Special Needs Trust Supplemental With Ira

Description

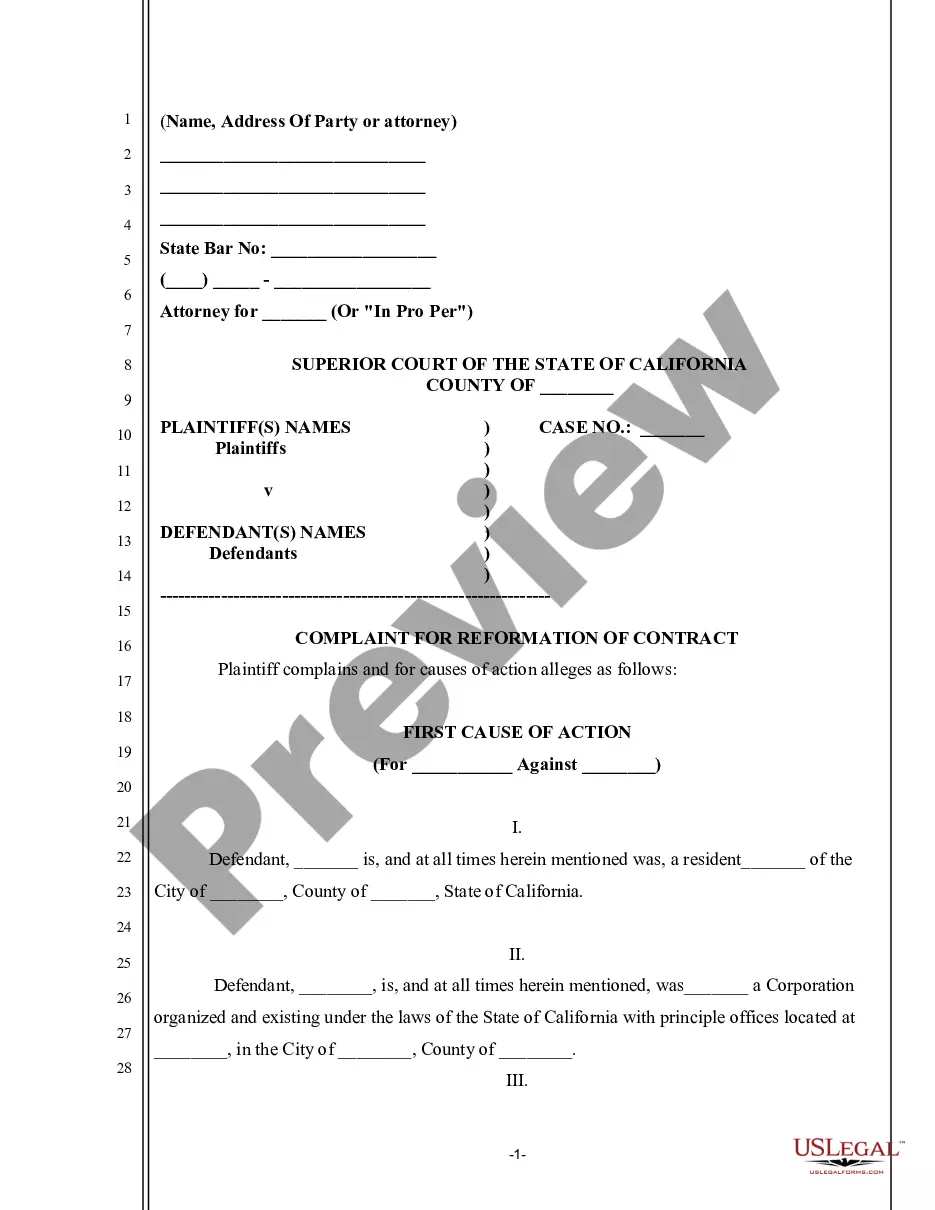

How to fill out Special Needs Irrevocable Trust Agreement For Benefit Of Disabled Child Of Trustor?

Managing legal documents can be daunting, even for seasoned experts.

If you are interested in a Special Needs Trust Supplemental With Ira and lack the time to find the correct and updated version, the process can be challenging.

US Legal Forms addresses all your needs, from personal to business documentation, all in one location.

Utilize cutting-edge tools to complete and manage your Special Needs Trust Supplemental With Ira.

Here are the steps to follow after obtaining the form you require: Confirm this is the appropriate document by previewing it and reviewing its description. Ensure that the template is valid in your state or county. Select Buy Now when you are ready. Choose a monthly subscription option. Locate the format you need, and Download, fill out, eSign, print, and submit your documents. Take advantage of the US Legal Forms online catalog, backed by 25 years of expertise and trustworthiness. Transform your everyday paperwork management into a seamless and user-friendly process today.

- Gain access to a repository of articles, guides, and materials highly pertinent to your circumstances and requirements.

- Save time and energy in locating the necessary paperwork, utilizing US Legal Forms’ sophisticated search and Review feature to find and acquire Special Needs Trust Supplemental With Ira.

- If you hold a membership, Log In to your US Legal Forms account, search for the form, and retrieve it.

- Check the My documents tab to review the documents you have previously downloaded and manage your folders as needed.

- If this is your first experience with US Legal Forms, create a free account and gain unrestricted access to all the platform's advantages.

- A comprehensive online form catalog could be a revolutionary solution for anyone wishing to handle these matters efficiently.

- US Legal Forms stands as a frontrunner in the online legal form sector, offering over 85,000 state-specific legal documents at any moment.

- With US Legal Forms, you can access legal and organizational forms specific to your state or county.

Form popularity

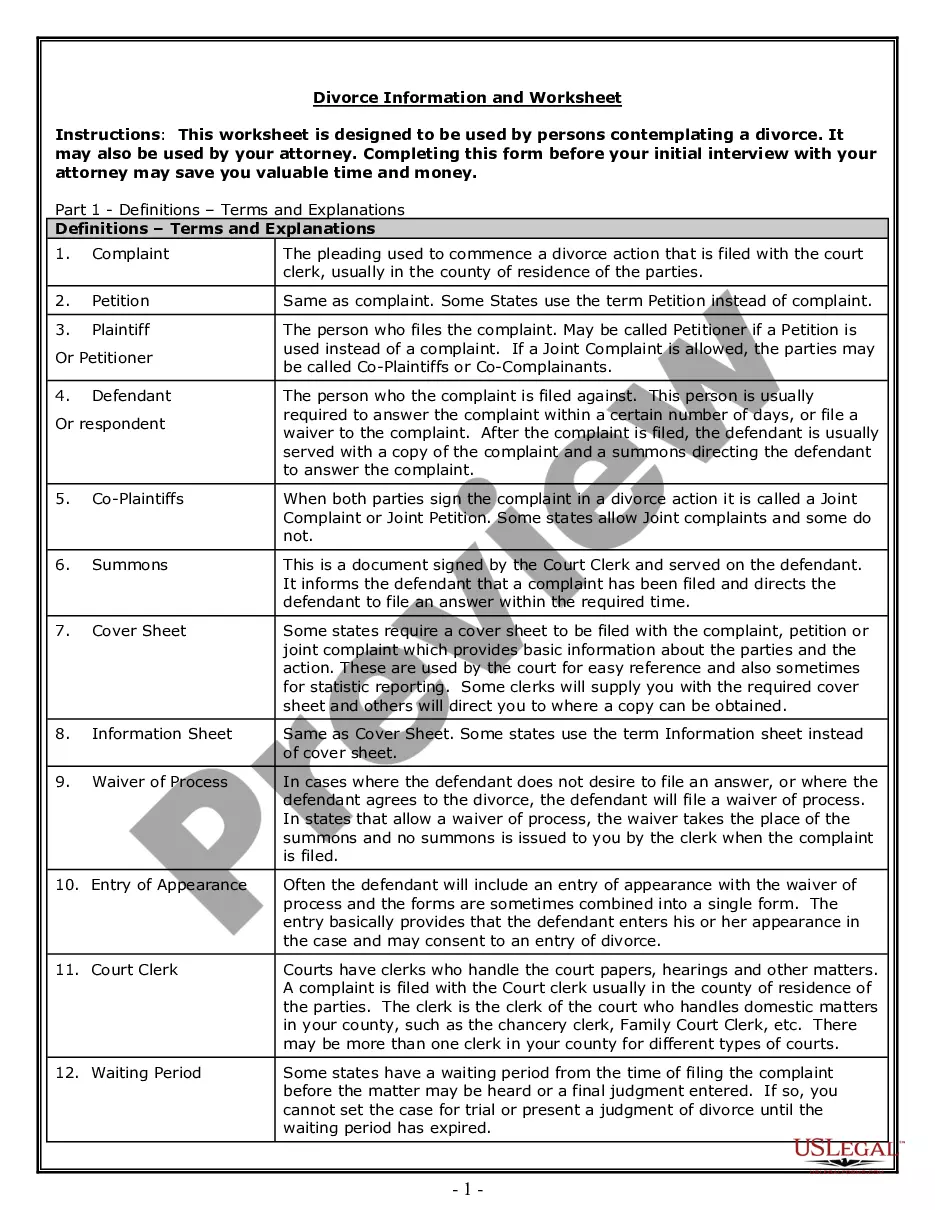

FAQ

The short answer: Anyone can be a beneficiary on your IRA, including minor children. And your beneficiaries don't need to be family members. It's important that the beneficiaries listed on your Vanguard accounts match your beneficiaries' legal names when they inherit the accounts, so don't use nicknames.

A beneficiary is generally any person or entity the account owner chooses to receive the benefits of a retirement account or an IRA after they die. The owner must designate the beneficiary under procedures established by the plan.

Pouring your Roth assets into a trust after your death can be a good idea?as long as you've chosen the right type of trust and your beneficiaries are specifically named in the trust. A conduit trust takes out the beneficiary's required minimum distributions (RMDs) each year.

You cannot put your individual retirement account (IRA) in a trust while you are living. You can, however, name a trust as the beneficiary of your IRA and dictate how the assets are to be handled after your death. This applies to all types of IRAs, including traditional, Roth, SEP, and SIMPLE IRAs.

Distributions from a trust are taxed at trust rates, which are in most cases much higher than individual tax rates. Another drawback is the complex treatment of distributions. IRA distributions are made only to the trust, and from there, the trustee makes the distribution to the beneficiary or beneficiaries.