Operating Agreement Template With Different Classes Of Units

Description

How to fill out Sample Limited Liability Company LLC Operating Agreement With Company Assets Divided Into Ownership Shares?

When you are required to present an Operating Agreement Template With Various Classes Of Units following your local state's regulations and laws, there may be numerous options available. You don’t have to inspect each form to ensure it satisfies all the legal requirements if you are a US Legal Forms member.

It is a reliable resource that can assist you in obtaining a reusable and current template on any topic.

US Legal Forms boasts the largest online repository with a collection of over 85k ready-to-use documents for both business and personal legal needs. All templates are guaranteed to adhere to each state's regulations.

Complete the subscription payment (methods include PayPal and credit card). Download the document in your preferred file format (PDF or DOCX). Print the form or fill it out electronically using an online editor. Obtaining professionally drafted legal documents is easy with US Legal Forms. Additionally, Premium members can also take advantage of the strong integrated solutions for online document editing and signing. Give it a try today!

- Consequently, when downloading the Operating Agreement Template With Various Classes Of Units from our site, you can be assured that you possess a valid and current document.

- Acquiring the required sample from our platform is remarkably simple.

- If you already have an account, just Log In to the system, confirm your subscription is active, and save the selected file.

- In the future, you can visit the My documents section in your profile to access the Operating Agreement Template With Various Classes Of Units anytime.

- If it’s your first time using our library, please follow the instructions below.

- Browse the recommended page and verify it aligns with your requirements.

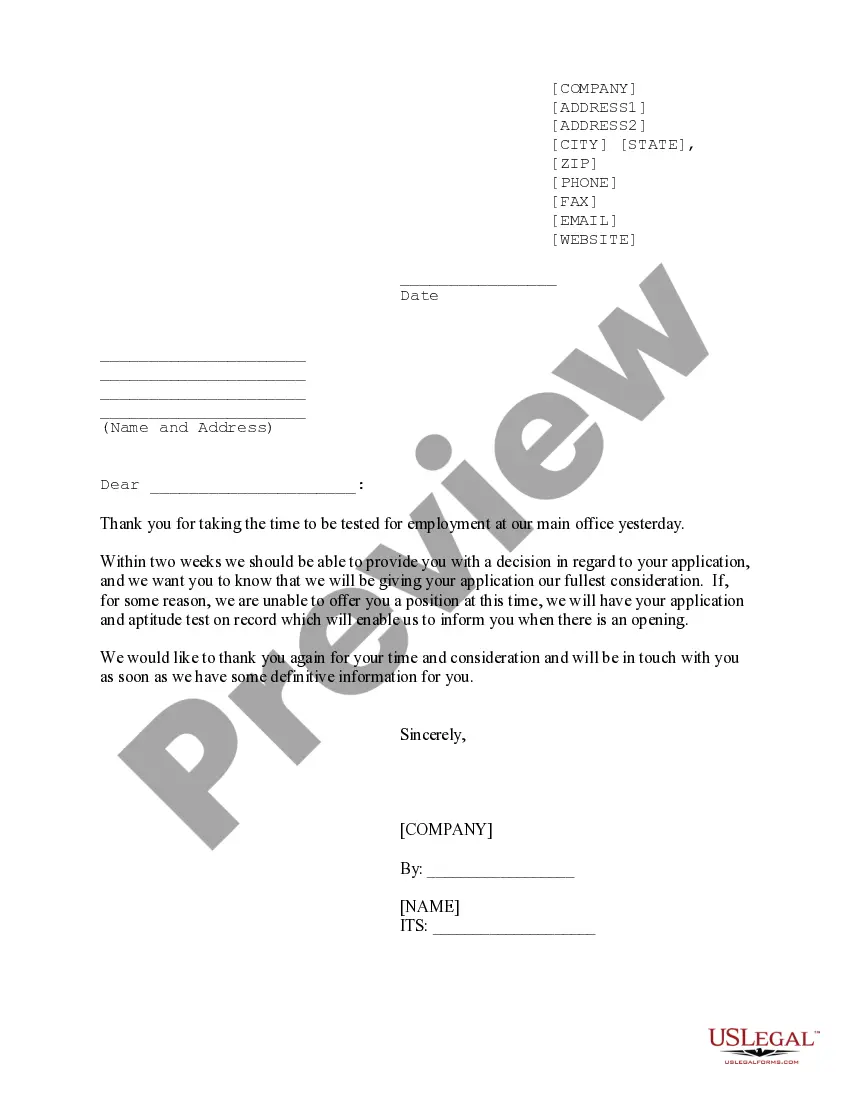

- Utilize the Preview mode and view the form description, if available.

- Search for another template using the Search bar located in the header if needed.

- Click Buy Now once you identify the right Operating Agreement Template With Various Classes Of Units.

- Select the most appropriate pricing plan, Log In to your account, or create a new one.

Form popularity

FAQ

LLCs do not have stock, but ownership units that the Operating Agreement usually calls membership units. An LLC can have more than one class of members. Different classes may have different rights.

LLC units represent ownership interests in an LLC. LLC members do not have shares of stock, but rather receive Units/Interests that collectively equal 100% ownership in the LLC. Units may be in different classes, such as voting and non-voting.

LLC membership units refer to a form of membership interests issued to a person or entity that made a capital contribution to a limited liability company (LLC). These units represent the party's ownership stake in the company.

It is possible to have multiple classes of equity in an LLC. In a real estate LLC, for example, you may have an actively managing member and other passive participants. The managing member may have more voting rights than the passive members.

How to Write an Operating Agreement Step by StepStep One: Determine Ownership Percentages.Step Two: Designate Rights, Responsibilities, and Compensation Details.Step Three: Define Terms of Joining or Leaving the LLC.Step Four: Create Dissolution Terms.Step Five: Insert a Severability Clause.