Independent Contractor Status With Reportable Income

Description

How to fill out Determining Self-Employed Independent Contractor Status?

What is the most dependable service to acquire the Independent Contractor Status With Reportable Income and other recent forms of legal documentation? US Legal Forms is the answer!

It's the most vast assortment of legal templates for any purpose. Each document is professionally drafted and verified for adherence to federal and state laws and regulations. They are categorized by industry and jurisdiction, making it easy to find the one you need.

Alternative document search. If there are any discrepancies, use the search bar in the page header to find another template. Click Buy Now to select the suitable one.

- Experienced users of the platform only need to Log In to the system, verify their subscription is valid, and click the Download button next to the Independent Contractor Status With Reportable Income to access it.

- Once saved, the template stays accessible for future reference within the My documents section of your profile.

- If you haven't created an account with us yet, here are the steps you need to follow to register.

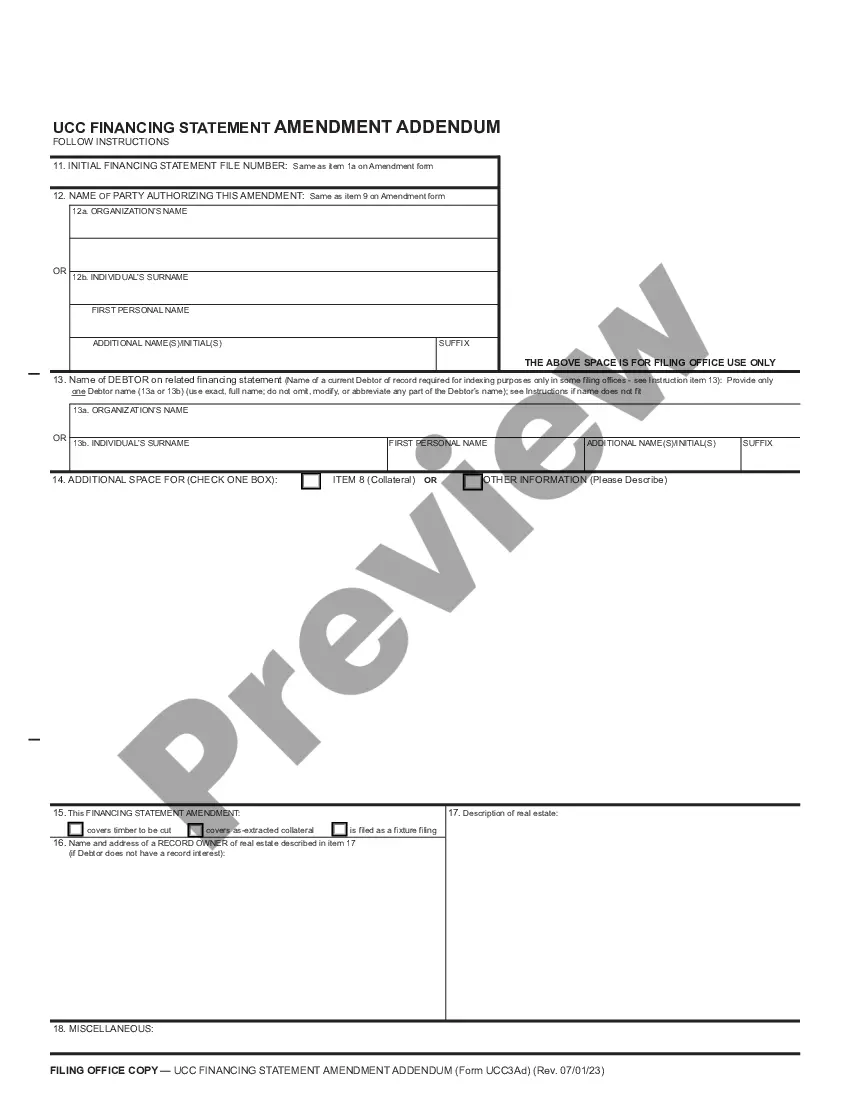

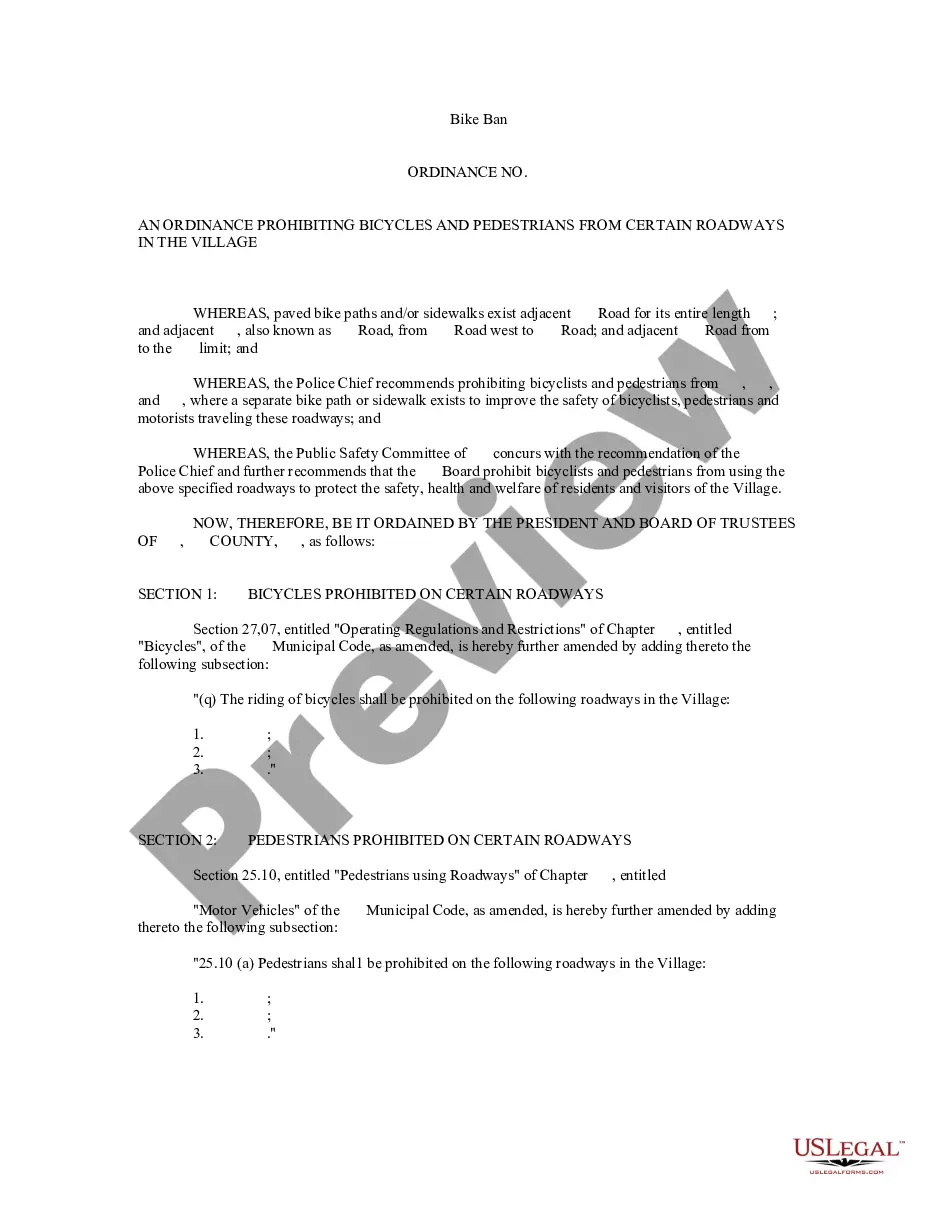

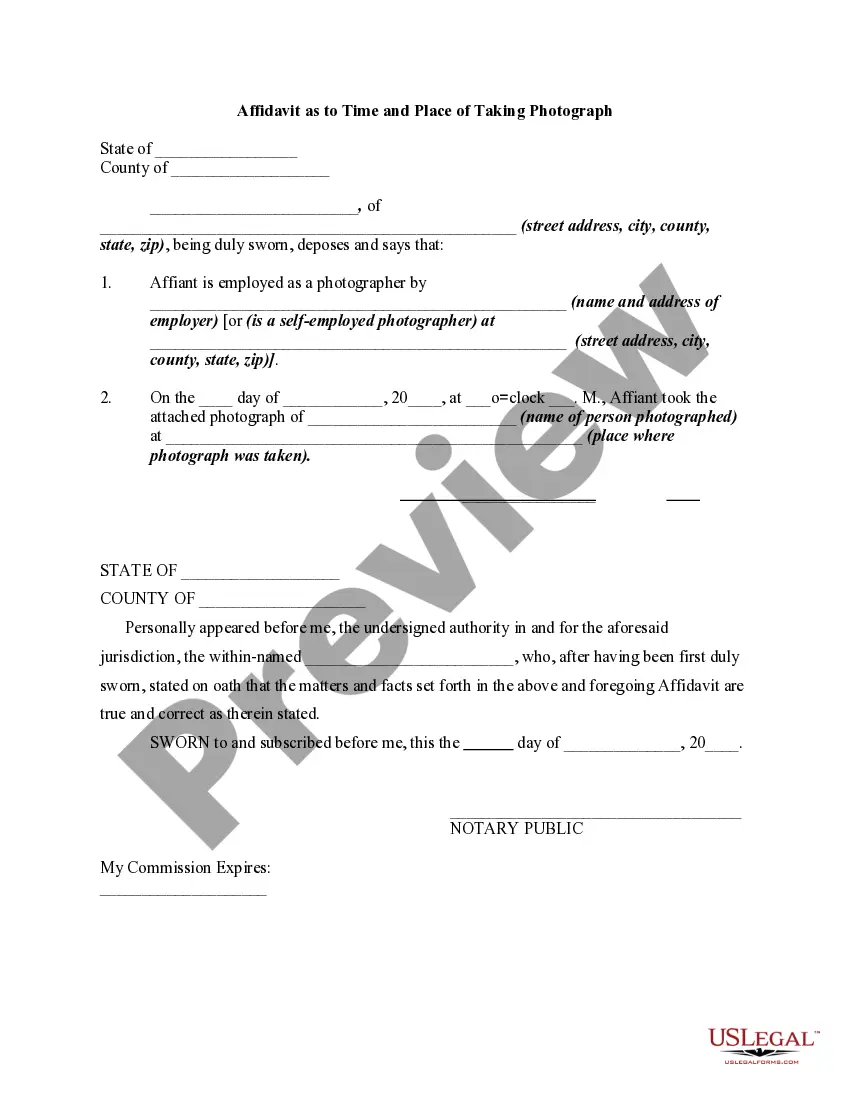

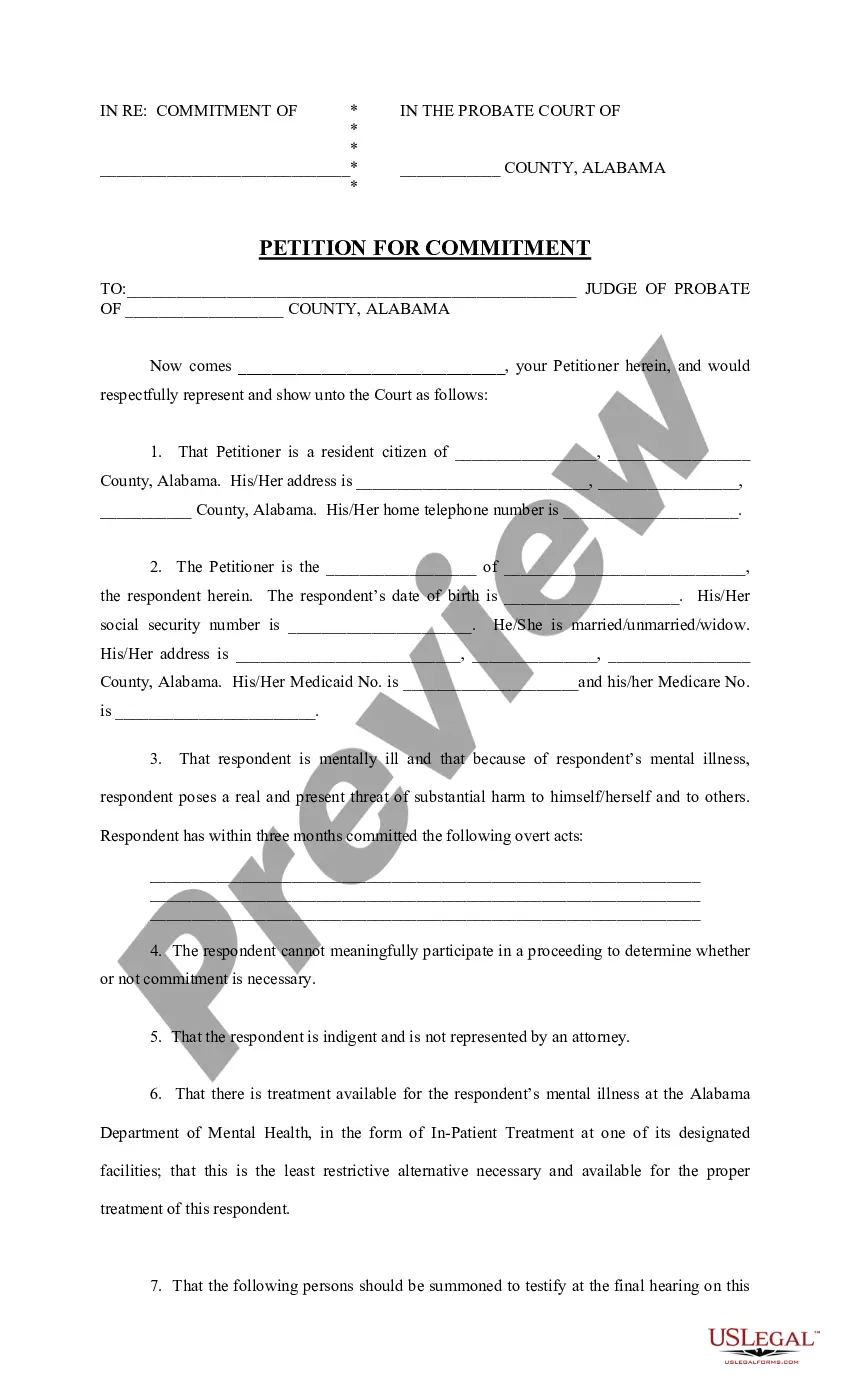

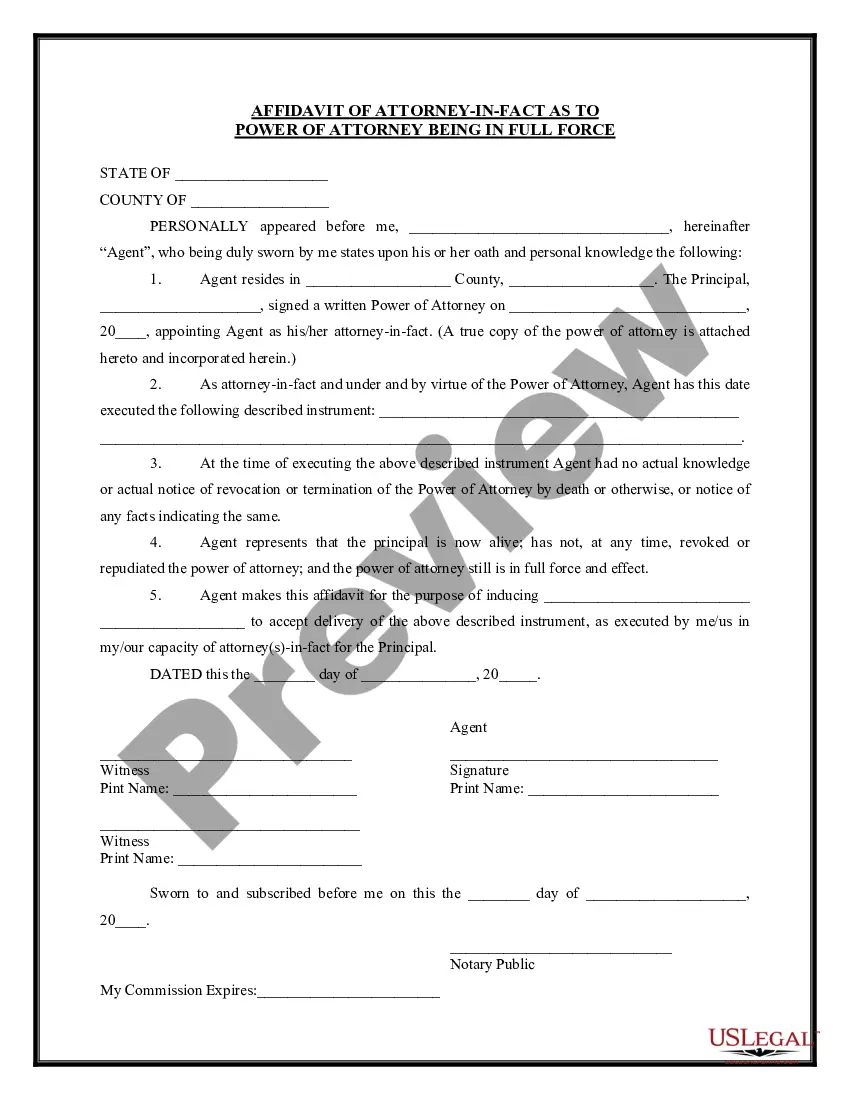

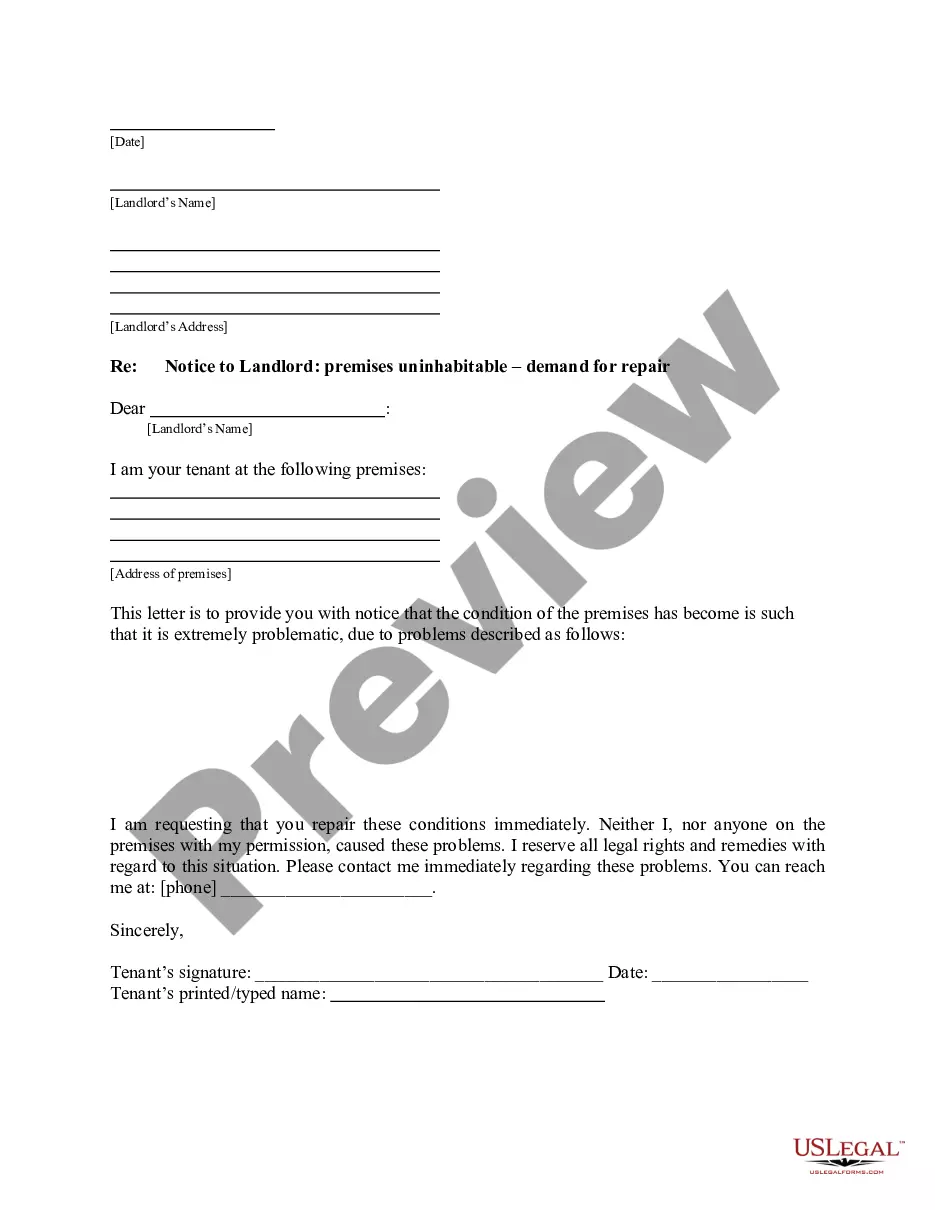

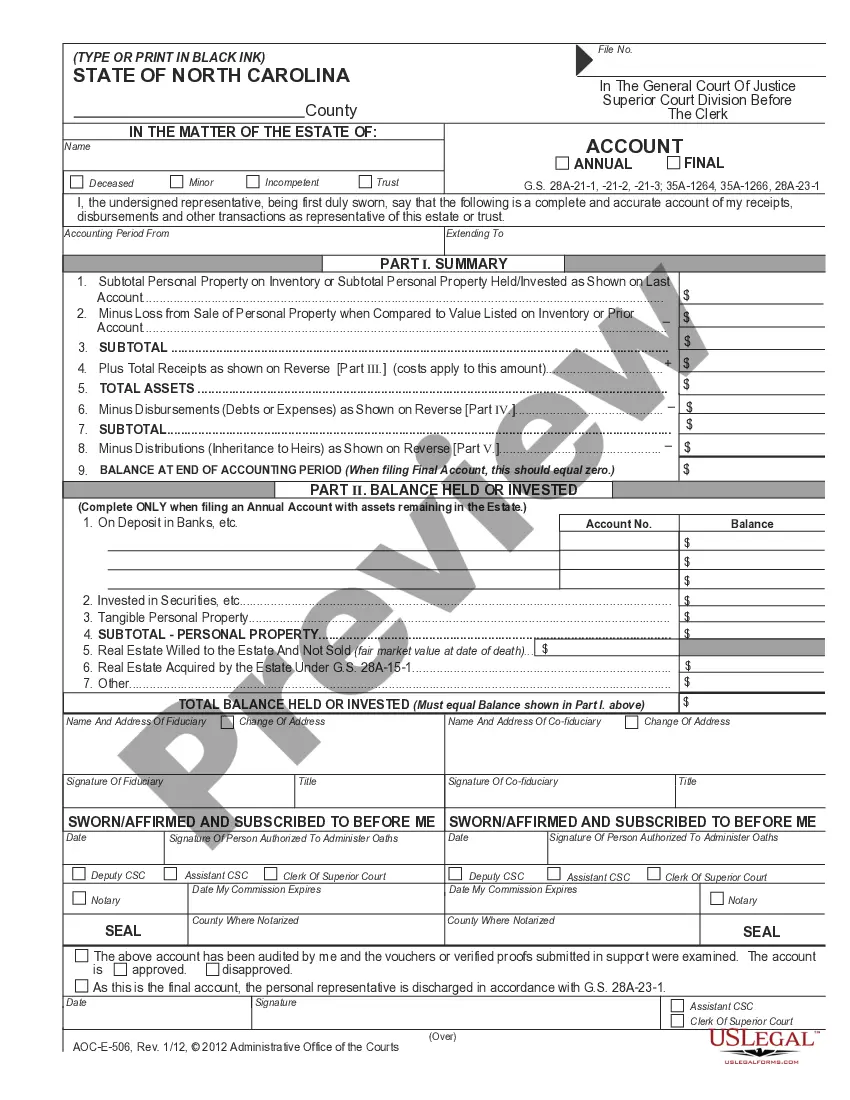

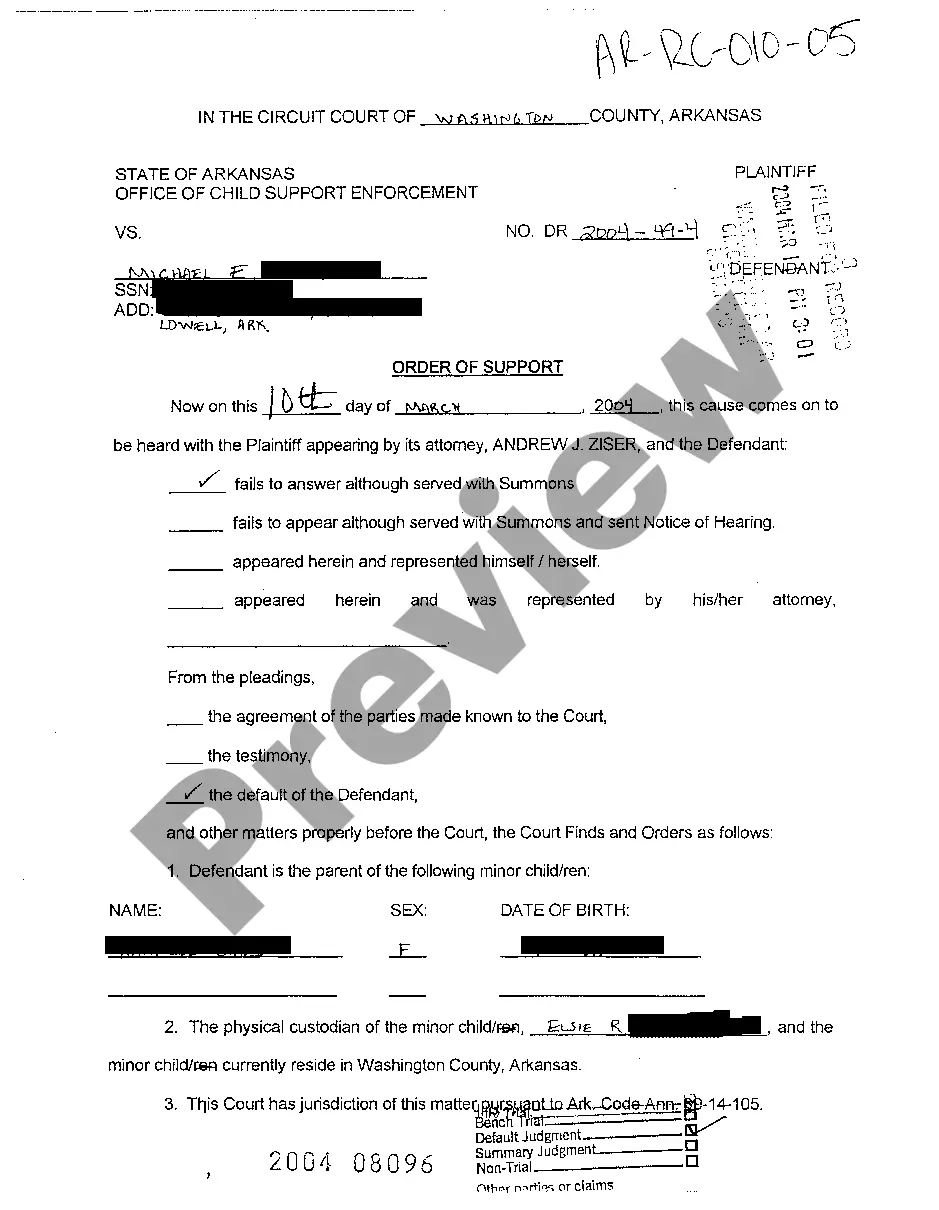

- Form compliance verification. Before acquiring any template, ensure it meets your use case requirements and your state or county's regulations. Review the form description and use the Preview if it's available.

Form popularity

FAQ

According to the IRS, if you pay independent contractors, you may have to file a Form 1099-MISC to report payments for services performed for your trade or business.

Independent Contractor ReportingYou are required to file a Nonemployee Compensation Form (1099-NEC) or a Miscellaneous Information Form (1099-MISC) for the services performed by the independent contractor.You pay the independent contractor $600 or more or enter into a contract for $600 or more.More items...

9 Form InstructionsLine 1 Name.Line 2 Business name.Line 3 Federal tax classification.Line 4 Exemptions.Lines 5 & 6 Address, city, state, and ZIP code.Line 7 Account number(s)Part I Taxpayer Identification Number (TIN)Part II Certification.

If you pay independent contractors, you may have to file Form 1099-NEC, Nonemployee Compensation, to report payments for services performed for your trade or business. If the following four conditions are met, you must generally report a payment as nonemployee compensation.

A: To file the Form 1099-MISC, you'll need a Form W-9 and a Tax Identification Number (TIN) for each independent contractor. The contractor provides you the Form W-9. You should have every contractor fill out this document before services are provided. This will ensure you have the information you need to file.