Cobra Insurance For How Long

Description

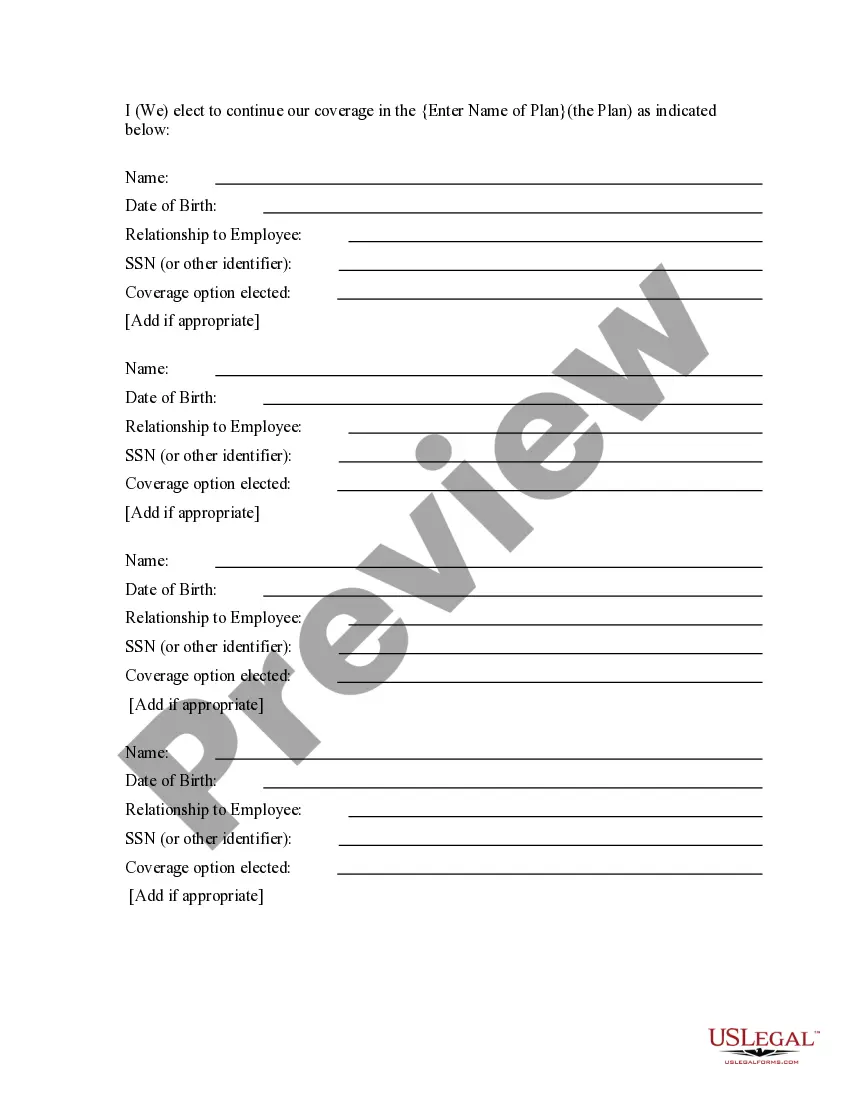

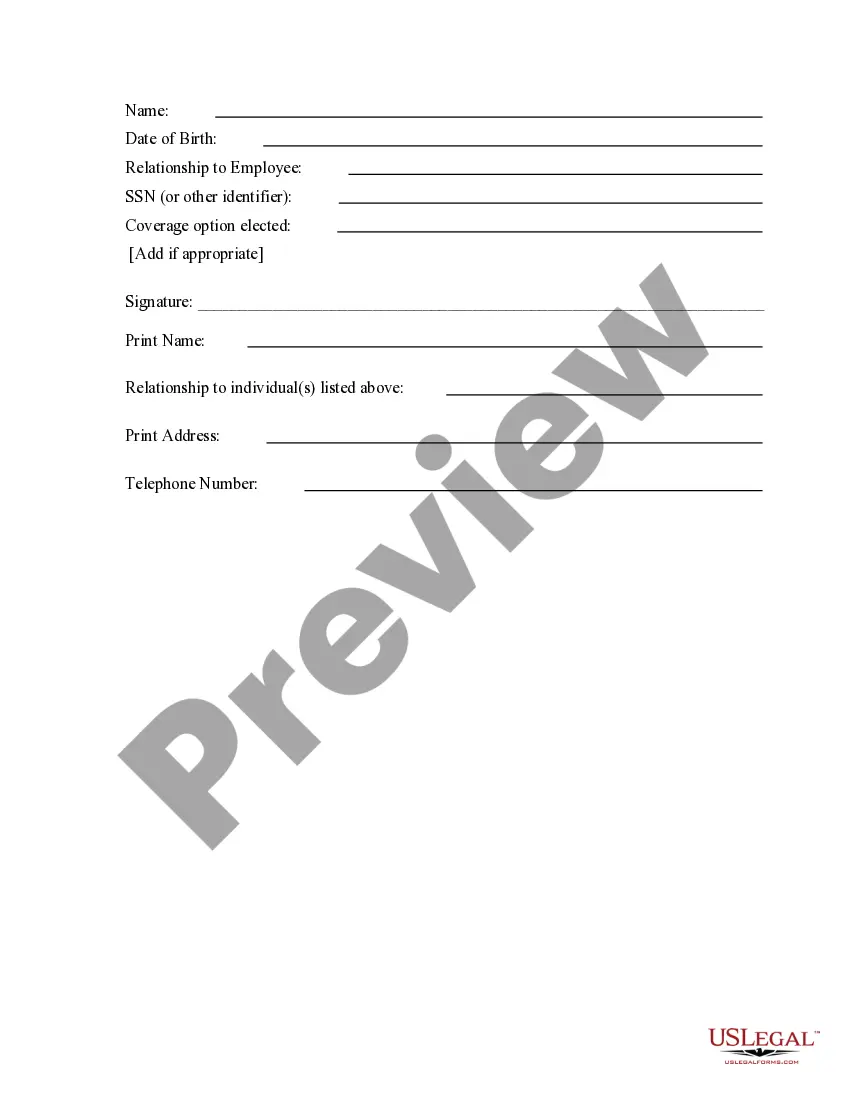

How to fill out COBRA Continuation Coverage Election Form?

Managing legal documents and processes can be a lengthy addition to the day.

Cobra Insurance For How Long and similar forms frequently require you to locate them and understand how to fill them out accurately.

Consequently, if you are addressing financial, legal, or personal issues, having a comprehensive and accessible web repository of forms at your disposal will be immensely helpful.

US Legal Forms is the premier online platform for legal templates, boasting over 85,000 state-specific forms and an array of resources that will assist you in completing your documents with ease.

- Discover the collection of pertinent documents available to you with a single click.

- US Legal Forms offers you state- and county-specific forms available for download at any time.

- Protect your document management activities by utilizing a superior service that enables you to produce any form within minutes without any extra or undisclosed fees.

- Simply Log In to your account, find Cobra Insurance For How Long, and obtain it instantly from the My documents section.

- You can also access previously downloaded forms.

Form popularity

FAQ

Yes, in certain circumstances, COBRA coverage can be extended up to 36 months. This extension usually applies to employees who qualify due to specific conditions like disability. It’s vital to understand your eligibility for extended coverage to maximize the duration of your COBRA insurance for how long you may require it.

You have 60 days from the date of your qualifying event to elect COBRA coverage. This short window can be a bit stressful, so make sure to review your options promptly. Remember, COBRA insurance for how long depends heavily on your timely decision to enroll, so don’t delay if you think you’ll need this crucial health benefit.

Once you elect COBRA insurance, the initial payment is due within 45 days. After that, subsequent payments usually follow a monthly schedule, which is much easier to manage. It is essential to stay on top of your payments to maintain uninterrupted coverage; otherwise, you risk losing your COBRA insurance for how long you need it.

The timeline for receiving a COBRA offer can vary, but typically you should expect to receive the offer within 14 days after your employer is notified of your qualifying event. You then have 60 days to decide whether to accept the coverage. Keep track of this timeline, as COBRA insurance for how long relies on timely decisions and actions from your end.

COBRA insurance does not take effect immediately upon qualifying for coverage. Instead, it generally begins after your employer provides you with notification of your eligibility. This process can take a few weeks, so it’s important to stay proactive. Understanding COBRA insurance for how long and when it begins can help you plan accordingly.

COBRA benefits generally last a maximum of 18 months, but this can extend to 36 months based on certain conditions, such as disability. It's important to know the specifics of your situation to understand how long COBRA insurance lasts in your case. If you need clarity on your COBRA options, using resources like USLegalForms can assist you in navigating the details.

Yes, COBRA coverage typically lasts for 18 months, beginning from the date of qualifying events like job loss or reduced hours. The coverage allows you to maintain your healthcare plan while you explore other insurance options. Keep in mind that certain qualifying factors may adjust this timeframe and it's beneficial to stay informed.

COBRA insurance generally lasts for 18 months. However, in certain situations, such as disability, it may extend up to 36 months. To fully grasp how long COBRA insurance lasts, consider your specific circumstances, as some life events can alter the standard period.

If you quit your job, your COBRA insurance typically lasts for 18 months. This duration begins from the last day of your employment. It's crucial to understand that the length of COBRA coverage is designed to provide you with continued health care as you transition to new employment or make other arrangements.

Cal COBRA coverage lasts for up to 36 months. This extension allows individuals to continue their health insurance after employment ends or a reduction in hours occurs. If you're looking into how long COBRA insurance lasts, it's helpful to know that Cal COBRA can specifically offer a longer coverage duration in California compared to federal COBRA.