Special Needs Trustor Order With Us

Description

How to fill out Special Needs Irrevocable Trust Agreement For Benefit Of Disabled Child Of Trustor?

- Log in to your US Legal Forms account by clicking here. Ensure your subscription is current; if not, renew according to your payment plan.

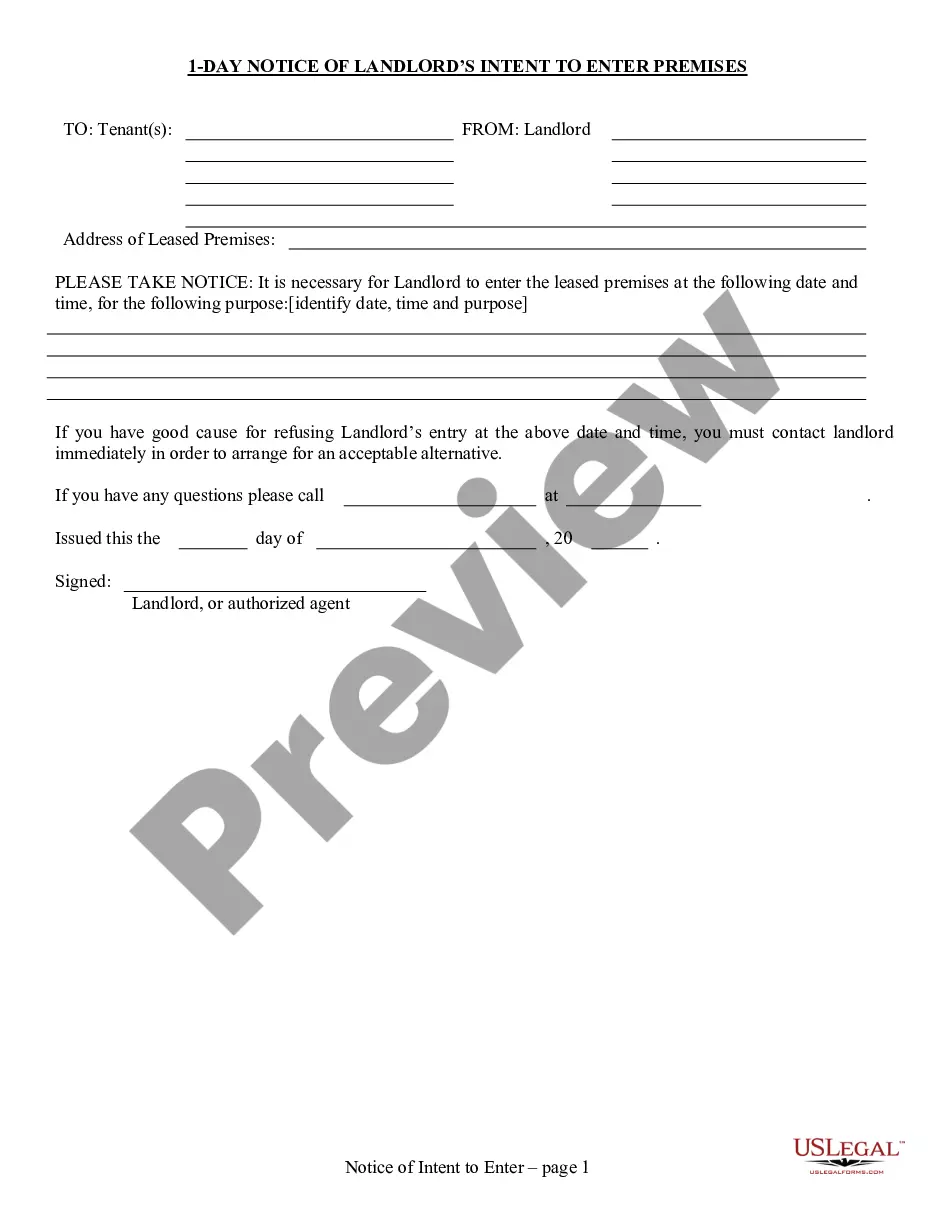

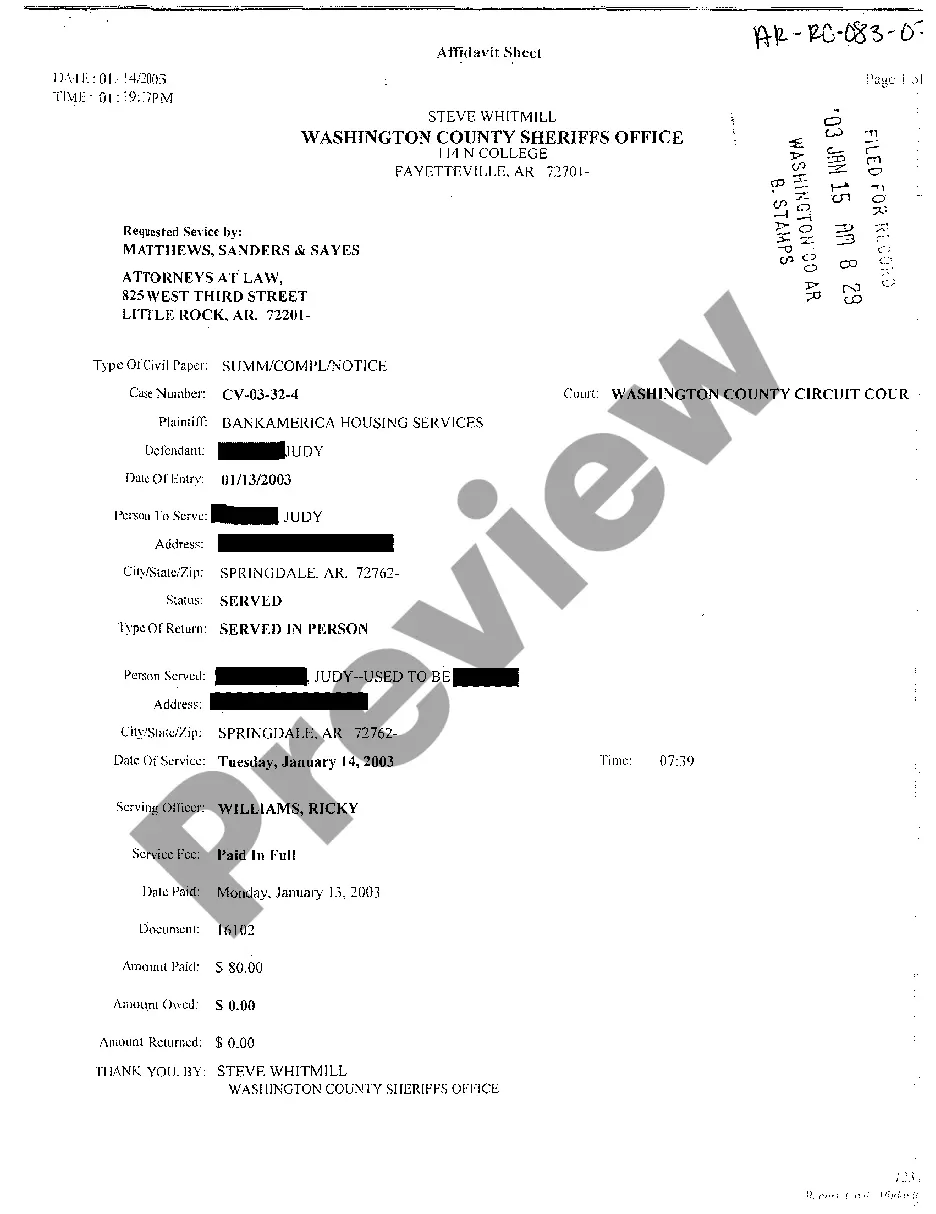

- Review the form description in Preview mode to confirm it's the correct template for your local jurisdiction requirements.

- If the selected form doesn't meet your needs, use the Search tab to find the appropriate template.

- Once you identify the correct document, click the Buy Now button and select your preferred subscription plan.

- Complete your purchase by entering your credit card details or using your PayPal account.

- Download the document and save it to your device. You can also revisit it anytime from the My Forms section.

US Legal Forms empowers individuals and attorneys to quickly execute legal documents with a comprehensive library offering over 85,000 fillable forms.

Take charge of your legal documentation with us today! Start your special needs trustor order by visiting US Legal Forms.

Form popularity

FAQ

A qualified disability trust is defined by specific criteria outlined by the IRS. Primarily, it must be established for the benefit of a disabled individual who is under the age of 65. The trust must also be set up with provisions that support the beneficiary, including maintaining access to government benefits. By utilizing our resources and expertise, you can secure a special needs trustor order with us and ensure your trust qualifies appropriately.

To qualify for a special needs trust, an individual must have a disability that significantly impacts their daily life. The trust typically benefits those who are receiving government assistance, such as Supplemental Security Income (SSI) or Medicaid. It is crucial to establish a special needs trustor order with us to ensure your loved one can access funds without losing their benefits. Working with our platform can help you navigate the qualifications and create a trust that meets legal requirements.

The best trust for a special needs child often depends on individual needs and financial circumstances. A special needs trust can help maintain eligibility for public benefits while providing additional financial support. It's crucial to work with a knowledgeable team that understands state laws and personal situations. Starting a special needs trustor order with us ensures you create a tailored solution that best fits your child's future.

Yes, reporting a special needs trust to Medicaid is essential. Medicaid requires that you disclose the existence of this trust as it can affect eligibility for benefits. By communicating openly with the appropriate agencies and properly reporting the trust, you can protect your loved one’s eligibility for vital support services. When you start a special needs trustor order with us, we can assist you in navigating this reporting process effectively.

The minimum amount needed to set up a special needs trust may vary based on the type of trust and your specific situation. Generally, some experts suggest starting with at least $10,000 to make it worthwhile considering maintenance costs and legal fees. It’s important to evaluate your unique needs and choose the right approach to safeguard your loved one's benefits. You can learn more about how to initiate a special needs trustor order with us, ensuring you make a solid investment.

A special needs trust may come with some disadvantages. One key aspect to consider is the legal and administrative costs associated with setting it up and maintaining it. There can also be restrictions on the type of benefits your loved one can receive, and managing the trust may require ongoing paperwork and compliance with regulations. However, by navigating these complexities, you can ensure a secure future for your loved one by starting a special needs trustor order with us.

The three main types of special needs trusts include first-party, third-party, and pooled trusts. First-party trusts hold assets belonging to the beneficiary, while third-party trusts are funded by someone other than the beneficiary. Pooled trusts combine resources from multiple beneficiaries for management purposes. Establish your special needs trustor order with us to determine which type best suits your needs.

After the death of a beneficiary, the special needs trust usually must be settled according to its terms. Assets may be directed to specific individuals or returned to the state, depending on Medicaid laws. It is essential to understand these stipulations to manage funds effectively. Using our platform to set up your special needs trustor order with us can help clarify these processes.

If you are on disability and turn 65, your benefits may shift. Typically, instead of receiving disability payments, you will start receiving retirement benefits. This change can impact your special needs trust, potentially altering how funds can be used. To navigate this transition smoothly, consider managing your special needs trustor order with us for expert guidance.

When a beneficiary of a special needs trust turns 65, it can lead to changes in their benefits eligibility. Generally, they may transition from receiving Social Security Disability Insurance to retirement benefits. This transition can affect the funding and use of the trust. It’s wise to consult our resources to ensure your special needs trustor order with us aligns with these laws.