Churches Required To File 990

Description

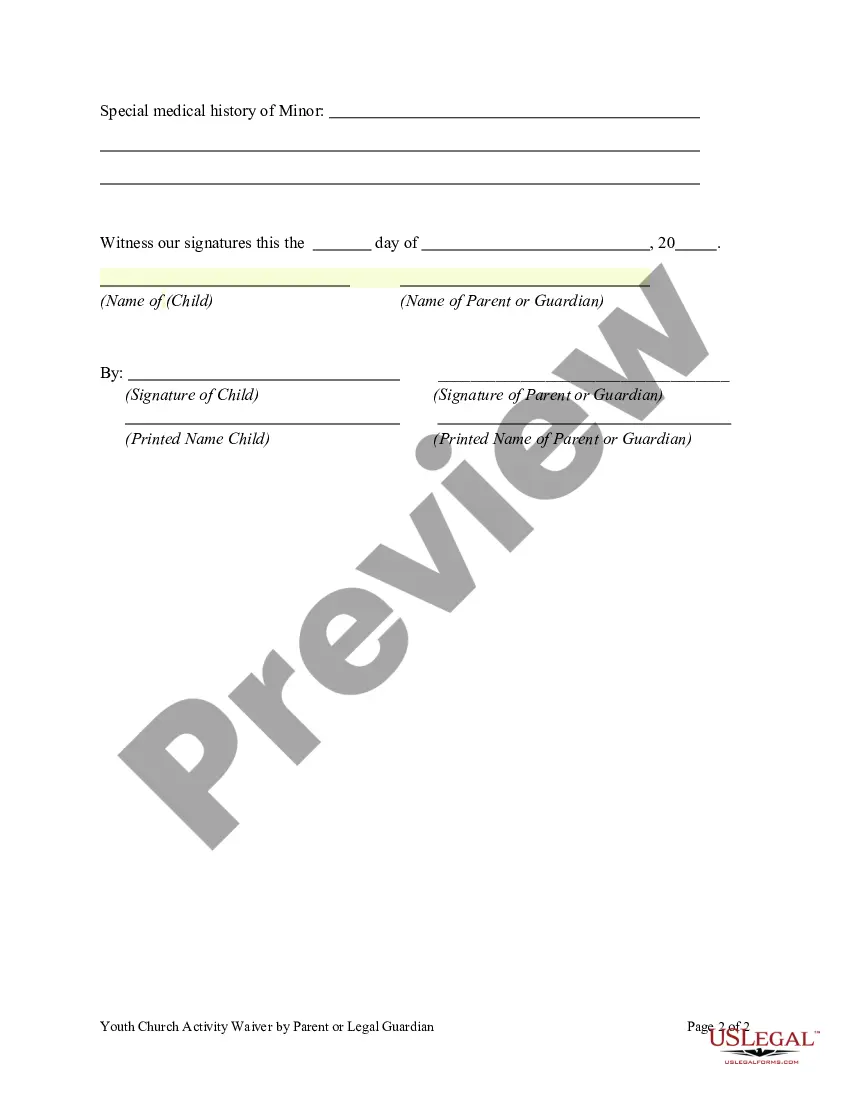

How to fill out Youth Church Activity Waiver And Release To Give Medical Information?

Whether for business purposes or for individual affairs, everybody has to deal with legal situations sooner or later in their life. Filling out legal paperwork requires careful attention, beginning from selecting the appropriate form sample. For example, if you pick a wrong version of a Churches Required To File 990, it will be turned down once you submit it. It is therefore crucial to get a dependable source of legal papers like US Legal Forms.

If you need to obtain a Churches Required To File 990 sample, stick to these simple steps:

- Get the template you need by using the search field or catalog navigation.

- Check out the form’s information to make sure it matches your case, state, and county.

- Click on the form’s preview to view it.

- If it is the incorrect document, get back to the search function to locate the Churches Required To File 990 sample you require.

- Get the template when it matches your needs.

- If you have a US Legal Forms profile, simply click Log in to gain access to previously saved documents in My Forms.

- If you don’t have an account yet, you can obtain the form by clicking Buy now.

- Select the proper pricing option.

- Finish the profile registration form.

- Choose your payment method: you can use a bank card or PayPal account.

- Select the file format you want and download the Churches Required To File 990.

- After it is saved, you can fill out the form with the help of editing applications or print it and finish it manually.

With a large US Legal Forms catalog at hand, you don’t have to spend time searching for the right template across the internet. Use the library’s simple navigation to find the appropriate form for any occasion.

Form popularity

FAQ

Some of the organizations that are tax exempt in Kenya include charities, NGOs, trusts, religious institutions, hospitals, educational institutions to mention a few.

It is important to note that churches are subject to tax on the income derived from activities that are covered under Section 3(2) of the Income Tax Act. In such instances, churches need to apply for tax exemption and obtain a tax exemption certificate from the KRA if they do not wish to pay the tax.

It is important to note that churches are subject to tax on the income derived from activities that are covered under Section 3(2) of the Income Tax Act. In such instances, churches need to apply for tax exemption and obtain a tax exemption certificate from the KRA if they do not wish to pay the tax.

Churches enjoy various tax exemptions such as the exemption from paying income tax on tithes, offerings and donations. This income is exempt from taxation since it does not fall within the scope of taxable income elaborated under section 3 of the Income Tax Act.

Register for the necessary taxes No Church is exempted from paying taxes in Kenya. Churches must register for tax and get Personal Identification Numbers (PINs). However, some activities by the Churches may be exempted. Therefore, Churches must register for all tax obligations where applicable.