Reasonable Accommodation Request Form Housing California

Description

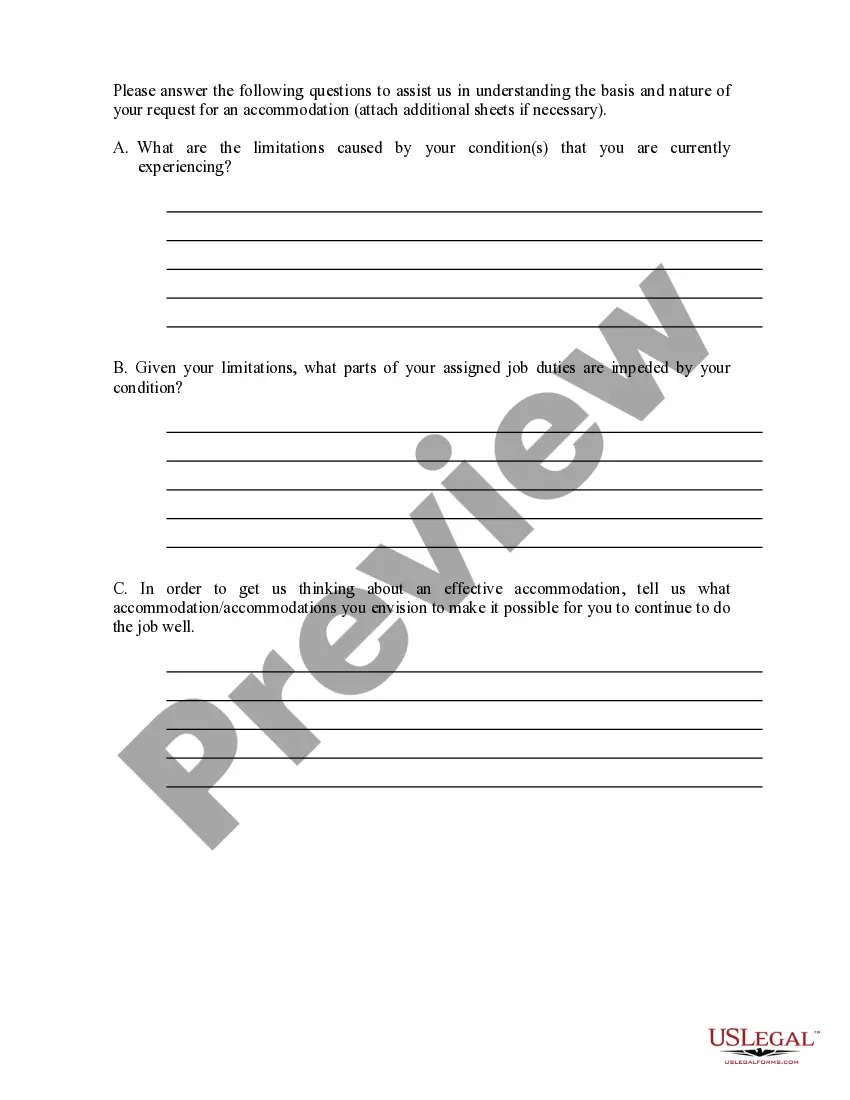

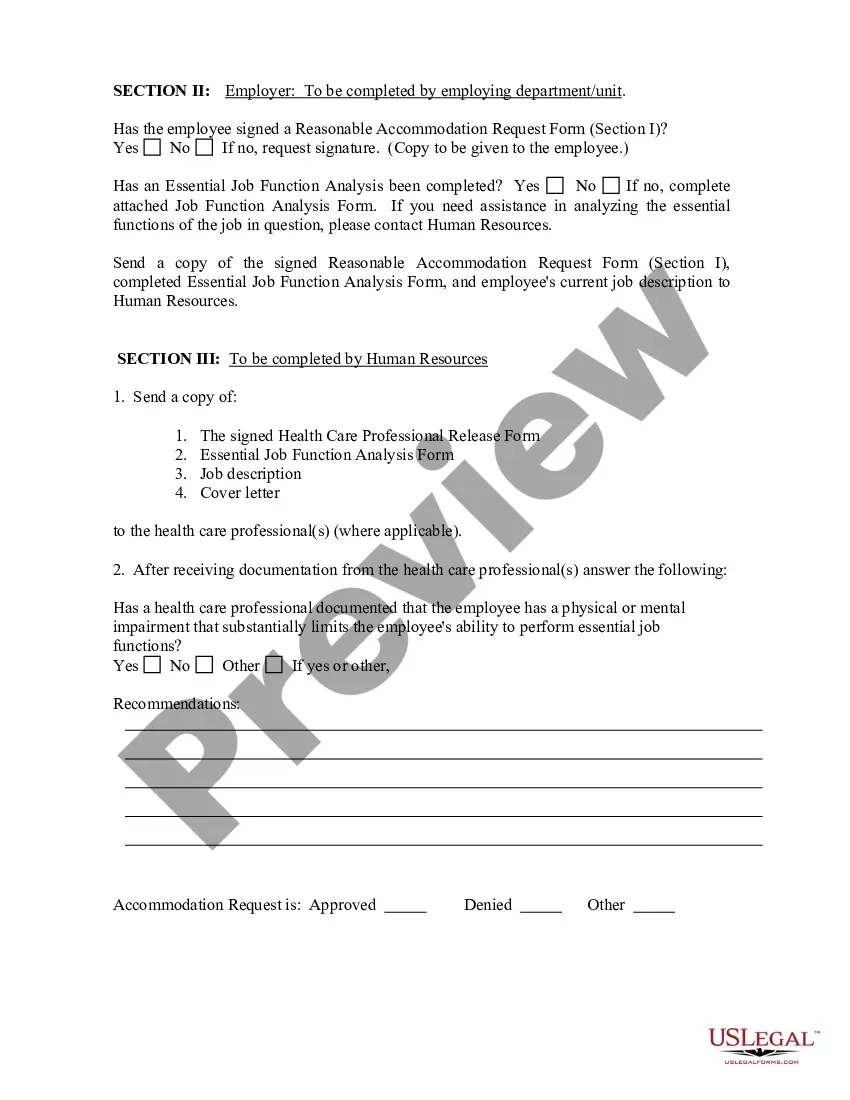

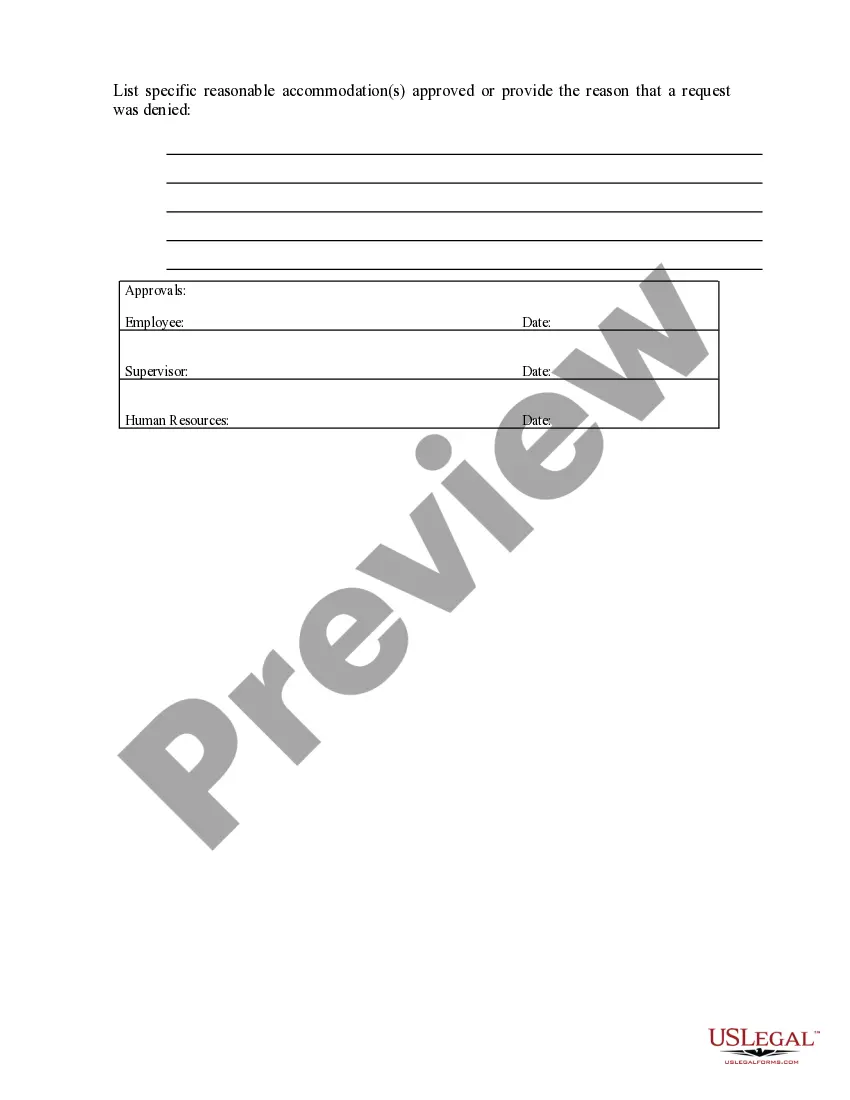

How to fill out Reasonable Accommodation Request Form?

Utilizing legal templates that comply with federal and state regulations is essential, and the internet provides numerous choices.

However, what's the value in spending time searching for the appropriate Reasonable Accommodation Request Form Housing California example online if the US Legal Forms digital library already offers such templates consolidated in one place.

US Legal Forms is the largest online legal repository featuring over 85,000 fillable templates created by lawyers for various business and personal situations.

All documents you find through US Legal Forms are reusable. To retrieve and complete previously obtained forms, access the My documents section in your account. Experience the most comprehensive and user-friendly legal document service!

- They are easy to navigate with all documents organized by state and intended purpose.

- Our experts stay updated on legal modifications, ensuring that your form is always current and compliant when securing a Reasonable Accommodation Request Form Housing California from our site.

- Acquiring a Reasonable Accommodation Request Form Housing California is quick and straightforward for both existing and new users.

- If you already possess an account with an active subscription, Log In and save the document sample you need in the correct format.

- If you are a new visitor to our website, follow the guidelines below.

Form popularity

FAQ

In computing stock basis, the shareholder starts with their initial capital contribution to the S corporation or the initial cost of the stock they purchased (the same as a C corporation). That amount is then increased and/or decreased based on the pass-through amounts from the S corporation.

California does tax S Corps Most states follow the federal IRS rules and don't make S Corps pay income tax, but California is an exception. All California LLCs or corporations that choose S Corp taxation must pay a 1.5% state franchise tax on their net income.

Setting Up an S Corp in North Carolina Choose a name. First, choose a name for your LLC. ... Designate a North Carolina registered agent. Select a registered agent in North Carolina. ... File North Carolina Articles of Organization. ... Create an operating agreement. ... Apply for an EIN. ... File the form for S corp election.

To form an S Corp in California, you must file Form 2553 (Election by a Small Business Corporation) with the IRS and then complete additional requirements with the state of California, including filing articles of incorporation, obtaining licenses and permits, and appointing directors.

In computing stock basis, the shareholder starts with their initial capital contribution to the S corporation or the initial cost of the stock they purchased (the same as a C corporation). That amount is then increased and/or decreased based on the pass-through amounts from the S corporation.

The minimum franchise tax is $200. For S-Corporations: The tax rate for an S-Corporation is $200 for the first one million dollars ($1,000,000) of the corporation's tax base and $1.50 per $1,000 of its tax base that exceeds one million dollars ($1,000,000).

Property that you convert becomes your capital contribution to the S-Corp, which would form your basis for a capital loss or gain if you later sell your interest. The value of the property becomes the corporation's basis in it.

Setting Up an S Corp in North Carolina Choose a name. First, choose a name for your LLC. ... Designate a North Carolina registered agent. Select a registered agent in North Carolina. ... File North Carolina Articles of Organization. ... Create an operating agreement. ... Apply for an EIN. ... File the form for S corp election.

Although you can theoretically calculate, file and pay all of your S Corporation income and self-employment taxes manually, in practice, it's much, much easier to use a dedicated payroll service. These payroll platforms will charge a monthly fee but will save you a considerable amount of time and frustration!

Forming an S corporation is straightforward. First, you start a business as a corporation by filing articles of incorporation with the Corporations Division of the North Carolina Secretary of State's Office. Next, to elect S corporation status, all shareholders in your company must sign and file Form 2553 with the IRS.