Real Estate Llc Operating Agreement Template

Description

How to fill out LLC Operating Agreement For Rental Property?

Creating legal documents from the beginning can occasionally feel daunting.

Certain situations may entail extensive investigation and significant financial expenditure.

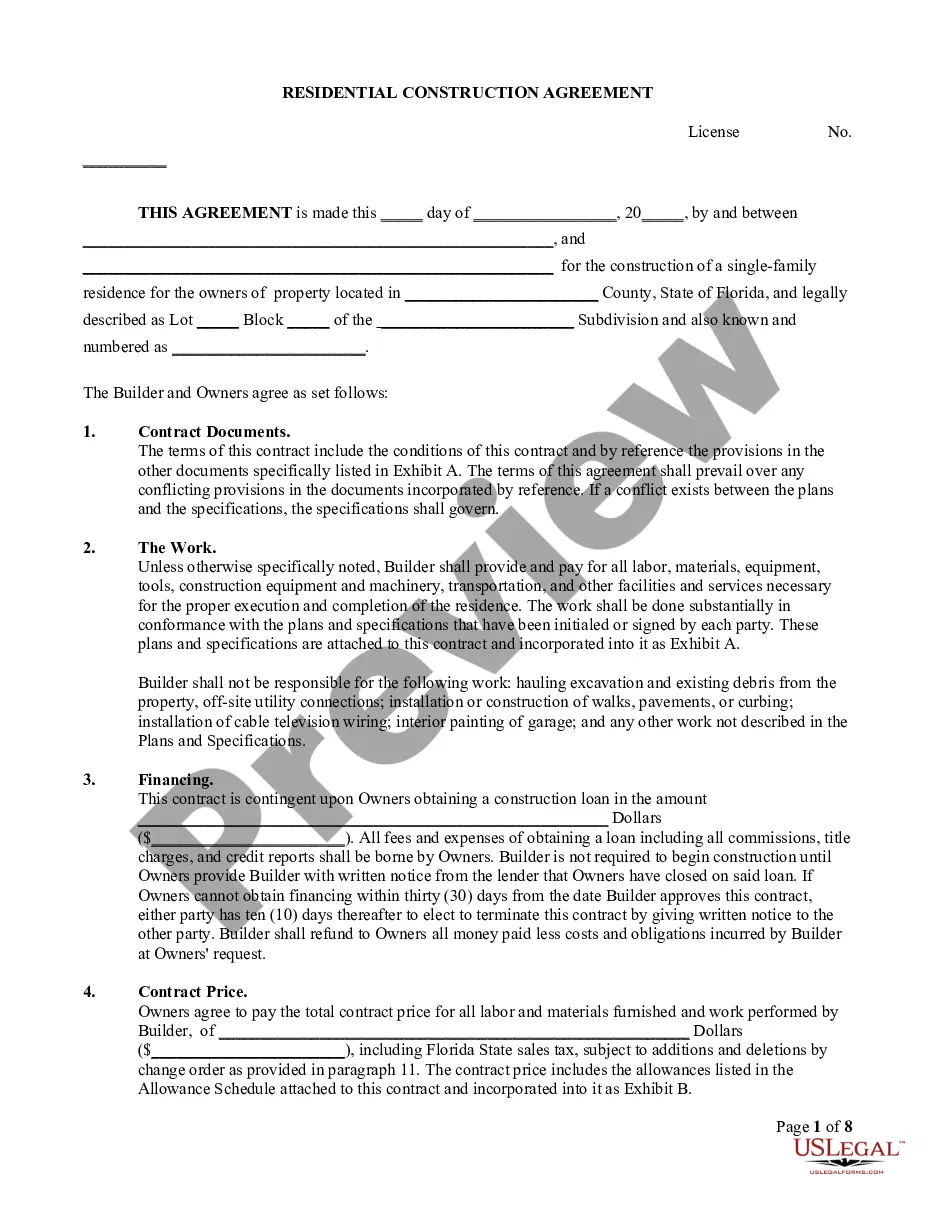

If you’re seeking a more direct and cost-effective method of drafting a Real Estate LLC Operating Agreement Template or other documents without unnecessary complications, US Legal Forms is readily available.

Our digital repository of over 85,000 current legal documents encompasses nearly every aspect of your financial, legal, and personal matters. With only a few clicks, you can swiftly obtain templates that are specific to your state and county, carefully crafted for you by our legal experts.

Examine the form preview and descriptions to ensure you’ve located the document you seek. Verify that the form you choose meets the stipulations of your state and county. Select the most appropriate subscription plan to obtain the Real Estate LLC Operating Agreement Template. Download the document, and then fill it out, verify it, and print.

- Utilize our website whenever you require a dependable and trustworthy service to swiftly find and download the Real Estate LLC Operating Agreement Template.

- If you are already familiar with our site and have created an account, simply Log In, choose the template, and download it, or retrieve it again any time from the My documents section.

- Not yet an account holder? No issue. It requires minimal time to sign up and peruse the document library.

- However, before diving into downloading the Real Estate LLC Operating Agreement Template, adhere to these recommendations.

Form popularity

FAQ

Forfeit or forfeiture means losing a right, privilege, or property without compensation as a consequence of violating the law, breaching a legal obligation, failing to perform a contractual obligation or condition, or neglecting a legal duty.

The Comptroller is required by law to forfeit a company's right to transact business in Texas if the company has not filed a franchise tax report or paid a franchise tax required under Chapter 171.

To revive or reinstate your Maryland LLC, you'll need to submit the following to Maryland's State Department of Assessments and Taxation, Charter Division: a completed Maryland Articles or Certificate of Reinstatement form. a tax clearance certificate issued by the city or county where your LLC owns property (if needed)

A business entity is typically suspended, or forfeited, by Franchise Tax Board (FTB) for failure to meet its tax requirements, such as; File a state tax return. Pay. Taxes. Penalties.

Corporations in Maryland must file personal property reports with the proper authorities before approval of dissolution can be given. If your business has been forfeited, you must file for reinstatement and submit the personal property reports before your company can be dissolved by Maryland's SDAT.

You can submit your revival documents to the SDAT by mail or in person. If you mail your revival documents to SDAT, include a check for fees. You can file your reinstatement documents in person for same day processing if you are in line at the Maryland SDAT counter by pm.

To amend your Maryland corporations charter, just file Articles of Amendment by mail or in person with the Maryland State Department of Assessments and Taxation (SDAT).

A business entity is typically suspended, or forfeited, by Franchise Tax Board (FTB) for failure to meet its tax requirements, such as; File a state tax return. Pay. Taxes. Penalties.