Contractor Status With Alien Number

Description

How to fill out Determining Self-Employed Independent Contractor Status?

Locating a preferred source for obtaining the latest and pertinent legal forms is a significant part of dealing with bureaucratic processes.

Identifying the proper legal documents necessitates precision and meticulousness, which is why it is crucial to source Contractor Status With Alien Number exclusively from trustworthy providers, such as US Legal Forms. An incorrect template could squander your time and hinder your current situation.

Eliminate the stress associated with your legal documentation. Explore the comprehensive US Legal Forms collection to discover legal templates, assess their applicability to your situation, and download them instantly.

- Utilize the library navigation or search bar to find your document.

- Review the form's description to determine if it aligns with your state's and area's requirements.

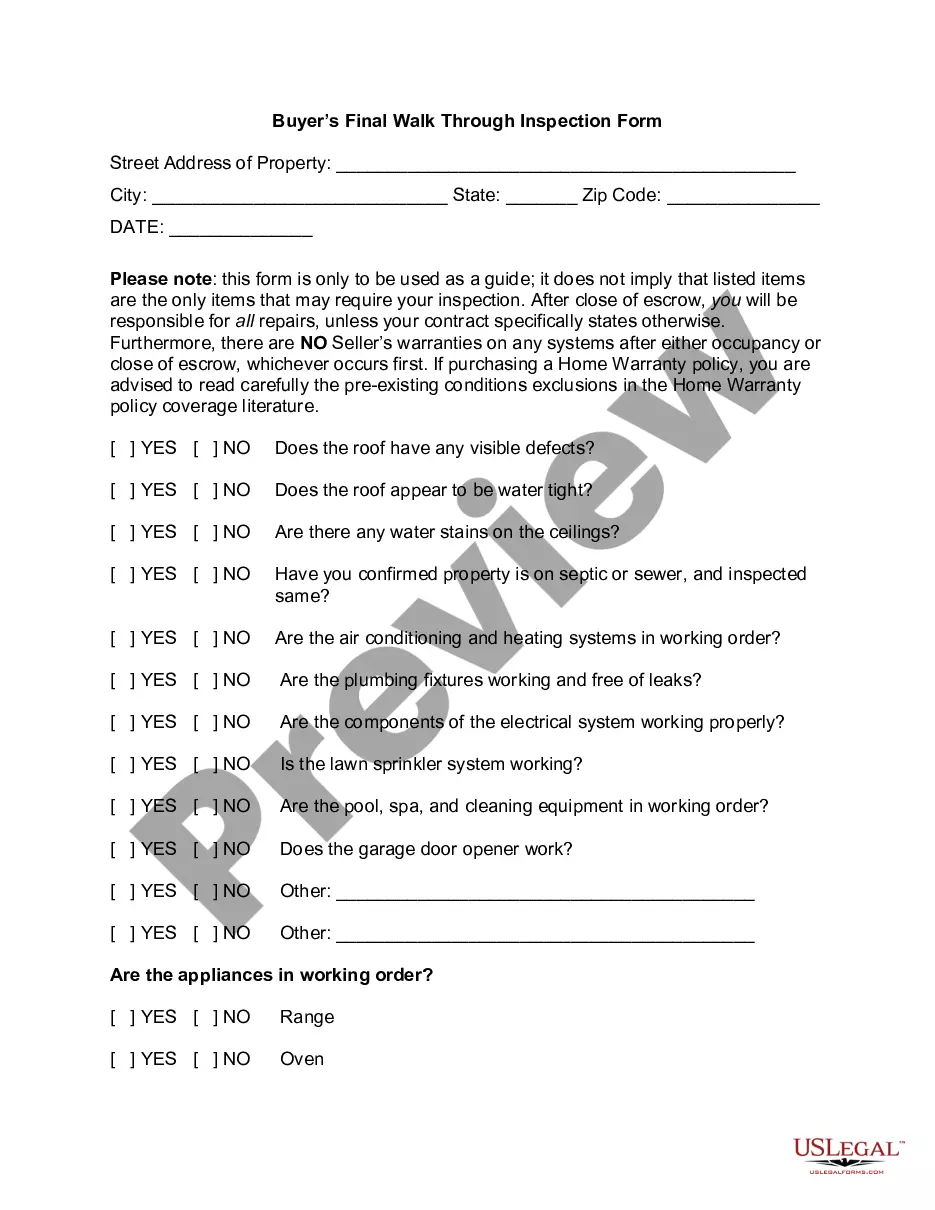

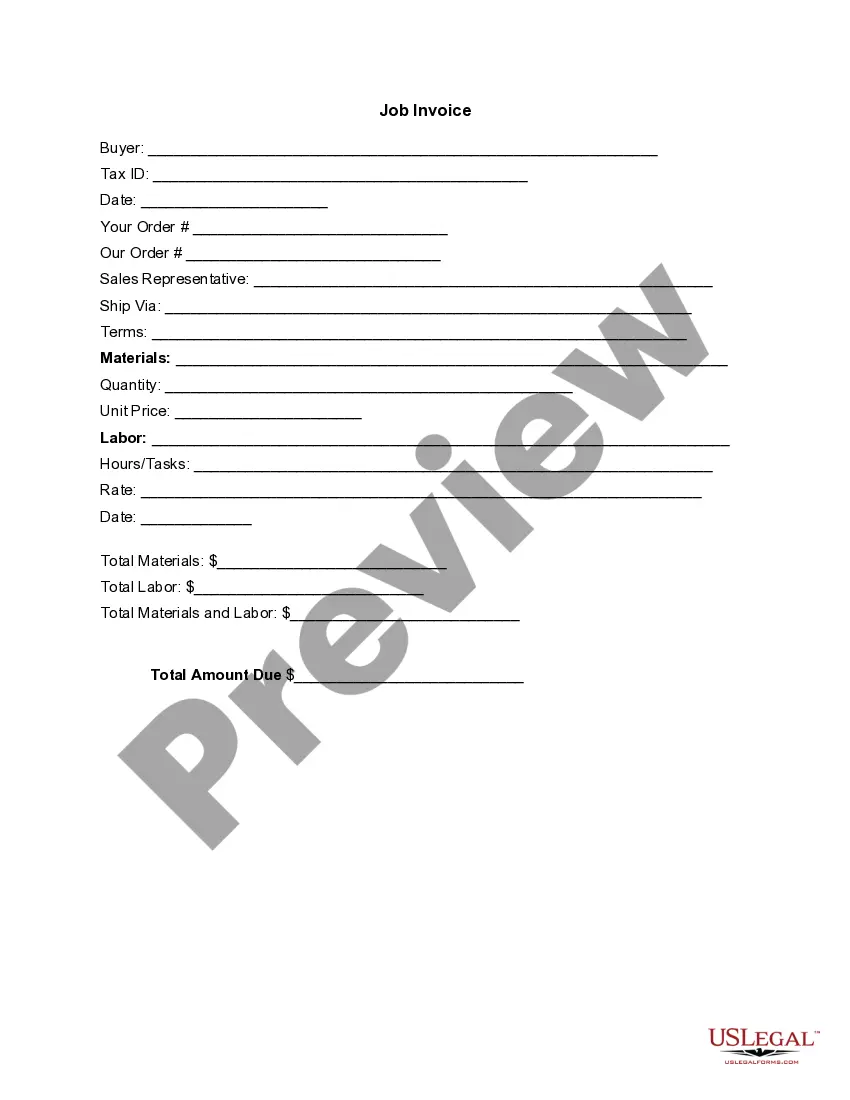

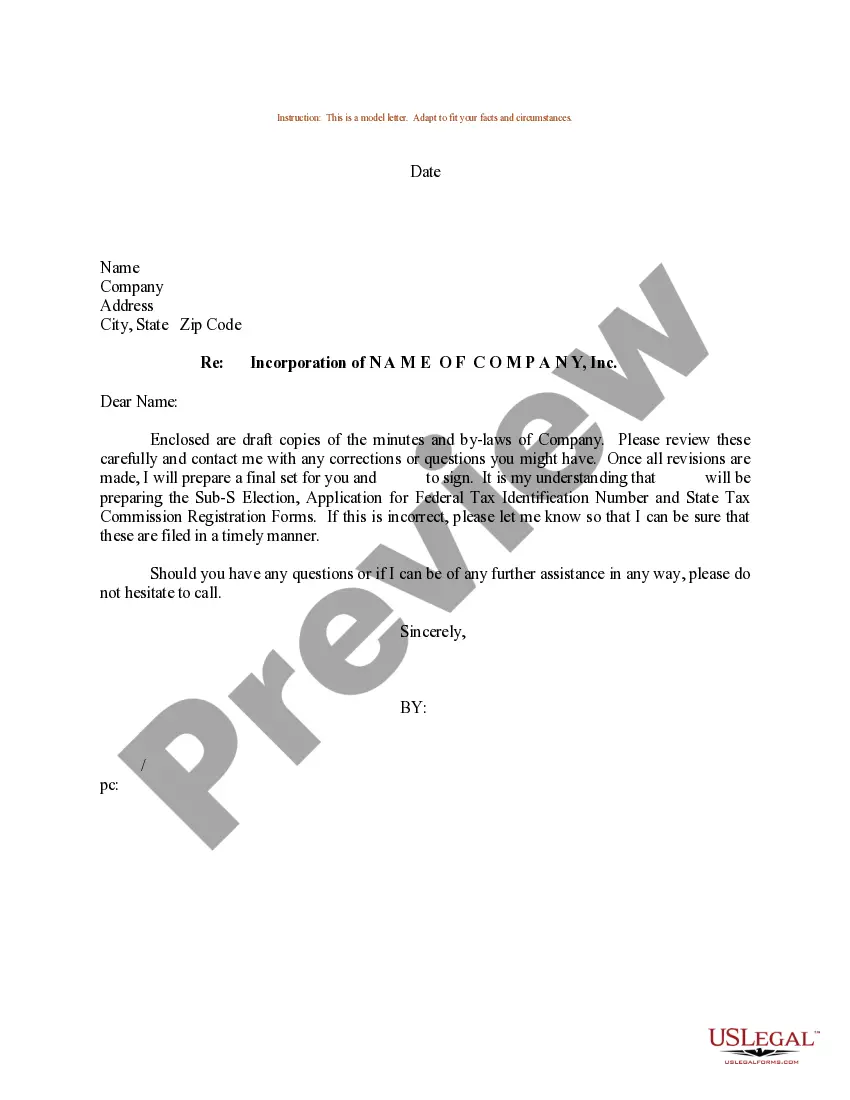

- Access the form preview, if available, to confirm that the form meets your needs.

- If the Contractor Status With Alien Number does not adhere to your specifications, continue your search for the appropriate template.

- Once you are certain of the form's applicability, proceed to download it.

- If you are a registered member, click Log in to verify your identity and access your selected forms in My documents.

- If you do not possess an account, click Buy now to acquire the template.

- Choose the payment plan that best suits your needs.

- Continue to the sign-up process to finalize your purchase.

- Complete your transaction by selecting a payment method (credit card or PayPal).

- Choose the format you wish to download for Contractor Status With Alien Number.

- After obtaining the form on your device, you may modify it using the editor or print it out to complete it manually.

Form popularity

FAQ

Personal Identification Required: The person or company that pays is not required to ask an independent contractor to fill out an I-9 (used to verify an employee's identity and to prove that the individual is able to legally work in the US), or otherwise inquire about immigration status.

Service-provider (independent contractor): First name, middle initial, and last name. Social Security number. Address. Start date of contract (if no contract, date payments equal $600 or more) Amount of contract, including cents (if applicable) Contract expiration date (if applicable)

Form W-9. If you've made the determination that the person you're paying is an independent contractor, the first step is to have the contractor complete Form W-9, Request for Taxpayer Identification Number and Certification.

Exceptions Of The Employer Not Liable For The Tortious Acts Of The Independent Contractor. Employer authorizes to perform an illegal task. Employer Vicariously Liable in cases of strict liability. Employer Vicariously Liable for damages caused on or near the highway by the Independent Contractor.

Form I-9 is not required for casual domestic services. An independent contractor is not considered an employee for Form I-9 purposes and does not need to complete Form I-9.