Determination Letter For Volume Submitter Plan

Description

How to fill out Determination Letter For Volume Submitter Plan?

There’s no further necessity to squander time searching for legal documents to comply with your local state legislation. US Legal Forms has compiled all of them in one location and improved their accessibility.

Our website provides over 85k templates for any business and personal legal situations categorized by state and area of application. All forms are expertly drafted and verified for authenticity, so you can be confident in acquiring an updated Determination Letter For Volume Submitter Plan.

If you are acquainted with our service and already have an account, you must ensure your subscription is active before obtaining any templates. Log In to your account, select the document, and click Download. You can also return to all saved documents anytime needed by accessing the My documents tab in your profile.

Print your form to complete it manually or upload the sample if you prefer working with an online editor. Creating legal documentsunder federal and state laws is quick and easy with our platform. Try US Legal Forms today to keep your documentation organized!

- If you've never used our service before, the process will involve a few more steps to finalize.

- Here’s how new users can acquire the Determination Letter For Volume Submitter Plan in our catalog.

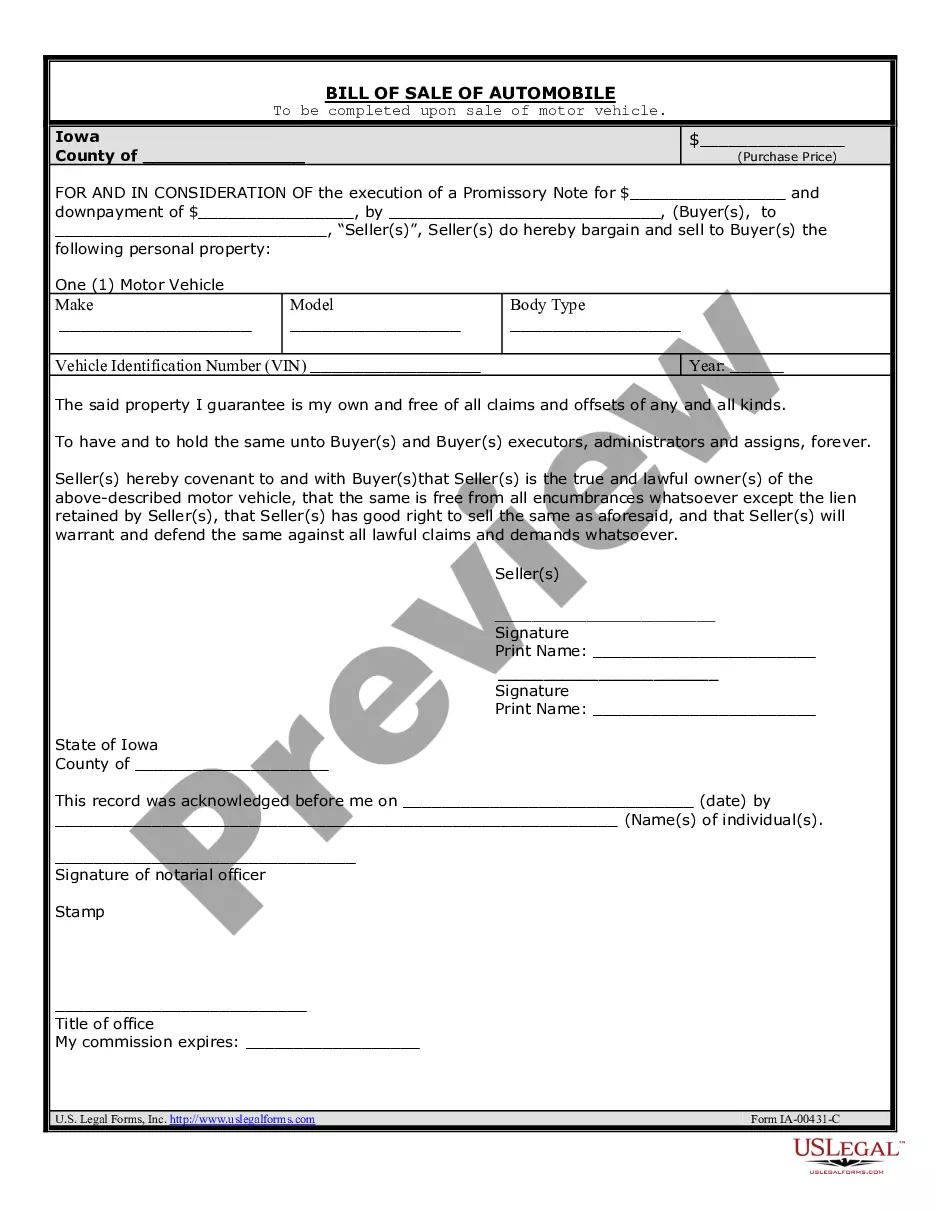

- Examine the page content thoroughly to confirm it features the sample you need.

- To do so, make use of the form description and preview options if available.

- Utilize the Search bar above to look for another template if the current one isn’t suitable for you.

- Click Buy Now beside the template name when you locate the appropriate one.

- Choose the desired subscription plan and register for an account or Log In.

- Process the payment for your subscription with a credit card or through PayPal to proceed.

- Choose the file format for your Determination Letter For Volume Submitter Plan and download it to your device.

Form popularity

FAQ

A letter of determination is essentially another term for a determination letter, specifically focusing on a decision made by the IRS regarding a plan's compliance. This document plays a critical role in confirming that your retirement plan follows the relevant tax laws. When you have a determination letter for volume submitter plan, it serves as official validation of your plan's tax-advantaged status, providing essential protection against future issues.

To obtain a determination letter, you need to prepare and submit an application to the IRS along with your plan documents. This process involves ensuring that your plan aligns with legal requirements and may require professional assistance. Using platforms like uslegalforms can simplify this process, as they provide resources and templates designed to help you secure a determination letter for volume submitter plan efficiently.

A determination letter can be issued when the IRS evaluates a retirement plan and confirms its compliance with the tax code. Generally, this can happen after the submission of a complete application along with the necessary plan documents. It's important to aim for a determination letter for volume submitter plan early in the planning process to address any compliance issues before implementation.

Determination letters are issued by the Internal Revenue Service (IRS), which is the federal agency responsible for administering tax laws. The IRS reviews plan documents to ensure they meet legal requirements before issuing a determination letter for volume submitter plan. This official approval provides assurance to plan sponsors that their retirement arrangements align with established tax rules.

A volume submitter plan document is a pre-approved retirement plan template designed for multiple employers to adopt. These documents are typically submitted to the IRS for review, which can lead to obtaining a determination letter for volume submitter plan. Using a volume submitter plan can streamline the process of securing compliance, saving time and resources for plan sponsors.

A plan determination letter is a specific type of written determination issued by the IRS that affirms the tax-qualified status of a retirement plan. This letter is crucial for plan sponsors who want to ensure that their plan design complies with the law. Receiving a determination letter for volume submitter plan means that the IRS has reviewed your plan documents and found them acceptable, adding confidence to your retirement offerings.

A determination letter signifies that the IRS has evaluated your retirement plan and confirmed its compliance with applicable tax laws. Specifically, receiving a determination letter for volume submitter plan means that your plan design adheres to legal standards, providing you with an essential safeguard against potential tax liabilities. It is a valuable tool for plan sponsors to demonstrate their commitment to regulatory compliance.

A written determination is an official finding made by the IRS concerning the tax consequences of a specific plan or transaction. This determination can be crucial for retirement plans to confirm their status under tax laws. When you receive a determination letter for volume submitter plan, it signifies that your plan design has been reviewed and approved, ensuring compliance with regulatory standards.

A written determination letter is an official document issued by the IRS that provides assurance regarding the tax-qualified status of a retirement plan. Specifically, a determination letter for volume submitter plan ensures that your plan meets all necessary legal requirements set forth under the tax code. This letter offers peace of mind, indicating that your plan design is compliant and can help you avoid potential legal issues.

Acquiring a letter of qualification or determination starts with ensuring your plan meets IRS guidelines. You'll need to gather your documentation and complete the required forms. Using US Legal Forms can greatly assist you, as they provide the right templates and expert advice. This way, you can confidently move forward and obtain your determination letter for volume submitter plans without unnecessary delays.