Indiana Special Needs Trust For Spouse

Description

How to fill out Special Needs Irrevocable Trust Agreement For Benefit Of Disabled Child Of Trustor?

Whether for commercial intentions or personal issues, everyone must handle legal matters at some stage in their life.

Completing legal documents demands meticulous attention, starting from selecting the correct form example. For example, if you choose an incorrect version of an Indiana Special Needs Trust For Spouse, it will be rejected upon submission. Thus, it is vital to source trustworthy legal documents like US Legal Forms.

With an extensive US Legal Forms catalog available, you do not have to waste time searching for the correct template online. Utilize the library’s straightforward navigation to find the right template for any occasion.

- Obtain the template you require by utilizing the search bar or catalog navigation.

- Review the form’s details to ensure it corresponds with your situation, state, and county.

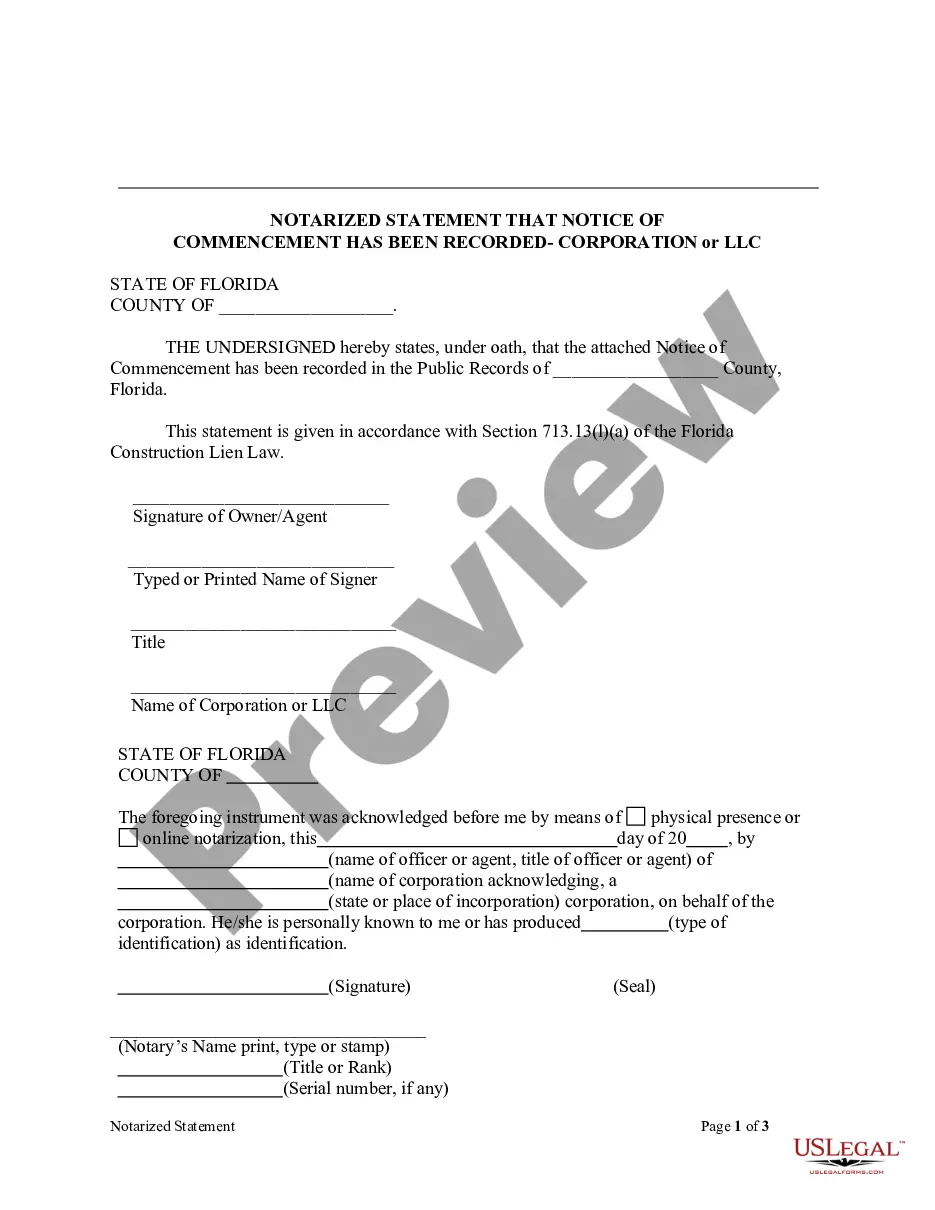

- Click on the form’s preview to examine it.

- If it is the incorrect document, return to the search feature to locate the Indiana Special Needs Trust For Spouse example you need.

- Download the file if it fulfills your criteria.

- If you possess a US Legal Forms account, simply click Log in to access previously saved documents in My documents.

- In case you do not have an account yet, you can acquire the form by clicking Buy now.

- Select the suitable pricing option.

- Complete the account registration form.

- Choose your payment method: use a credit card or PayPal account.

- Select the file format you desire and download the Indiana Special Needs Trust For Spouse.

- Once downloaded, you can complete the form using editing software or print it out and fill it in manually.

Form popularity

FAQ

When you create and fund the trust, you draw up a trust agreement. In this agreement you name a trustee to administer the trust. The beneficiary cannot directly handle assets that have been conveyed into the trust. However, the trustee can use of the trust's assets to address the supplemental needs of the beneficiary.

To create a first-party SNT, the government must officially recognize your disability status, and you need to be under the age of 65. The trust will only hold your assets and not serve as a receptacle for funds from other family members.

Creating a living trust in Indiana is simple. There is no specific form required and your trust document must simply be clear in its terms. You sign the document in front of a notary and then fund the trust by placing ownership of assets in its name. A living trust provides many benefits that can be very appealing.

In Indiana, the cost for comprehensive estate plan drafting can range from $1,150 to $4,250 or more, depending on the complexity of your estate and the attorney's experience. The cost of creating a will in Indiana can range from roughly $350 to $850. A Indiana trust typically costs anywhere between $1,150 and $2,950.

Indiana Law requires that a settlor be over the age of 18 and be of sound mind. A trust must be described in writing and state what is included in the trust, name the trustee, name the beneficiaries, what each beneficiary will receive, and how the trust will be distributed.