Partnership Domestic Provided With Child

Description

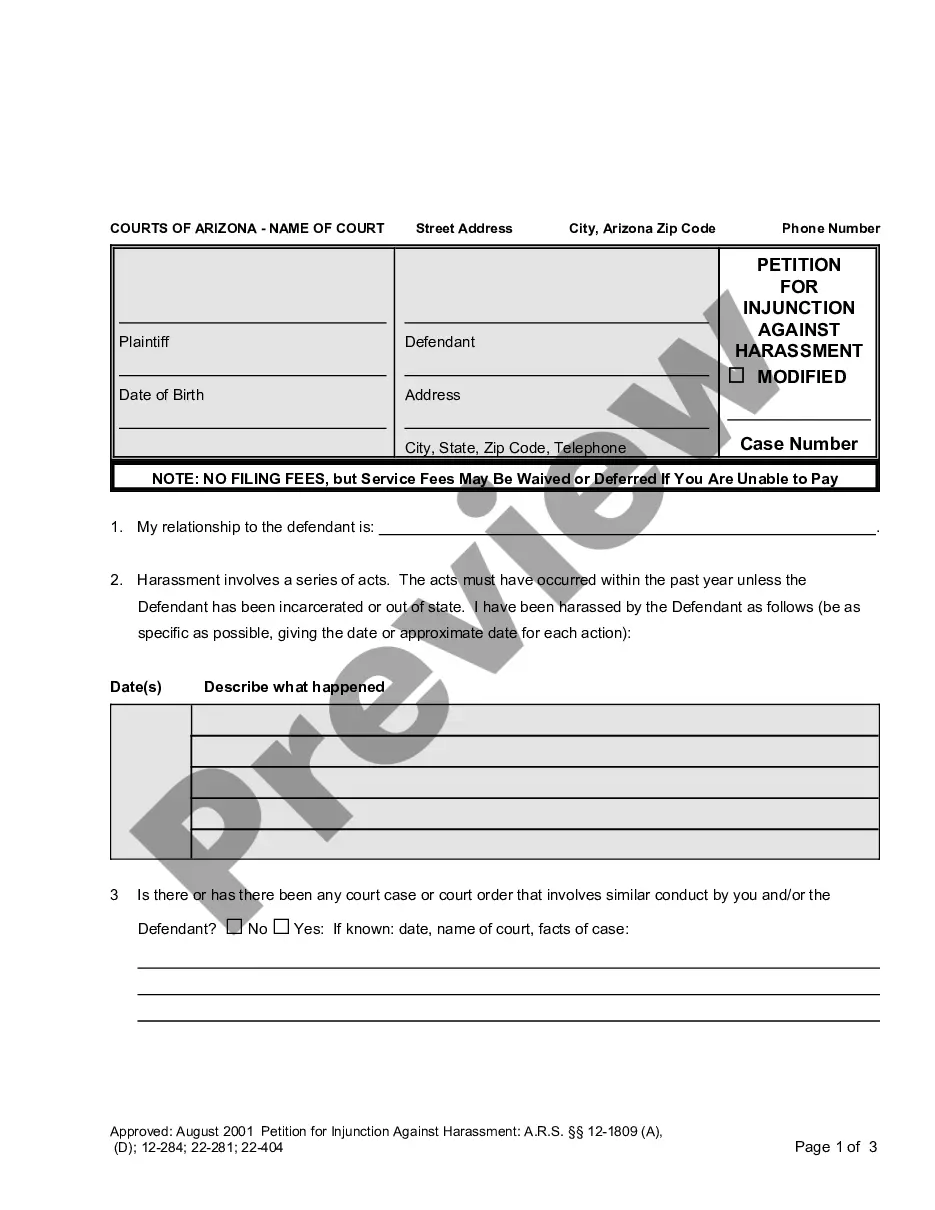

How to fill out Termination Of Domestic Partnership?

Regardless of whether it is for commercial reasons or personal matters, everyone must confront legal issues at some point in their life.

Completing legal documents requires meticulous care, starting with selecting the correct form model. For example, if you choose an incorrect variant of the Partnership Domestic Provided With Child, it will be rejected when you submit it. Thus, it is vital to find a reliable source for legal paperwork such as US Legal Forms.

With an extensive US Legal Forms collection available, you do not have to waste time searching for the correct template online. Utilize the library’s straightforward navigation to locate the appropriate form for any situation.

- Obtain the template you require by utilizing the search bar or catalog navigation.

- Review the form’s details to confirm it aligns with your situation, state, and locality.

- Click on the form’s preview to inspect it.

- If it is the wrong document, return to the search feature to find the Partnership Domestic Provided With Child template you need.

- Download the file if it satisfies your criteria.

- If you already have a US Legal Forms account, click Log in to access previously saved templates in My documents.

- If you do not have an account yet, you may acquire the form by clicking Buy now.

- Select the appropriate pricing option.

- Complete the profile registration form.

- Choose your payment method: you can use a credit card or PayPal account.

- Select the document format you prefer and download the Partnership Domestic Provided With Child.

- Once it is downloaded, you can fill out the form using editing software or print it and complete it by hand.

Form popularity

FAQ

If your child lives with you and your partner, one of you may file as head of household to claim the child tax credit, but only if you've provided at least 50% of the financial support for the child. Additionally, you can only claim the credit if your child lived with you for the last six months of the tax year.

Child of the Domestic Partner means the biological or adopted child of the Domestic Partner of a deceased Active Member, Disabled Member, or deceased Retired Member, who was residing with or in the care of such Member immediately before the. Sample 1.

You can claim a boyfriend or girlfriend as a dependent on your federal income taxes if that person meets certain Internal Revenue Service requirements. To qualify as a dependent, your partner must have lived with you for the entire calendar year and listed your home as their official residence for the full year.

While it is required for taxpayers to claim all of their dependents on their tax returns so the IRS can issue tax breaks, taxpayers can choose how many dependents they can claim on their W-4 to influence how much they are paid in each paycheck, and ultimately if they will owe money or be eligible for a tax refund when ...

Either unmarried parent is entitled to the exemption so long as they support the child. Typically, the best way to decide which parent should claim the child is to determine which parent has the higher income. The parent with the higher income will receive a bigger tax break.