Who Can Contribute To A Special Needs Trust

Description

How to fill out Special Needs Irrevocable Trust Agreement For Benefit Of Disabled Child Of Trustor?

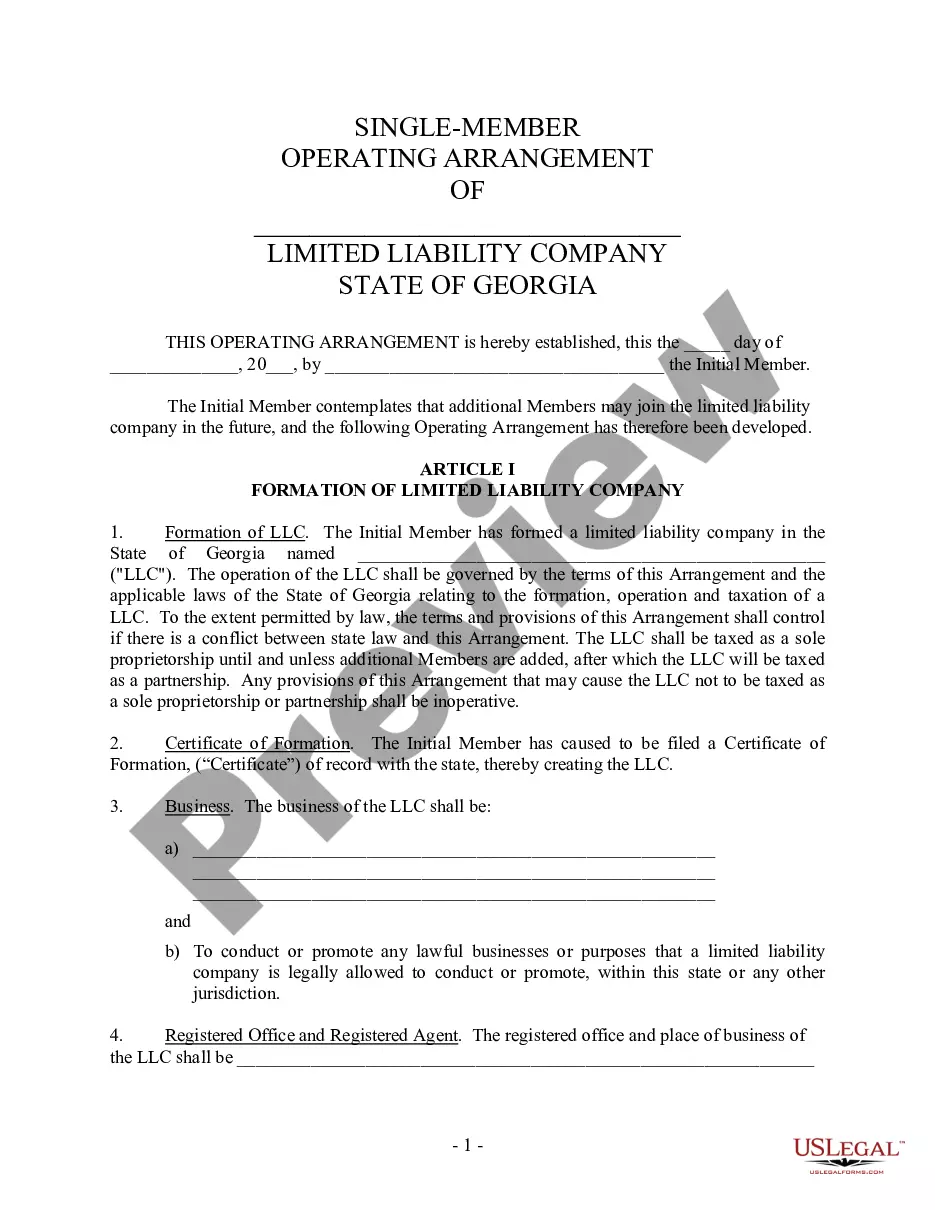

- Log in to your US Legal Forms account to access your documents. Ensure your subscription is active.

- Preview the available forms and check descriptions to verify they meet your specific legal needs.

- Search for additional templates if necessary and select the document that complies with local laws.

- Click the 'Buy Now' button to choose your subscription plan, but remember to register an account for full access.

- Complete your purchase by entering your credit card details or using your PayPal account.

- Download the necessary form to your device and locate it in the 'My Forms' section of your account for future reference.

By utilizing US Legal Forms, you can streamline the process of obtaining legal documents, benefiting from an extensive library of over 85,000 forms. This empowers both individuals and professionals to create legally binding documents efficiently.

Take control of your legal needs today and explore the vast resources at US Legal Forms. Start your journey towards secure legal documentation!

Form popularity

FAQ

The beneficial owner of a special needs trust is typically the individual with a disability who the trust is designed to assist. The trust provides financial support while protecting the owner’s eligibility for government benefits. Establishing the beneficial owner clearly in legal documents helps maintain transparency and accountability. Utilizing platforms like US Legal Forms can simplify this process and ensure accuracy.

An eligible designated beneficiary of a trust is a person or entity that can receive benefits from the trust. This could be family members, charities, or specific individuals identified in the trust agreement. Clearly identifying eligible designated beneficiaries ensures that the trust operates smoothly and fulfills its purpose. Consulting with legal professionals can help clarify this process.

Yes, other individuals can contribute to a trust. Family, friends, and even organizations can make contributions that enhance the trust’s assets. However, it’s crucial to have clear guidelines on contributions to avoid complications down the road. A well-structured trust helps in efficiently managing contributions while sustaining the intended support for beneficiaries.

An eligible designated beneficiary for a special needs trust is a person with a qualifying disability. This ensures that they can receive benefits through the trust without losing access to essential government programs. It's important to accurately document this eligibility in your trust paperwork. Properly designating beneficiaries protects their financial future and access to needed support.

An eligible designated beneficiary (EDB) can be an individual who benefits from a retirement account after the original owner's death. This includes disabled individuals, individuals under age 18, or beneficiaries who are not more than ten years younger than the deceased owner. Understanding the definition of EDB helps you make informed decisions regarding estate planning. It’s best to clarify this with legal professionals to ensure compliance.

The eligible designated beneficiary of a special needs trust is typically an individual with a disability who requires special assistance. These beneficiaries benefit from payments without losing access to government benefits. It's crucial to clearly identify the beneficiary in the trust document to avoid confusion. This ensures that their needs are met while protecting their financial support.

Deciding whether your parents should put their assets in a trust depends on their financial goals and personal circumstances. If they want to protect their assets or ensure their distributions are managed according to their wishes, a trust might be beneficial. However, it's crucial to consider who can contribute to a special needs trust and whether such an arrangement aligns with their objectives. Consulting with a legal expert can provide clarity.

A disadvantage of a family trust is that it may create tension among family members, especially if there is disagreement on how the trust should be managed. Furthermore, family trusts can complicate estate planning if their terms are not clear or transparent. Misunderstandings around contributions, such as who can contribute to a special needs trust, can exacerbate these tensions. Communication is essential for a successful family trust.

One significant downfall of having a trust is the complexity and upkeep required to manage it effectively. Trusts can involve intricate legal and tax implications that may overwhelm some individuals. Additionally, if the trust is not properly funded or managed, it can be rendered ineffective, failing to provide the intended benefits. It's vital to consider these factors carefully.

The best trustee for a special needs trust is someone who is trustworthy, knowledgeable, and understands the specific needs of the beneficiary. A family member or close friend who can handle the responsibility is often a good choice. Alternatively, a professional trustee may be suitable, especially if they have experience managing special needs trusts. Ultimately, the key is to ensure the trustee is committed to maintaining the trust's integrity.