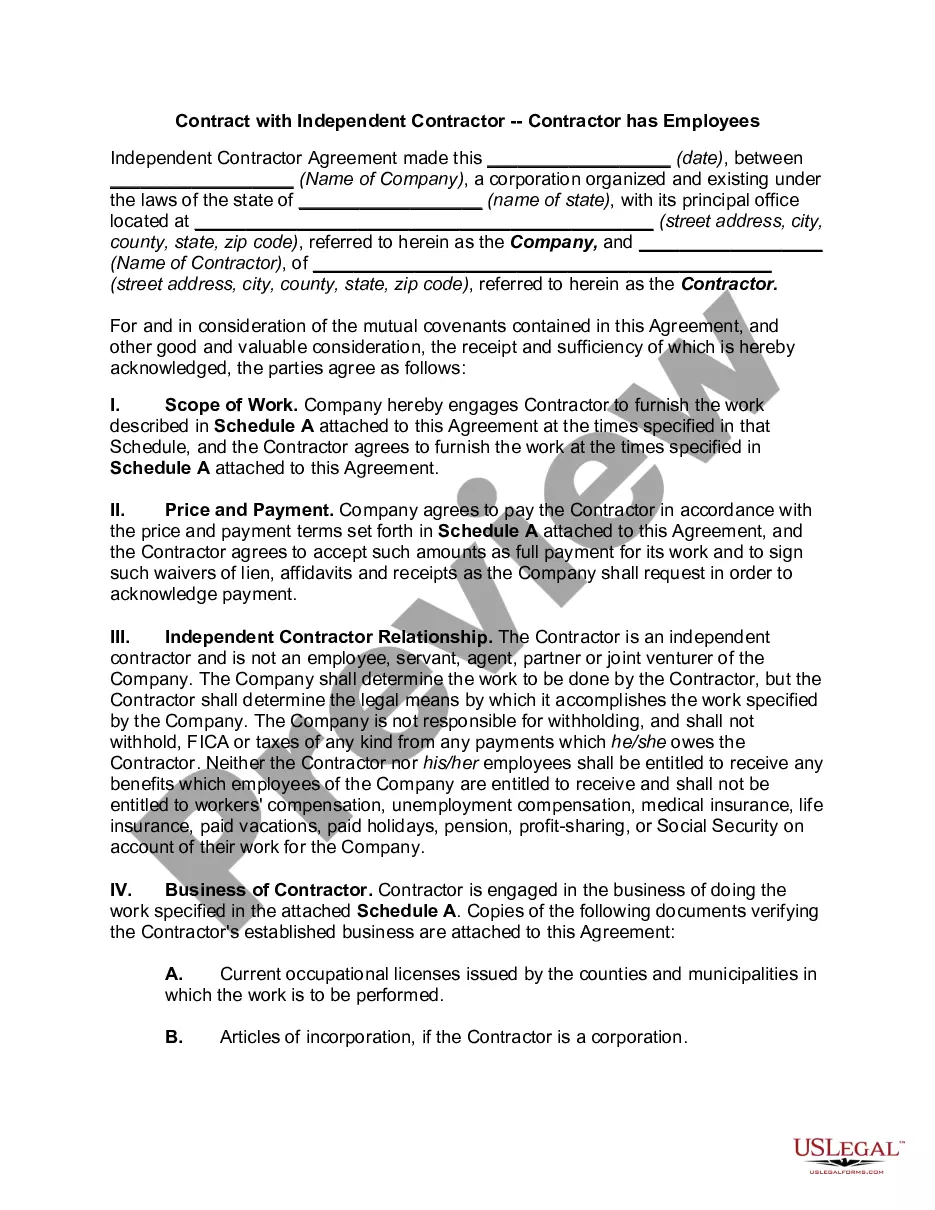

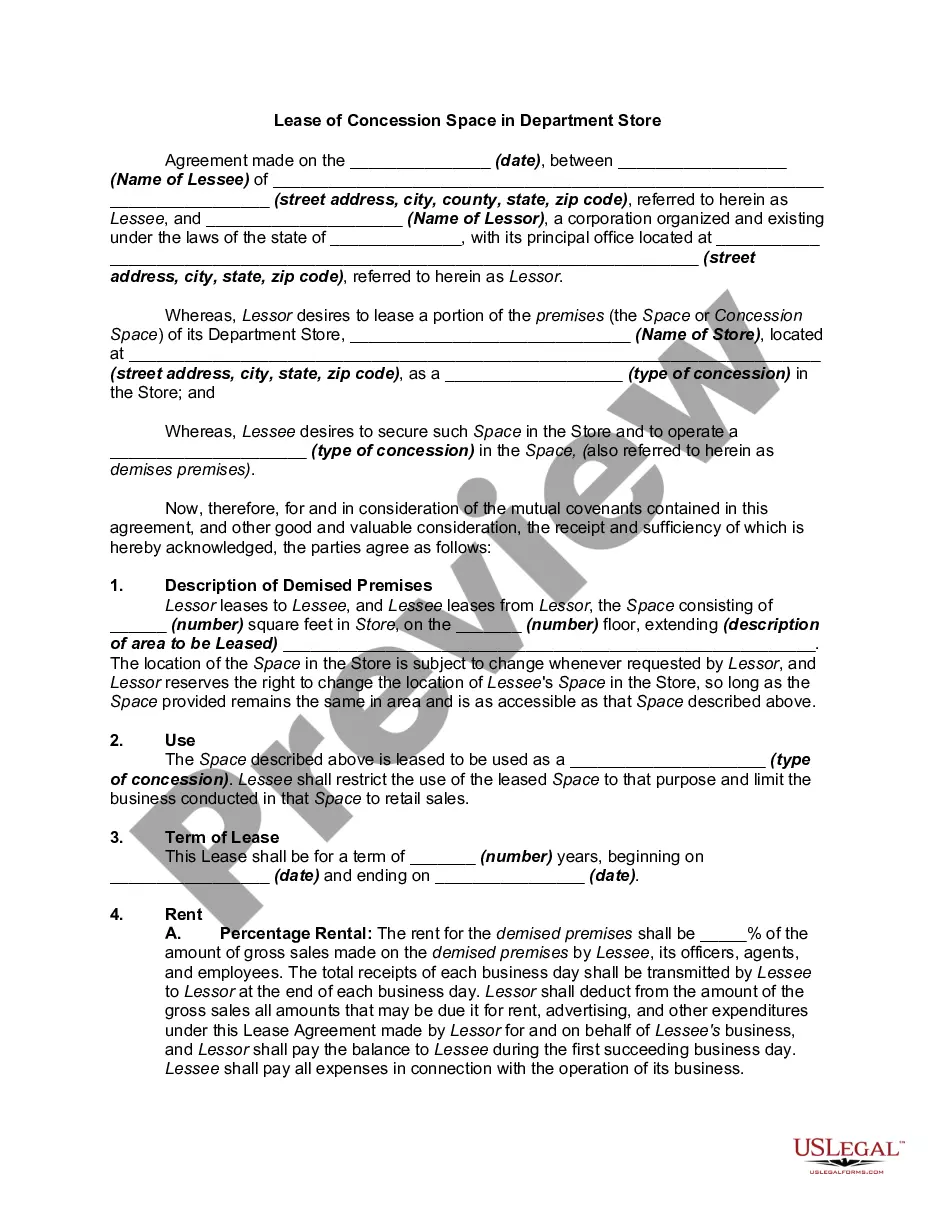

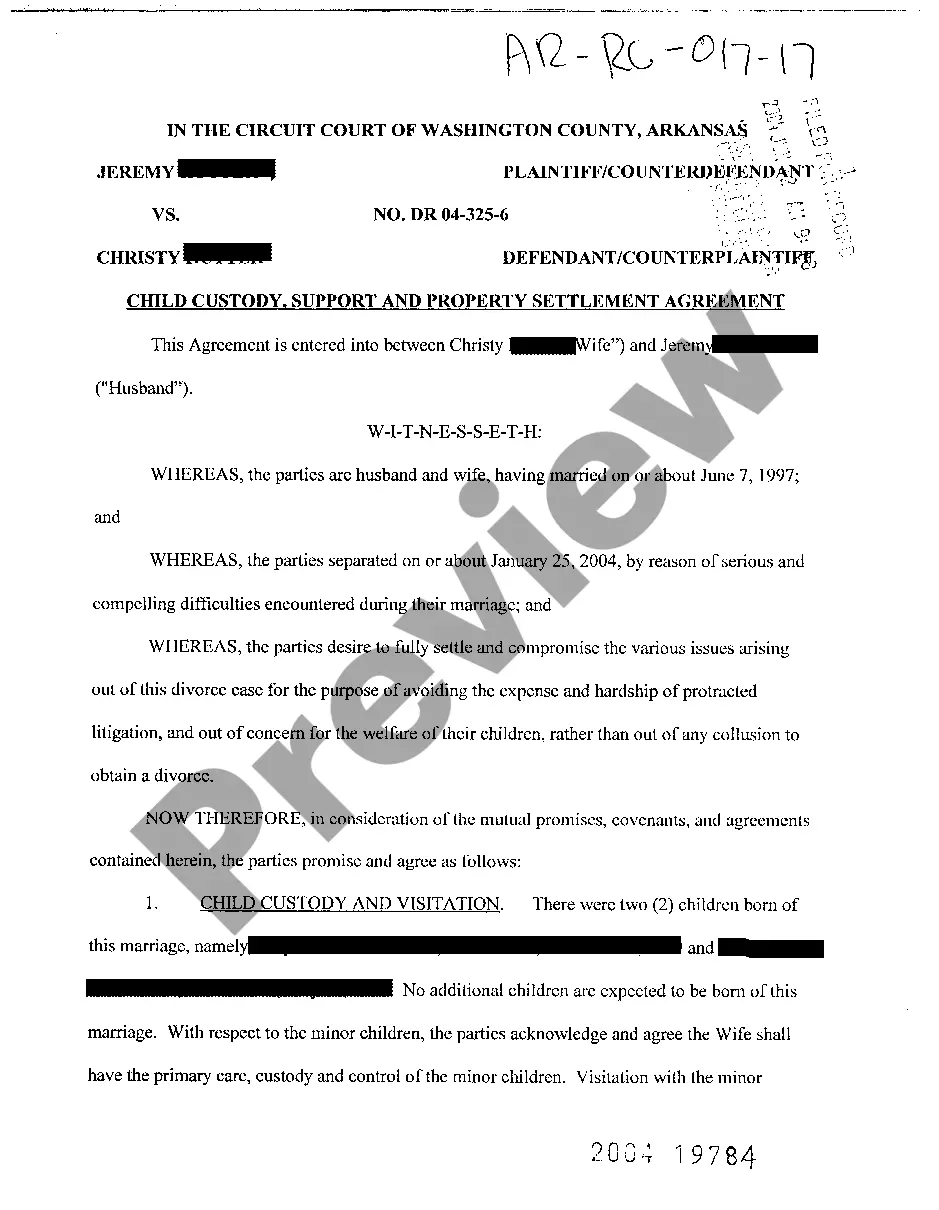

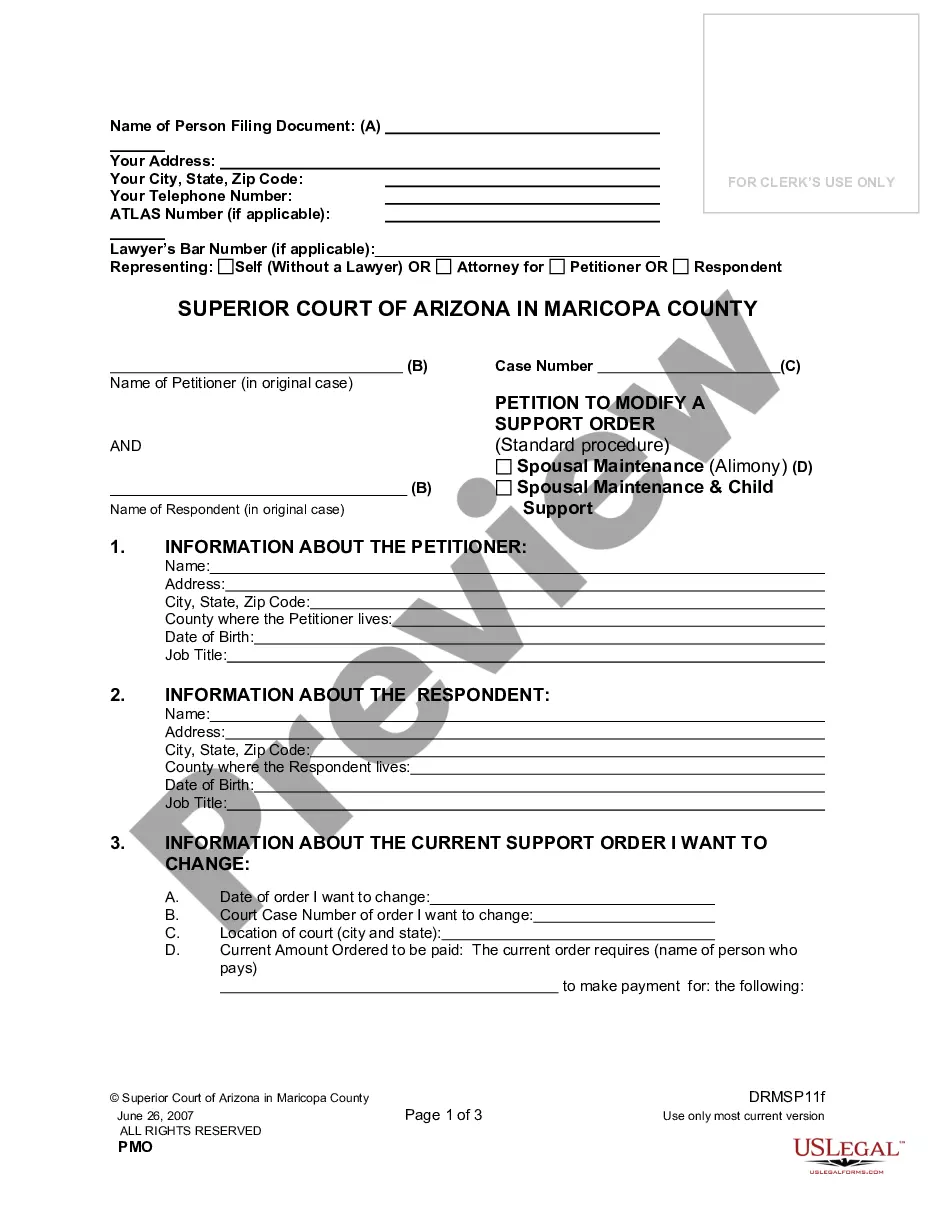

Independent Contractor Status Without Business License

Description

How to fill out Determining Self-Employed Independent Contractor Status?

There’s no further justification to waste hours searching for legal documents to adhere to your local state laws. US Legal Forms has collected all of them in one location and streamlined their accessibility.

Our platform provides over 85,000 templates for various business and personal legal matters categorized by state and area of application.

All forms are expertly crafted and verified for accuracy, allowing you to have confidence in acquiring an up-to-date Independent Contractor Status Without Business License.

Select the most suitable subscription plan and create an account or sign in. Proceed to pay for your subscription using a credit card or PayPal.

- If you are acquainted with our service and already possess an account, ensure your subscription is active before accessing any templates.

- Log In to your account, select the document, and click Download.

- You can also retrieve all saved documents anytime needed by navigating to the My documents tab in your profile.

- If you’ve never utilized our service before, the process will require a few extra steps to finish.

- Here’s how new users can find the Independent Contractor Status Without Business License in our catalog.

- Read the page content thoroughly to verify it contains the sample you seek.

- To do so, utilize the form description and preview options if available.

- Employ the Search bar above to find another sample if the current one doesn’t meet your needs.

- Click Buy Now next to the template title when you locate the appropriate one.

Form popularity

FAQ

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

In the event that you are not paid as an employee, you are considered an independent contractor and must have a business license.

Four ways to verify your income as an independent contractorIncome-verification letter. The most reliable method for proving earnings for independent contractors is a letter from a current or former employer describing your working arrangement.Contracts and agreements.Invoices.Bank statements and Pay stubs.

Can You 1099 Someone Without A Business? Form 1099-NEC does not require you to have a business to report payments for your services. As a non-employee, you can perform services. In your case, the payer has determined that there is no relationship between you and your employer.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.