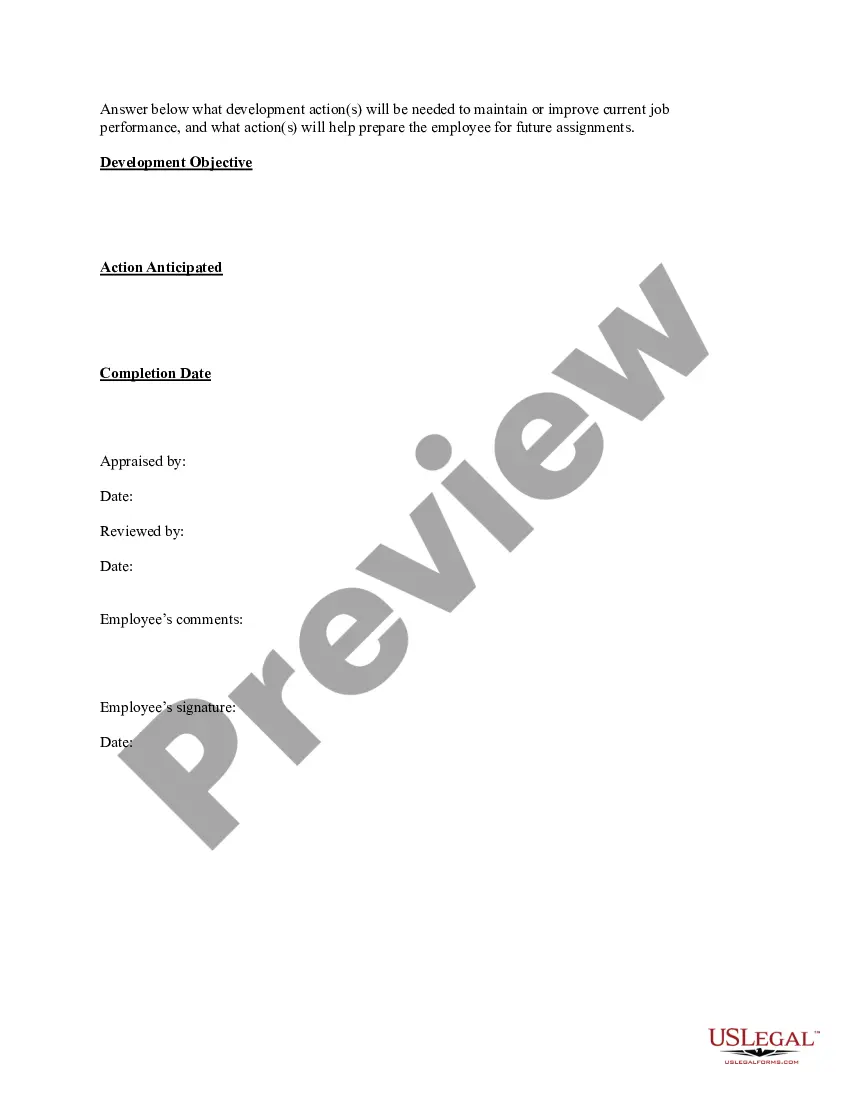

How to fill out Sample Performance Review For Nonexempt Employees?

Regardless of whether for corporate objectives or personal matters, every individual must confront legal scenarios at some point in their life.

Completing legal paperwork requires meticulous focus, starting with selecting the suitable form template.

With an extensive catalog from US Legal Forms available, you don't have to waste time searching for the best template online. Make use of the library’s simple navigation to discover the correct form for any circumstance.

- Search for the template you require by utilizing the search bar or browsing the catalog.

- Review the form’s details to ensure it aligns with your circumstances, state, and locality.

- Click on the form’s preview to examine it.

- If it is not the correct form, return to the search feature to find the Self Evaluation Examples For Medical Assistant sample you need.

- Download the document if it fulfills your criteria.

- If you already possess a US Legal Forms account, click Log in to access previously stored documents in My documents.

- If you do not have an account yet, you can acquire the form by clicking Buy now.

- Select the suitable pricing plan.

- Fill out the account registration form.

- Choose your payment method: use a credit card or PayPal account.

- Select the file format you prefer and download the Self Evaluation Examples For Medical Assistant.

- Once downloaded, you can fill out the form using editing software or print it and complete it manually.

Form popularity

FAQ

Don't pay, don't promise to pay and don't give any payment information the collector may use later. Ask for information on the debt and say you'll call back to discuss it later. Making a single payment ? even just $5 or $10 ? is an acknowledgment of the debt and can have serious repercussions.

If you notify the debt collector in writing that you dispute the debt within 30 days of receiving a validation notice, the debt collector must stop trying to collect the debt until they've provided you with verification in response to your dispute.

Don't provide personal or sensitive financial information Never give out or confirm personal or sensitive financial information ? such as your bank account, credit card, or full Social Security number ? unless you know the company or person you are talking with is a real debt collector.

To further establish as evidence the date and fact that you sent the debt collector a DV letter, it's a good idea to have someone else mail your DV letter along with an "Affidavit of Mailing". This signed and notarized affidavit by a third party will firmly establish your evidence of mailing the DV letter.

You have the right to send what's referred to as a ?drop dead letter. '' It's a cease-and-desist motion that will prevent the collector from contacting you again about the debt. Be aware that you still owe the money, and you can be sued for the debt.

Debt Validation Letter Example I am requesting that you provide verification of this debt. Please send the following information: The name and address of the original creditor, the account number, and the amount owed. Verification that there is a valid basis for claiming I am required to pay the current amount owed.

If you are struggling with debt and debt collectors, Farmer & Morris Law, PLLC can help. As soon as you use the 11-word phrase ?please cease and desist all calls and contact with me immediately? to stop the harassment, call us for a free consultation about what you can do to resolve your debt problems for good.

NMSA 1978 §37-1-1 et seq. governs New Mexico's statute of limitations for the collection of open accounts, written contracts, and judgments entered by the Court. In New Mexico, the statute of limitations for open accounts is four years, while the statute of limitations for written contracts is six years.