Llc Salary Calculator

Description

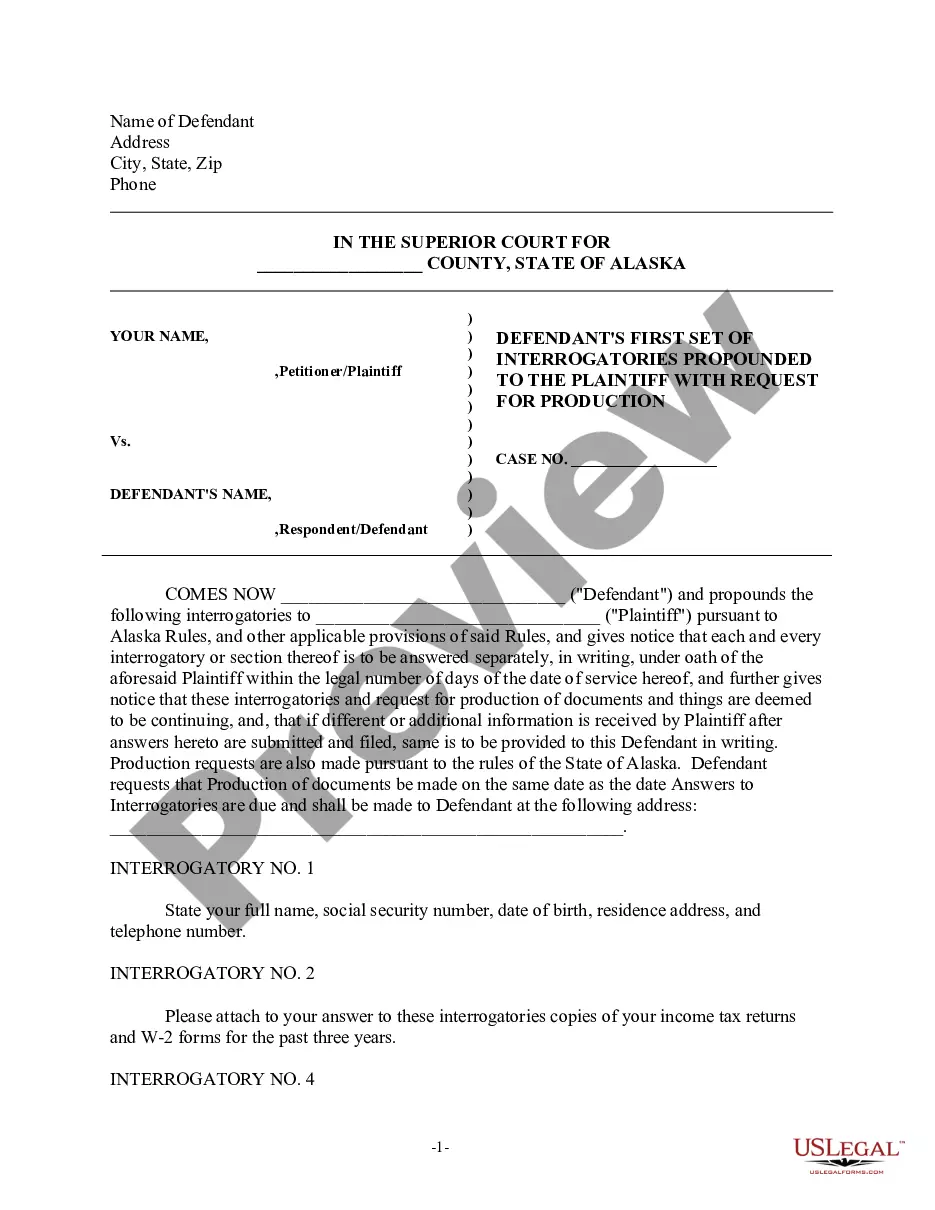

How to fill out Resolution Of Meeting Of LLC Members To Set Officer Salary?

Locating a reliable source for the latest and suitable legal templates is a significant part of dealing with bureaucracy. Identifying the appropriate legal documents requires precision and meticulousness, which is why it is crucial to obtain samples of Llc Salary Calculator exclusively from credible sources, such as US Legal Forms. An incorrect template could waste your time and prolong your situation. With US Legal Forms, you have minimal concerns. You can access and verify all the information regarding the document's application and relevance for your circumstances and within your state or region.

Follow the outlined steps to complete your Llc Salary Calculator.

Remove the stress associated with your legal paperwork. Explore the vast US Legal Forms collection where you can discover legal samples, assess their applicability to your situation, and download them instantly.

- Use the library navigation or search function to locate your sample.

- Examine the form's details to ensure it aligns with the requirements of your state and county.

- Preview the form, if available, to confirm it is the document you are seeking.

- Return to the search to find the appropriate template if the Llc Salary Calculator does not meet your needs.

- If you are confident about the form's relevance, download it.

- If you are a registered user, click Log in to verify and access your chosen templates in My documents.

- If you do not possess an account yet, click Buy now to acquire the template.

- Select the pricing option that suits your requirements.

- Proceed to register to complete your purchase.

- Conclude your purchase by choosing a payment method (credit card or PayPal).

- Select the document format for downloading Llc Salary Calculator.

- Once you have the form on your device, you can modify it using the editor or print it out and complete it manually.

Form popularity

FAQ

Income from salary is the sum of Basic salary + HRA + Special Allowance + Transport Allowance + any other allowance. Some components of your salary are exempt from tax, such as telephone bills reimbursement, leave travel allowance. If you receive HRA and live on rent, you can claim exemption on HRA.

Simply take the total amount of money (salary) you're paid for the year and divide it by 12. For example, if you're paid an annual salary of $75,000 per year, the formula shows that your gross income per month is $6,250. Many people are paid twice a month, so it's also useful to know your biweekly gross income.

LLC members are subject to the 15.3% combined self-employment tax (12.4% for social security and 2.9% for Medicare). A benefit of doing business in Texas is that there's no state income tax for individuals or corporations.

If you make ? 60,000 a year living in India, you will be taxed ? 7,200. That means that your net pay will be ? 52,800 per year, or ? 4,400 per month. Your average tax rate is 12.0% and your marginal tax rate is 12.0%.

Steps to calculate taxable income Add up the different salary components to arrive at your gross salary. ... Next, deduct the non-taxable portion of partially taxable allowances, such as HRA and LTA. ... Actual HRA received. Actual rent per month minus 10% of basic monthly salary, or.