Waiving Inheritance With Intent To Distribute

Description

How to fill out Agreement Waiving Right Of Inheritance Between Husband And Wife In Favor Of Children By Prior Marriages?

Creating legal documents from the ground up can occasionally be overwhelming.

Certain situations may require extensive research and substantial financial investment.

If you’re looking for a simpler and more budget-friendly method of generating Waiving Inheritance With Intent To Distribute or any other documents without unnecessary complications, US Legal Forms is always available to you.

Our digital library of over 85,000 current legal forms covers nearly every aspect of your financial, legal, and personal affairs. With merely a few clicks, you can promptly access state- and county-compliant templates carefully assembled for you by our legal experts.

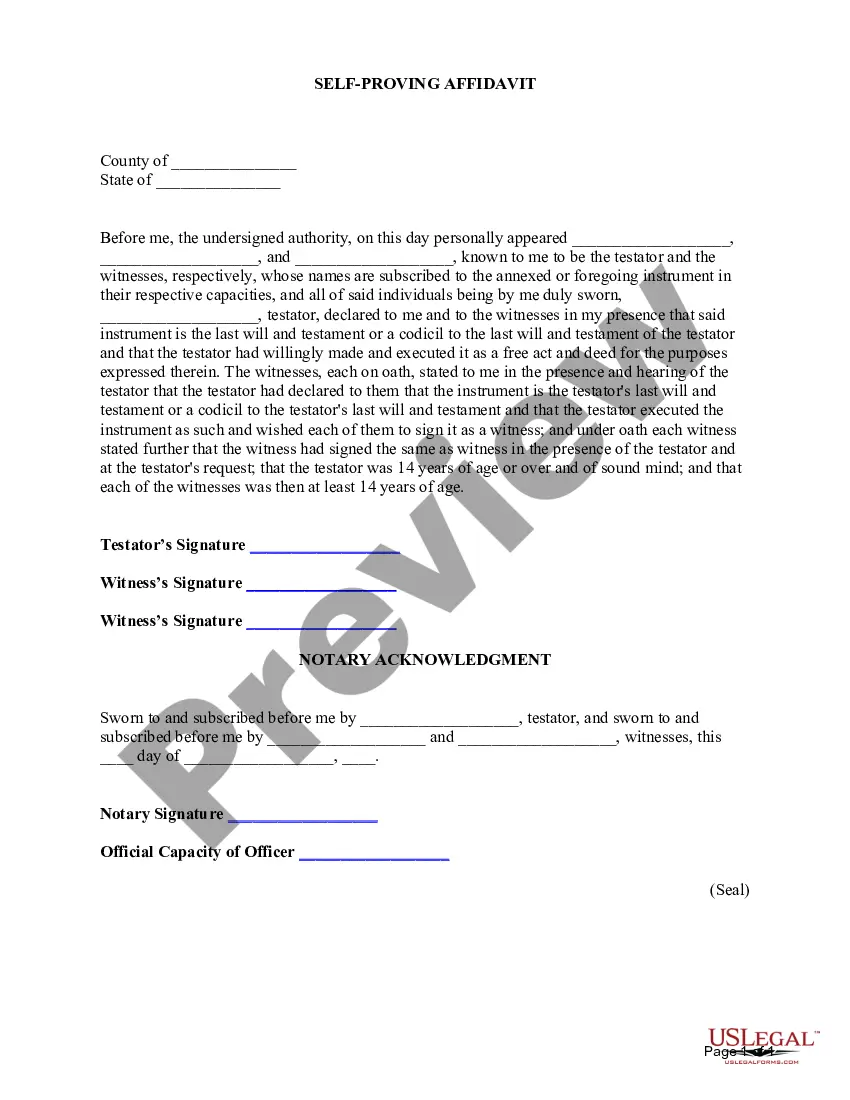

Review the form preview and descriptions to ensure you are accessing the document you need. Verify that the template you select adheres to the regulations and laws of your state and county. Choose the most suitable subscription plan to acquire the Waiving Inheritance With Intent To Distribute. Download the form, then complete, sign, and print it out. US Legal Forms enjoys a solid reputation and over 25 years of experience. Join us now and make form completion simple and efficient!

- Utilize our site whenever you need a dependable and trustworthy service through which you can swiftly find and download the Waiving Inheritance With Intent To Distribute.

- If you’re familiar with our site and have previously registered an account with us, simply Log In to your account, select the form, and download it or re-download it at any time through the My documents section.

- Don't have an account? No worries. It takes just a few minutes to sign up and explore the library.

- Before proceeding to download Waiving Inheritance With Intent To Distribute, remember to follow these guidelines.

Form popularity

FAQ

If you refuse to accept an inheritance, you will not be responsible for inheritance taxes, but you'll have no say in who receives the assets in your place.

If a beneficiary has expressed to the trustee that they wish to refuse their distribution from the trust, the trustee should have them sign a disclaimer.

You make your disclaimer in writing. Your inheritance disclaimer specifically says that you refuse to accept the assets in question and that this refusal is irrevocable, meaning it can't be changed. You disclaim the assets within nine months of the death of the person you inherited them from.

DISCLAIMER OF INHERITANCE RIGHTS I have been fully advised of my rights to certain property of the Estate of __________________ and waive and disclaim my right to same voluntarily and without duress or undue influence. This disclaimer applies to all real and personal property I would have received.

The disclaimer must be in writing: A signed letter by the person doing the disclaiming, identifying the decedent, describing the asset to be disclaimed, and the extent and amount, percentage or dollar amount, to be disclaimed, must be delivered to the person in control of the estate or asset, such as an executor, ...