Writ Possession State Withholding

Description

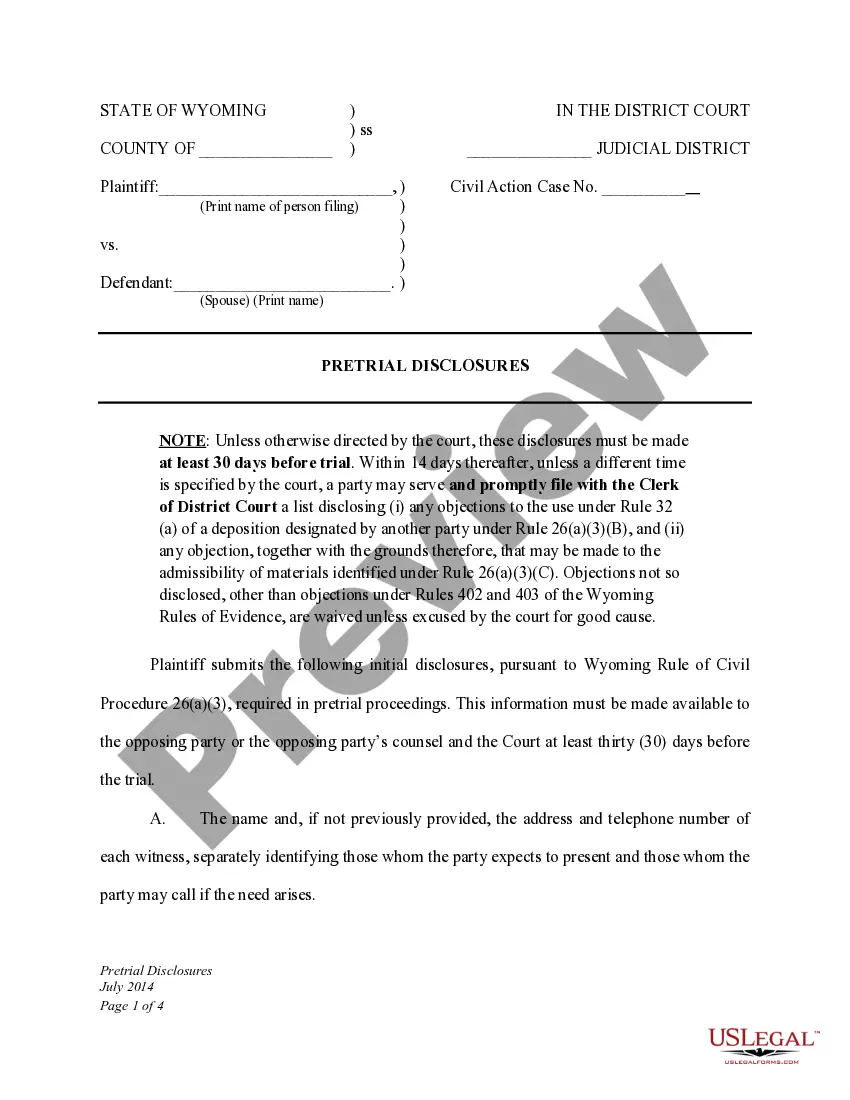

How to fill out Sample Letter For Final Judgment - Writ Of Possession?

The Writ Possession State Withholding you see on this page is a multi-usable formal template drafted by professional lawyers in accordance with federal and local regulations. For more than 25 years, US Legal Forms has provided people, companies, and attorneys with more than 85,000 verified, state-specific forms for any business and personal situation. It’s the fastest, easiest and most reliable way to obtain the documents you need, as the service guarantees bank-level data security and anti-malware protection.

Obtaining this Writ Possession State Withholding will take you just a few simple steps:

- Look for the document you need and review it. Look through the sample you searched and preview it or review the form description to verify it satisfies your needs. If it does not, use the search bar to get the right one. Click Buy Now when you have located the template you need.

- Subscribe and log in. Select the pricing plan that suits you and register for an account. Use PayPal or a credit card to make a quick payment. If you already have an account, log in and check your subscription to proceed.

- Obtain the fillable template. Choose the format you want for your Writ Possession State Withholding (PDF, Word, RTF) and download the sample on your device.

- Complete and sign the paperwork. Print out the template to complete it by hand. Alternatively, use an online multi-functional PDF editor to rapidly and accurately fill out and sign your form with a valid.

- Download your papers one more time. Make use of the same document once again whenever needed. Open the My Forms tab in your profile to redownload any previously saved forms.

Sign up for US Legal Forms to have verified legal templates for all of life’s circumstances at your disposal.

Form popularity

FAQ

The Writ of Possession gives the tenant at least 7 days to vacate the property.

To acquire a Texas writ of possession that will lawfully enable you to reclaim your property after your evicted tenant's grace period is over, you must go to the county clerk's office and pay a fee to have the writ issued.

A writ of possession is issued to evict an occupant from the property. The dispossessory complaint is filed under oath by the owner (landlord), testifying to the unlawful possession of the owners property by a tenant. The relationship between the parties must be Landlord and Tenant.

"Executing a writ of possession" is when a tenant and all their belongings and property are removed from the rental unit. A writ of possession cannot be issued more than 60 days after the judgment is signed, but a court can allow 90 days for good cause.

Move out process The sheriff/constable posts the Writ of Possession on the property. This informs the tenant that they have 24 hours to vacate the premises with their belongings. Once the 24 hours are up, the sheriff/constable is allowed to remove the tenant by force. If the tenant refuses, they will be arrested.