Special Needs Trust Definition With Ira

Description

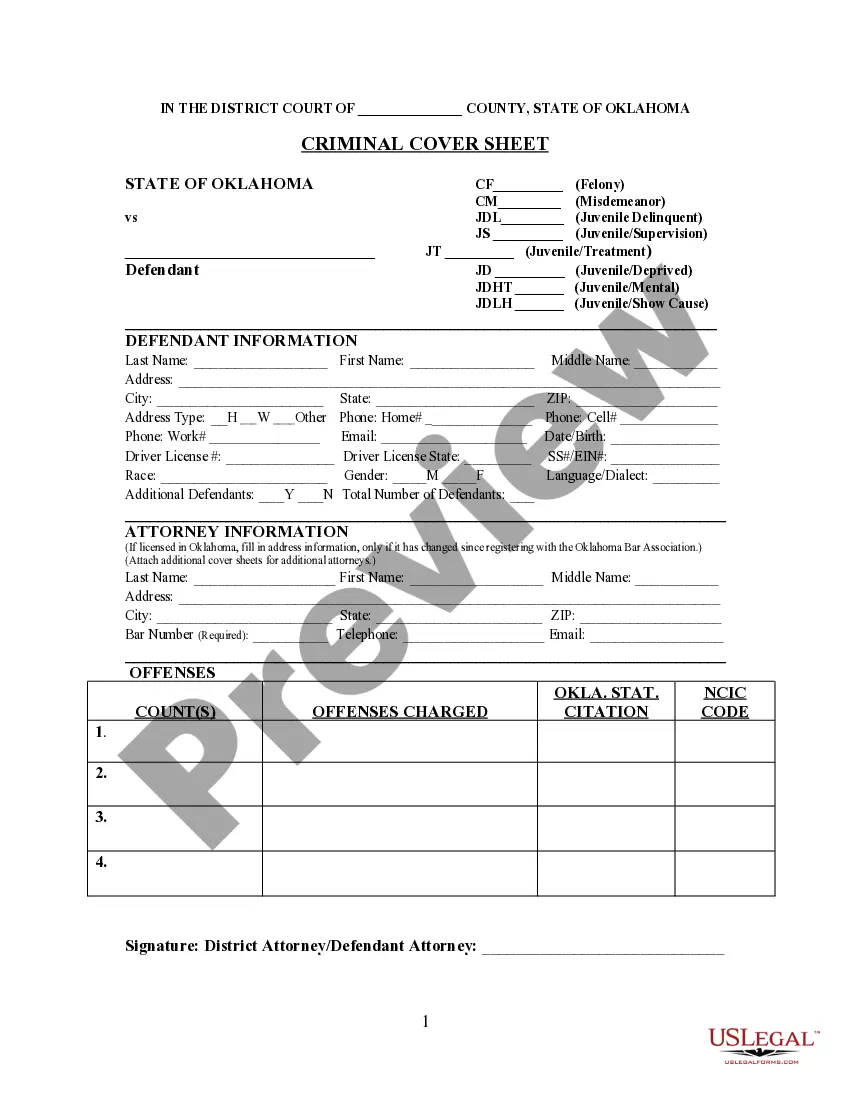

How to fill out Special Needs Irrevocable Trust Agreement For Benefit Of Disabled Child Of Trustor?

Managing legal documents and procedures can be a lengthy addition to your entire schedule.

Special Needs Trust Definition With Ira and similar forms generally require you to search for them and comprehend how to fill them out efficiently.

Hence, if you are handling financial, legal, or personal issues, utilizing a comprehensive and user-friendly online repository of forms when needed will significantly help.

US Legal Forms is the top online source of legal templates, featuring over 85,000 state-specific forms and numerous resources to aid you in completing your documents effortlessly.

Is this your first time using US Legal Forms? Register and create an account in a few minutes to gain access to the form library and Special Needs Trust Definition With Ira. Then, follow the steps outlined below to complete your form: Ensure you have located the correct form using the Preview feature and reviewing the form details. Choose Buy Now when ready, and select the monthly subscription plan that suits your requirements. Click Download and then fill out, sign, and print the form. US Legal Forms has twenty-five years of expertise assisting users in managing their legal documents. Obtain the form you need today and simplify any process without difficulty.

- Explore the collection of relevant documents available with just one click.

- US Legal Forms provides you with state- and county-specific forms available for download at any time.

- Protect your document management processes using a premium service that enables you to prepare any form within minutes without additional or hidden fees.

- Simply Log In to your account, locate Special Needs Trust Definition With Ira, and obtain it immediately in the My documents section.

- You can also review previously downloaded documents.

Form popularity

FAQ

The primary disadvantage of naming a trust as beneficiary is that the retirement plan's assets will be subjected to required minimum distribution payouts, which are calculated based on the life expectancy of the oldest beneficiary.

To leave property to your living trust, name your trust as beneficiary for that property, using the trustee's name and the name of the trust. For example: John Doe as trustee of the John Doe Living Trust, dated January 1, 20xx.

The promoter directs the investor to transfer funds from the original IRA to a new third-party custodian to facilitate the transaction. A third-party custodian is a company that keeps track of the IRA and completes the required reporting to the IRS in order to keep the money in a tax-deferred status.

You cannot put your individual retirement account (IRA) in a trust while you are living. You can, however, name a trust as the beneficiary of your IRA and dictate how the assets are to be handled after your death. This applies to all types of IRAs, including traditional, Roth, SEP, and SIMPLE IRAs.

All distributions may be transferred over, except the required minimum distribution and any distribution of excess contributions and related earnings. The transfer must be deposited in the new account within 60 days. Only one transfer may be made per 12-month period.