Repair Rent Deduction Formula

Description

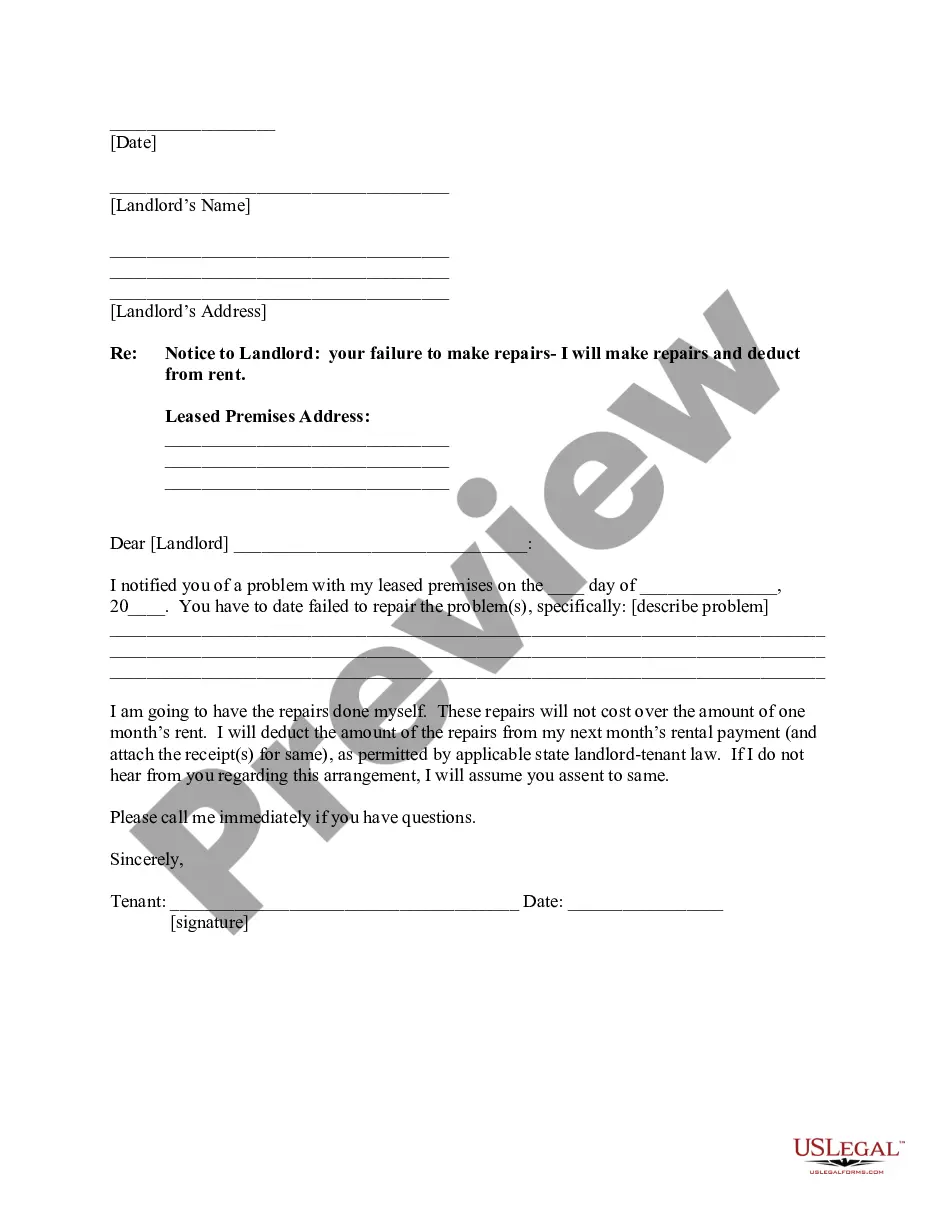

How to fill out Letter From Tenant To Landlord Containing Notice Of Use Of Repair And Deduct Remedy?

It's well-known that you cannot become a legal authority overnight, nor can you quickly master how to prepare the Repair Rent Deduction Formula without a specialized background.

Drafting legal documents is a lengthy process that demands particular education and expertise. So why not entrust the preparation of the Repair Rent Deduction Formula to the professionals.

With US Legal Forms, one of the most extensive legal template repositories, you can find everything from court documents to templates for internal communication.

You can regain access to your files from the My documents tab at any time. If you're an existing client, you can simply Log In and find and download the template from the same tab.

Regardless of the purpose of your documents—be it financial, legal, or personal—our website has you covered. Try US Legal Forms today!

- Find the document you need by utilizing the search bar at the top of the page.

- Preview it (if this feature is available) and review the accompanying description to determine if the Repair Rent Deduction Formula is what you're looking for.

- Begin your search again if you require another document.

- Create a free account and choose a subscription option to buy the document.

- Click Buy now. Once the payment is completed, you can download the Repair Rent Deduction Formula, fill it out, print it, and send or mail it to the designated parties or organizations.

Form popularity

FAQ

How to calculate HRA tax exemption in India The amount of HRA paid to you by your employer. The actual rent you pay for housing minus 10% of the basic pay. 50% of basic salary if you live in a metro city or 40% of basic salary if you live in a non-metro city.

How do I calculate the home office tax deduction? 12 hours x 5 days x 50 weeks = 3,000 hours per year. 3,000 hours ÷ 8,760 total hours in the year = 0.34 (34%) of available hours. 34% of available hours x 40% of the house used for business = 13.6% business write-off percentage.

Divide the square feet you use for your home workspace by the total number of square feet in your home to get a percentage. Multiply that number by the amount of your monthly rent to get the dollar amount you can write off from your taxes.

Routine maintenance and repairs normally aren't tax deductible and can't be included in the basis of your home. However, repairs and maintenance that are part of a larger home improvement project can be rolled into the adjusted basis for your home.

More In Credits & Deductions If you make qualified energy-efficient improvements to your home after Jan. 1, 2023, you may qualify for a tax credit up to $3,200. You can claim the credit for improvements made through 2032. For improvements installed in 2022 or earlier: Use previous versions of Form 5695.