Certificate Of Employment With Compensation Template

Description

How to fill out Employment Verification Request Letter?

Creating legal documents from the beginning can frequently feel somewhat daunting.

Certain situations may require numerous hours of investigation and substantial expenses.

If you're seeking a more straightforward and economical method of preparing the Certificate Of Employment With Compensation Template or any other documents without unnecessary hurdles, US Legal Forms is readily available to assist you.

Our online repository of over 85,000 contemporary legal documents encompasses nearly every aspect of your financial, legal, and personal matters.

Before proceeding to download the Certificate Of Employment With Compensation Template, please consider these guidelines: Review the form preview and details to verify that you have located the correct form. Ensure the template you select abides by the regulations and statutes of your state and county. Choose the appropriate subscription option to acquire the Certificate Of Employment With Compensation Template. Download the form, complete it, certify it, and print it. US Legal Forms boasts a solid reputation and over 25 years of experience. Join us today and make document handling a straightforward and efficient process!

- With just a few clicks, you can swiftly obtain forms that are compliant with state and county laws, meticulously crafted for you by our legal experts.

- Utilize our platform whenever you need dependable and trustworthy services, where you can easily find and download the Certificate Of Employment With Compensation Template.

- If you’re already familiar with our site and have set up an account with us in the past, simply Log In to your account, select the form, and download it or access it later in the My documents section.

- Not registered yet? No worries. It takes only a few minutes to create your account and explore the library.

Form popularity

FAQ

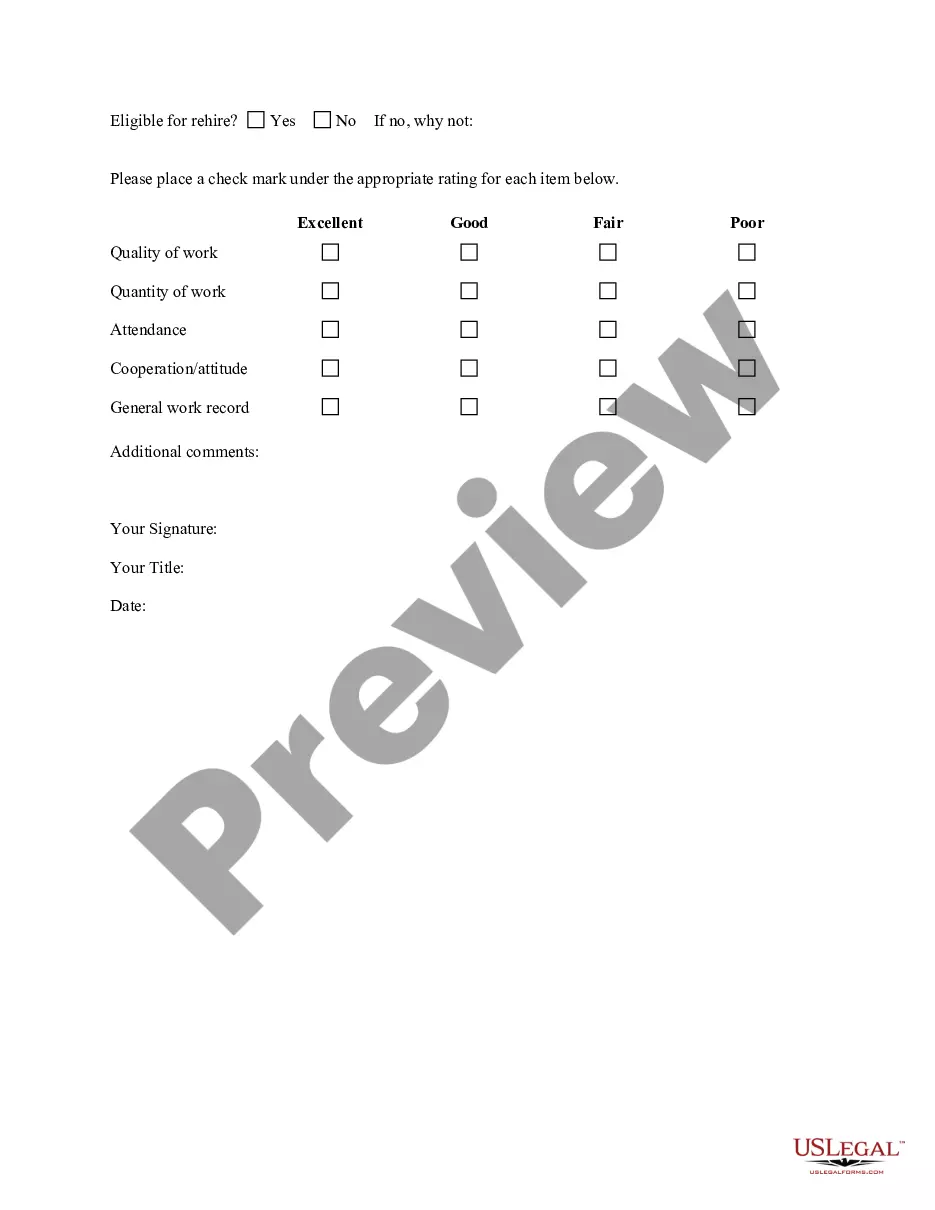

To fill out the verification of employment template, gather all necessary employee information, such as their position, employment dates, and salary. Ensure that you accurately fill in each section according to the details provided. Utilizing a Certificate of employment with compensation template can help simplify the process, making sure nothing is overlooked.

A good answer regarding the probability of continued employment should be straightforward. You can say that it largely depends on the employee's performance and the company's needs. Additionally, if you include a statement that aligns with the Certificate of employment with compensation template, you can provide consistent and clear insights.

Typically, the employer or HR representative fills out the employment verification form. This ensures that the information is accurate and up-to-date. If you need structured guidance, consider using the Certificate of employment with compensation template for clarity and completeness in the information provided.

§§ 66-29-101-155 is the Tennessee Unclaimed Property Act. The act requires all holders of unclaimed or abandoned property to report and transmit all unclaimed property to the state. All reports must be filed electronically in an accepted format. The Department of Treasury has free software available on their website.

Due diligence consists of mailing a first class letter to the owner. The purpose of the letter is to give the owner the opportunity to collect the funds from you and relieve you of the liability to have to report and remit the funds to the Unclaimed Property Division.

NAUPA defines unclaimed property as accounts in financial institutions or companies that have had no activity generated or contact with the owner for one year or longer. Unclaimed property may include refunds, un-cashed payroll checks, stocks, credit balance on overpayment, and many other forms.

For information about additional unclaimed property not in Metro's custody, you can visit the State of Tennessee Unclaimed Property Division website or call 866-370-9429.

If a specified amount of time has passed (typically 1?3 years) and the company has not been able to return your asset or make contact with you, then the property becomes abandoned.

In California, unclaimed property is anything a business owes to stakeholders past the period of abandonment. Stakeholders include employees, vendors, customers, creditors, or shareholders. Types of property, also called abandoned property, are: Uncashed or voided payroll checks and/or accounts payable disbursements.

§§ 66-29-101-155 is the Tennessee Unclaimed Property Act. The act requires all holders of unclaimed or abandoned property to report and transmit all unclaimed property to the state. All reports must be filed electronically in an accepted format. The Department of Treasury has free software available on their website.