Qualified Personal Residence Trust Rules

Description

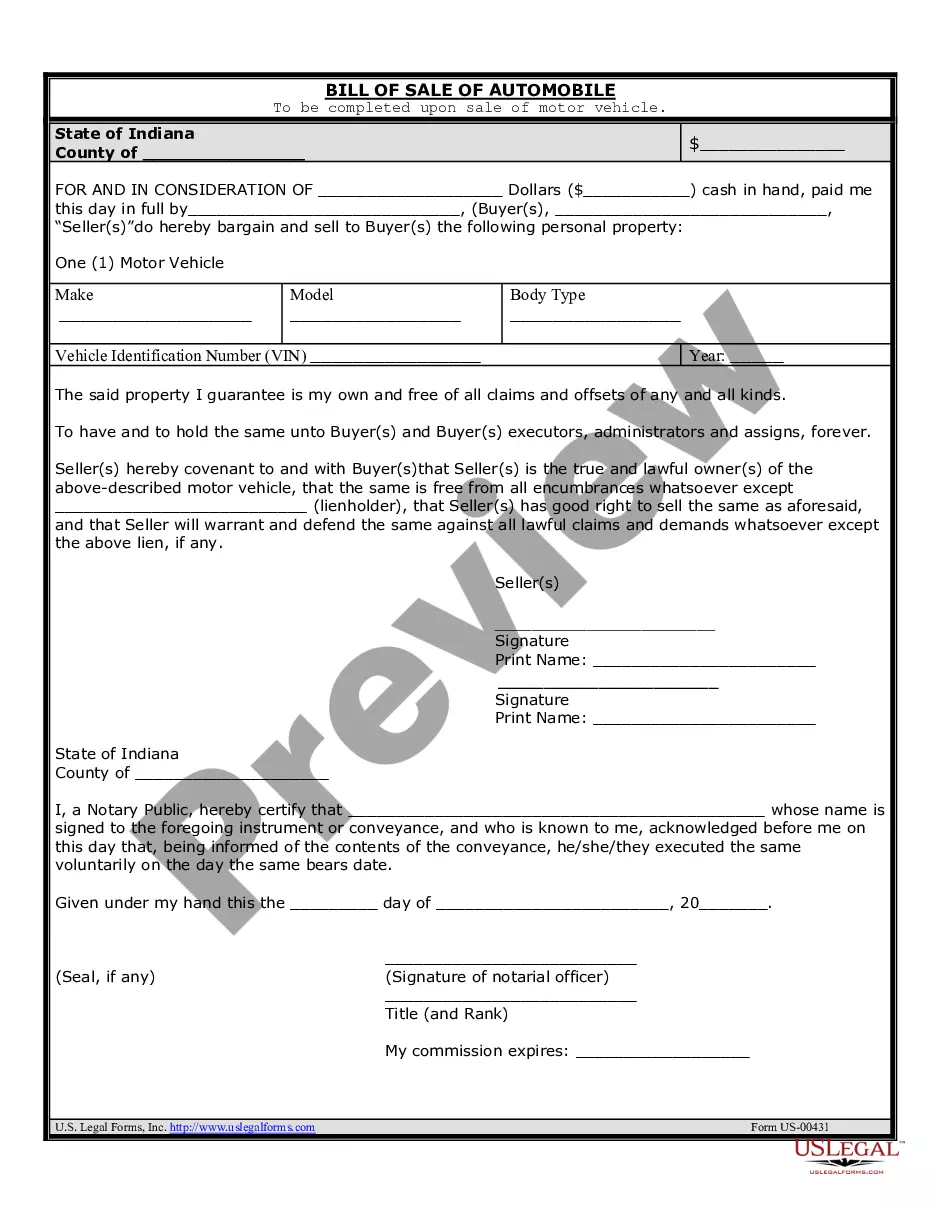

How to fill out Qualified Personal Residence Trust?

Managing legal documents can be challenging, even for experienced experts.

When you are looking for Qualified Personal Residence Trust Rules and lack the time to invest in finding the correct and current version, the tasks can be tough.

Access a valuable resource base of articles, guides, manuals, and materials related to your situation and needs.

Save time and effort searching for the forms you require, and use US Legal Forms’ sophisticated search and Review tool to find Qualified Personal Residence Trust Rules and obtain it.

Select Buy Now once you are ready. Opt for a monthly subscription plan, choose the format you need, and Download, complete, sign, print, and send your documents. Leverage the US Legal Forms web library, backed by 25 years of experience and reliability. Improve your everyday document management in an efficient and user-friendly manner today.

- If you have a subscription, Log In to your US Legal Forms account, search for the form, and download it.

- Check your My documents tab to see the documents you previously downloaded and organize your folders as needed.

- If this is your first time using US Legal Forms, create an account to gain unrestricted access to all the library's benefits.

- After downloading the form you require, verify that it is the correct one by previewing and reading its content.

- Make sure the sample is recognized in your state or county.

- Access state- or county-specific legal and business forms.

- US Legal Forms meets all your needs, from personal to business documentation, all in one place.

- Utilize advanced tools to complete and manage your Qualified Personal Residence Trust Rules.

Form popularity

FAQ

The primary purpose of a qualified personal residence trust is to reduce estate taxes while allowing you to retain use of your home during your lifetime. By transferring a home into a QPRT, you can significantly lower the value of your taxable estate under the qualified personal residence trust rules. This strategy not only helps with tax mitigation but also facilitates a smooth transfer of property to your beneficiaries. Explore US Legal Forms to find templates and guides that can help you create an effective QPRT.

Yes, a home in a qualified personal residence trust can be sold, but this process requires careful consideration of the trust's terms. When selling the home, the proceeds must typically go back into the trust, allowing you to retain benefits while following the qualified personal residence trust rules. It’s crucial to consult with a legal professional to ensure that selling does not affect the trust’s intended tax advantages. If you need assistance with the legal aspects of selling, US Legal Forms offers valuable resources.

A qualified personal residence trust, or QPRT, is a legal arrangement that allows you to transfer your home into a trust while retaining the right to live there for a specified period. After this period ends, the home passes to your beneficiaries, which can significantly reduce the taxable value of your estate. Utilizing QPRT can provide tax benefits under the qualified personal residence trust rules while allowing you to maintain residence in your home during your lifetime. Consider exploring US Legal Forms to establish a QPRT properly and ensure compliance with all regulations.

A QPRT, or qualified personal residence trust, is a financial tool that helps you pass on your home to loved ones while minimizing tax implications. In simple terms, you place your home in this trust but still live there for a specified number of years. After you move out, your heirs own the home without facing high taxes, thanks to the qualified personal residence trust rules. For anyone looking to navigate estate planning efficiently, using platforms like USLegalForms can provide valuable guidance.

Imagine you own a primary residence valued at $1 million. You decide to create a qualified personal residence trust, specifying a 10-year term during which you continue to live there. After this term, your children inherit the home without facing hefty gift taxes on its value. This is an effective example of utilizing qualified personal residence trust rules to protect your assets while benefiting your family.

A qualified personal residence trust (QPRT) allows you to transfer ownership of your home while retaining the right to live there for a set period. This arrangement can significantly reduce the taxable value of your estate. Under qualified personal residence trust rules, once the trust term ends, your beneficiaries gain full ownership without incurring substantial gift taxes. It's a strategic way to manage your assets and provide for your loved ones.

Yes, it’s possible to terminate a QPRT early, but it generally involves some complications. You would need to follow specific legal procedures and may incur gift tax implications. Consulting with an estate planning expert can help you navigate the requirements and consequences of an early termination.

The 2-year rule for QPRT refers to an important provision in the qualified personal residence trust rules. This rule states that if you transfer a home into a QPRT and withdraw it within two years, the IRS may treat the transaction differently for tax purposes. Understanding this rule can help you make informed decisions regarding your estate plan.

Setting up a QPRT involves several key steps. First, you need to choose the property you want to transfer into the trust and understand its value. Then, working with an estate planning attorney can help you draft the trust documents according to the qualified personal residence trust rules and ensure compliance with regulations.

Yes, a QPRT can include a vacation home as long as it meets the defined criteria set forth in the qualified personal residence trust rules. This can allow you to transfer valuable assets while reducing the impact on your taxable estate. Ensuring proper documentation and adherence to the rules is vital for success.