Exemption

Description

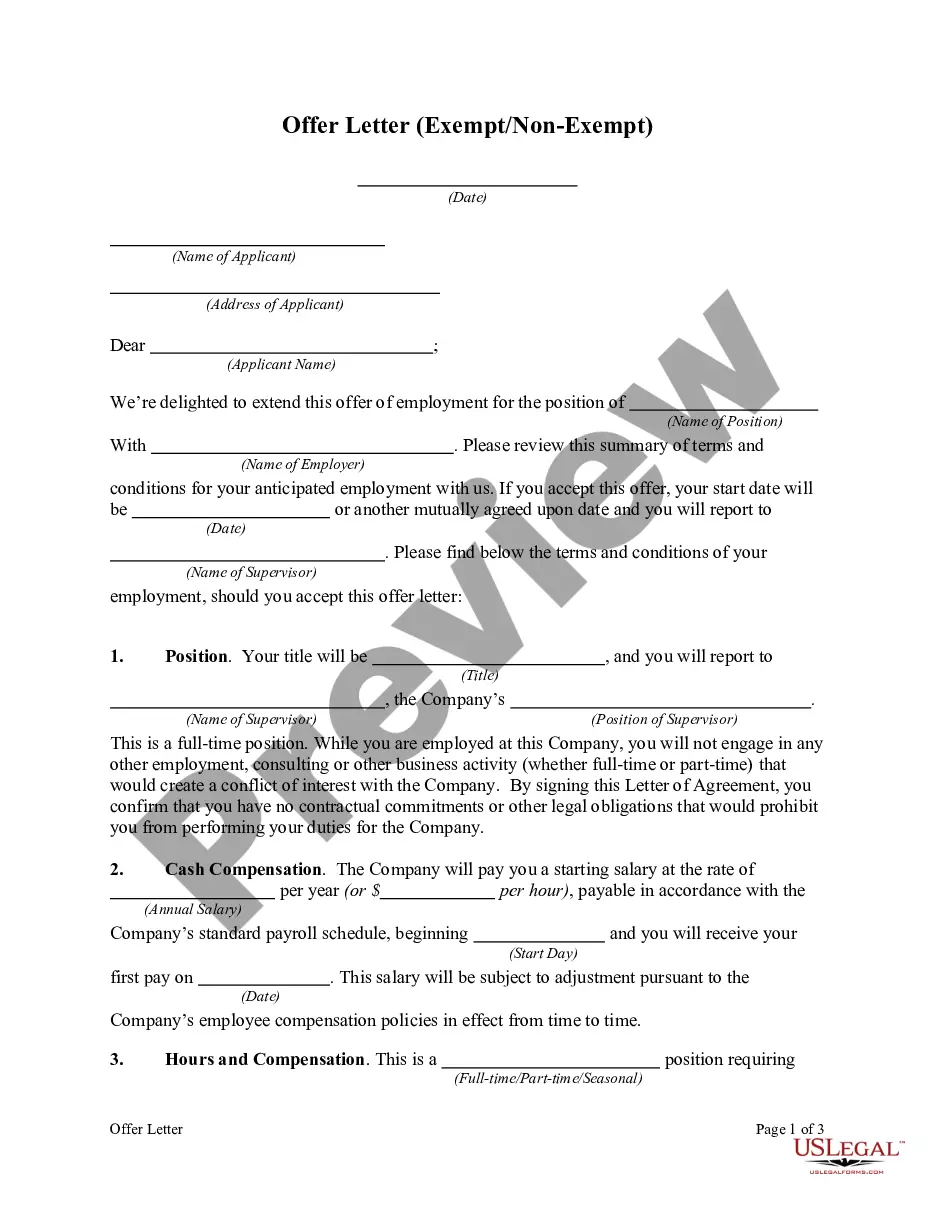

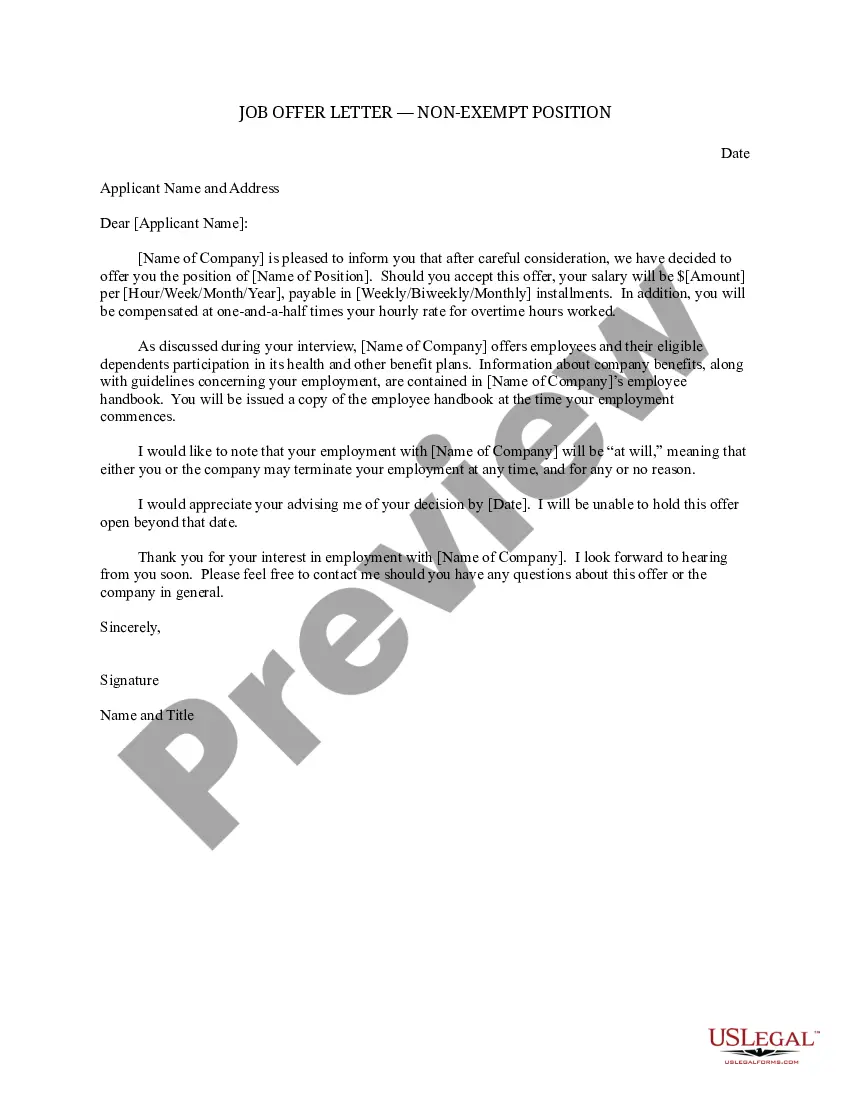

How to fill out Job Offer Letter - Exempt Position - Detailed?

- If you've used US Legal Forms before, log in to your account and ensure your subscription is active. If it needs renewing, follow the instructions for your payment plan.

- For first-time users, start by exploring the Preview mode and form descriptions to ensure you select the correct exemption that meets your local jurisdiction's standards.

- If you need another form, utilize the Search tab to find additional templates that might fit your requirements.

- To acquire your chosen document, click on the Buy Now button and select your desired subscription plan, ensuring you create an account for access.

- Complete your purchase by entering your payment details via credit card or PayPal.

- Finally, download your form and save it on your device, or access it anytime through the My Forms section of your profile.

US Legal Forms not only provides a robust collection of forms but also offers access to premium experts who can assist you with proper form completion, ensuring your documents are accurate and legally valid.

Start your journey towards hassle-free legal documentation today and discover the immense benefits of using US Legal Forms for your exemption needs!

Form popularity

FAQ

You can qualify to file as exempt if your combined income does not meet the minimum requirement for federal taxes. Additionally, if you had no tax liability for the previous year and do not expect to owe taxes this year, you can file exempt. It's important to stay informed about your eligibility, and uslegalforms provides tools to help you assess your qualifications effectively.

To file as exempt, you need to demonstrate that you had no tax liability last year and expect none this year, which is key for eligibility. In addition, your total income should fall below the taxable threshold. Making sure you understand these criteria helps you avoid issues with the IRS, and uslegalforms offers insights to help clarify your situation.

To claim exempt on your tax form, you typically need to fill out your W-4, marking the appropriate box to indicate your exempt status. Make sure to provide your employer with the completed form, so they can adjust your withholding accordingly. For clear instructions and templates, you can turn to uslegalforms, which simplifies the tax form process.

You can file as exempt on your paycheck for the entire calendar year, but you must reapply each year. If your financial situation changes, such as earning additional income or filing with a different status, you should adjust your exemption status accordingly. Uslegalforms provides a straightforward process to help you keep track of your exemptions yearly.

To qualify for tax exemption, you must meet specific criteria set by the IRS. Generally, you can claim exemption if you had no tax liability in the previous year and expect none in the current year. You should also consider your filing status and income level. For personalized guidance, uslegalforms offers resources to help you navigate the requirements.

Exemption in simple terms means you are freed from paying certain taxes. It allows you to reduce your taxable income or avoid paying taxes altogether in specific cases. For instance, an exemption can apply to dependents or special circumstances defined by tax laws. Recognizing exemptions can lead to considerable tax savings.

Claiming an exemption may be advantageous if you have minimal or no tax liability expected for the current year. However, if you're unsure about your tax situation, withholding may provide a safety net against unexpected liabilities. It's essential to evaluate your financial and tax scenarios thoroughly. Consulting resources like uslegalforms can guide your decision.

Claiming exemption from withholding can be beneficial if you expect not to owe taxes for the year. However, this decision requires careful consideration. If you have additional income or anticipate changes in your tax situation, it might be wise to withhold. The uslegalforms platform can assist you in determining if claiming exemption is right for you.

When applying for an exemption, you should refer to IRS guidelines to accurately reflect your tax situation. Typically, this involves filling out a W-4 form, where you can specify the number of exemptions you wish to claim. An accurate declaration aids in appropriate tax withholding. If in doubt, consulting a tax professional can provide clarity.

To be considered a tax-exempt individual, you usually must meet criteria such as having earned income below a specific amount or receiving income from certain exempt sources. Often, tax-exempt status applies to specific organizations rather than individuals. Ensure you consult tax regulations to determine if you qualify.