Accident Forgiveness With Allstate

Description

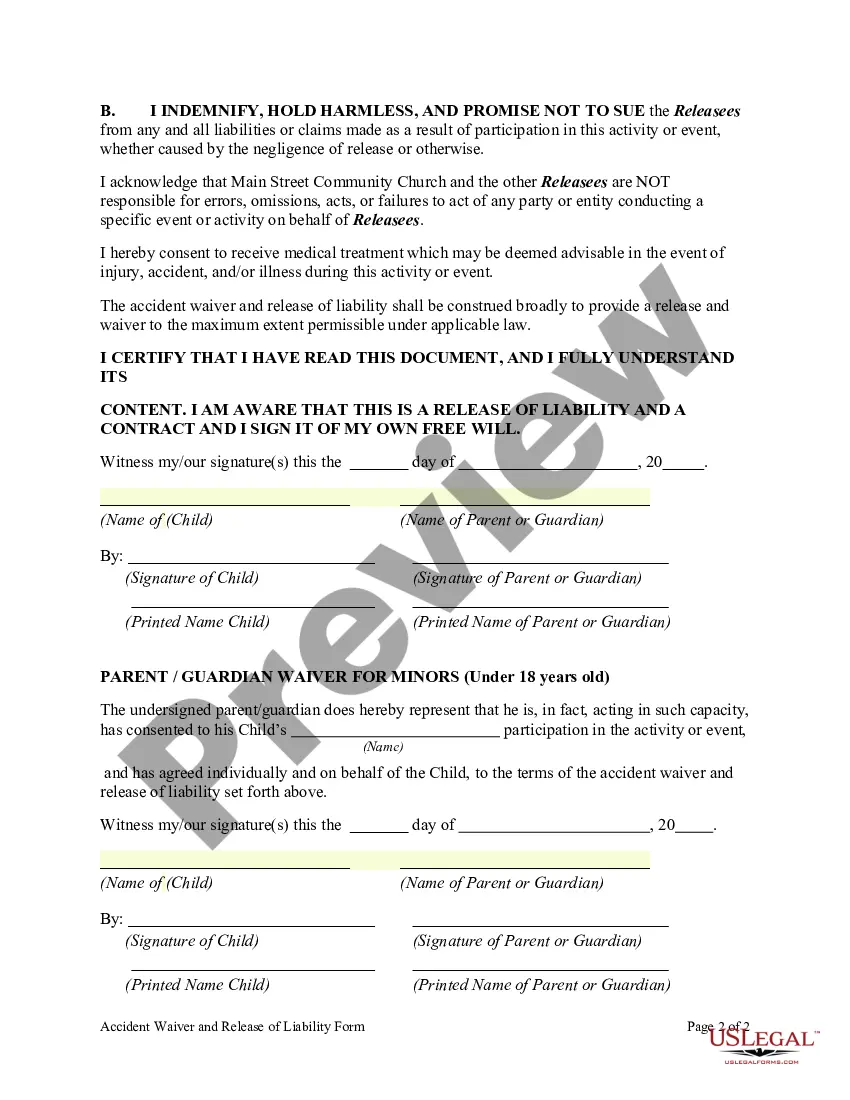

How to fill out Accident Waiver And Release Of Liability Form?

The Accident Forgiveness With Allstate presented on this page is a reusable formal template crafted by expert attorneys in accordance with national and state laws.

For over 25 years, US Legal Forms has supplied individuals, enterprises, and legal practitioners with more than 85,000 validated, state-specific documents for any business and personal circumstance. It is the quickest, easiest, and most dependable method to acquire the forms you require, as the service ensures bank-level data security and malware protection.

Re-download your documents as needed. Access the My documents section in your profile to retrieve any previously purchased forms. Subscribe to US Legal Forms to have certified legal templates for all of life's events readily available.

- Search for the document you need and review it.

- Browse through the file you located and preview or examine the form description to ensure it meets your needs. If it does not, use the search bar to find the suitable document. Click Buy Now once you have located the template you require.

- Enroll and Log In.

- Choose the pricing plan that fits your needs and create an account. Utilize PayPal or a credit card for a swift payment. If you already possess an account, Log In and verify your subscription to continue.

- Acquire the editable template.

- Select the format you prefer for your Accident Forgiveness With Allstate (PDF, Word, RTF) and download the file onto your device.

- Fill out and sign the document.

- Print the template to complete it manually. Alternatively, use an online versatile PDF editor to quickly and accurately fill out and sign your form electronically.

Form popularity

FAQ

In many cases, if the accident wasn't your fault, you may be eligible for reimbursement of your deductible through your insurance provider. With accident forgiveness with Allstate, this process can sometimes be more straightforward, allowing you to minimize out-of-pocket expenses. Always check with your agent to clarify the specifics of your policy, as well as any applicable state laws. Understanding these terms can help you make informed decisions in challenging situations.

To qualify for accident forgiveness with Allstate, you typically need to have a clean driving record for a designated period before filing a claim. There may also be specific eligibility criteria based on your policy type or coverage level. It's essential to review your individual policy details to understand how accident forgiveness applies to you. This feature can make a significant difference in your overall driving experience.

Accident forgiveness with Allstate can provide significant peace of mind. It helps protect your driving record from the impact of your first accident, preventing a potential increase in your premium. This feature allows you to focus on safe driving without the fear of financial penalties after a minor mishap. Ultimately, it can be a wise investment in maintaining your insurance costs.

Accident forgiveness with Allstate works by ensuring that your first at-fault accident does not affect your premium rates. This protective feature can ease the financial burden of rising insurance costs after an accident. Allstate's policies are designed to reward responsible drivers who occasionally face mishaps without severe penalties. By adding accident forgiveness to your coverage, you can drive with confidence knowing that one mistake will not define your insurance experience.

To qualify for accident forgiveness with Allstate, you typically need to maintain a clean driving record for a certain period. Allstate often reviews your history to confirm that you meet their criteria before granting you this feature. It's also available in many states, so checking with Allstate can clarify your eligibility. Maintaining good driving habits will help you take advantage of this valuable benefit.

To file a claim against Allstate, start by gathering all necessary details about the incident, including any photos and witness information. You can then visit Allstate's website or use their app for an easy, guided claims process. If you prefer speaking with someone, calling Allstate’s claims department is also an option. Regardless of the method you choose, make sure to provide all required information to ensure a smooth claims experience.

When you file an accident claim with Allstate, their process is efficient and straightforward. You can initiate your claim online, through the Allstate mobile app, or by calling their claims hotline. Allstate promises prompt processing to help you get back on the road quickly. They prioritize clear communication to keep you informed at each stage of the claims process.

Accident forgiveness with Allstate allows you to avoid a premium increase after your first accident. This feature is particularly beneficial for safe drivers who may get into an accident occasionally. Under this policy, your first accident will not impact your insurance rates, providing peace of mind while driving. Overall, it offers a safety net, ensuring that minor incidents do not lead to significant financial consequences.

Yes, you can negotiate with Allstate regarding various aspects of your insurance policy, including accident forgiveness. If you feel that your situation warrants a discussion, reaching out to an Allstate representative can help clarify your options. They may provide tailored solutions that cater to your needs, especially if you have a strong driving history. Being proactive in this negotiation can lead to enhanced savings and coverage.

With accident forgiveness with Allstate, the forgiveness applies right away after your first at-fault accident. Your premiums remain unchanged immediately, allowing you to avoid the stress of rising costs. Typically, you do not have to wait for any specific period for the forgiveness to take effect. This instant support can make a big difference in your overall insurance experience.