Cobra Coverage Complete For How Long

Description

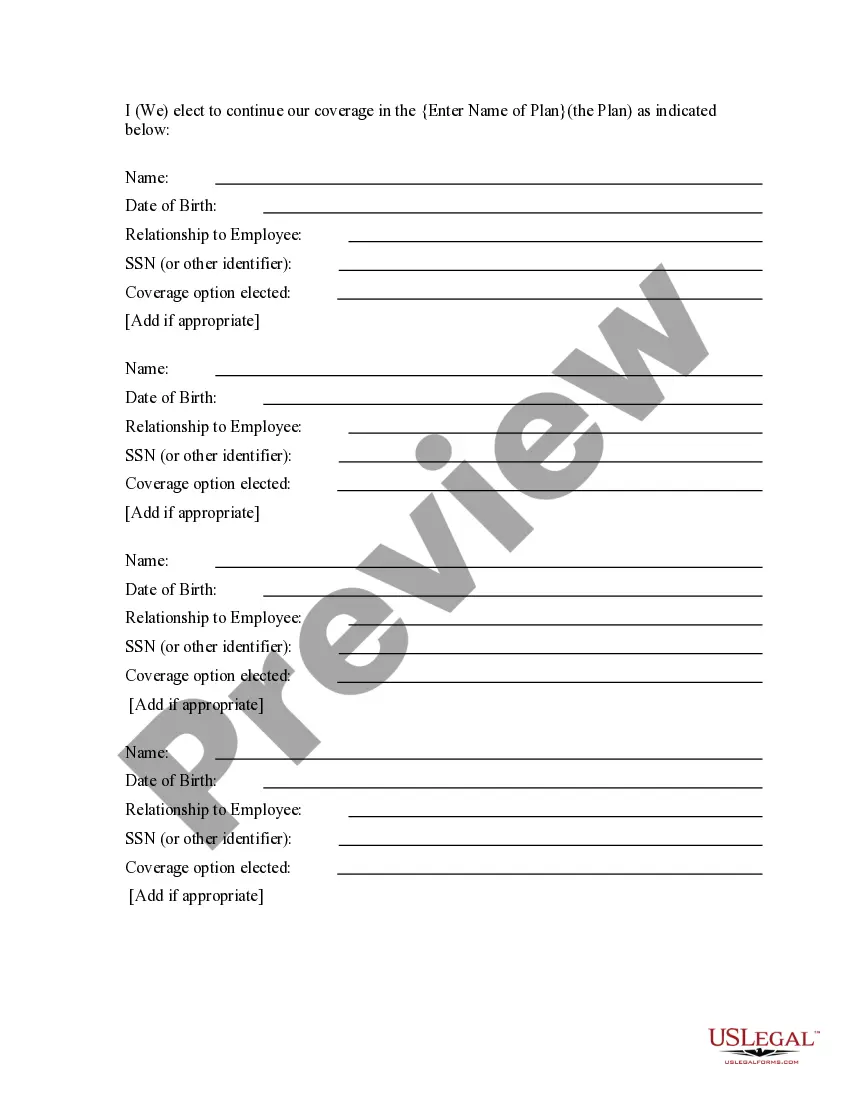

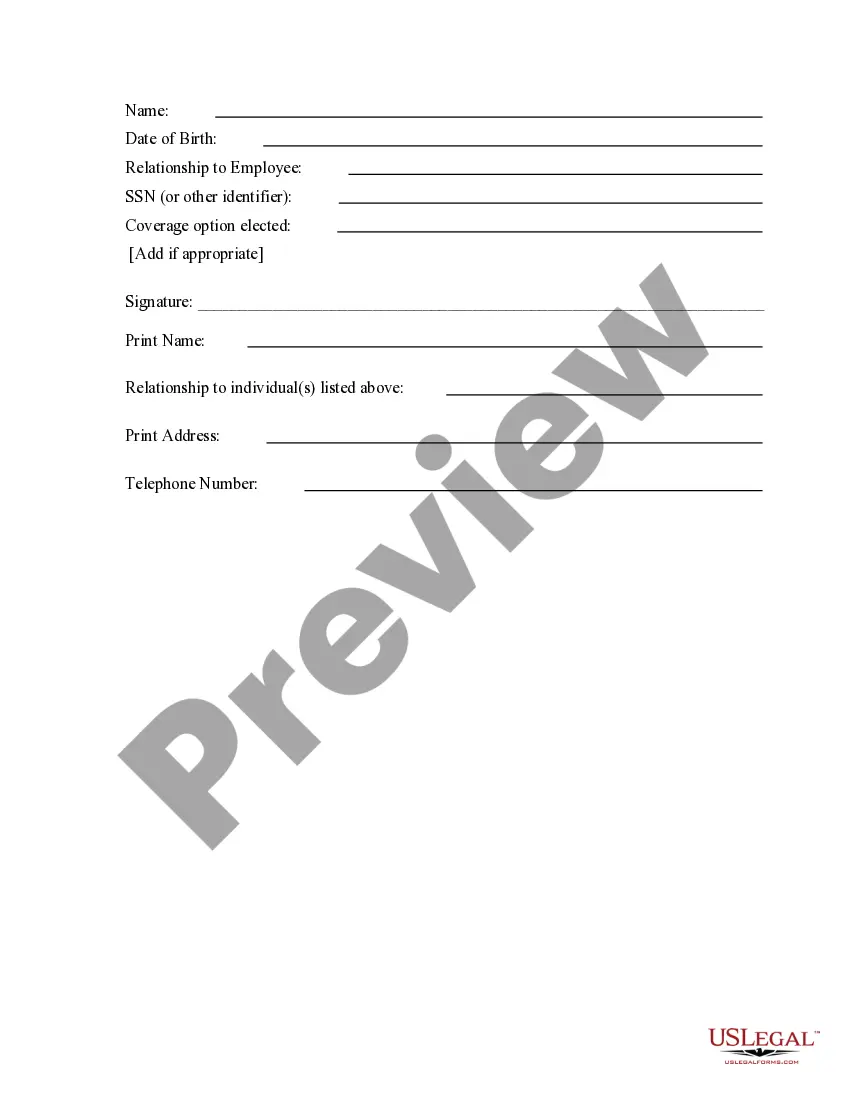

How to fill out COBRA Continuation Coverage Election Form?

The Cobra Coverage Complete For How Long that you view on this page is a versatile legal blueprint crafted by experienced attorneys in compliance with federal and local laws.

For over 25 years, US Legal Forms has supplied individuals, businesses, and legal practitioners with over 85,000 authenticated, state-specific forms for any business and personal needs. It is the fastest, most straightforward, and most trustworthy method to acquire the documentation you require, as the service ensures bank-level data safety and anti-malware safeguards.

Subscribe to US Legal Forms to have validated legal templates for all of life’s scenarios readily available.

- Examine the document you need and review it.

- Choose the pricing plan that fits your needs and set up an account. Use PayPal or a credit card for swift payment. If you possess an existing account, Log In and verify your subscription to proceed.

- Select the format desired for your Cobra Coverage Complete For How Long (PDF, Word, RTF) and download the template to your device.

- Print the template to fill it out manually. Alternatively, employ an online multi-functional PDF editor to swiftly and accurately complete and sign your form with an electronic signature.

- Re-download your paperwork whenever required. Access the My documents section in your profile to retrieve any previously downloaded forms.

Form popularity

FAQ

COBRA mandates a time limit on coverage duration, typically up to 18 months for most individuals. In some cases, such as a disability, this period can extend beyond 18 months, providing valuable peace of mind. Recognizing this time limit helps you make informed decisions about your healthcare options. If you're looking for guidance, uslegalforms can help clarify your rights and options related to COBRA coverage.

Yes, there is a time limit for COBRA coverage. Generally, COBRA allows you to keep coverage for up to 18 months, but it can extend to 36 months in certain situations. It’s important to know your specific circumstances, as this will determine how long you can rely on COBRA coverage. Staying informed helps you plan for your health insurance needs effectively.

Yes, COBRA can be retroactive, typically allowing a window of up to 45 days for coverage to take effect. This period lets you ensure you have continuity of care without interruption. However, to maintain this retroactive coverage, you must file your application within the required time frame. With clarity on how long COBRA coverage lasts, you can navigate your health insurance options more effectively.

COBRA coverage typically lasts for 18 months, but it can extend under certain circumstances, such as disability or other qualifying events. During this period, you maintain access to your previous health plan, which can provide peace of mind while you transition. Understanding how long COBRA coverage remains effective is crucial for planning your healthcare needs. If you seek specific timelines, the US Legal Forms platform can help clarify your options.

You generally have 60 days to apply for COBRA coverage after job termination. This allows you to consider your options and prepare necessary documents. Keep in mind that your eligibility continues until you complete the application. Knowing how long COBRA coverage lasts can ensure you secure your health insurance without a gap.

COBRA insurance can last up to 18 months for most individuals after job loss or reduction of hours. However, if you or a qualified dependent are disabled, you may extend this coverage for up to 29 months. Understanding these timeframes helps you plan your healthcare needs during the transition. US Legal Forms can provide you with the information needed to make informed decisions about your COBRA options.

COBRA does not specifically have a 30-day grace period for payment, but you usually have a 30-day window to make your initial premium payment. After that, your payments must be made on time to maintain your COBRA coverage. It's crucial to stay proactive with your payments to avoid any lapses in your health insurance. Check with US Legal Forms for assistance regarding payment schedules.

When you leave your job, you can typically access COBRA coverage for up to 18 months. This period may extend to 29 months if you qualify due to disability. It's essential to keep track of your timeline to maximize your COBRA benefits. For more details on your specific situation, you can explore resources on the US Legal Forms platform.

The COBRA loophole refers to a situation where individuals can extend their COBRA coverage beyond the typical duration with specific circumstances. In some cases, people may continue coverage for a longer period if they face certain health events or changes in their life situation. While this may sound beneficial, it can also become complex. Using a platform like USLegalForms can help you navigate the COBRA laws and understand your options.

After leaving a job, you can keep your COBRA coverage for a maximum of 18 months in most cases. If you experience a qualifying event, such as a divorce, you might qualify for extensions. Staying informed about how long COBRA coverage remains active can help you plan for your health insurance needs. Understanding these timelines ensures you maintain adequate protection during your transition.