Accident Release Liability Application Withholding Tax

Description

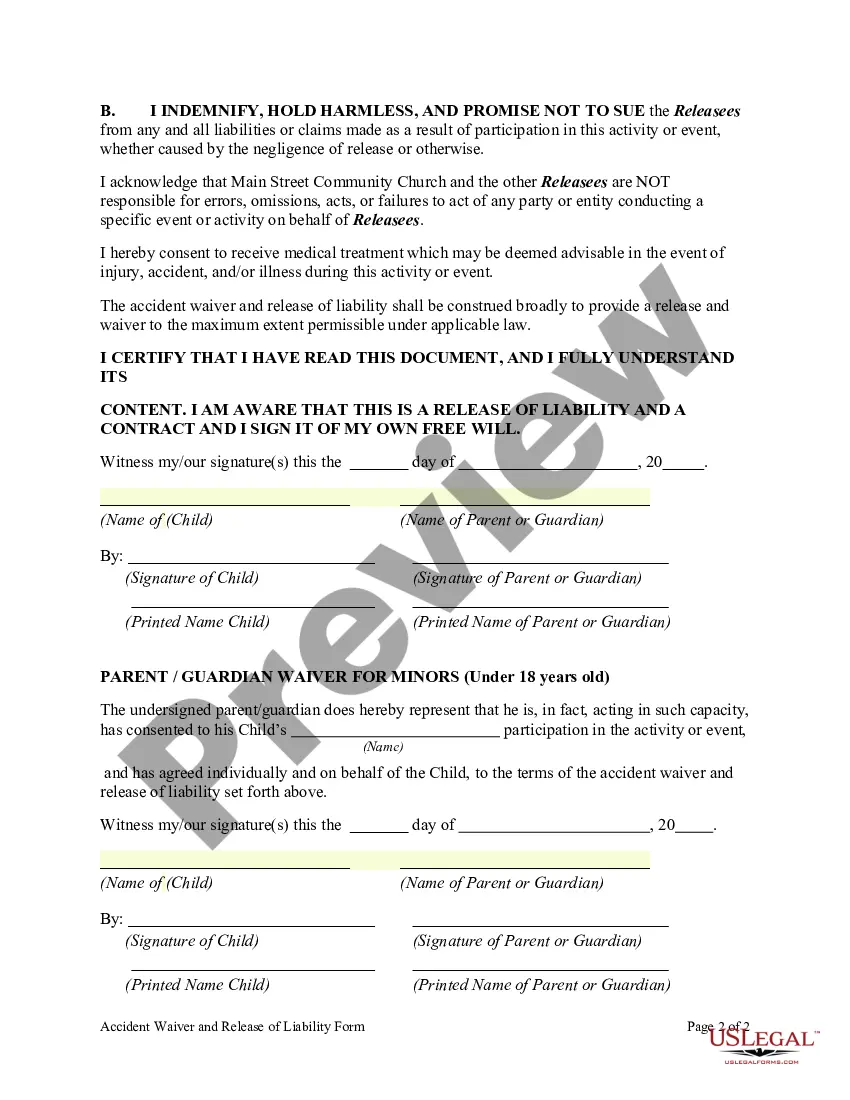

How to fill out Accident Waiver And Release Of Liability Form?

Obtaining legal document examples that comply with federal and state regulations is essential, and the internet provides a variety of choices. However, why waste time searching for the properly constructed Accident Release Liability Application Withholding Tax sample online when the US Legal Forms digital library already consolidates such templates in one location.

US Legal Forms is the largest online legal repository with over 85,000 customizable templates created by attorneys for any business and personal circumstance. They are easy to navigate with all documents categorized by state and intended use. Our experts stay updated with legislative changes, so you can always trust your form is current and compliant when acquiring an Accident Release Liability Application Withholding Tax from our site.

Acquiring an Accident Release Liability Application Withholding Tax is swift and straightforward for both existing and new users. If you already possess an account with an active subscription, Log In and store the document sample you need in your desired format. If you are a newcomer to our platform, follow these steps.

All templates you discover through US Legal Forms are reusable. To re-download and complete previously saved forms, access the My documents tab in your account. Take advantage of the most comprehensive and user-friendly legal documentation service!

- Review the template using the Preview feature or through the text outline to verify it suits your requirements.

- Search for another sample using the search tool at the top of the webpage if necessary.

- Click Buy Now once you've located the appropriate form and select a subscription plan.

- Create an account or Log In and complete the payment using PayPal or a credit card.

- Choose the most suitable format for your Accident Release Liability Application Withholding Tax and download it.

Form popularity

FAQ

Insurance settlements can count as income depending on various factors. If the settlement relates to lost wages or punitive damages, it typically needs to be claimed on your tax return. It's important to assess how the accident release liability application withholding tax affects what you need to report. Consulting a tax expert or using resources from uslegalforms can provide the guidance you need.

Car accident settlements can be taxable depending on their nature. The IRS usually does not tax amounts awarded for personal physical injuries, but compensation for lost income may be taxable. Therefore, understanding how the accident release liability application withholding tax fits into your settlement is vital. For clarity and assistance, using uslegalforms can simplify this process.

Typically, the portion of a settlement that compensates for lost wages or punitive damages is taxable. Conversely, compensation for physical injuries is generally not taxable. It's crucial to determine how the accident release liability application withholding tax applies to each segment of your settlement. Keeping detailed records can assist in accurately reporting your taxes.

In general, accident insurance payouts are not taxable if they are meant to compensate for physical injuries or sickness. However, if the payout includes interest or punitive damages, those portions may be subject to tax. You should consider how the accident release liability application withholding tax might affect your overall tax obligations. Using a reliable platform like uslegalforms can help you navigate these complexities.

Settlements can indeed be subject to withholding under certain conditions. If the settlement involves a taxable component, the IRS may require withholding tax on those amounts. It's essential to understand how the accident release liability application withholding tax applies to your specific situation. Consulting with a tax professional can clarify your responsibilities.

The payer is typically responsible for issuing a 1099 to the recipient when payments exceed the IRS threshold. This includes payments for services, rent, or certain settlement payments. If your payment relates to an accident release liability application withholding tax, it is critical to comply with IRS regulations. USLegalForms offers tools to ensure you fulfill this obligation appropriately.

When you accept liability for an accident, you acknowledge responsibility for the damages caused. This can lead to financial consequences, including potential claims against your insurance. Additionally, understanding how this impacts your accident release liability application withholding tax is vital. Consider consulting USLegalForms for resources that can help you navigate this process.

You may need to issue a 1099 for a settlement payment, especially if the payment includes taxable income. The IRS requires that any income reported exceeds $600 for a 1099 to be necessary. It’s crucial to consider how this relates to your accident release liability application withholding tax. USLegalForms can provide clarity on when and how to issue a 1099 for settlement payments.

Typically, you will receive a 1099 form for an injury settlement if the settlement includes taxable amounts, such as punitive damages. The 1099 form reports income to the IRS, and it’s essential to keep this in mind when filing your taxes. If your settlement involves an accident release liability application withholding tax, ensure you consult with a tax professional. USLegalForms can also assist you in understanding the implications of receiving a 1099.

A car accident release of liability form in Texas is a document that frees one party from future claims related to an incident. By signing this form, the injured party agrees not to pursue legal action against the other party involved in the accident. It’s important to understand how this relates to your accident release liability application withholding tax. USLegalForms provides templates and guidance to help you draft this document correctly.