Llc Business Owners With Small

Description

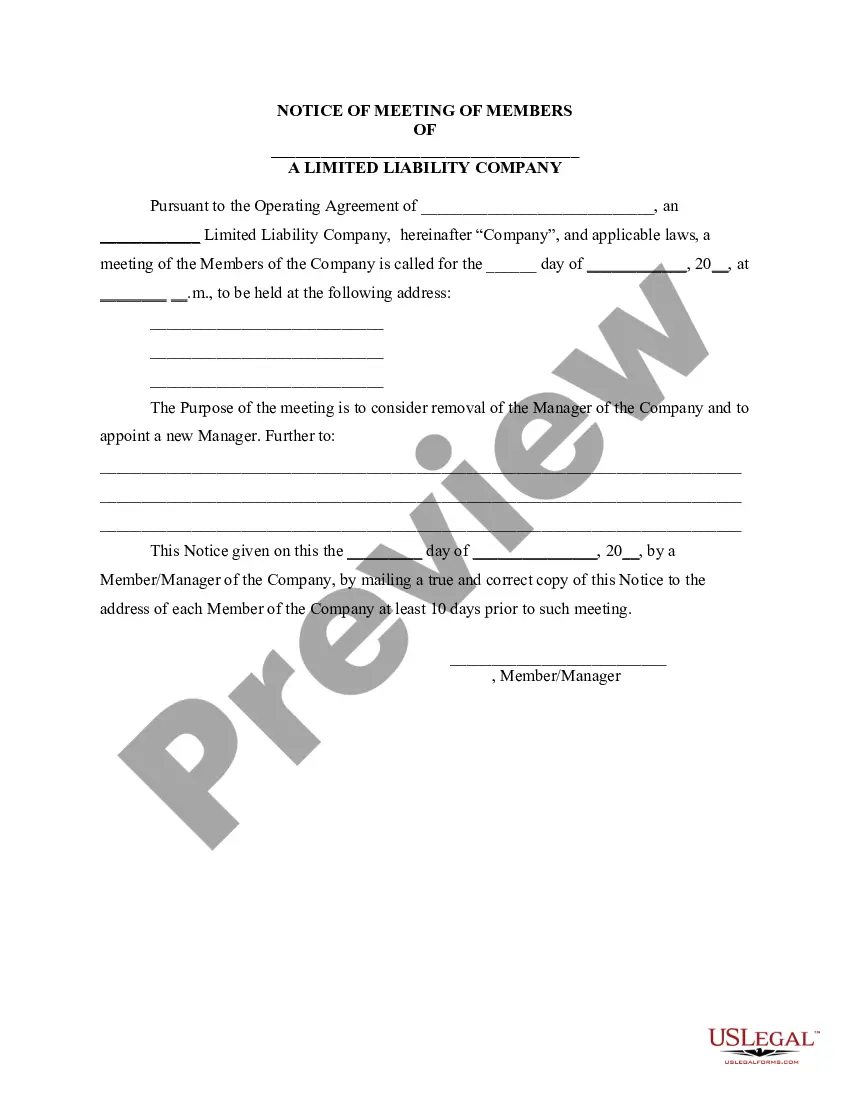

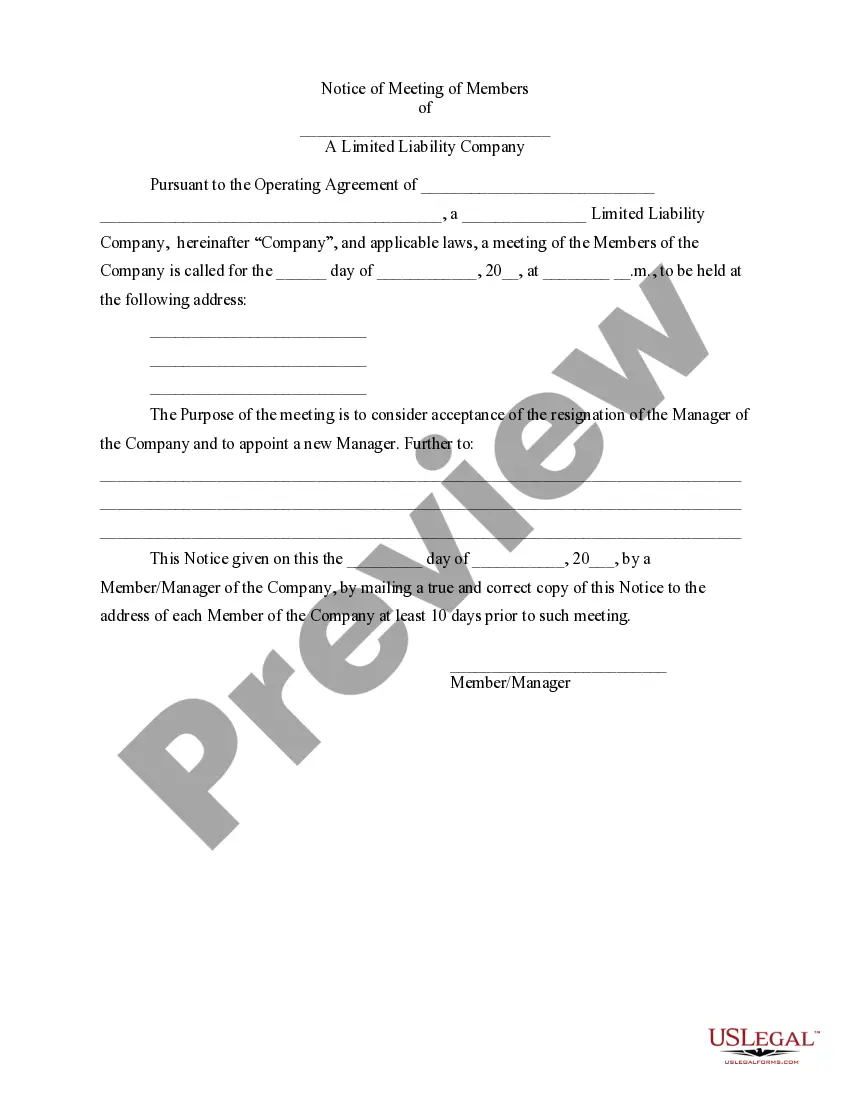

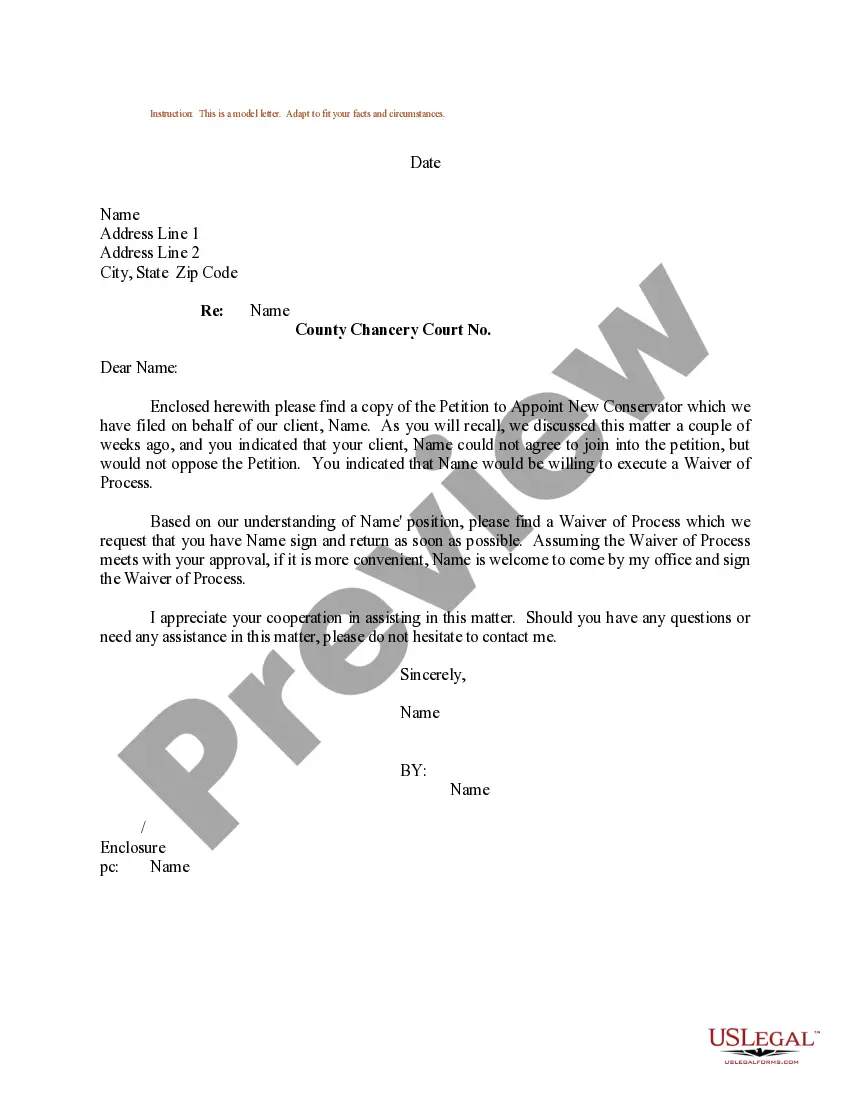

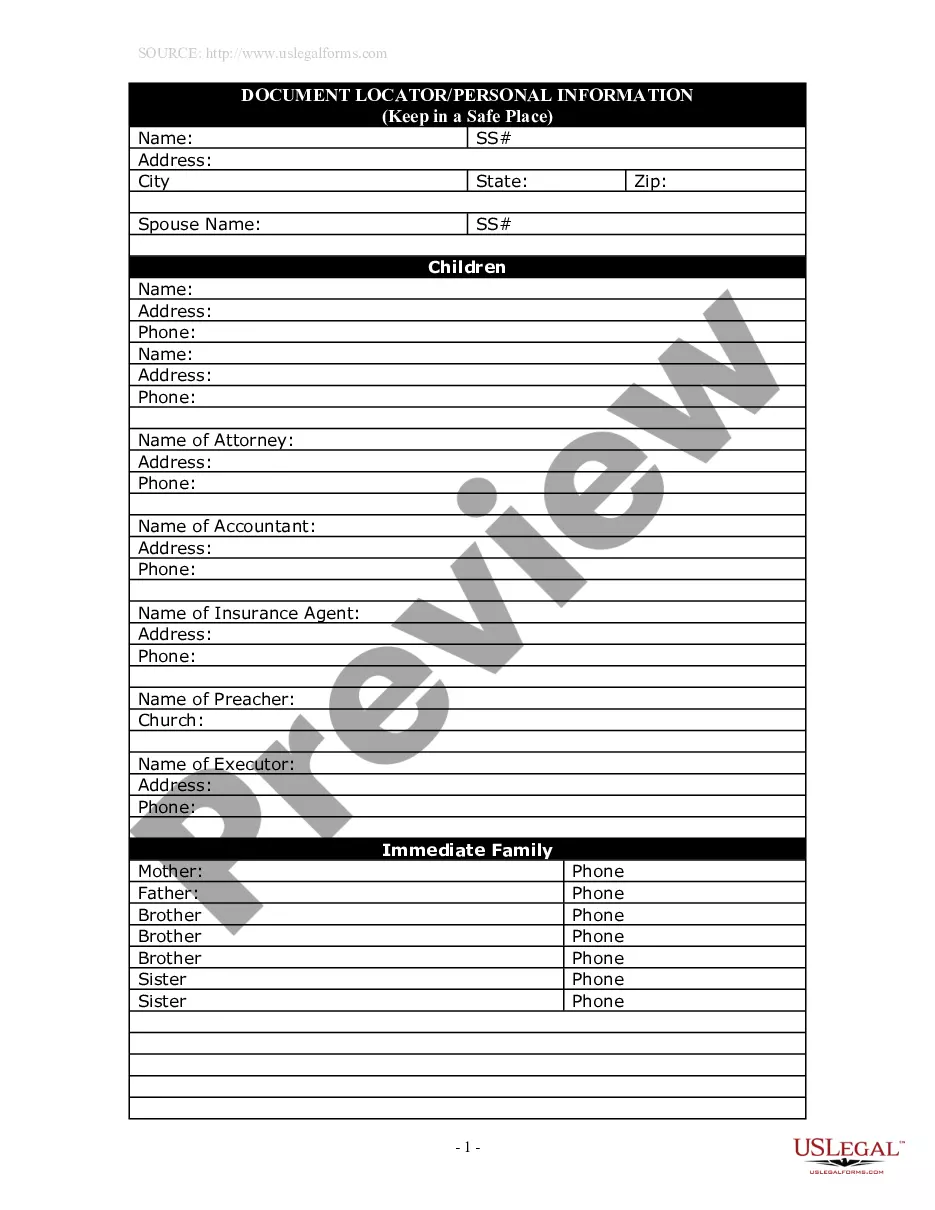

How to fill out Resolution Of Meeting Of LLC Members To Remove The Manager Of The Company And Appoint A New Manager?

Creating legal documents from the ground up can occasionally feel somewhat daunting.

Certain situations may require extensive research and a significant financial investment.

If you’re in search of a more straightforward and economical method for preparing Llc Business Owners With Small or any other paperwork without excessive hassle, US Legal Forms is always available to assist you.

Our online repository of over 85,000 current legal forms encompasses nearly every facet of your financial, legal, and personal matters.

However, before diving directly into downloading Llc Business Owners With Small, consider these tips: Check the form preview and descriptions to ensure you’ve identified the document you’re looking for. Confirm that the form you select adheres to the rules and regulations of your state and county. Choose the appropriate subscription option for purchasing the Llc Business Owners With Small. Download the document, then fill it out, sign it, and print it. US Legal Forms enjoys a strong reputation and boasts over 25 years of expertise. Join us today and make form completion an effortless and efficient process!

- With just a few clicks, you can swiftly obtain state- and county-compliant templates meticulously crafted for you by our legal experts.

- Utilize our website whenever you require a dependable and trustworthy service through which you can easily locate and download the Llc Business Owners With Small.

- If you’re a returning user and have previously created an account with us, simply Log In to your account, choose the template, and download it, or re-download it later anytime in the My documents section.

- Don’t have an account? No problem. It requires minimal time to set one up and navigate the library.

Form popularity

FAQ

Filling out a W9 as an LLC business owner with small operations involves a few straightforward steps. First, enter your LLC's name as shown on the IRS documents. Then, for the business type, select 'Limited Liability Company' and provide your EIN or Social Security Number if you are a single-member LLC. USLegalForms offers helpful templates and guidance to ensure your W9 is correctly completed and submitted.

Yes, as an LLC business owner with small enterprises, you can operate multiple small businesses under one LLC. This approach can simplify your management, reduce paperwork, and save on costs. However, it’s essential to keep each business's finances separate to maintain clarity and prevent potential legal issues. Utilizing the services of USLegalForms can help you effectively manage these businesses under your LLC.

Adding your LLC to your personal taxes is straightforward for LLC business owners with small operations. Single-member LLCs report their income on Schedule C of the Form 1040 tax return. Multi-member LLCs require the completion of Form 1065 and may involve additional paperwork for each member’s income allocation. With resources from uslegalforms, you can navigate these requirements efficiently and ensure your filings are accurate.

There's no minimum income requirement for an LLC to file taxes, regardless of business size. LLC business owners with small enterprises must file a tax return if they have business income, even if it's below certain thresholds. This ensures compliance with IRS regulations and helps avoid penalties. Therefore, it is advisable to keep accurate records and file, even if profits are modest.

An LLC serves as a legal entity that separates personal and business assets, offering protection to its owners. This structure allows LLC business owners with small companies to limit their liability, meaning personal assets remain safe if the business incurs debts or legal issues. Furthermore, the flexibility in management and taxation makes the LLC an attractive option for small business owners aiming for growth while managing risk effectively.

Filing taxes for your small business LLC involves identifying your LLC's tax classification first. If you are a single-member LLC, report your income on Schedule C of your personal tax return. If you have multiple members, you'll need to file Form 1065 and issue K-1 forms to each member. Using platforms like uslegalforms can simplify this process, providing guidance tailored for LLC business owners with small establishments.

LLCs offer flexibility in tax treatment that benefits LLC business owners with small businesses. They can choose to be taxed as a sole proprietorship, partnership, or corporation. This choice allows LLCs to minimize tax burdens and take advantage of deductions available to small business owners. Additionally, the pass-through taxation means that profits are taxed only at the individual level, preventing double taxation.

Yes, LLCs must generally file a tax return, but how they do this depends on how many members they have. Single-member LLCs are typically treated as sole proprietorships, so they report income on the owner's personal tax return. Multi-member LLCs usually file Form 1065, yet the profits still flow through to the individual members' tax returns. This structure benefits LLC business owners with small enterprises by allowing for simplified tax reporting.

The latest rule for LLC owners emphasizes transparency and compliance in reporting business activities. LLC business owners with small companies must stay updated with regulations to avoid penalties. This includes maintaining proper records and filing taxes appropriately. Staying compliant not only protects your business but also ensures a smoother operation in your entrepreneurial journey.

Indeed, you can have an LLC with only one person, known as a single-member LLC. This structure is particularly beneficial for LLC business owners with small businesses who seek liability protection with minimal complexity. Having a single-member LLC allows you to separate personal and business assets effectively. This separation is key in managing risks and ensuring that your personal finances remain protected.