Cobra Election Form Online

Description

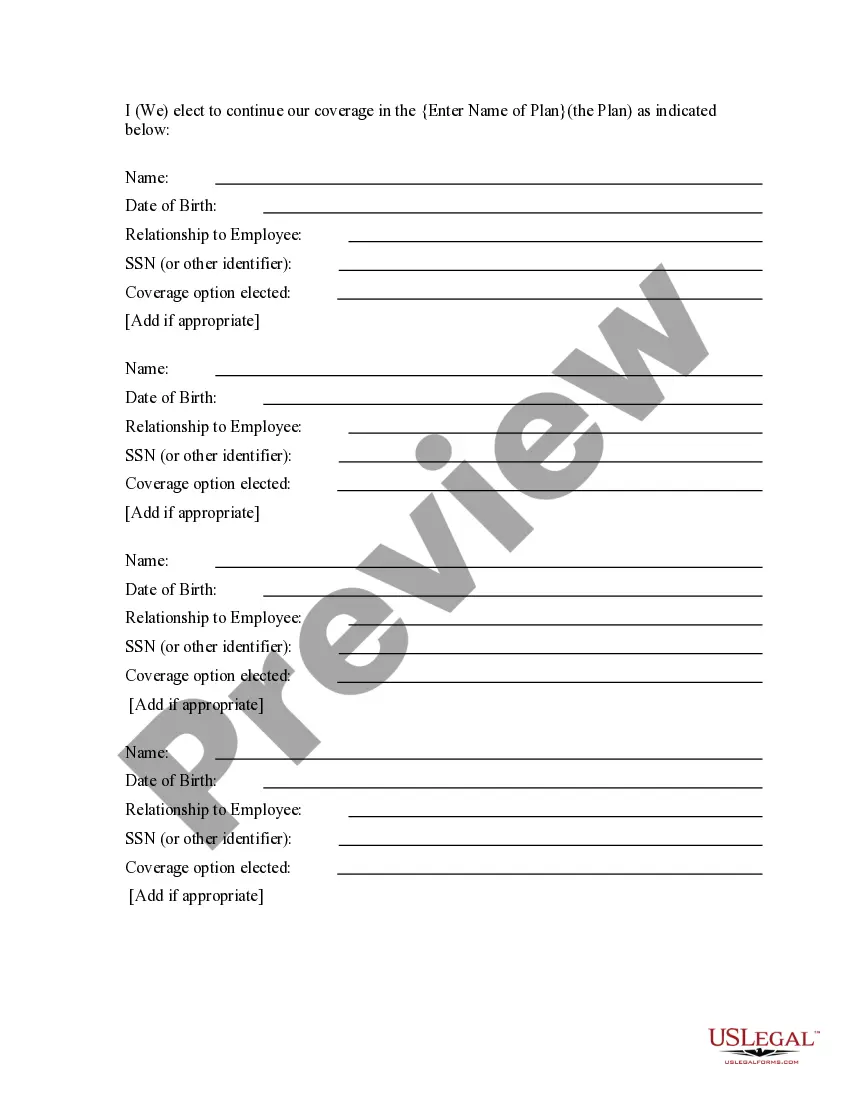

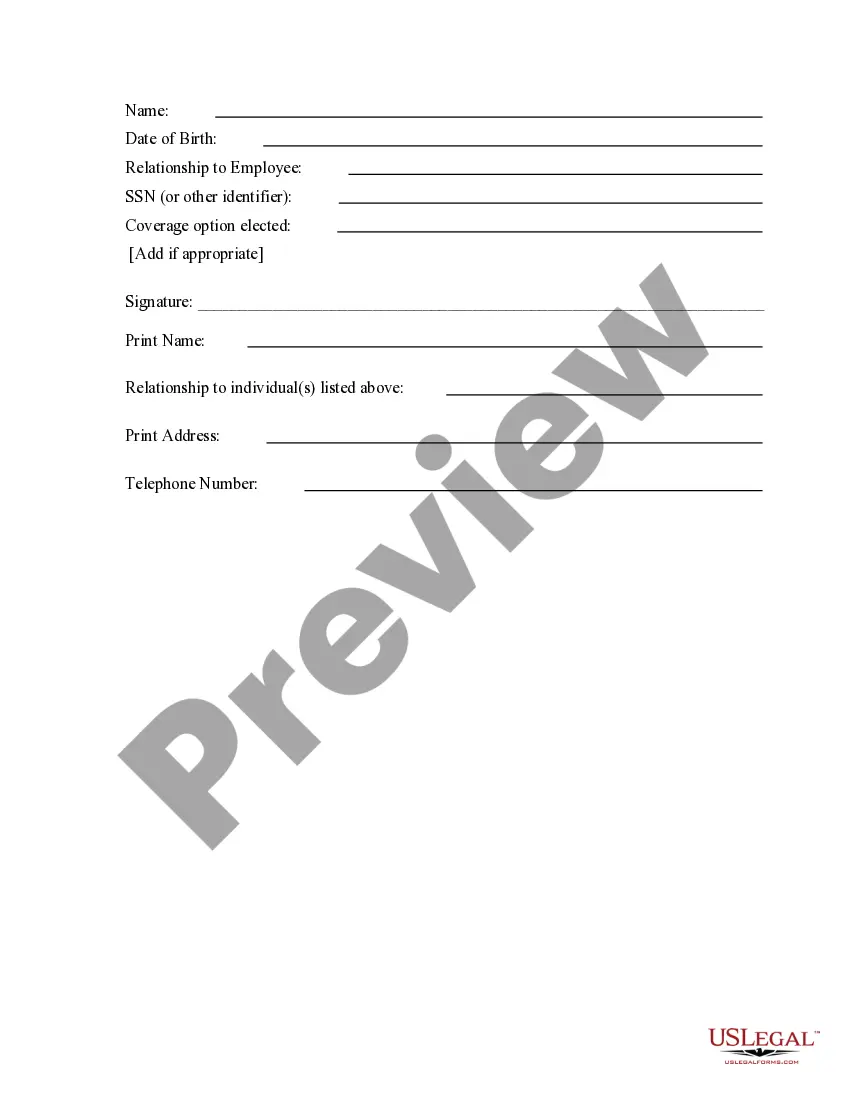

How to fill out COBRA Continuation Coverage Election Form?

Handling legal documents can be daunting, even for seasoned experts.

When you are looking for a Cobra Election Form Online and lack the time to search for the suitable and updated version, the tasks can be challenging.

US Legal Forms accommodates any requirements you may have, from personal to business documents, all in one place.

Utilize state-of-the-art tools to fill out and manage your Cobra Election Form Online.

Here are the steps to follow after downloading the form you require: Verify it is the correct form by previewing it and reviewing its description, ensure that the sample is accepted in your state or county, select Buy Now when you are prepared, choose a subscription plan, find the file format you need, and Download, fill out, eSign, print, and send your document. Enjoy the US Legal Forms online catalog, backed by 25 years of experience and reliability. Transform your daily document management into a simple and user-friendly process today.

- Access a resource library of articles, guides, handbooks, and materials relevant to your situation and needs.

- Save time and effort in finding the documents you need, and take advantage of US Legal Forms’ advanced search and Review feature to locate Cobra Election Form Online and obtain it.

- If you have a membership, Log In to your US Legal Forms account, search for the form, and acquire it.

- Check your My documents tab to view the documents you have previously downloaded and to manage your folders as you see fit.

- If this is your first experience with US Legal Forms, create a free account and gain unlimited access to all the benefits of the library.

- A comprehensive web form directory could be a game changer for anyone aiming to navigate these situations effectively.

- US Legal Forms is a frontrunner in online legal forms, offering over 85,000 state-specific legal documents available at your convenience.

- With US Legal Forms, you can access legal and business forms tailored to your state or county.

Form popularity

FAQ

COBRA coverage lets you pay to stay on your job-based health insurance for a limited time after your job ends (usually 18 months). You usually pay the full premium yourself, plus a small administrative fee. Contact your employer to learn about your COBRA options.

Qualified beneficiaries must be given an election period of at least 60 days during which each qualified beneficiary may choose whether to elect COBRA coverage. This period is measured from the later of the date of the qualifying event or the date the COBRA election notice is provided.

To be eligible for COBRA, your group policy must be in force with 20 or more employees covered on more than 50 percent of its typical business days in the previous calendar year.

Canceling COBRA coverage Enter a support request in the online message center. Send a letter to WageWorks requesting termination of your COBRA coverage (note that certain cancellation requests are subject to the employer's applicable group health plan provisions).

There are state and federal COBRA continuation coverage laws in place in Massachusetts that give employees and their families who would lose their group health plan because of a serious life event the right to continue their health benefits, usually at their own expense, for a limited period of time.