Work Employee Outside Formula

Description

How to fill out Outside Work - Strict Policy?

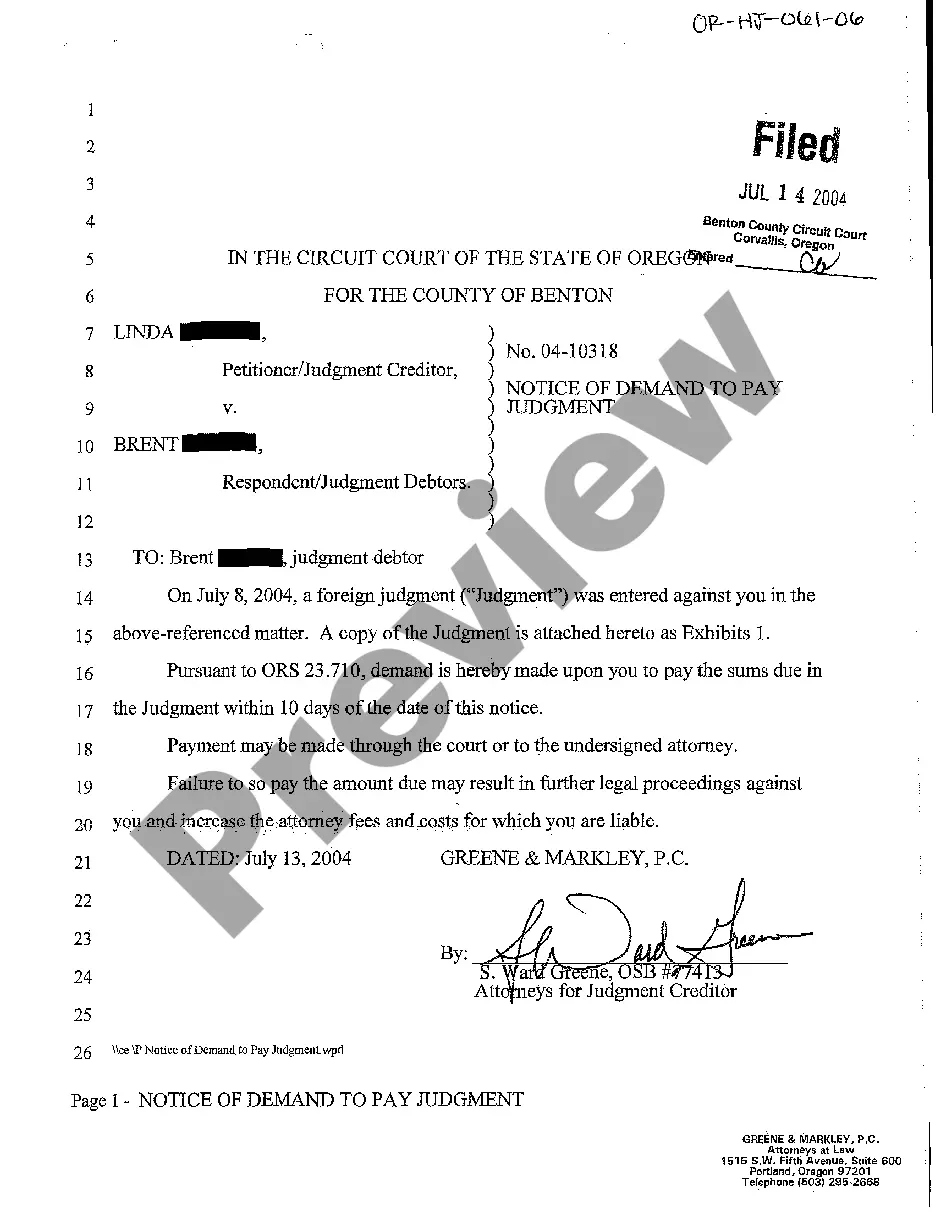

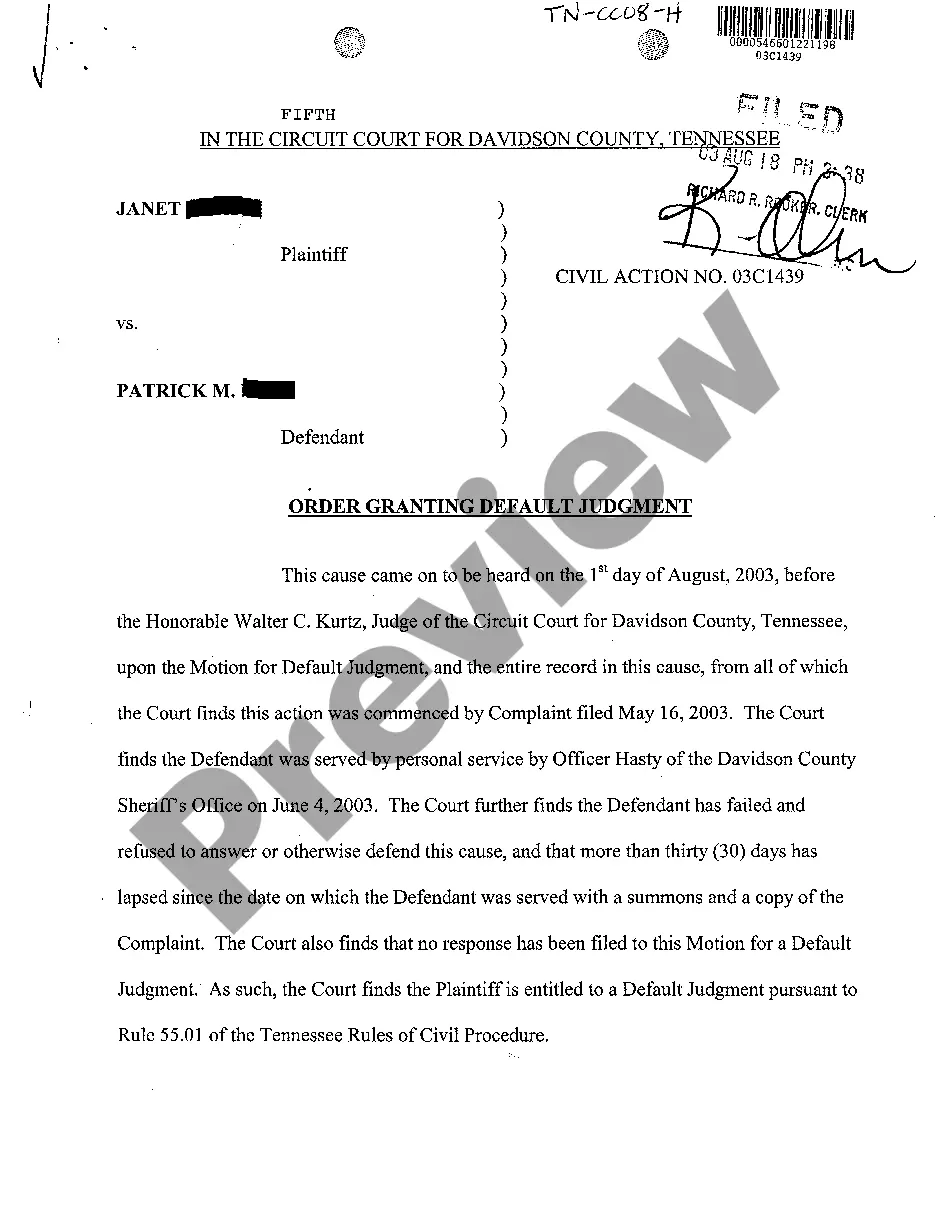

The Work Employee Outside Template you find on this page is a versatile legal document created by expert attorneys in accordance with federal and local laws.

For over 25 years, US Legal Forms has offered individuals, businesses, and lawyers with over 85,000 authenticated, state-specific documents for any business and personal situation. It’s the quickest, simplest, and most dependable method to obtain the documents you require, as the service ensures bank-level data security and anti-malware safeguards.

Subscribe to US Legal Forms to have authenticated legal templates for every aspect of life readily available.

- Search for the document you require and examine it.

- Scan through the file you looked for and preview it or review the form description to ensure it meets your requirements. If it does not, utilize the search function to find the correct one. Click Buy Now once you have found the template you need.

- Register and Log In.

- Select the pricing plan that fits you and create an account. Use PayPal or a credit card to make a swift payment. If you already possess an account, Log In and check your subscription to continue.

- Obtain the editable template.

- Choose the format you desire for your Work Employee Outside Template (PDF, DOCX, RTF) and save the document on your device.

- Complete and sign the document.

- Print the template to fill it out by hand. Alternatively, use an online multi-purpose PDF editor to quickly and accurately complete and sign your form with a legally-binding electronic signature.

- Download your documents again.

- Re-use the same document whenever necessary. Access the My documents tab in your profile to redownload any previously acquired forms.

Form popularity

FAQ

Working time encompasses any period during which you are engaged in duties for your employer. This includes hours spent actively working, attending meetings, or performing tasks directly related to your job. It's essential to accurately track all working time to ensure that you receive benefits that align with the work employee outside formula. This clarity can lead to a better understanding of your rights and entitlements.

Hours worked play a significant role in determining employee benefits. Employers often calculate benefits based on the total hours you put in, which includes overtime and regular hours. Understanding this relationship can help you maximize your benefits under the work employee outside formula. Ensuring accurate tracking of hours will also keep you informed about what you can expect from your employer.

An outside employment form is a document that employees fill out to disclose any additional work they engage in outside of their primary position. This form allows the employer to review and approve outside employment and ensures that it aligns with company policies. Utilizing such forms can help you manage your commitments effectively while adhering to the work employee outside formula.

Outside employment can include any work that an employee takes on beyond their primary job responsibilities. This may encompass freelance tasks, consulting services, or part-time jobs in different industries. It’s essential to evaluate how this work fits within the company’s guidelines regarding the work employee outside formula to maintain clarity and compliance.

The outside employment policy outlines the rules and expectations for employees engaging in work outside their main job. This policy helps ensure that outside work does not interfere with your primary job performance or present a conflict of interest. By understanding this policy, you can better navigate your opportunities while adhering to the work employee outside formula.

Employees should generally avoid using their official title during outside activities unless given explicit permission from their employer. Using your title can create confusion about your affiliation with the company and might imply endorsements. Always review company policies regarding titles and their use in external contexts, especially when considering the work employee outside formula.

Outside employment involves any job or work you perform outside of your primary employment. This could include freelance work, contract jobs, or part-time positions in addition to your main job. While some organizations may allow it, they often require employees to disclose outside employment to ensure transparency and compliance with the work employee outside formula.

An outside activity typically refers to any engagement or pursuit outside an employee's official job responsibilities. This can include volunteering, pursuing hobbies, or participating in community events. It's crucial to understand how these activities align with your role and the company's policies. Always ensure that these activities do not conflict with your work employee outside formula.

To fill out an employee withholding form effectively, start with your basic information and tax filing status. Then, claim the appropriate number of allowances based on your circumstances, remembering that more allowances reduce your withholding. For additional clarity and support, US Legal Forms provides templates and resources to ensure you fill out your withholding form correctly.

When filling out your withholding form, take your time to review each section carefully. Begin by providing accurate personal information, then decide on your filing status and number of allowances based on your tax liability. Tools like the IRS withholding calculator can help you determine the most accurate approach to avoid surprises during tax time.