Consultants Self Employed Without A Business

Description

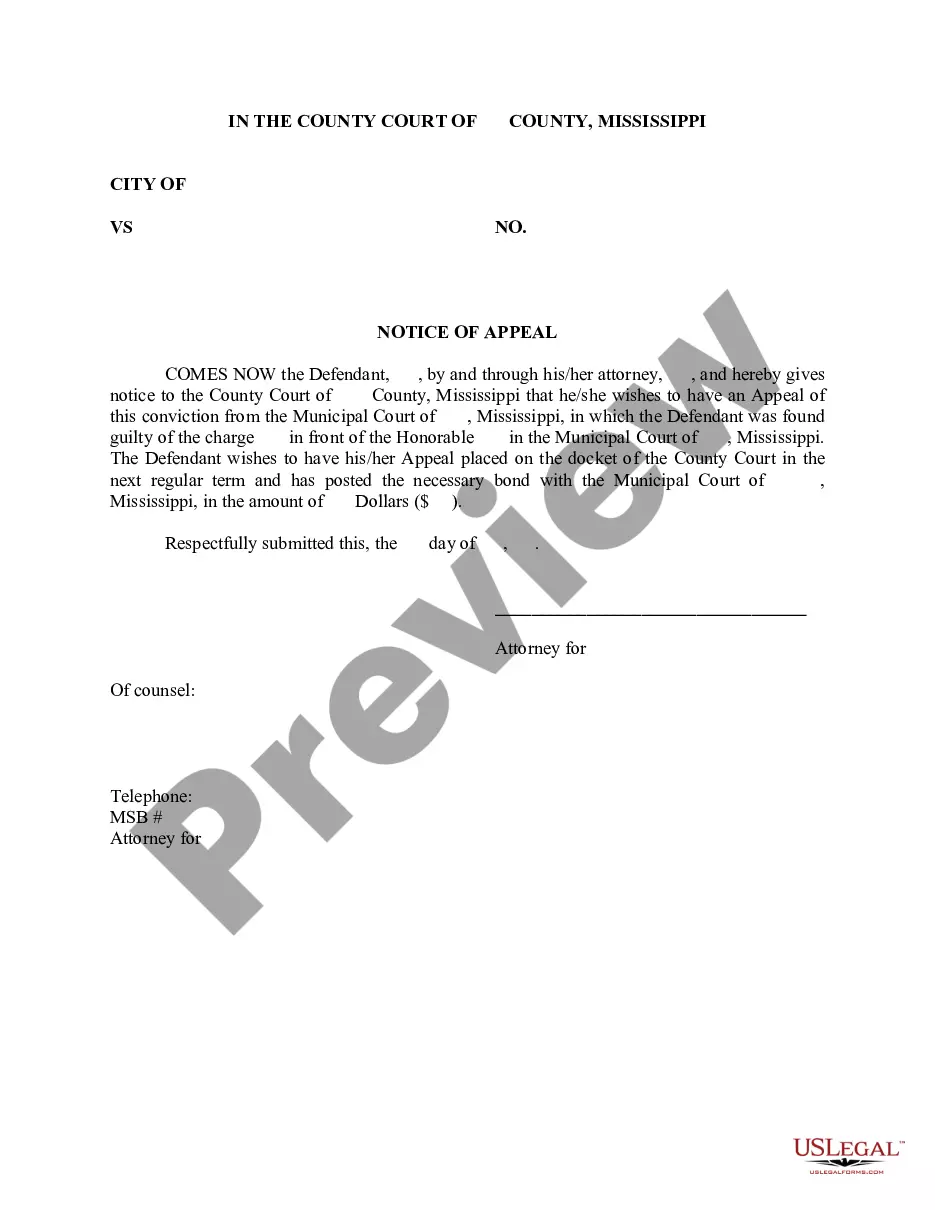

How to fill out Acknowledgment Form For Consultants Or Self-Employed Independent Contractors?

Legal document management might be overwhelming, even for the most experienced professionals. When you are looking for a Consultants Self Employed Without A Business and don’t get the a chance to commit trying to find the right and updated version, the procedures may be stressful. A robust online form catalogue could be a gamechanger for anybody who wants to deal with these situations effectively. US Legal Forms is a market leader in web legal forms, with more than 85,000 state-specific legal forms available to you anytime.

With US Legal Forms, you are able to:

- Gain access to state- or county-specific legal and organization forms. US Legal Forms handles any needs you might have, from personal to business paperwork, all-in-one spot.

- Make use of advanced resources to complete and manage your Consultants Self Employed Without A Business

- Gain access to a resource base of articles, instructions and handbooks and resources related to your situation and needs

Save time and effort trying to find the paperwork you will need, and make use of US Legal Forms’ advanced search and Preview tool to discover Consultants Self Employed Without A Business and download it. In case you have a monthly subscription, log in to the US Legal Forms account, look for the form, and download it. Review your My Forms tab to see the paperwork you previously downloaded as well as to manage your folders as you see fit.

If it is your first time with US Legal Forms, make an account and get unrestricted access to all benefits of the platform. Here are the steps to take after accessing the form you want:

- Confirm it is the proper form by previewing it and reading through its description.

- Be sure that the sample is recognized in your state or county.

- Choose Buy Now once you are all set.

- Choose a monthly subscription plan.

- Find the formatting you want, and Download, complete, sign, print and send out your papers.

Take advantage of the US Legal Forms online catalogue, backed with 25 years of expertise and trustworthiness. Change your daily papers managing in a easy and user-friendly process today.

Form popularity

FAQ

Some ways to prove self-employment income include: Annual Tax Return (Form 1040) 1099 Forms. Bank Statements. Profit/Loss Statements. Self-Employed Pay Stubs.

You must file Form 1040 or Form 1040-SR as a self-employed consultant. You must attach Schedule C on which you've figured out your net profit or loss after accounting for deductible business expenses. Be sure to consult a tax attorney about any additional forms that may apply to you.

Consultants who work for themselves are not employees. For tax purposes, they usually qualify as an independent contractor . This means that the client company who hires them to perform work does not have to pay for their benefits, unemployment or training.

All business owners are self-employed, but not all self-employed are small business owners. While being self-employed is defined as being your own boss, being a small business owner is simply characterized by having others work for you. As a small business owner, you can hire independent contractors or employees.

But are they really the same things? The answer is no. When you're self-employed, you're not always a business owner. You may simply have created your own job.