Shareholders Consent Form

Description

Form popularity

FAQ

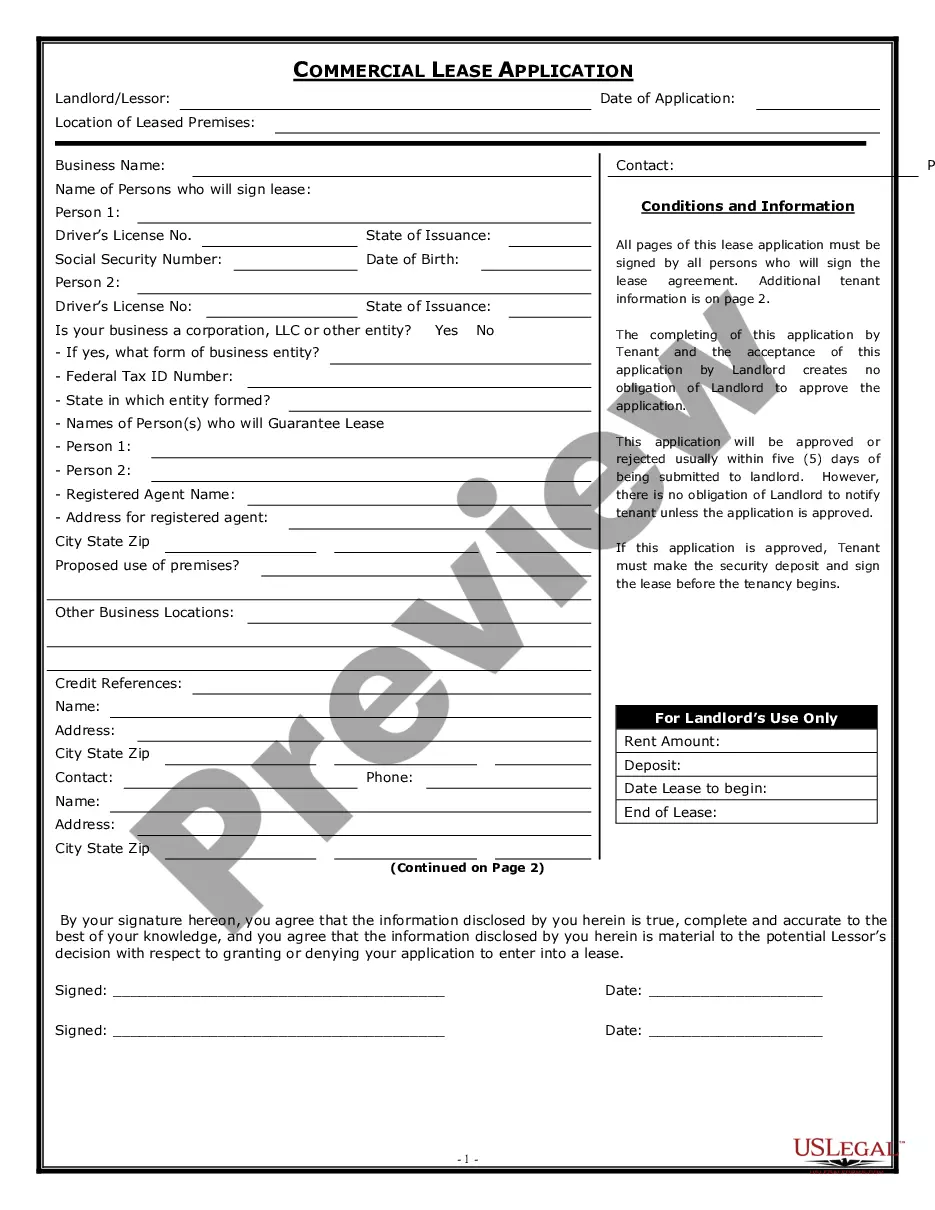

You may need to file both forms 8832 and 2553 depending on your business's classification. Form 8832 allows you to choose your entity type, while form 2553 is required for S Corporation election. Ensure that your Shareholders consent form is correctly completed, as it plays a crucial role in both filings.

Shareholders of a Controlled Foreign Corporation (CFC) need to file form 5471. This form provides necessary information about the CFC and its shareholders to the IRS. Using the Shareholders consent form is essential when documenting shareholder agreements related to this filing.

Yes, you can file form 2553 electronically, which simplifies the process for many businesses. However, you must ensure that all required signatures from shareholders are included in the Shareholders consent form before submitting. Additionally, electronic filing may help expedite the approval process with the IRS.

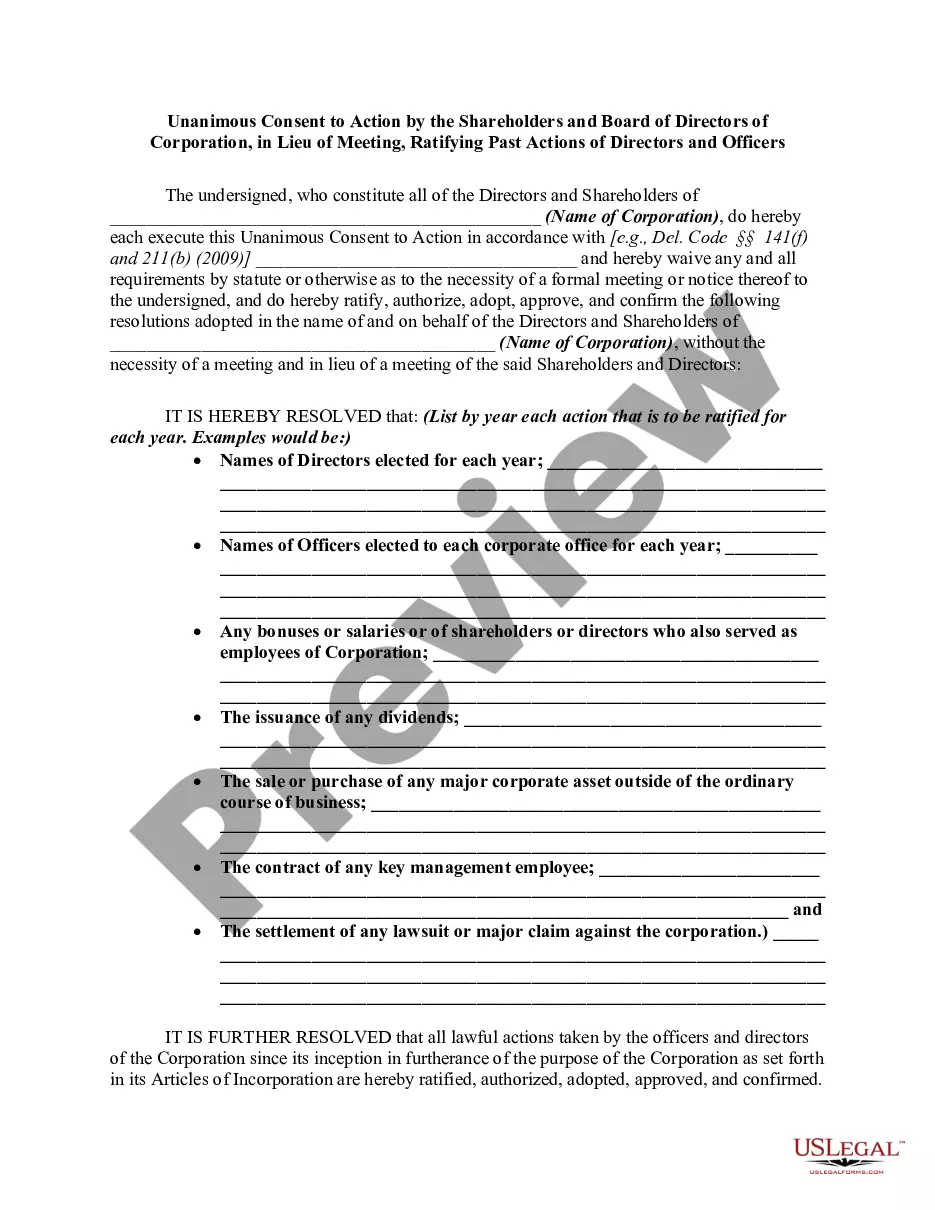

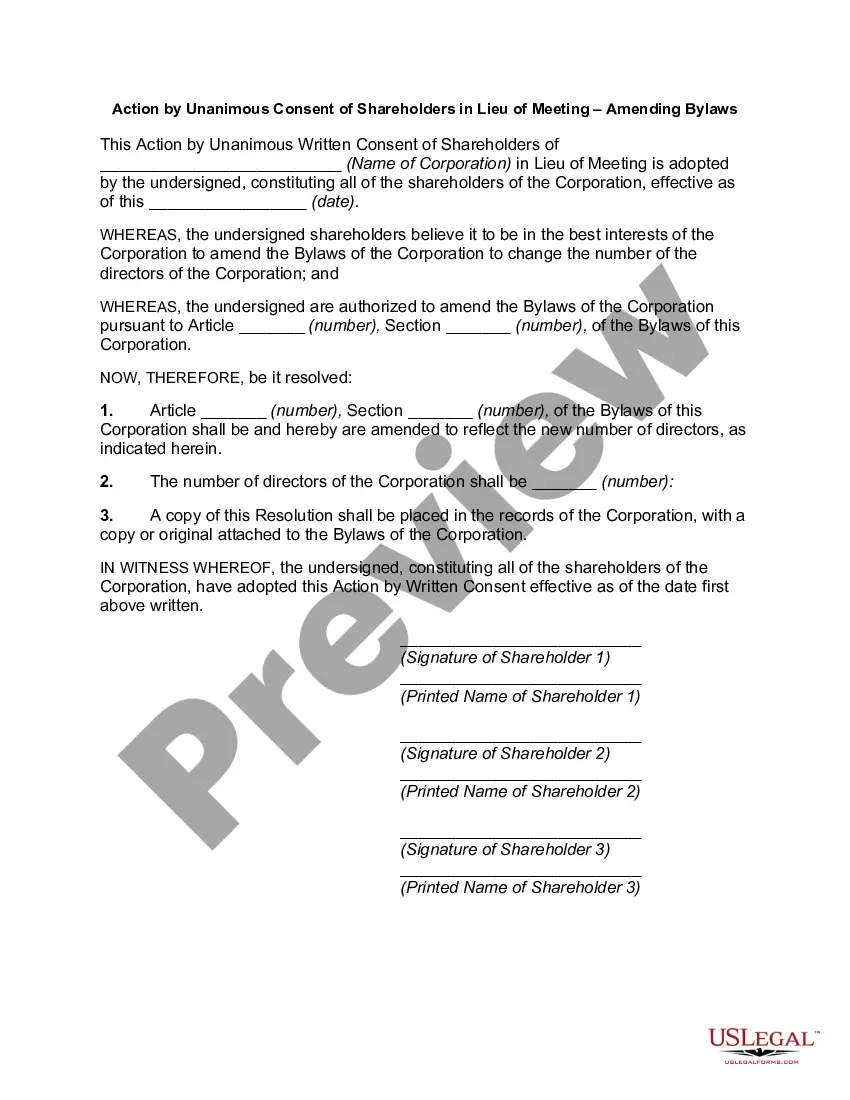

The consent of the shareholders denotes their formal agreement to certain corporate actions, typically documented through a shareholders consent form. This consent may address various decisions, such as mergers or changes in policies. By obtaining shareholder consent, companies ensure that they operate within legal boundaries while respecting the wishes of their shareholders.

Shareholder consent rights refer to the legal entitlements of shareholders to approve or disapprove decisions made by the company, often exercised through a shareholders consent form. These rights empower shareholders to influence corporate governance and major decisions. It's essential for shareholders to understand their consent rights to protect their interests.

A written consent shareholder proposal is a request put forth by shareholders that seeks approval for certain actions or initiatives via a shareholders consent form. This proposal outlines the specifics of the requested action, making it easier for all shareholders to understand and decide. It promotes transparency and engagement while ensuring that shareholder rights are respected.

A consent solicitation of shareholders is the process of seeking agreement from shareholders to approve a proposal through a written consent form. This typically involves distributing a shareholders consent form along with information about the proposal, allowing shareholders to vote without attending a meeting. It encourages participation and enables shareholders to voice their opinions efficiently.

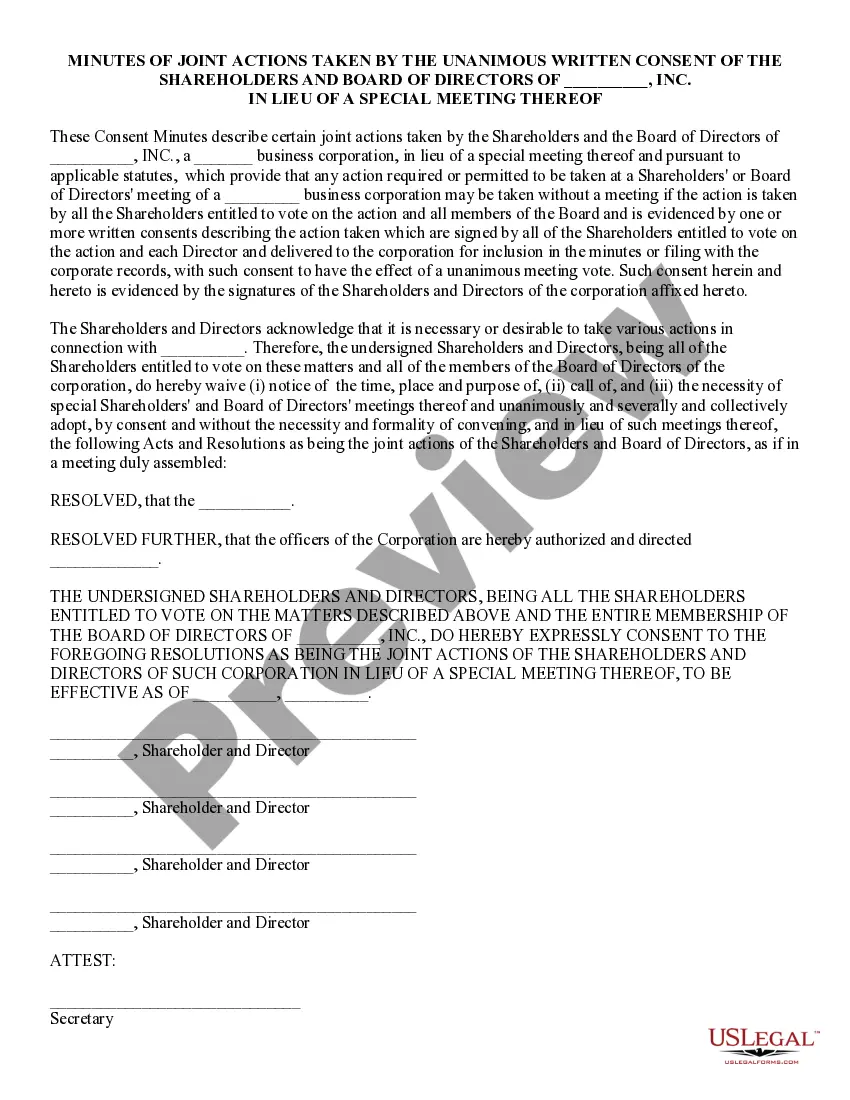

'Written consent' signifies a documented agreement among shareholders to approve specific actions or decisions. This consent is captured through a shareholders consent form, ensuring that all shareholders acknowledge and agree to the terms outlined. It provides a formal way to record shareholder decisions for legal and organizational purposes.

Act by written consent is a procedure that enables shareholders to agree on corporate matters without convening a physical meeting. By using a shareholders consent form, shareholders can express their agreement in writing, making the process faster and more convenient. This method ensures that all necessary approvals can be obtained in a timely manner.

A shareholder act by written consent refers to a formal agreement among shareholders to make specific decisions without holding a meeting. This process allows shareholders to sign a shareholders consent form, enabling decisions that typically require a vote to be made efficiently. It's an effective way to streamline decision-making while still complying with legal regulations.