Most Common Interview Questions With Answers

Description

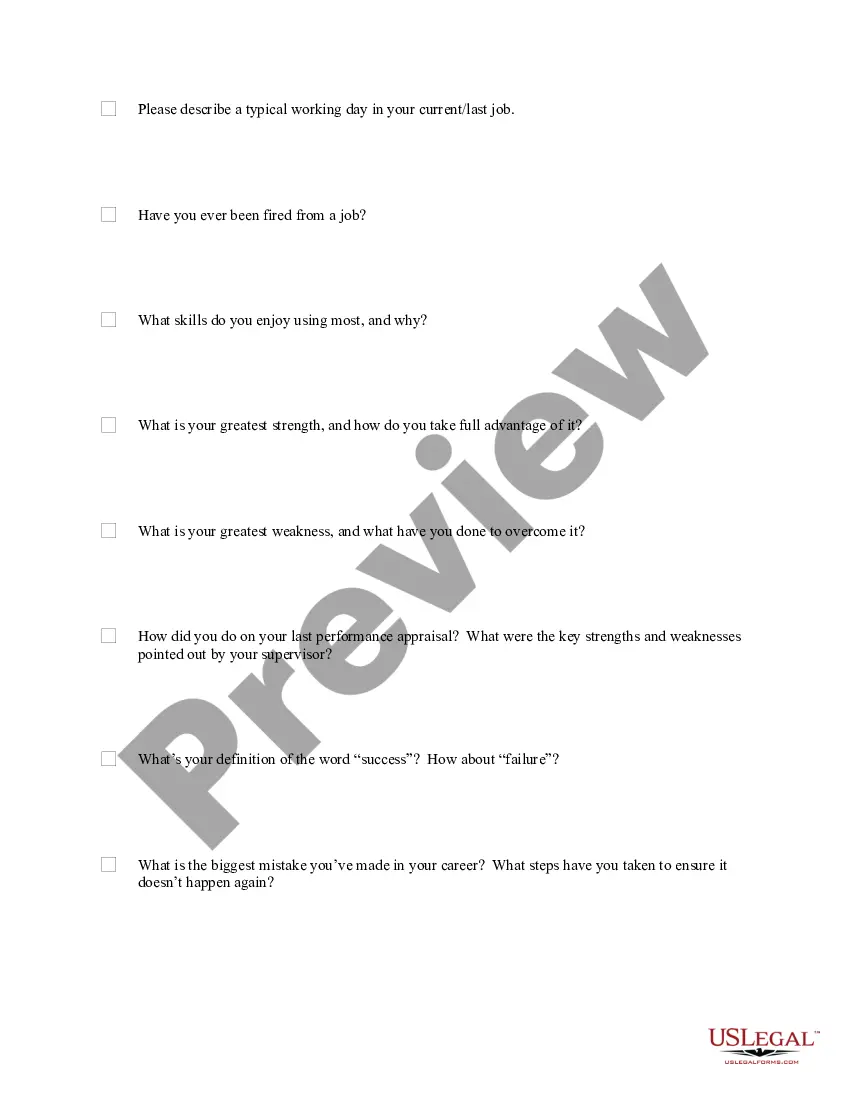

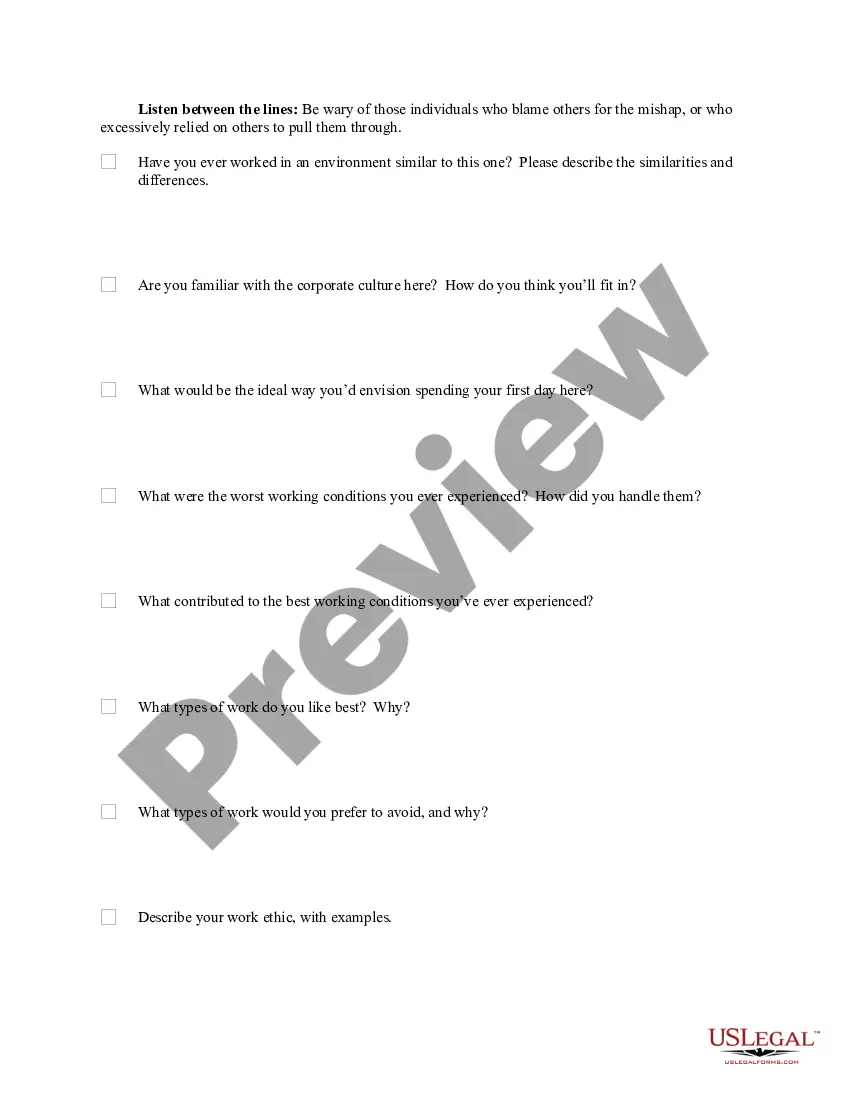

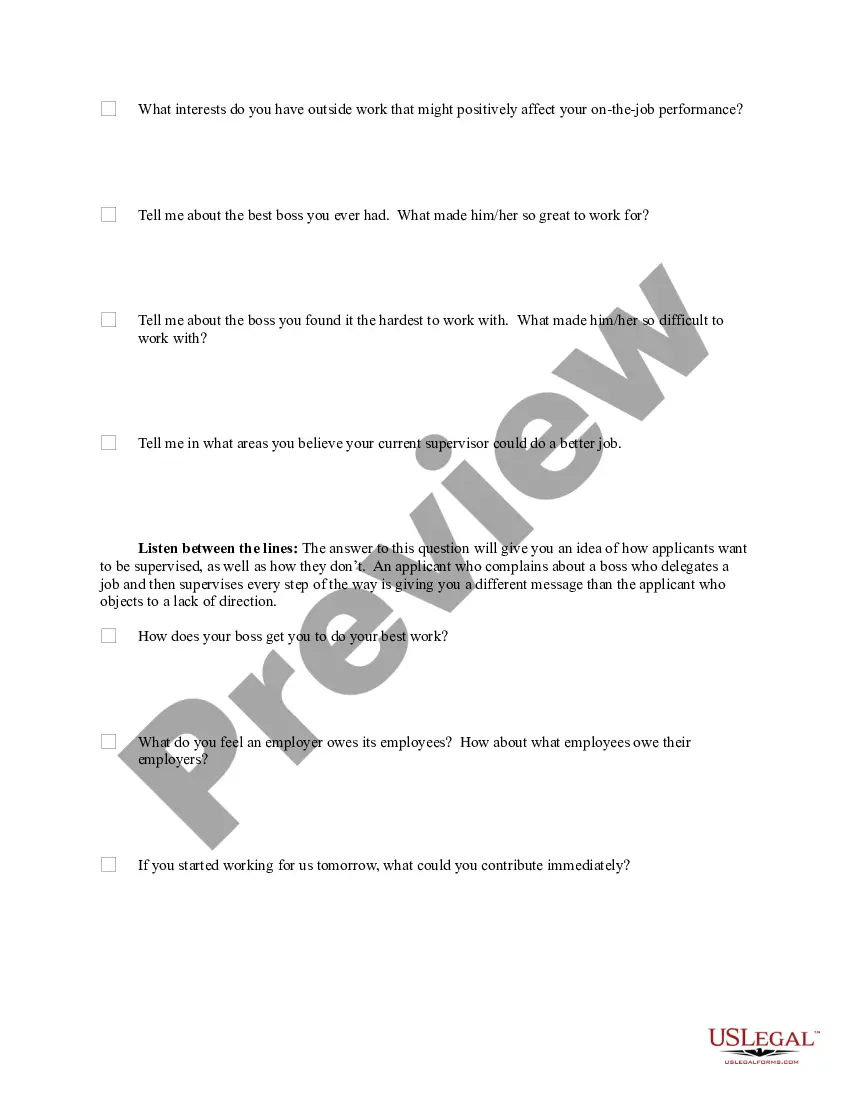

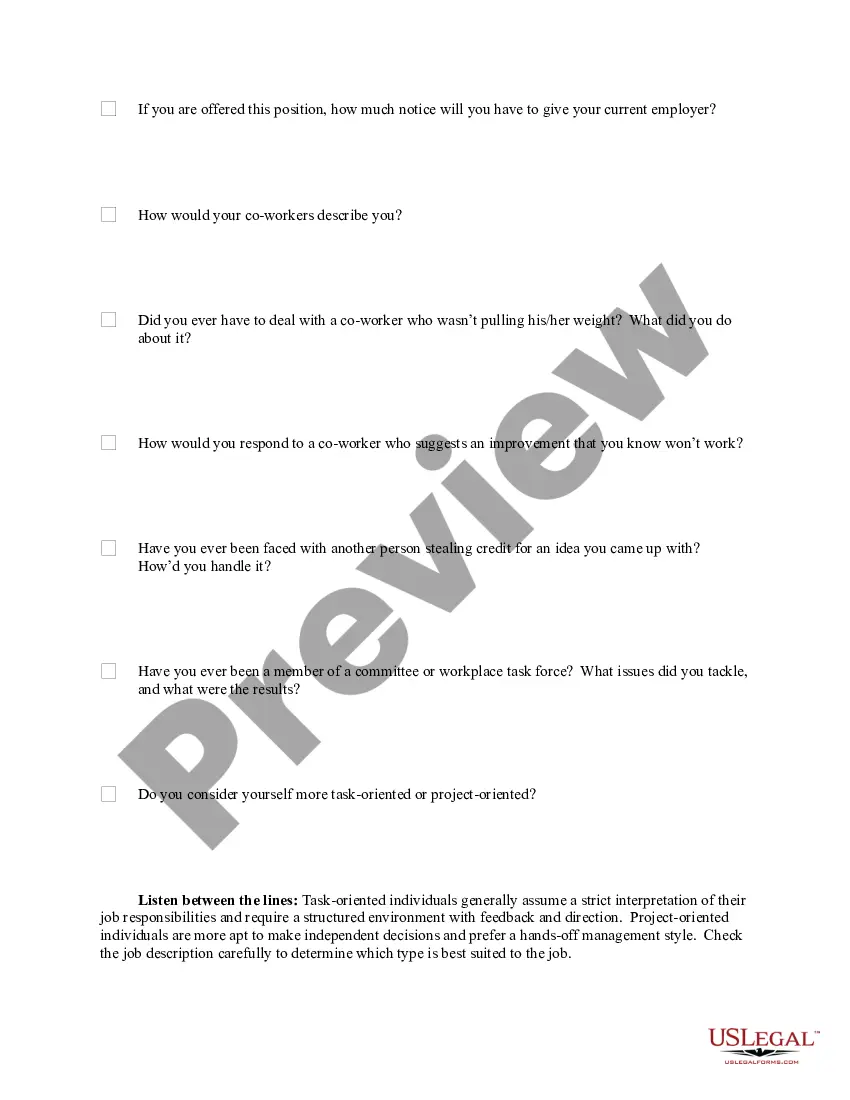

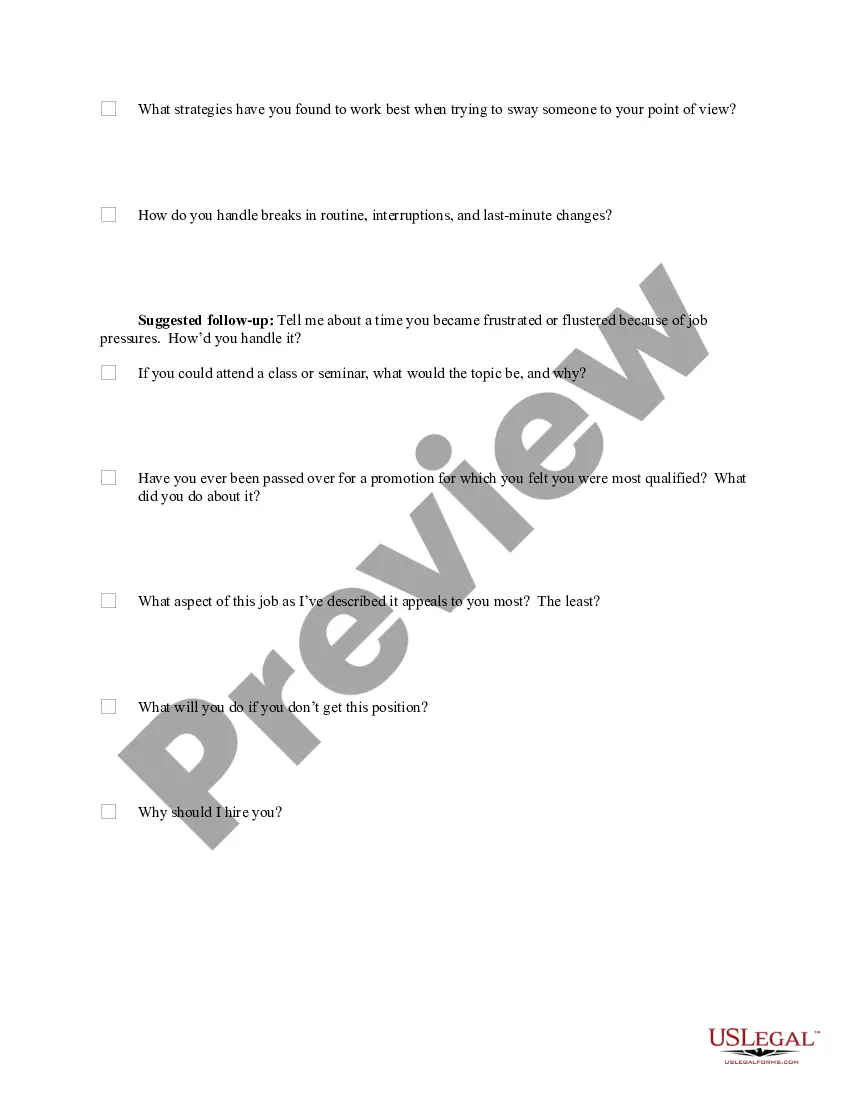

How to fill out Checklist Of Standard Hiring Interview Questions With Listening Tips And Suggested Follow-up Questions?

Identifying a go-to location to obtain the most up-to-date and pertinent legal templates is half the challenge of navigating bureaucracy.

Securing the appropriate legal documents requires accuracy and meticulousness, which is why it is crucial to obtain samples of Most Common Interview Questions With Answers solely from reliable sources, such as US Legal Forms.

Once you possess the form on your device, you can alter it using the editor or print it out to complete it by hand. Eliminate the stress associated with your legal documents. Explore the extensive US Legal Forms collection where you can discover legal templates, assess their suitability for your situation, and download them instantly.

- Utilize the library navigation or search bar to find your sample.

- Examine the form's details to determine if it aligns with the needs of your state and locality.

- Preview the form, if possible, to confirm it is the document you wish to acquire.

- Return to the search to find the correct template if the Most Common Interview Questions With Answers does not meet your requirements.

- Once certain of the form's relevance, proceed to download it.

- If you are a registered customer, click Log in to verify and access your selected templates in My documents.

- If you do not have an account yet, click Buy now to obtain the template.

- Select the pricing plan that suits your needs.

- Continue to the registration process to finalize your purchase.

- Complete your transaction by choosing a payment method (credit card or PayPal).

- Select the document format for downloading Most Common Interview Questions With Answers.

Form popularity

FAQ

The 4 pillars of an interview consist of Preparation, Engagement, Assessment, and Follow-up. Successfully addressing these pillars will help you respond effectively to the most common interview questions with answers that impact hiring decisions. Preparation ensures you understand the role, while engagement keeps the conversation dynamic. Don’t forget to follow up with a thank-you note; it reinforces your interest and professionalism.

Legally, you are not required to have the Affidavit notarized. But many institutions will ask you to do so, so it may be a good idea to notarize it before you try to use it to transfer the property. If there are other people entitled to inherit the property, they must also sign the Affidavit.

Maximum Value of Small Estate: $166,250?$184,500 To use the affidavit for small estates under Probate Code §13100, the value of an estate must be no larger than $184,500. (For deaths prior to April 1, 2022, the maximum value of an estate that could use the small estate affidavit was $166,250.)

Code §§ 13100-13116, the person(s) entitled to the property may present a Small Estate Affidavit, commonly known as an Affidavit for Collection of Personal Property, to the person or institution having custody of the property, requesting that the property be delivered or transferred to the successor.

This form may be used to collect the unclaimed property of a decedent without procuring letters of administration or awaiting probate of the decedent's will if you are entitled to the decedent's property under Section 13101 of the California Probate Code.

California Small Estate Affidavit: Instructions 2023 This document allows a petitioner to transfer the unclaimed property of a deceased if the petitioner is entitled to the deceased's assets ing to Section 13101 of the California Probate Code.

File your affidavit with the probate court where the deceased resided. The filing fee in California is $435. The court clerk will provide you with further instructions regarding the process.

If probate has started, a personal representative of the estate has to agree in writing to the use of this informal settlement process. The affidavit doesn't have to be filed with the court. To use it, the person claiming the assets presents it to the bank, brokerage or another holder of the asset.

Use the Court Locator and find the probate court where the decedent was a resident. The State filing fee is $435.