A mortgage commitment letter is a formal document issued by a lender to a borrower, indicating their commitment to provide a loan for a specific property. This letter serves as proof that the borrower has been approved for a mortgage loan and can help ensure a smoother and more transparent home buying process. Here is a detailed description of mortgage commitment letters, including essential components and types: 1. Purpose of a Mortgage Commitment Letter: A mortgage commitment letter is a crucial step towards finalizing a real estate transaction. It provides detailed information about the loan terms, conditions, and amount approved by the lender. This letter assures the borrower and the seller that the financing for the property is secure. 2. Contents of a Mortgage Commitment Letter: — Loan Details: The letter specifies the loan amount, interest rate, and type of mortgage being offered. It may also include details regarding the down payment requirements, loan term, and any applicable points or fees. — Specific Property Information: The commitment letter typically mentions the property's address, legal description, and purchase price. It may also state any conditions or requirements related to the property, such as appraisals or inspections. — Borrower Information: The letter includes the borrower's name, contact information, and credit score. It may also outline any additional documentation required from the borrower, such as income verification or bank statements. — Expiration Date: A commitment letter has a time limit, commonly 30 to 90 days, within which the borrower must close the loan. If the loan is not closed by the specified date, the commitment may expire, and the borrower may need to reapply for financing. 3. Different Types of Mortgage Commitment Letters: — Conditional Mortgage Commitment: This type of commitment letter includes conditions that must be met before the loan can be finalized. Conditions may involve the satisfactory completion of home inspections, addressing any property title issues, or clarifying any outstanding debt. — Unconditional Mortgage Commitment: Also known as a firm commitment, this type of letter signifies that all the required conditions have been met and the loan is guaranteed. It indicates that the lender is fully committed to providing the loan and that the borrower can proceed with confidence to close the transaction. In summary, a mortgage commitment letter is a formal agreement between a lender and a borrower, outlining the terms and conditions of a mortgage loan. It establishes the lender's commitment to funding the loan and provides vital information to aid in completing the home purchase. Conditional and unconditional commitment letters are the two main types, each serving distinct purposes in the loan approval process.

Mortgage Commitment Letter Sample With Loan

Description

How to fill out Mortgage Commitment Letter Sample With Loan?

Securing legal templates that comply with federal and state regulations is essential, and the internet provides numerous selections to choose from.

But what’s the advantage in squandering time searching for the appropriate Mortgage Commitment Letter Sample With Loan online if the US Legal Forms digital library already has such templates gathered in one location.

US Legal Forms is the largest online legal repository with over 85,000 customizable templates created by attorneys for any business and personal situation. They are user-friendly, with all documents organized by state and intended use. Our experts keep track of legislative updates, so you can always trust your documents are current and compliant when acquiring a Mortgage Commitment Letter Sample With Loan from our site.

All templates you find through US Legal Forms are reusable. To re-download and fill out previously acquired forms, access the My documents tab in your account. Experience the most comprehensive and user-friendly legal documentation service!

- Obtaining a Mortgage Commitment Letter Sample With Loan is straightforward and fast for both existing and new users.

- If you already have an account with an active subscription, Log In and save the document sample you need in the appropriate format.

- If you are new to our platform, follow the steps outlined below.

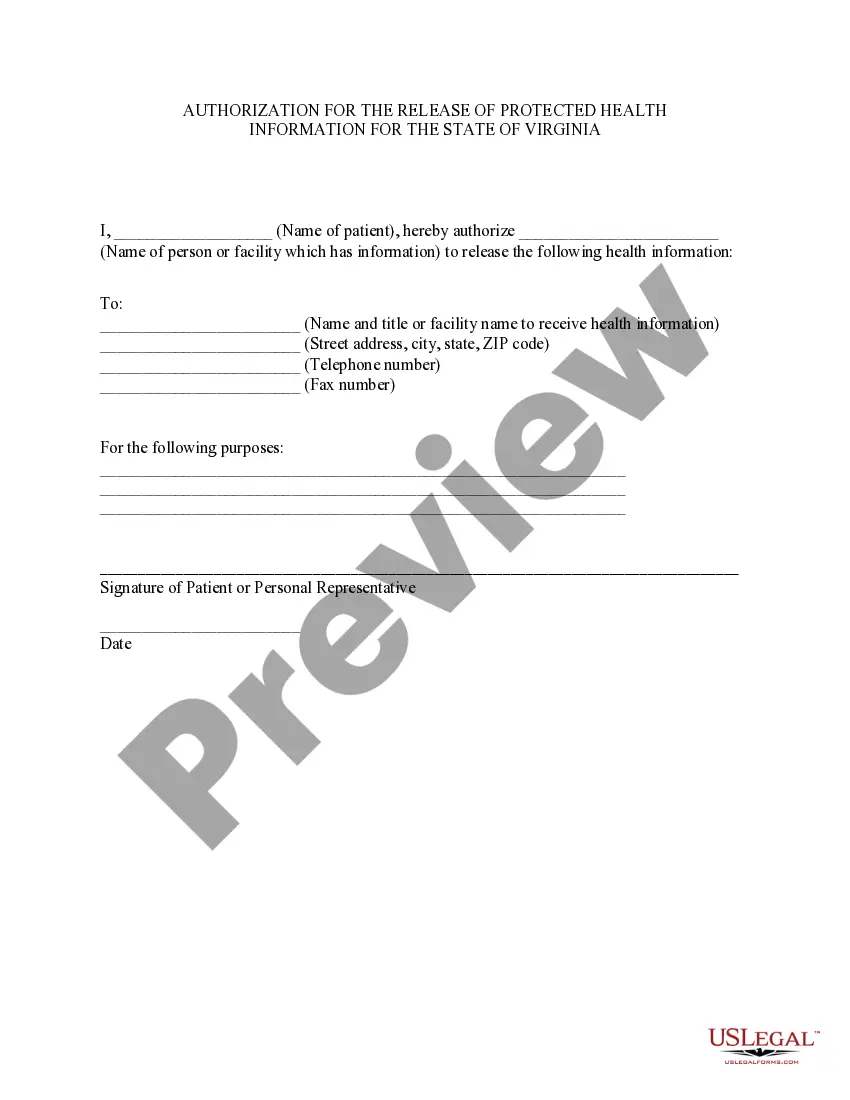

- Review the template using the Preview feature or through the text description to confirm it meets your requirements.

- If necessary, search for another sample using the search function at the page's top.

- Press Buy Now once you have found the correct form and select a subscription plan.

- Create an account or Log In and complete the payment via PayPal or a credit card.

- Select the correct format for your Mortgage Commitment Letter Sample With Loan and download it.

Form popularity

FAQ

Character affidavits should be one page in most cases. Personal or client affidavits will run longer, 2 to 4 pages or more depending on the facts of the case.

The affidavit must be paragraphed and numbered. The person making the affidavit (the deponent) must sign the bottom of each page in the presence of an authorized person, such as a lawyer.

(2) Every affidavit shall be typed in Arial 12 fonts on one side of A4 size (210 x 297 mm or 8.27" x 11.69") white bond paper in double space with 2" margin on the left and 1" margin on all other sides. (3) Every affidavit shall dearly state the cause or matter in which it is sworn.

An affidavit to be valid has to be executed on Stamp paper or duly stamped otherwise and has to be notarised by a Notary public or commissioner of oaths. The affidavit is required to be executed on the stamp paper and has to be notarised by a Notary public in India.

The pages of the affidavit must be sequenced numerically, i.e., page 1, page 2, page 3. Do not include annexures in this sequence. the pages of each individual annexure must be numbered numerically with the first page of each annexure being page 1.