Arkansas Child Support And Alimony

Description

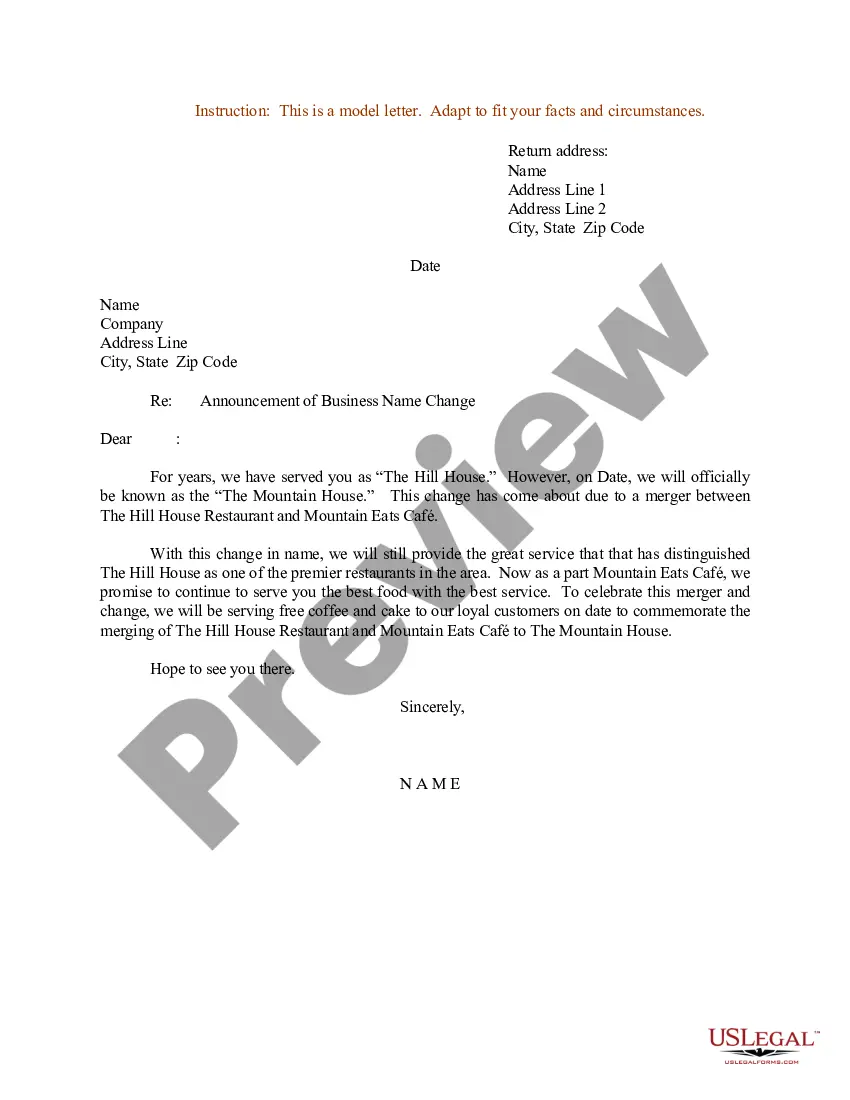

How to fill out Arkansas Order Of Child Support?

Bureaucracy necessitates exactness and correctness.

If you do not manage completing documents like Arkansas Child Support And Alimony on a daily basis, it may lead to some misconceptions.

Choosing the proper sample from the outset will guarantee that your document submission proceeds smoothly and avert any troubles of re-sending a file or repeating the entire task from the beginning.

Review the form descriptions and download those you require at any time. If you are not a registered user, locating the necessary sample might take a few extra steps.

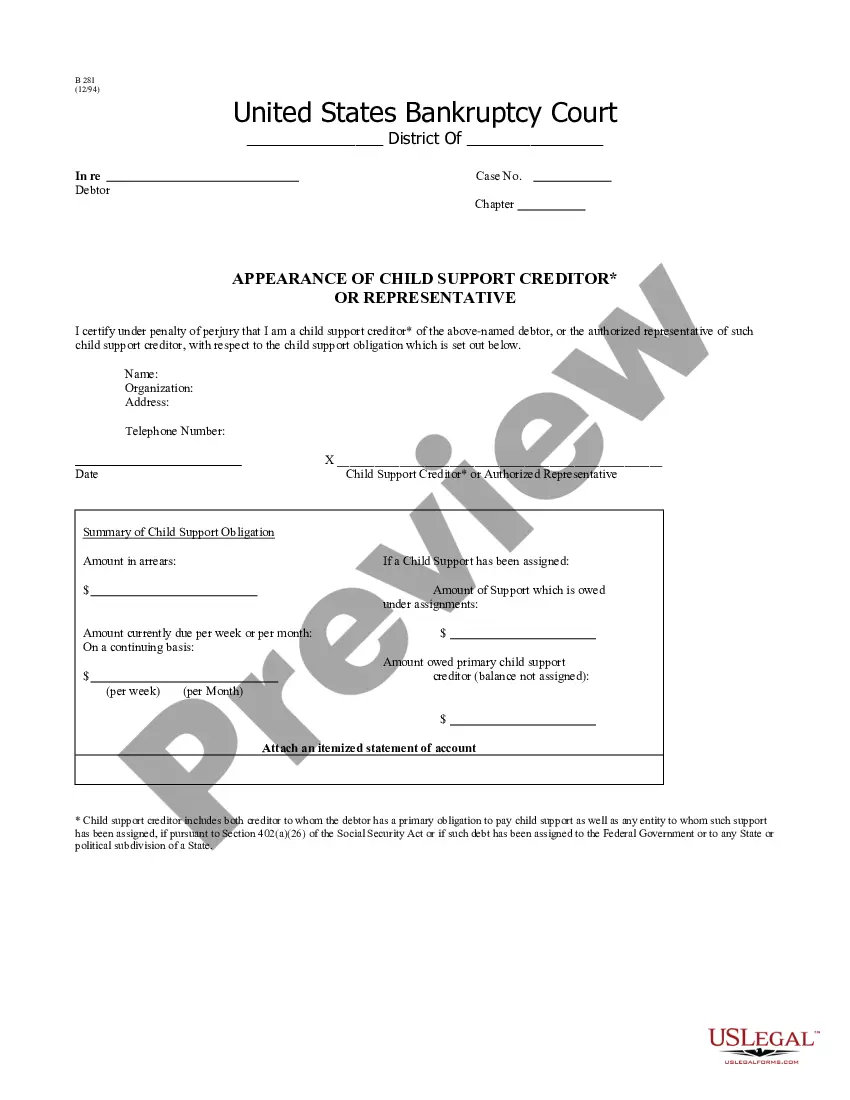

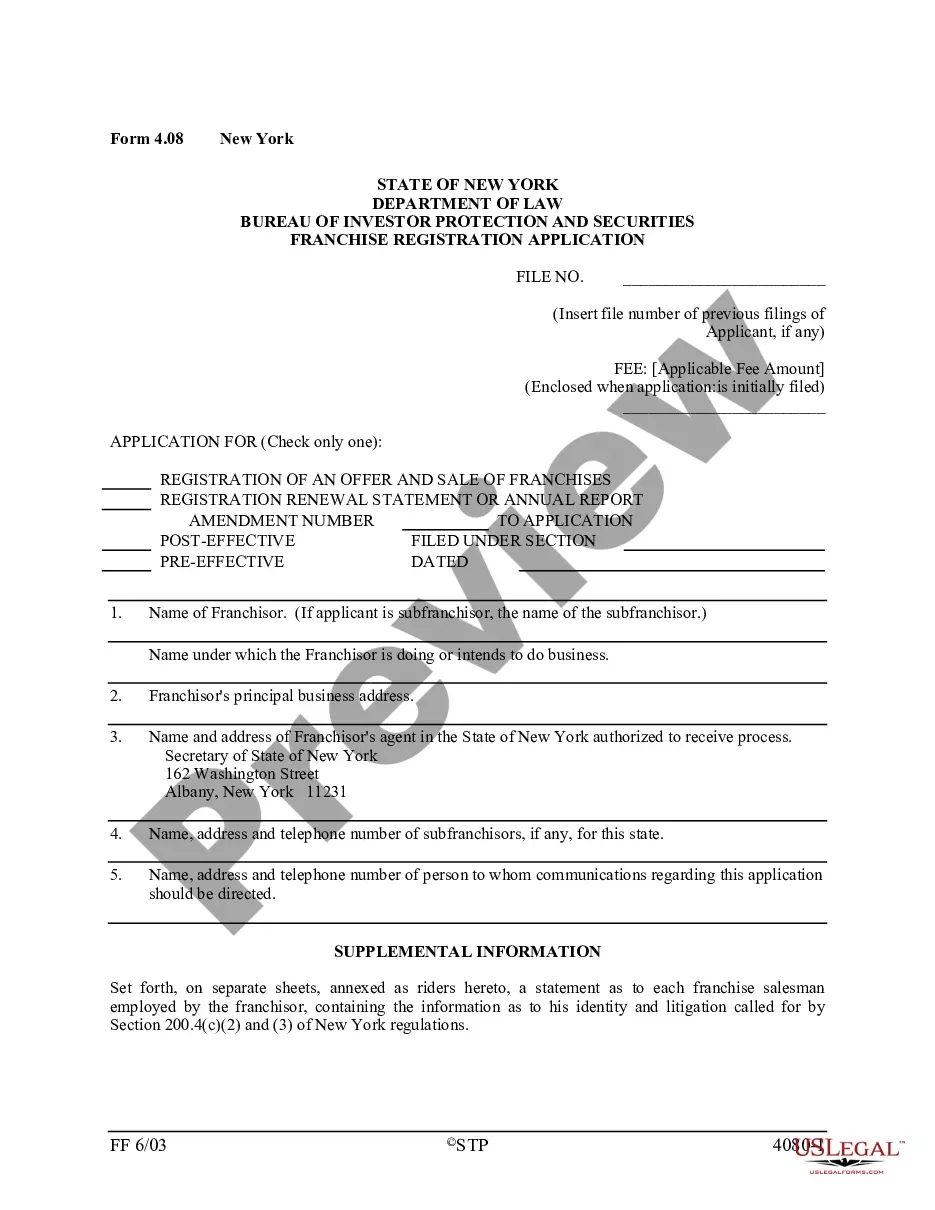

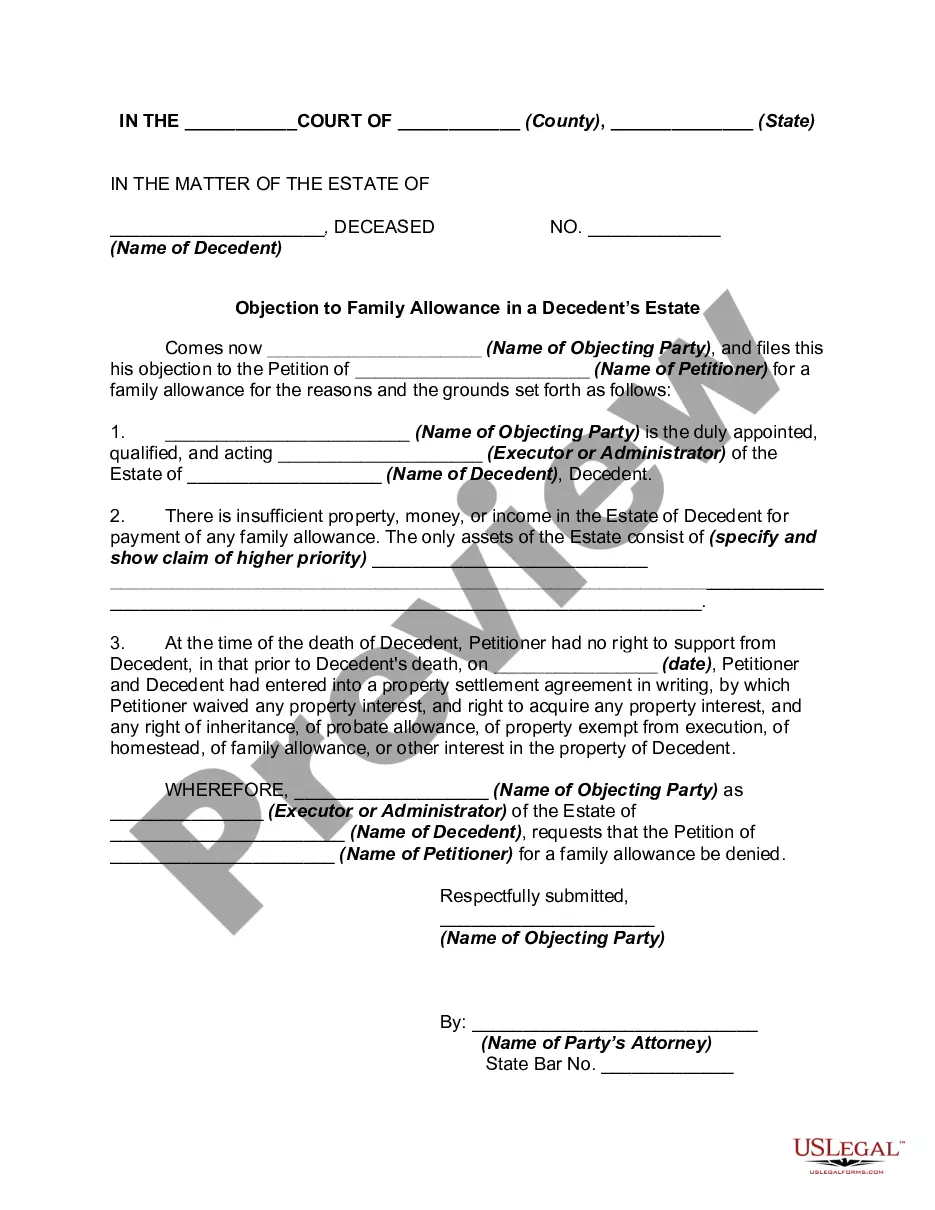

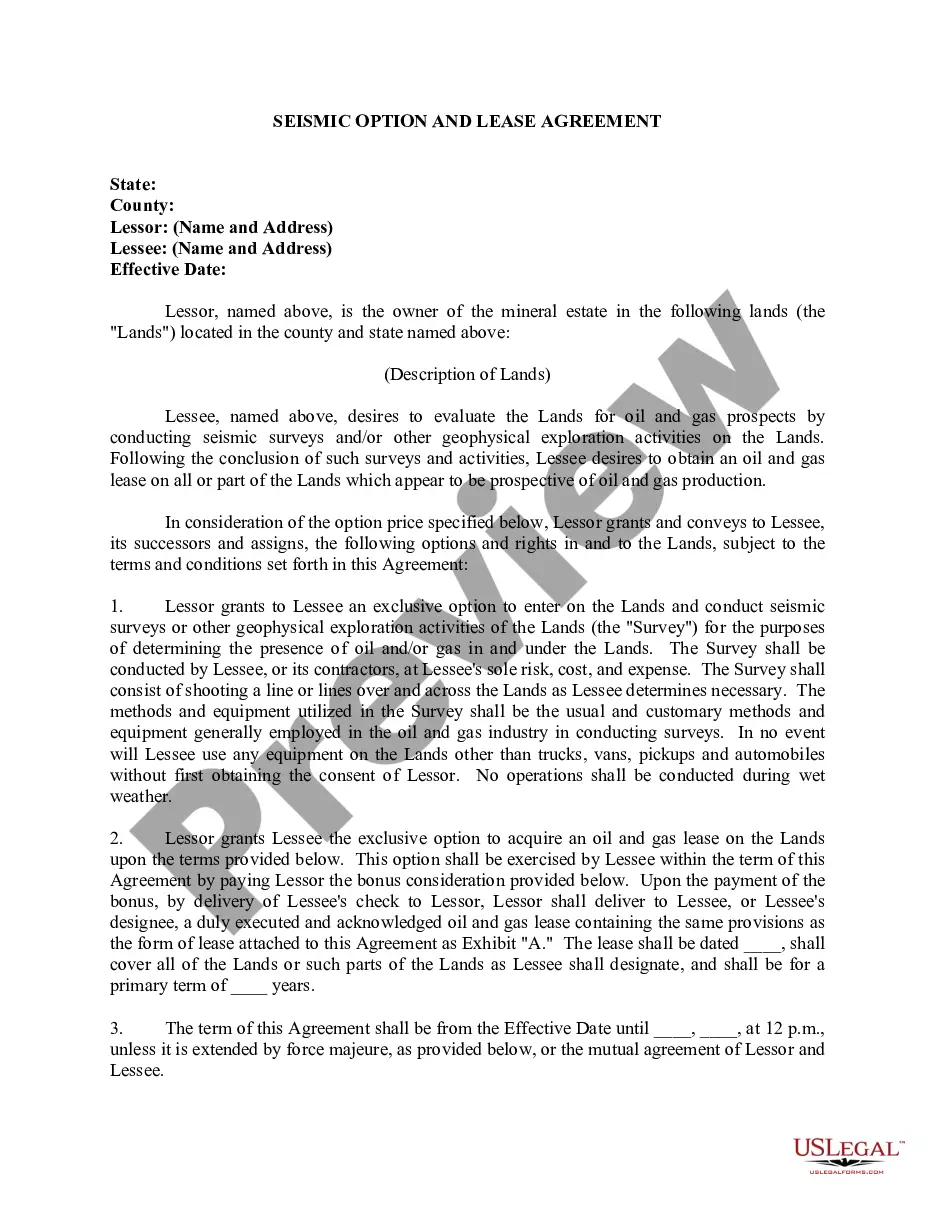

- You can always obtain the right sample for your documentation in US Legal Forms.

- US Legal Forms is the largest online repository of forms that provides more than 85 thousand samples for various fields.

- You can discover the latest and the most suitable version of the Arkansas Child Support And Alimony by simply searching it on the site.

- Locate, save, and download templates in your account or review the description to ensure you have the correct one available.

- With an account at US Legal Forms, you can obtain, store in one spot, and navigate the templates you save to reach them in just a few clicks.

- When on the site, click the Log In button to authenticate.

- Next, go to the My documents page, where the record of your forms is archived.

Form popularity

FAQ

Yes, alimony can be modified or eliminated under certain circumstances in Arkansas. A change in financial situations or remarriage of the receiving spouse may lead to a reassessment of the alimony agreement. It is important to consult with legal professionals for advice on how to approach this matter effectively. USLegalForms can offer forms and information to guide you through the process concerning Arkansas child support and alimony changes.

Alimony can have an impact on child support payments in Arkansas. Generally, if one parent receives alimony, it may be considered as income, potentially influencing the child support calculations. Understanding these relationships is crucial for ensuring that both child support and alimony are determined fairly. For personalized assistance, explore the resources available at USLegalForms to help clarify how Arkansas child support and alimony relate.

To file for child support in Arkansas, you need to complete the appropriate forms and submit them to your local family court. Gathering necessary documents, such as your income information and any relevant financial statements, is essential. Additionally, consider using platforms like USLegalForms to streamline this process. They provide guidance and templates that can help you navigate the Arkansas child support and alimony filing procedure effectively.

The new custody law in Arkansas emphasizes the importance of joint custody and encourages cooperative parenting to serve the best interests of the child. The law aims to provide clarity on how custody decisions are made, ensuring that both parents have a fair chance to be involved in their child's life. As you consider Arkansas child support and alimony, it's helpful to stay informed about these legal changes to better understand how they might affect your situation.

In Arkansas, certain criteria can disqualify an individual from receiving alimony. For instance, if the receiving spouse is capable of self-support or if the marriage lasted a very short time, the court may deny alimony requests. If you are exploring Arkansas child support and alimony, understanding these disqualifying factors is important for setting realistic expectations.

Alimony does not directly reduce child support payments in Arkansas. However, courts may consider both payments when evaluating the overall financial situation of the paying spouse. If you're concerned about how Arkansas child support and alimony interact, seeking legal guidance can provide clarity on how each obligation impacts your financial responsibilities.

In Arkansas, the minimum child support amount is determined by the state's guidelines, which take into account the income of the non-custodial parent and the number of children involved. Generally, these guidelines establish a baseline amount to ensure that children's needs are met. If you're navigating Arkansas child support and alimony issues, understanding these guidelines can be essential for both parents.

No, in Arkansas, child support does not count as alimony. These two forms of financial support are distinct, reflecting different responsibilities. While child support focuses on the needs of the child, alimony addresses the financial support between ex-spouses. If you want to understand more about these separations or how they influence your obligations, using resources like US Legal Forms can be helpful.

In Arkansas, child support and alimony serve different purposes and are calculated separately. Alimony, or spousal support, is designed to support a former spouse, while child support provides financial assistance for raising children. Hence, child support does not typically get added to alimony amounts. For clarity on how these financial obligations could affect you, consulting with a professional can be beneficial.

In Arkansas, child support obligations typically fall on the biological parents, not their spouses. Therefore, your ex cannot directly pursue your new wife for child support. However, if your ex believes your financial situation has changed due to your new marriage, they may attempt to modify the child support amount. It's crucial to understand your rights and seek legal advice to navigate these situations effectively.