Resolution In Companies Act 2013

Description

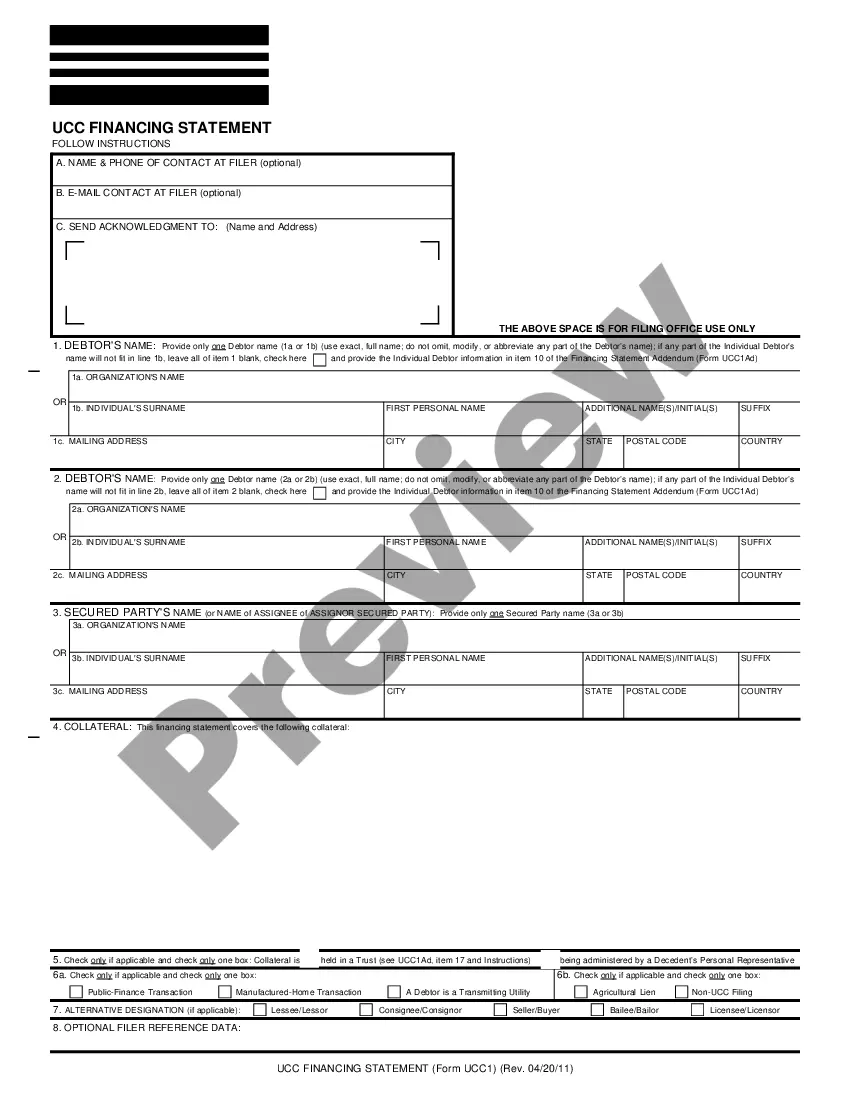

How to fill out Resolution Of Meeting Of LLC Members To Borrow Money?

The Document In Companies Act 2013 you observe on this page is a reusable legal template crafted by expert attorneys in accordance with national and local laws.

For over 25 years, US Legal Forms has supplied individuals, organizations, and legal practitioners with over 85,000 authenticated, state-specific documents for any business and personal occasion. It’s the quickest, simplest, and most dependable method to obtain the forms you require, as the service ensures bank-level data security and anti-malware safeguards.

Select the format you prefer for your Document In Companies Act 2013 (PDF, Word, RTF) and save the sample on your device.

- Search for the document you require and verify it.

- Browse through the file you looked for and preview it or review the form description to confirm it meets your needs. If it doesn’t, utilize the search function to find the appropriate one. Click Buy Now once you have identified the template you need.

- Register and Log In.

- Choose the pricing plan that fits you and create an account. Use PayPal or a credit card to make a swift payment. If you already possess an account, Log In and check your subscription to continue.

- Obtain the fillable template.

Form popularity

FAQ

(1) A resolution shall be an ordinary resolution if the notice required under this Act has been duly given and it is required to be passed by the votes cast, whether on a show of hands, or electronically or on a poll, as the case may be, in favour of the resolution, including the casting vote, if any, of the Chairman, ...

Examples of matters that can be dealt with by an ordinary resolution include the approval of annual financial statements, the appointment of auditors, and the declaration of dividends. On the other hand, a special resolution is a resolution that requires a higher majority vote, typically 75% or more, to be passed.

Ing to Section 114 of the Companies Act, 2013, a special resolution requires the approval of not less than three-fourths (75%) of the shareholders present and voting at a general meeting.

The resolution is considered as 'passed' when the last member signs (i.e. 100% of voting members agree to pass the resolution.) The 75% threshold only applies to votes cast at a physical meeting; 100% of votes are needed to pass a resolution without a meeting.

If the motion is finally passed, it becomes a 'resolution' (because the meeting so 'resolves' or decides). A resolution, thus, is a motion which has been carried. A resolution means a formal expression of opinion or intention made, usually after voting. It is a binding decision made by the members of a company.