Trust Child Complete For Baby

Description

How to fill out Crummey Trust Agreement For Benefit Of Child With Parents As Trustors?

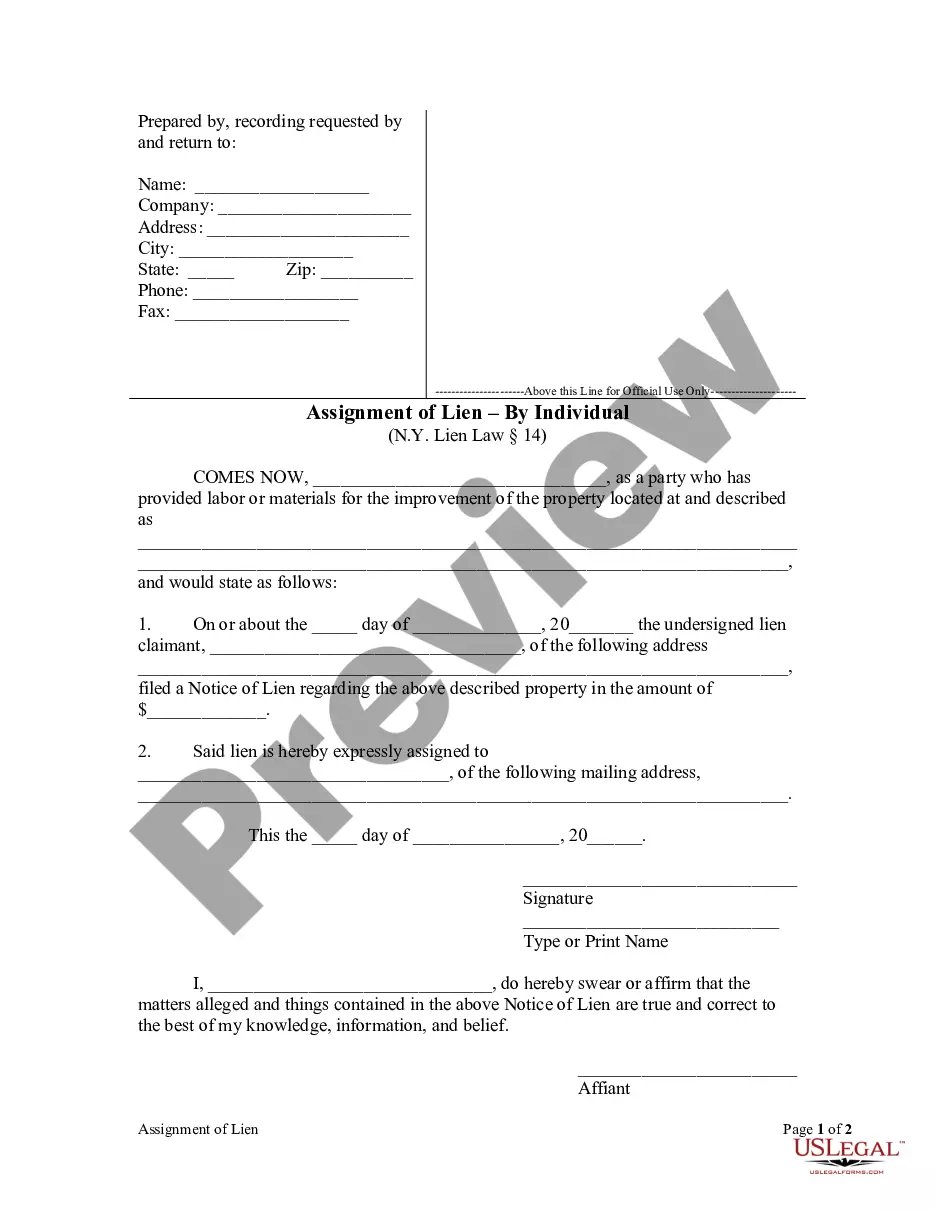

- Log in to your US Legal Forms account if you're a returning user, and click the Download button to retrieve your desired document. Ensure your subscription is active; renew it if necessary.

- For first-time users, start by exploring the form preview and detailed descriptions. Confirm that the form matches your requirements and is compliant with local jurisdiction laws.

- If you need a different template, utilize the Search feature to find the correct document that suits your needs.

- Once you've identified the right form, click the Buy Now button. Select your preferred subscription plan and create an account to unlock all resources.

- Proceed with your purchase by entering your credit card information or opting for PayPal for a smooth transaction.

- After completing the purchase, download the form to your device. You can access it anytime from the My Forms section in your account.

In conclusion, US Legal Forms equips you with a robust collection of legal documents tailored for your child's needs. With their user-friendly interface and access to premium expert assistance, you can confidently navigate legal requirements.

Start your journey today and ensure your child's legal needs are securely managed!

Form popularity

FAQ

To be considered a trust fund baby, an individual typically receives financial support from a trust established by their parents or relatives. This funding often influences their lifestyle choices and opportunities throughout life. Recognizing what it means to be a trust child complete for baby involves understanding both the advantages and responsibilities connected to inherited wealth.

Trust fund syndrome is a term used to describe individuals who struggle with identity and motivation because of their financial safety net. This condition may stem from an overwhelming sense of security that limits their drive to achieve personal goals. Exploring ways to ensure that a trust child complete for baby maintains a balanced approach to wealth can promote healthier development.

Trust fund baby syndrome refers to a mindset where individuals feel entitled due to their inherited wealth. This mentality can lead to a lack of ambition or self-sufficiency. Instead, focusing on how to establish a trust child complete for baby can help cultivate a sense of responsibility and purpose, which future beneficiaries should strive for.

Yes, an unborn child can be named as a beneficiary of a trust. This provision allows parents to plan for their child’s future even before birth, ensuring they receive financial support once they arrive. The concept of a trust child complete for baby emphasizes the importance of early financial planning and protection for future generations.

The stereotype of a trust fund baby often portrays them as privileged individuals who lack motivation or work ethic. However, this oversimplified view overlooks the diversity among beneficiaries who may be hardworking and dedicated. It's essential to recognize that not every trust child complete for baby fits this stereotype, as many are driven to create their own paths.

Choosing between gifting a house and placing it in a trust depends on your financial goals and family dynamics. A trust offers more control over how and when your child inherits the property, while gifting a house could incur immediate tax implications. Ultimately, using the phrase 'trust child complete for baby' highlights the long-term benefits of securing assets in a trust for future generations.

A trust fund baby typically refers to someone who has inherited significant wealth through a trust, often leading to a comfortable lifestyle. They might have access to resources that enable them to explore interests, travel, or pursue education without financial concerns. Importantly, the term 'trust child complete for baby' emphasizes that these individuals are often financially secure from birth, thanks to the trust set up by their guardians.

To start a trust fund for your child, many financial institutions often suggest an initial investment of at least $1,000 to $5,000. However, you can begin with less, depending on your goals. A trust child complete for baby can be established with flexible contribution plans that align with your financial situation. Always check with providers like US Legal Forms to find suitable options that meet your needs.

A trust fund baby typically refers to an individual who receives financial support through a trust fund set up by their parents or guardians. This financial support can cover various expenses, including education and living costs. By setting up a trust child complete for baby, you can provide your child with a stable foundation and security for the future. It's a great way to ensure they have resources to rely on.

The minimum child trust fund varies depending on the provider you choose. However, common amounts start around $500. Establishing a trust child complete for baby ensures that you create a secure financial future for your child. Always consider consulting a financial advisor to help you navigate the options.