File Llc With State

Description

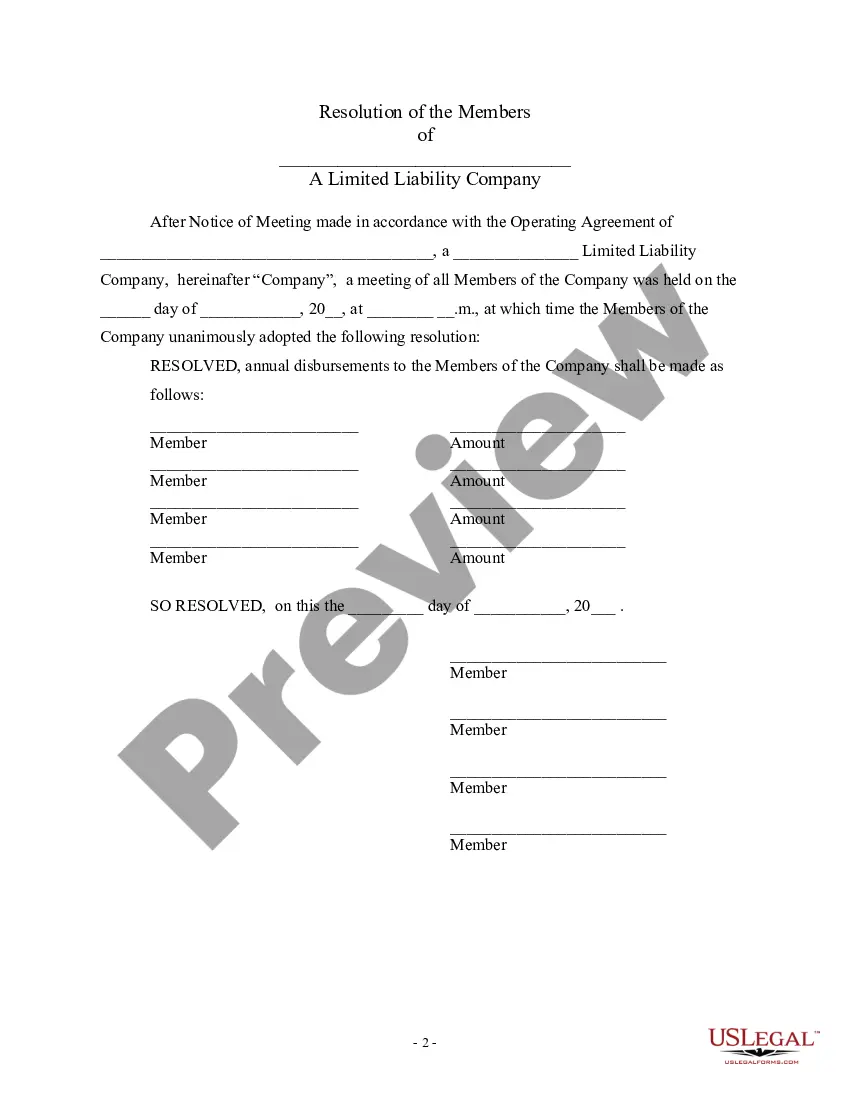

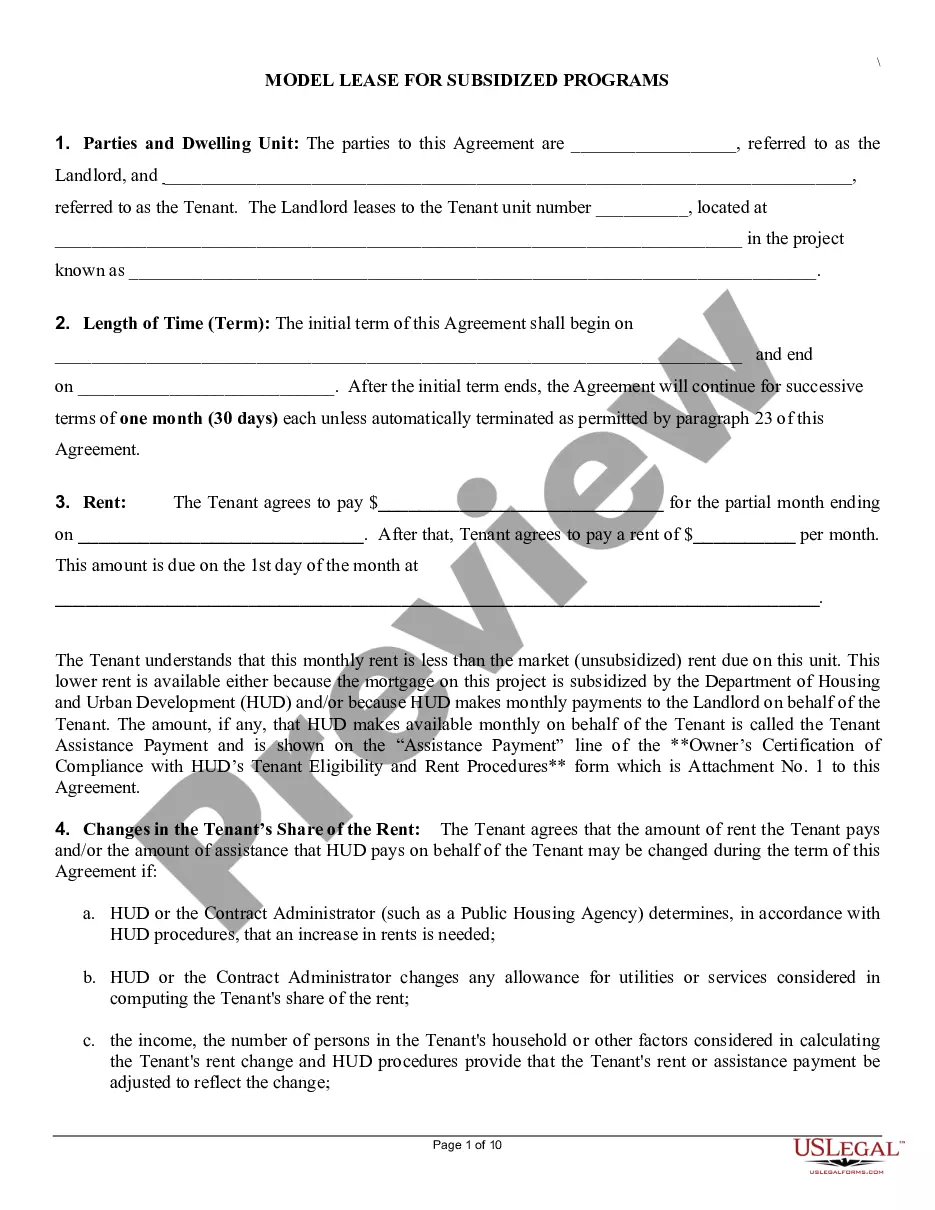

How to fill out Notice Of Meeting Of Members Of LLC Limited Liability Company To Consider Annual Disbursement To Members?

- If you're a returning user, log in to your account to access your previous forms. Ensure your subscription is current. If it's expired, renew it based on your plan.

- For first-time users, start by browsing the Preview mode. Assess the form descriptions to ensure you select one that meets your specific requirements and adheres to local regulations.

- Should you find any discrepancies, utilize the Search tab above to locate a suitable template. If you find the right one, proceed to the next step.

- Select and purchase the document by clicking the Buy Now button. Choose your preferred subscription plan and create an account to gain access to the extensive library.

- Finalize your transaction by entering your payment information, either through a credit card or PayPal.

- Once your purchase is complete, download the form directly to your device and store it in your profile’s My Forms section for future reference.

In conclusion, US Legal Forms empowers users and attorneys alike with easy access to over 85,000 legal documents, making the filing process straightforward and efficient. With premium support available for document completion, you can ensure your filings are accurate and compliant.

Start your journey to filing your LLC with confidence. Visit US Legal Forms today!

Form popularity

FAQ

Yes, LLCs are recognized in all 50 states, but the rules governing them can differ significantly. Each state has unique requirements for formation and maintenance, so it’s essential to research the specific regulations of the state where you plan to file. Using uslegalforms can simplify the process as you navigate the nuances of filing LLC with state.

Yes, the state you choose for your LLC can significantly impact your business. Different states have varied regulations, tax rates, and filing fees, which can affect your operations. When you file LLC with state, consider how these factors align with your business goals and future growth plans.

If you move to another state, you may need to adjust your LLC's registration, but it depends on your situation. You can either register your existing LLC in the new state or dissolve it and create a new one. Regardless of your choice, be sure to explore how to file LLC with state to navigate this process smoothly.

Yes, you can file your LLC by yourself, but it requires careful attention to detail. Filing LLC with state involves completing specific forms and providing necessary information about your business. While handling the process independently is possible, using platforms like uslegalforms for guidance can help ensure you meet all requirements accurately.

The best state to file an LLC often depends on your specific circumstances, such as your business type and location. However, many entrepreneurs consider states like Delaware, Nevada, and Wyoming for their business-friendly regulations and low fees. When you decide to file LLC with state, consider tax implications and ongoing compliance requirements as well.

Yes, the state in which you file your LLC can significantly impact your business operations. Each state has different regulations, taxes, and fees that can affect your LLC's success. By choosing a state with favorable laws and tax benefits, you can maximize your business potential. It's essential to carefully evaluate your options and consider using resources like US Legal Forms to guide your decision.

Deciding to file an LLC with the state in another jurisdiction can have benefits and drawbacks. If you find that another state offers favorable tax advantages or fewer regulations, it might be worth considering. However, keep in mind that operating an LLC in a different state requires compliance with that state's laws, which can add complexity. Consult with a professional to determine what makes the most sense for your business.

The time it takes to file an LLC with the state of Mississippi typically ranges from a few days to several weeks. Once you submit your Certificate of Formation, the state usually processes it within 48 hours if you choose expedited services. However, standard processing can take longer, especially during peak filing seasons. To speed up the process, consider using a professional service like US Legal Forms.

To file an LLC with the state of Mississippi, you need to complete a few key steps. First, choose a unique name for your LLC that complies with state naming rules. Next, appoint a registered agent to receive legal documents on behalf of your LLC. Finally, file the Certificate of Formation with the Secretary of State, including details like the business address and member information.

The state for your LLC should align with where you plan to conduct most of your business. If you are primarily local, registering in your home state is usually best. However, if you want advantages like lower taxes and confidentiality, consider states like Delaware or Wyoming. Aligning your choice with your business strategy is crucial—allowing you to file LLC with state regulations that suit your needs.